In 2025, the Kuwaiti Dinar (KWD) remains the strongest currency in the world, trading at approximately USD 3.26 per KWD. It's followed by the Bahraini Dinar (BHD) at around USD 2.65, and the Omani Rial (OMR) at USD 2.60.

These Gulf currencies dominate the top rankings thanks to oil wealth, small populations, and peg-based stability.

Below, we explore the complete list of the strongest currencies in the world in 2025, what defines a strong currency and why these currencies remain at the top.

Top 30 Strongest Currencies in the World 2025

| Rank |

Currency (Code) |

Approx. Exchange Rate (1 Unit ≈ USD) |

Notes |

| 1 |

Kuwaiti Dinar (KWD) |

$3.26 |

The world’s highest-value currency, supported by significant oil revenues and a basket-peg framework. |

| 2 |

Bahraini Dinar (BHD) |

$2.65 |

Fixed to the USD; strengthened by hydrocarbons and a regional financial centre. |

| 3 |

Omani Rial (OMR) |

$2.60 |

Long-standing USD peg; valuation stability reflects oil income. |

| 4 |

Jordanian Dinar (JOD) |

$1.41 |

Fixed USD peg; high unit value maintained by prudent policy management. |

| 5 |

British Pound Sterling (GBP) |

$1.31 |

Major free-floating currency backed by a large advanced economy and global financial activity. |

| 6 |

Gibraltar Pound (GIP) |

$1.31 |

Pegged 1:1 to GBP; mirrors sterling’s valuation. |

| 7 |

Falkland Islands Pound (FKP) |

$1.31 |

Pegged 1:1 to GBP; thinly traded but retains high unit value. |

| 8 |

Swiss Franc (CHF) |

$1.19 |

A global safe-haven, supported by political neutrality, strong institutions, and low inflation. |

| 9 |

Cayman Islands Dollar (KYD) |

$1.20 |

USD-pegged; reflects the islands’ role as a major offshore financial hub. |

| 10 |

Euro (EUR) |

$1.07 |

Currency of the Eurozone; second most traded globally and backed by a large economic bloc. |

| 11 |

United States Dollar (USD) |

$1.00 |

The world’s benchmark reserve currency and primary medium of global trade. |

| 12 |

Bahamian Dollar (BSD) |

$1.00 |

Pegged 1:1 to the USD. |

| 13 |

Bermudian Dollar (BMD) |

$1.00 |

Pegged 1:1 to the USD. |

| 14 |

Panamanian Balboa (PAB) |

$1.00 |

Pegged 1:1 to the USD; USD circulates as legal tender. |

| 15 |

Singapore Dollar (SGD) |

$0.73 |

Managed float; supported by strong fundamentals and a trade-driven financial economy. |

| 16 |

Brunei Dollar (BND) |

$0.73 |

Pegged to the SGD at parity, sharing its valuation. |

| 17 |

Canadian Dollar (CAD) |

$0.72 |

A major commodity-linked currency with developed-market credibility. |

| 18 |

Australian Dollar (AUD) |

$0.66 |

Commodity-sensitive currency tied to Asian trade flows and resource prices. |

| 19 |

Bulgarian Lev (BGN) |

$0.55 |

Currency board arrangement to the euro; moves with EUR/USD shifts. |

| 20 |

Bosnia & Herzegovina Convertible Mark (BAM) |

$0.55 |

Pegged to the euro; shares the same valuation dynamics as BGN. |

| 21 |

Azerbaijani Manat (AZN) |

$0.59 |

Managed by the central bank; supported by oil exports and a semi-pegged regime. |

| 22 |

New Zealand Dollar (NZD) |

$0.61 |

Floating commodity currency tied to agriculture and dairy export cycles. |

| 23 |

Aruban Florin (AWG) |

$0.56 |

Pegged to the USD at ~0.5556. |

| 24 |

Fijian Dollar (FJD) |

$0.47 |

Supported by tourism, remittances, and steady monetary policy. |

| 25 |

East Caribbean Dollar (XCD) |

$0.37 |

Fixed USD peg; used by multiple Caribbean nations. |

| 26 |

Georgian Lari (GEL) |

$0.35 |

Floating EM currency showing resilience due to reforms and inflows. |

| 27 |

Tunisian Dinar (TND) |

$0.34 |

Strongest unit-value currency in Africa; held up by tight FX controls. |

| 28 |

Qatari Riyal (QAR) |

$0.27 |

USD-pegged; supported by large LNG revenues and sovereign reserves. |

| 29 |

Saudi Riyal (SAR) |

$0.27 |

Long-standing USD peg backed by one of the world’s largest oil economies. |

| 30 |

UAE Dirham (AED) |

$0.27 |

USD-pegged; supported by a diversified, trade-driven Gulf economy. |

What Defines a "Strong" Currency?

