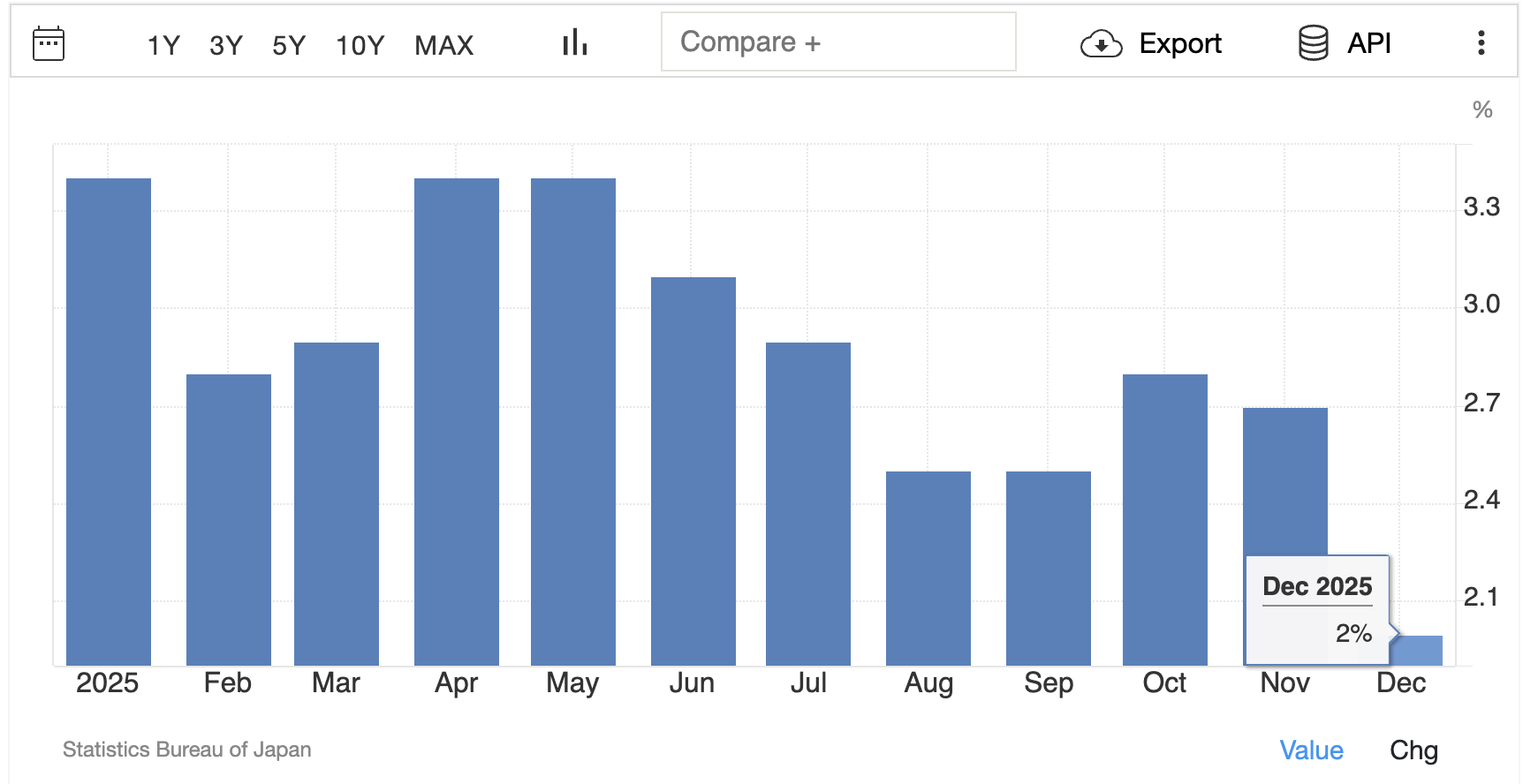

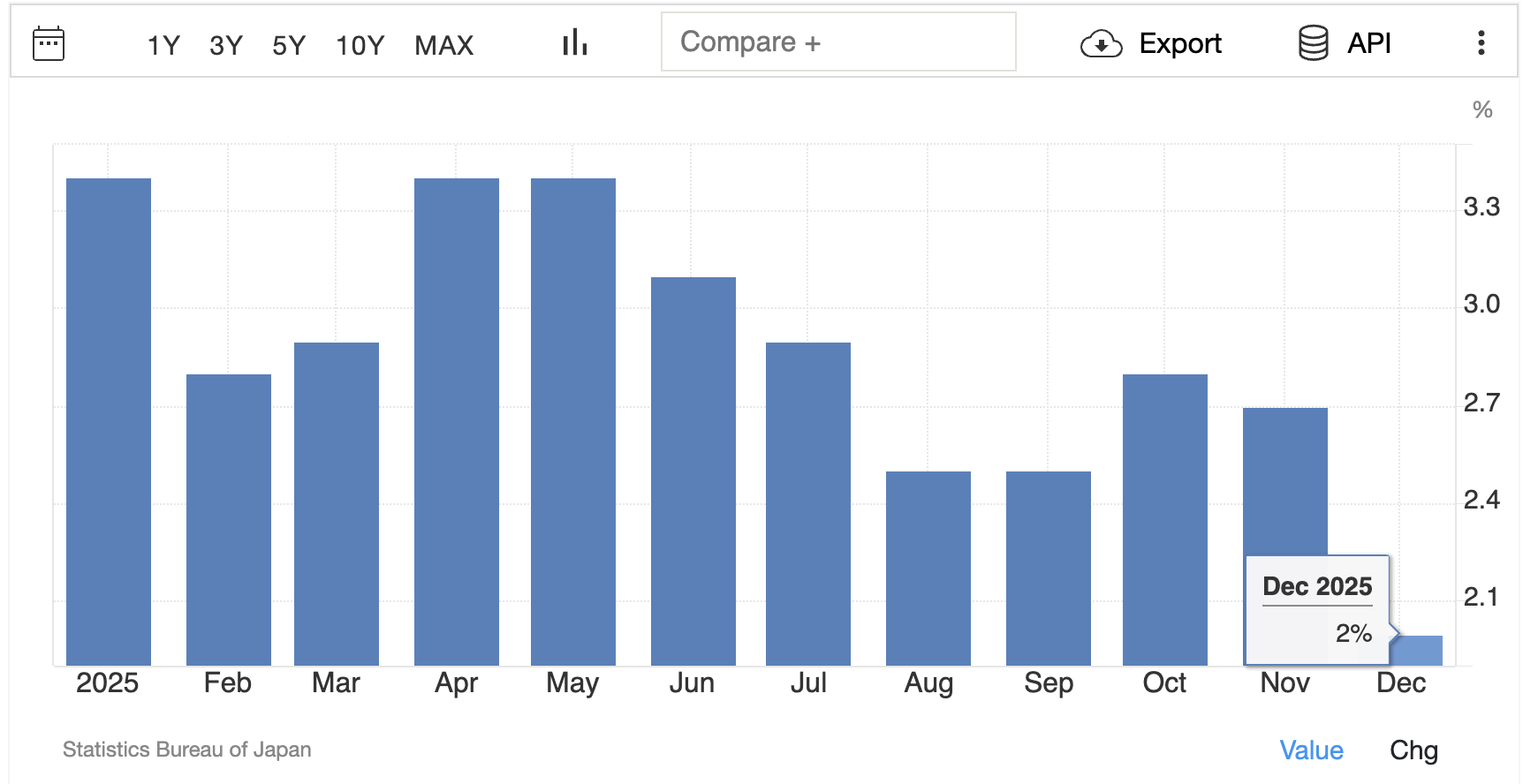

Tokyo inflation cooled sharply in December, reinforcing the view that headline price pressures are easing even as underlying inflation remains sticky. In its latest publication, Tokyo CPI slowed to 2.0%, and core CPI eased to 2.3%

For the Bank of Japan (BoJ), this matters because it is grappling with a difficult question: Is inflation becoming truly "normal" in Japan, or is it still being driven by temporary shocks to food and energy prices?

The BoJ has begun to increase rates, but it still seeks evidence that a wage-and-price cycle can maintain inflation near 2% without ongoing cost shocks. This is why a gentler Tokyo inflation figure can rapidly alter market expectations, despite being merely a single data point.

Tokyo CPI Just Cooled: Key Numbers

| Measure (Ku-area of Tokyo) |

November 2025 |

December 2025 |

What it tells the market |

| Headline CPI (all items) |

2.7% |

2.0% |

The "cost of living" headline cooled sharply |

| Core CPI (all items less fresh food) |

2.8% |

2.3% |

The BoJ's most quoted gauge eased but stayed above target |

| Core-core CPI (less fresh food and fuel) |

2.8% |

2.6% |

A cleaner read on underlying prices also eased, but stayed firm |

Tokyo's December data showed a clear slowdown in the headline measure, while the measures that strip out the noisiest items stayed above the BoJ's 2% target.

Two points stand out:

Headline inflation easing to 2.0% is notable because it suggests the worst of the food- and utility-driven price spike may be fading, at least for now.

The "core-core" reading at 2.6% matters because it indicates underlying inflation isn't sliding back toward the 1% range that defined Japan's earlier low-inflation pattern.

Why Core Inflation in Japan Cooled?

The December slowdown appears to be a narrative of reduced pressure from energy and food, along with some advantageous base effects stemming from last year's utility changes.

1) Food Inflation May Be Peaking, but It Is Not "Fixed"

Food has been the dominant driver of Japan's recent inflation bursts, and Tokyo was no different. In November, Tokyo's food items showed eye-watering rises (including rice and other staples), which made the overall CPI feel sticky and uncomfortable.

December did not erase those increases. It merely indicated that the rate of growth is not rising at the same speed, which is a significant distinction for central bankers.

Key Takeaway: If food inflation is merely decreasing due to last year's increase fading from the yearly comparison, inflation could surge again if the yen declines and import expenses increase.

