Deflation is a sustained fall in the general price level of goods and services in an economy. In other words, the inflation rate is below 0 percent for a period of time, not just one month. You can see this in price indexes such as CPI or a GDP deflator.

Deflation sounds good because money buys more. The problem is that it often comes with weak demand, falling wages and rising real debt. For traders, deflation risk changes how central banks act, how bond yields move, and how currencies behave against each other.

Definition

Deflation signals a period when prices across the economy decline. Central banks track this through consumer price indexes and related data.

When deflation appears, it suggests weak demand or slow activity. Investors shift toward safe assets and expect lower interest rates. Traders who follow currencies, bonds and indices watch deflation closely because it can reshape long trends.

On trading platforms, signs of deflation appear in falling yields, stronger safe haven currencies and slower equity growth. Reports from central banks, inflation releases and economic calendars highlight data points that warn of deflation risk.

Macro traders, rate traders and long term equity traders pay the most attention to these signals.

A simple example is, imagine a small town with several grocery stores. After a long slowdown, people begin buying less food and fewer household items.

Every week,imagine you want a new phone, but you notice that prices keep dropping every month. You think, “If I wait one more month, it will be cheaper.”

Your friends think the same. Stores now sell fewer phones. The shop cuts prices even more to attract buyers. Some staff lose their jobs because sales are low.

This is what deflation feels like. When people (buyers) expect prices to keep falling, they delay spending. Companies (sellers) earn less, so they cut costs, wages and jobs. That can start a loop of weaker demand and lower prices, which is exactly what worries central banks and markets.

Why Deflation Matters to Traders

Deflation influences multiple asset classes in ways that can alter trading strategies and risk assumptions:

Bond markets often experience falling yields as investors seek safety and central banks cut rates.

Equity markets may weaken due to lower revenue expectations and shrinking profit margins.

Foreign exchange markets may see currency appreciation if traders expect domestic purchasing power to rise relative to others.

Commodities typically decline because lower demand reduces pricing power.

Because deflation frequently corresponds with recessionary conditions, traders monitor it closely for early signals of trend reversals or shifts in monetary policy.

Main Cause Of Deflation

Several conditions can lead to deflation:

Demand contraction from lower household income or reduced business investment.

Credit tightening as banks limit lending and borrowers reduce leverage.

Technological efficiencies that reduce production costs across industries.

Falling asset prices that trigger negative wealth effects.

Strong currency appreciation making imports cheaper and exerting downward pressure on domestic prices.

How Deflation Affects Your Trades

Impact on Market Direction, Costs and Risk Choices

Deflation affects entries and exits because markets behave differently when prices fall broadly. Safe haven currencies often strengthen. Risk assets may weaken. Bond yields tend to fall as investors expect lower interest rates.

Entry timing becomes important because deflation trends can be slow but persistent. Exits may need wider spacing because price moves can grind in one direction without strong reversals.

Trading costs sometimes change as volatility compresses, spreads narrow in calm periods or widen during sudden deflation shocks.

Good situations

Clear data showing declining prices over several months.

Predictable central bank responses, such as steady rate cuts.

Strong liquidity in major currency pairs and indices.

Bad situations

Sudden deflation surprises creating sharp one-day drops.

Markets expecting stimulus but not receiving it.

Thin conditions where spreads widen around data releases.