Currency strength usually refers to how much of the U.S. dollar one unit can purchase. This reflects:

Economic fundamentals: Oil-rich economies such as Kuwait, Bahrain, and Oman continue to enjoy high demand and pricing power. However, recent moderation in oil prices has slightly narrowed current account surpluses.

Monetary discipline: Meanwhile, stable inflation, prudent fiscal management, and robust foreign exchange reserves continue to support the country's long-term economic stability and currency value.

Although the U.S. dollar remains the world's dominant reserve and settlement currency, it still ranks around 11th by unit value, a reminder that "strength" in nominal value does not necessarily mean global dominance.

Why Do These Currencies Hold Their Strength?

1. Resource Wealth & Population Dynamics

Small Gulf states sustain strong currencies through vast oil and gas reserves, continued fiscal surpluses, and limited domestic money supply growth. Kuwait, Bahrain, and Oman remain among the top three thanks to high per-capita income and disciplined currency management.

2. Stable Pegs to the U.S. Dollar

Many of these currencies are pegged or quasi-pegged to the USD, ensuring predictability and shielding from volatility. The Omani Rial (OMR) and Bahraini Dinar (BHD) remain firmly pegged to the U.S. dollar.

On the other hand, the Kuwaiti Dinar (KWD) employs a basket peg, offering it slightly more flexibility in response to global economic shifts.

3. Economic Diversification & Fiscal Discipline

Diversification into sectors such as finance (Bahrain, Singapore) and tourism (Oman, Jordan) helps sustain long-term resilience.

Despite lacking significant oil reserves, the Jordanian Dinar (JOD) maintains stability through sound fiscal policy and an active IMF-supported reform program throughout 2025.

4. Safe Haven & Institutional Strength

Safe-haven currencies such as the Swiss Franc (CHF) continue to attract investors amid ongoing global uncertainty. The Euro (EUR) benefits from a broadly integrated economy.

Elsewhere, the British Pound (GBP) gains strength from London's role as a leading financial centre, even as it navigates post-Brexit adjustments.

