Depreciation is the gradual decrease in a currency’s value driven by market forces rather than official policy action. Unlike devaluation, which is a deliberate government decision, depreciation reflects natural shifts in supply and demand for a currency within a floating or partially floating exchange rate system.

Traders watch depreciation closely because it influences capital flows, inflation expectations, and cross-asset pricing across global markets.

Definition

In trading, depreciation is a market driven decline in a currency’s value. It reflects economic data, interest rate expectations, risk mood and capital flows. There is no official announcement. Traders see depreciation in real time as the exchange rate moves lower.

On trading platforms, depreciation shows up as a steady rise or fall in currency pairs, depending on which side is the base and which is the quote. If the euro depreciates against the dollar, EUR/USD moves lower.

Macro traders, intraday traders and hedgers all watch depreciation closely because it affects entries, exits and the patterns visible on charts.

Main Causes of Depreciation

Depreciation occurs when a currency loses value because market forces reduce demand for it or increase demand for other currencies. Several core drivers commonly influence this process:

1. Interest-rate differentials

Lower domestic interest rates make a currency less attractive to international investors. When capital flows outward in search of higher yields, the domestic currency weakens.

2. High inflation

If domestic prices rise faster than those of trading partners, the currency’s purchasing power falls. Markets adjust by pricing the currency lower to reflect this erosion.

3. Trade deficits

A country that imports more than it exports must frequently purchase foreign currency. Persistent demand for foreign currencies pushes the home currency downward over time.

4. Slowing economic growth

Weak GDP growth, declining productivity or negative business sentiment reduces investor confidence. This often leads to reduced capital inflows and a softer currency.

5. Political or policy uncertainty

Unpredictable fiscal decisions, unstable governance or unclear regulation can trigger capital flight. Investors generally avoid holding currency in uncertain environments.

6. Market sentiment and speculation

If traders expect a currency to weaken based on economic signals, selling pressure alone can accelerate depreciation. Momentum can reinforce itself when key technical levels break.