Quick Example

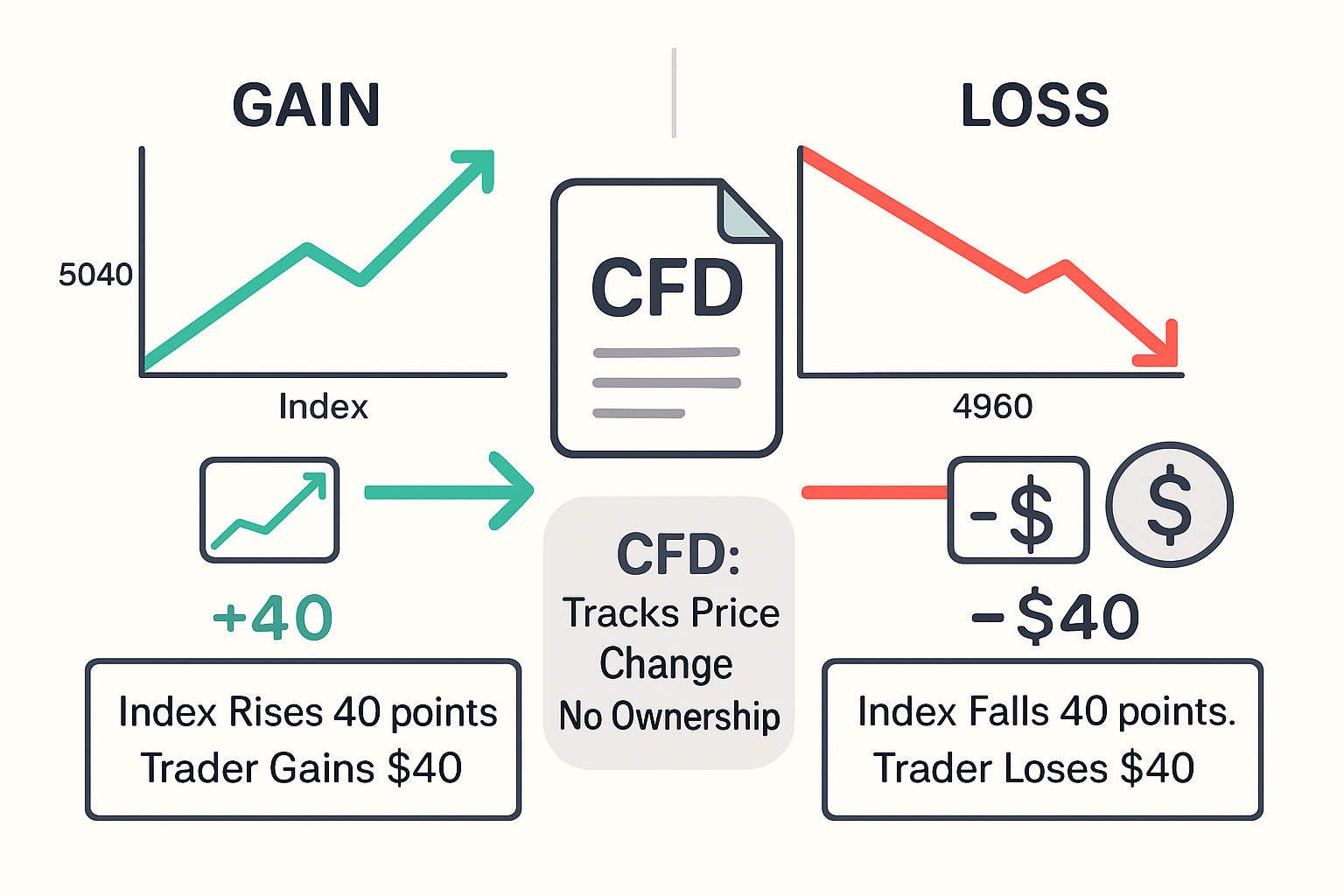

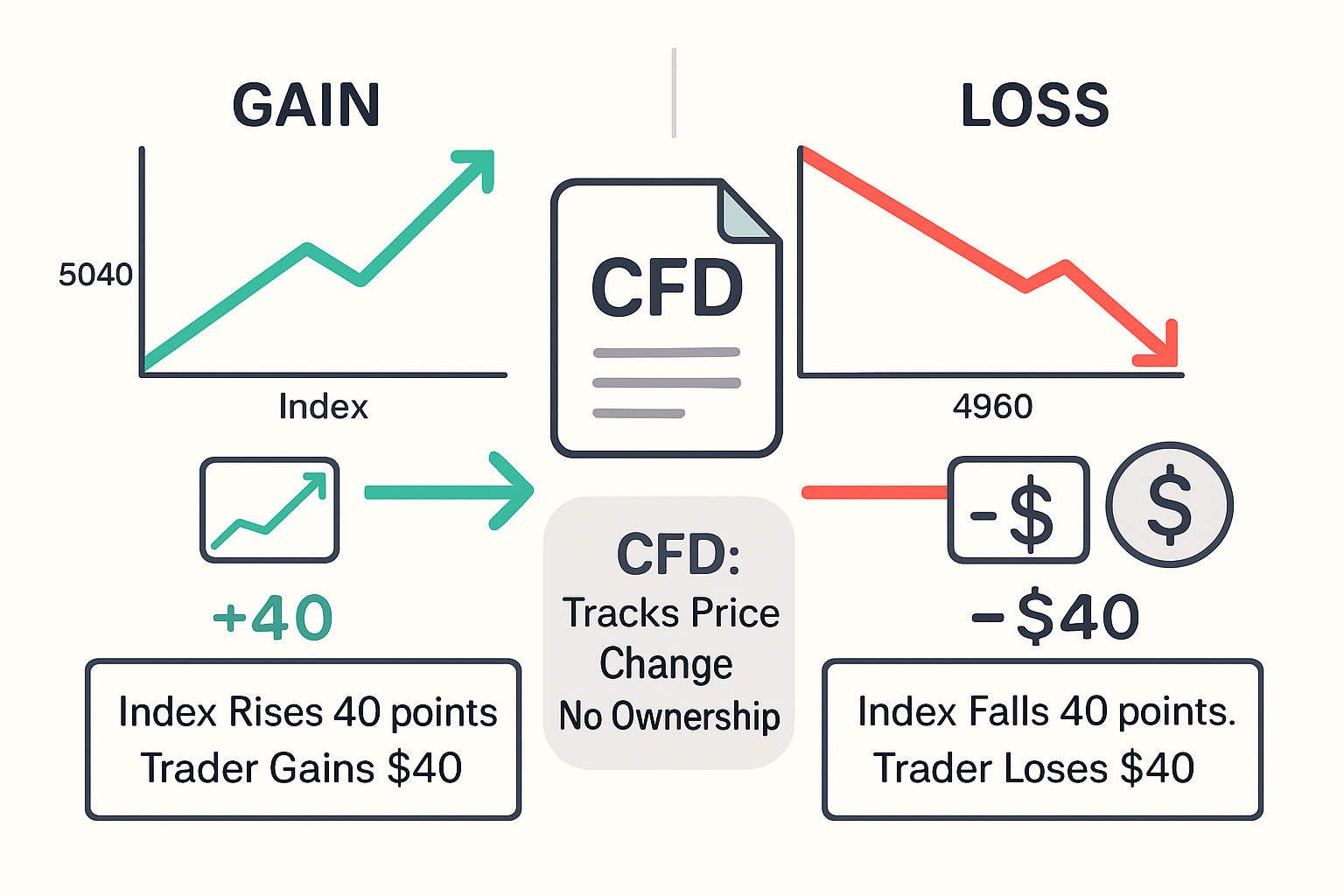

Suppose a central bank has a target inflation rate of 2 percent. Instead, inflation prints at minus 1 percent for several months. Traders see confirmed deflation. Bond yields drop from 3 percent to 2 percent because markets expect rate cuts.

A trader longs a bond for CFD benefits. If the CFD gains 1 percent in price, a position sized at 2,000 dollars earns 20 dollars. If the same trader held a long position in a stock index sensitive to growth, the index might fall 2 percent as earnings expectations weaken.

A 2,000 dollar position would lose 40 dollars.

This example shows how deflation helps some assets and hurts others. The key is understanding which markets respond to falling prices.

Common Mistakes Traders Make With Deflation

1. Treating any price drop as deflation

A one-off fall in oil or food prices is not deflation. Real deflation is broad and persistent.

2. Ignoring the difference between inflation and disinflation

Slower inflation is not the same as negative inflation. The policy response and market impact can be very different.

3. Focusing only on the headline CPI print

Traders sometimes skip core inflation, expectations, and central bank tone, which often move first.

4. Assuming deflation always strengthens a currency

Real yields matter, but if deflation raises fears of deep recession or extreme easing, the currency can weaken instead.

5. Trading big around CPI without a plan

Deflation scares can trigger sharp moves and wider spreads. Trading full size with tight stops around these events can lead to repeated whipsaw losses.

How to Check Deflation Before You Click Buy or Sell

1. Inflation reports

Look for multi-month declines in CPI or core CPI.