Market Exceptions & Global Movements in 2025

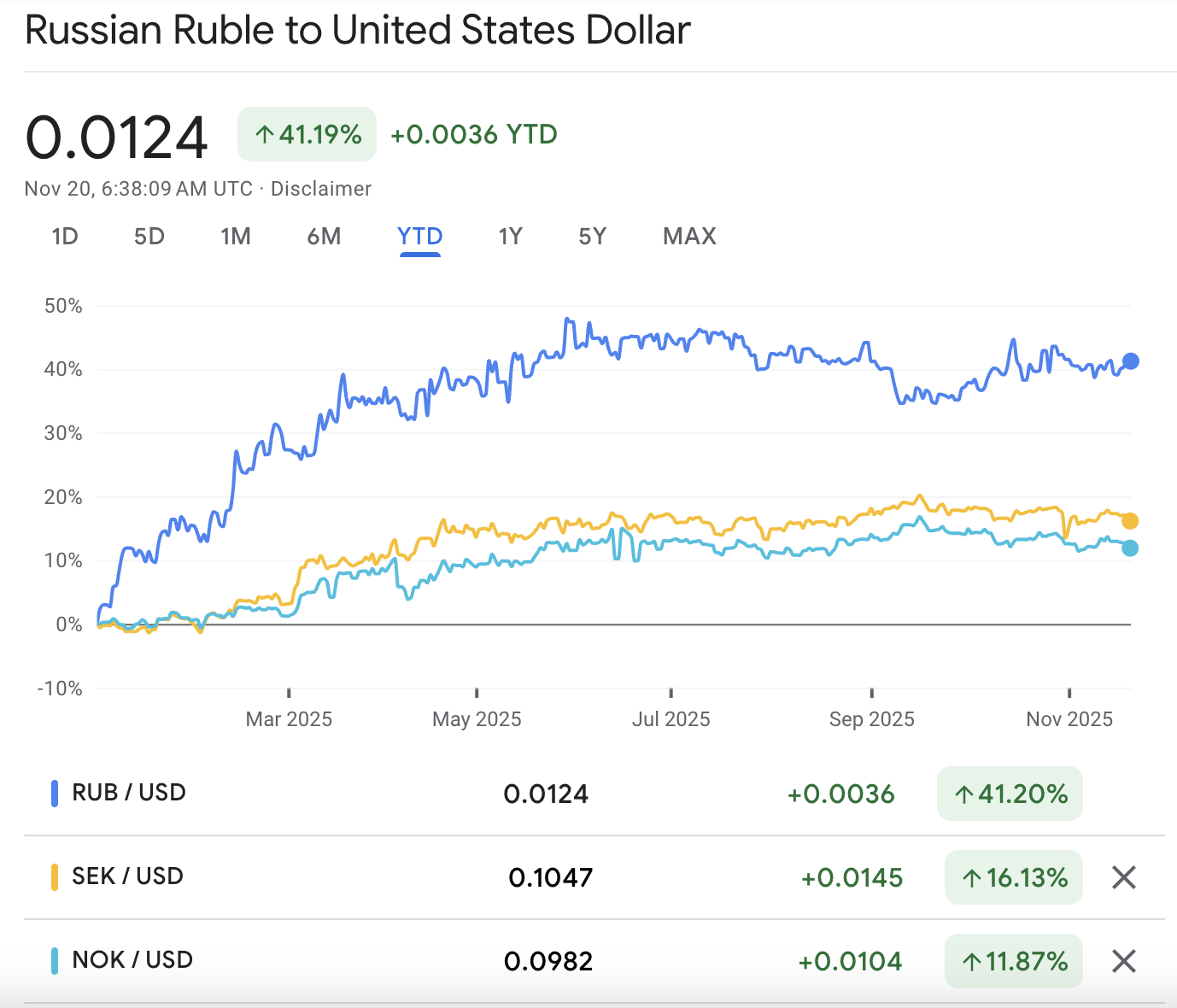

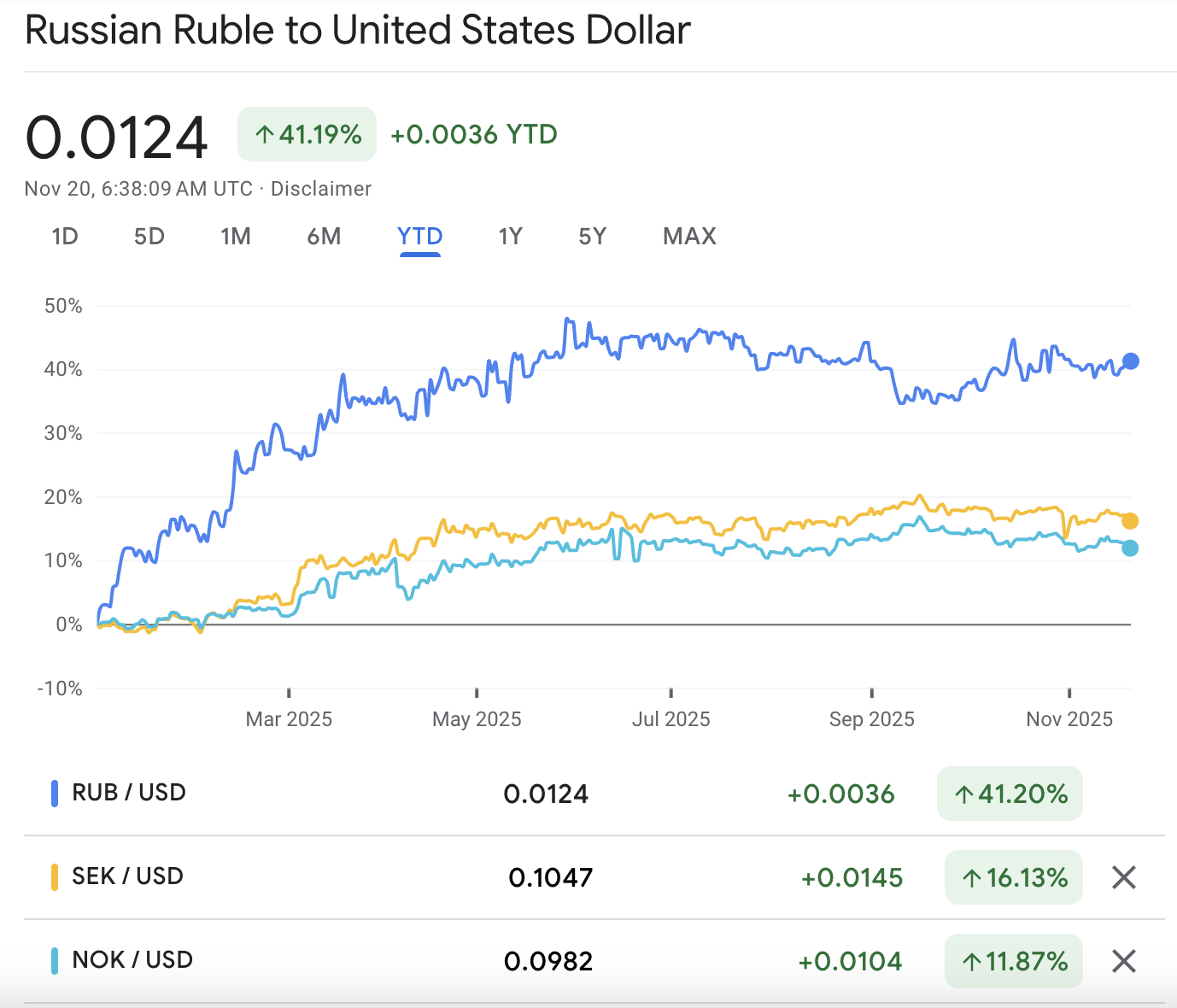

1) Russian Ruble (RUB):

Following a strong rebound earlier in 2025, the Russian Ruble has experienced partial retracement after a prior surge of roughly 40%. As of November 2025, it trades weaker due to lower oil prices, ongoing Western sanctions, and structural economic pressures.

Despite this, tight capital controls continue to provide artificial support, masking underlying currency vulnerabilities.

2) U.S. Dollar (USD):

As of November 2025, the U.S. dollar has weakened significantly, having fallen by around 10-11% year-to-date against a broad basket of major currencies, its worst first-half performance since 1973.

This softness reflects strong market expectations for further Federal Reserve rate cuts, as well as mounting concerns over a deteriorating U.S. fiscal outlook, including a large and persistent budget deficit.

Many analysts now believe these rate cuts may continue into 2026, as inflation cools and yield differentials between the U.S. and other major economies narrow.

3) Scandinavian Currencies:

The Swedish Krona (SEK) is one of 2025's top performers, up about 15%-17% against the U.S. dollar, while the Norwegian Krone (NOK) has gained modestly but remains below its earlier peaks. Both currencies benefited from dollar weakness and regional policy stability.

4) Asian Currencies:

The Singapore Dollar (SGD) and Brunei Dollar (BND) remain regionally strong due to their managed USD linkages and tight monetary policy.

The Japanese Yen (JPY), however, continues near historic lows against the U.S. dollar, reflecting the Bank of Japan's ultra-loose stance compared to the Fed and ECB.

What Traders and Investors Should Watch Next

1. Currency Policy Shifts:

Watch for potential peg reviews or fiscal recalibrations in smaller Gulf economies if global oil demand softens.

2. Geopolitical Changes:

Ongoing de-dollarisation efforts, including BRICS currency initiatives and yuan-based settlements, could reshape FX dynamics.

3. Interest-Rate Differentials:

Divergence in monetary policy between the Federal Reserve, European Central Bank (ECB), and Gulf central banks is likely to shape currency rankings in 2026.

4. Comprehensive Metrics:

Beyond nominal exchange rates, investors should monitor real effective exchange rates (REER), purchasing power parity (PPP), and reserve diversification to gain a more comprehensive understanding of currency strength.

Frequently Asked Questions

1. What Is the Strongest Currency in the World Right Now (2025)?

The Kuwaiti Dinar (KWD) continues to be the strongest currency in the world, trading at approximately 3.26 U.S. dollars per unit as of 20 November 2025. It is followed closely by other high-value Gulf currencies such as the Bahraini Dinar (BHD) and Omani Rial (OMR).

2. Is the Strongest Currency Also the Most Widely Used?

No. While the Kuwaiti Dinar (KWD) holds the highest nominal value globally, the U.S. Dollar (USD) remains the dominant currency in terms of global foreign exchange reserves and all forex transactions.

3. Can a Strong Currency Be Bad for a Country's Economy?

Yes. A strong currency can hurt export competitiveness by making domestic goods more expensive abroad. This can widen trade deficits and slow industrial growth, although it reduces import costs and inflationary pressure.

Conclusion

In conclusion, the Kuwaiti Dinar (KWD) continues to hold its position as the strongest currency in the world as of 20 November 2025.

It is followed by other high‑value Gulf currencies such as the Bahraini Dinar (BHD) and Omani Rial (OMR), and by globally stable units like the Swiss Franc (CHF) and British Pound Sterling (GBP).

Meanwhile, the United States Dollar (USD) has exhibited noticeable depreciation against a broad basket of currencies in 2025, with estimates of a drop of around 5-10 % year‑to‑date.

Given ongoing trends including increased monetary diversification, discussions around de‑dollarisation among major economies, and shifts in global trade settlement practices ; currency rankings may experience meaningful shifts heading into 2026.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.