Quick Example

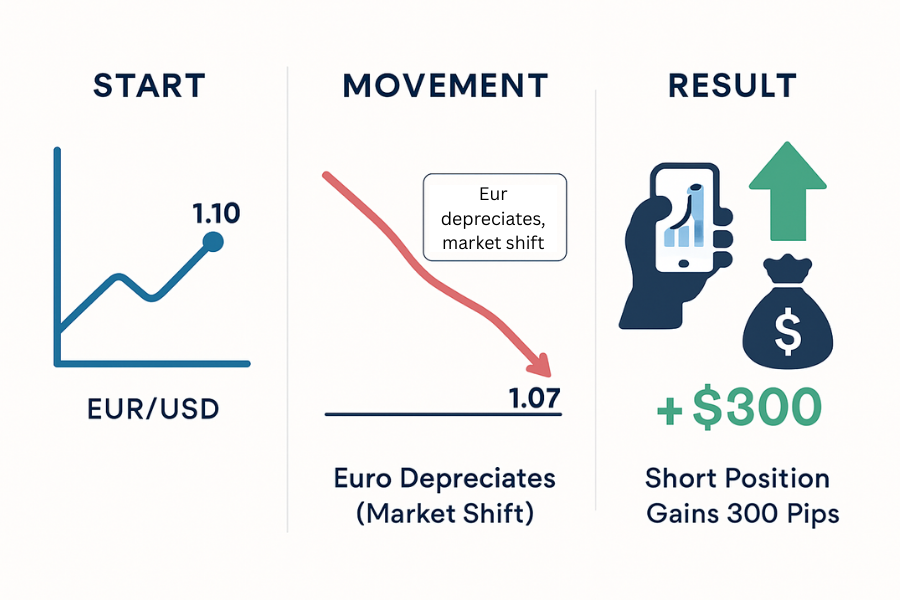

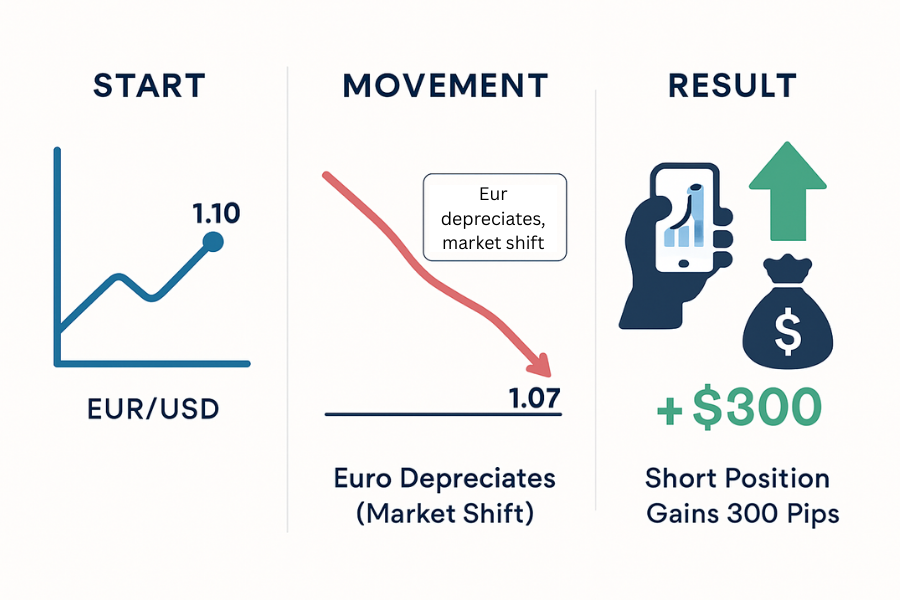

Assume EUR/USD trades at 1.10. Over several days, euro data weakens and US yields rise. The euro depreciates. The pair moves gradually to 1.07.

A trader holding a small short position of 1 dollar per pip gains as the currency falls. A move from 1.10 to 1.07 is 300 pips, worth 300 dollars for that position. The move is smooth because depreciation is often gradual.

If the trader had been long, the same move would create a 300 dollar loss. This example shows how depreciation affects trades through natural market shifts rather than sudden policy changes.

How Depreciation Affects Your Trades

Impact on Timing, Levels and Risk

Depreciation changes entry levels because trends in the affected currency can move quickly. Buying in the direction of depreciation means entering at falling prices. Selling means riding the larger move, but timing becomes more important because pullbacks occur.

Exit levels also shift because a depreciating currency can overshoot major support or resistance. Stops may need wider room, and targets need realistic spacing. Trading costs rise when spreads widen during sharp moves. Slippage becomes more likely during news.

Good situations

Clear trend with consistent data pointing in one direction.

Normal spreads during active sessions.

Enough liquidity to manage entries and exits.

Bad situations

Sudden news shocks that extend depreciation rapidly.

Thin liquidity during off hours.

Trying to pick a bottom without clear signals.

Can Depreciation Be Solved?

Depreciation is not always a problem needing a solution. Sometimes it acts as a natural pressure valve, helping an economy rebalance trade or recover competitiveness. Whether it should be addressed depends on the scale, speed and underlying cause.

Possible approaches include:

Raising interest rates to attract capital and stabilize currency demand.

Improving fiscal discipline so markets view debt and spending as sustainable.

Boosting export competitiveness through structural reforms rather than forced currency interventions.

Reducing inflation via effective monetary policy and supply-side improvements.

Strengthening political confidence through transparent and predictable policy environments.

These measures aim to improve economic fundamentals, which is the most durable way to stabilize a currency experiencing depreciation.

Related Terms

Devaluation: A government-led reduction in a currency’s value within a fixed exchange-rate system.

Appreciation: A market-driven increase in a currency’s value relative to others.

Inflation: The general rise in prices that can erode currency purchasing power.

Frequently Asked Questions (FAQ)

1. What is the key difference between depreciation and devaluation?

Depreciation is driven by market forces, while devaluation occurs through an official policy decision.

2. Does depreciation always signal economic weakness?

Not always. It can reflect temporary sentiment shifts, interest-rate changes or adjustments in global capital flows.

3. How can traders respond to a depreciating currency?

They may use hedging tools, adjust exposure in currency pairs, or apply trend-following strategies depending on volatility and fundamentals.

Summary

Depreciation is the natural, market-driven decline in a currency’s value and a core concept in global trading. It shapes pricing in FX, commodities, equities and bonds, while offering both opportunities and risks for traders.

By understanding the economic forces behind depreciation and monitoring how these forces interact with market sentiment, traders can better position themselves for shifts in volatility, trend formation and cross-asset performance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.