2. Central Bank Communication

Statements about weak demand, falling prices or stimulus plans signal deflation risk.

3. Bond Yields

Falling yields often reflect deflation expectations.

4. Consumer And Business Surveys.

Low confidence can point to weaker spending.

5. Commodity Trends.

Broad declines in metals, oil or agricultural prices can reflect weakening demand.

Check these signals at least weekly for long term trades and daily before major inflation releases. Patterns matter more than one-time readings.

Related Terms

Inflation: A general increase in price levels across the economy.

Disinflation: A slowdown in the rate of inflation without prices turning negative.

Stagflation: High inflation combined with stagnant economic growth.

Frequently Asked Questions (FAQ)

1. Is deflation always harmful?

It can help consumers briefly, but long periods of falling prices can reduce wages, weaken growth and increase debt burdens.

2. How do central banks fight deflation?

They may cut interest rates, adjust guidance or use bond-buying programs to support spending and prevent deeper price declines.

3. Does deflation strengthen a currency?

Often yes. Real interest rates rise during deflation, which can make the currency more attractive.

Summary

Deflation is the sustained decline in general price levels and a key macroeconomic condition that affects nearly every major market. It alters consumer behavior, investment decisions and monetary policy, while reshaping the performance of currencies, bonds, equities and commodities.

Traders who understand the drivers and risks of deflation can better interpret economic signals, anticipate policy responses and adapt their strategies to changing market dynamics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.