2) Energy and Utility Bills Gave Inflation a Breather

Energy costs tend to swing more than most categories, and they can make inflation look "better" or "worse" than the underlying trend. December's slowdown was partly linked to the base effect from last year's utility bills and easing energy pressure.

Some analysts also expect headline inflation to dip further in early 2026 because government measures and energy dynamics reduce the year-on-year rate.

What to take away: A softer headline number can buy the BoJ time, but it does not automatically change the longer-term direction if underlying measures remain above 2%.

The BoJ's Real Focus: Underlying Inflation and Wages

A central bank can tolerate inflation that swings with imported oil prices or a poor harvest. It struggles more with inflation that stays high due to persistent domestic demand and wage increases, putting additional strain.

That's why the BoJ tracks a whole family of inflation gauges rather than relying on a single headline rate. It also publishes its own measures of underlying inflation, such as trimmed-mean and weighted-median estimates, to filter out temporary noise.

The Big Signal for BoJ: Core-Core Stayed at 2.6%

Core-core inflation (excluding fresh food and fuel) cooled from 2.8% to 2.6%. That is still well above the BoJ's target, and it lines up with the BoJ's message that inflation could ease for a period, then firm again as demand and wages improve.

This is the "sweet spot" for the BoJ's argument for gradual tightening:

Inflation is not running away to 4% across the board.

Inflation is also not collapsing back to near-zero.

The next steps depend on wages and price-setting behaviour, not just commodities.

BoJ Governor Kazuo Ueda has also been explicit that the BoJ is willing to keep raising rates if the baseline scenario on growth and inflation holds, and he has pointed to tight labour markets and structural wage pressure.

Key Takeaway: If salaries continue to increase and companies persist in transferring expenses to prices, the BoJ will not limit itself to just one or two rate hikes.

BoJ Policy Outlook: Softer Tokyo CPI, but Not a Policy "Pivot"

Japan's latest step towards normal rates is already in place.

On 19 December 2025, the BoJ set the guideline for the uncollateralised overnight call rate at around 0.75%.

The BoJ's next policy meeting is scheduled for 22–23 January 2026, when it will also update its economic and inflation forecasts.

Tokyo's softer inflation reading argues for a slower pace of tightening rather than a complete pause. It gives the BoJ room to signal patience while keeping the bias toward higher rates intact.

Simple Scenario Map for Traders

| Scenario |

What the BoJ does |

What would have to happen |

Likely market reaction |

| Base case |

Holds in January, keeps a tightening bias |

Core-core stays above 2%, wages hold up, growth is not collapsing |

Yen stays sensitive to US–Japan rate gap; JGB yields stay elevated |

| Hawkish risk |

Tightens sooner than markets expect |

Yen weakens sharply and lifts import costs; inflation proves sticky again |

Yen strengthens quickly; risk assets wobble as funding costs rise |

| Dovish detour |

Pauses longer than expected |

Consumption softens, activity data weakens, inflation cools faster |

Yen softens; Japanese stocks may like it, but inflation credibility gets tested |

This is not a forecast guarantee. It is a decision framework that fits the BoJ's current messaging.

What to Watch Next?

BoJ Meeting (22–23 January 2026): Forecast updates and language on the yen will matter.

Japan Nationwide CPI for December 2025 (scheduled 23 January 2026): Tokyo is the leading signal, but the national print confirms the trend.

Spring Wage Negotiation Signals (early 2026): The BoJ has said wage-setting behaviour is central to sustainable inflation.

Yen Direction and Any Policy Response: Officials have already signalled readiness to act against excessive moves.

Food Inflation Trends (Especially Staples): November's surge serves as a reminder that this can return quickly.

Frequently Asked Questions (FAQ)

1) What Does "Tokyo CPI" Measure?

Tokyo CPI measures changes in prices paid by households in Tokyo's wards. It is released earlier than the national CPI, so traders use it as a leading indicator for Japan's inflation trends.

2) Did Japan's Inflation Fall Below the BoJ's 2% Target?

Tokyo's headline CPI slowed to about 2.0% in December, which is right on the target.

3) What Is the BoJ Policy Rate Now?

The BoJ set the guideline for the uncollateralised overnight call rate at around 0.75% in its December 2025 decision.

4) When Is the Next Big Japan Inflation Release?

The nationwide CPI for December 2025 is scheduled for 23 January 2026, and it will confirm whether Tokyo's cooling trend is spreading across the country.

Conclusion

In conclusion, Tokyo inflation cooled sharply in December, with headline CPI slowing to 2.0% and core CPI easing to 2.3%. The near-term implication is that Tokyo's December slowdown reduces urgency for an immediate follow-up move, but it does not remove the case for further tightening.

A 2.6% rise in the ex-fresh-food-and-energy index suggests price increases are still spreading beyond energy and volatile food components, which is closer to the demand-led inflation profile the BoJ has been seeking.

The next key test is whether inflation stays firm as the boost from energy and fresh-food prices fades, and whether wage growth remains strong enough to keep service-sector prices rising.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.