The Q3 2025 US GDP report is not a routine data drop. It is a delayed "initial estimate" landing right before the holidays, with markets primed to trade it like a major event because it resets the narrative on growth, inflation, and the Fed path for early 2026.

What makes this release even more significant is its timing and format. Due to the federal government shutdown disruption, the BEA is publishing two estimates instead of the usual three today, 23 December 2025, at 8:30 a.m. ET

Additionally, an updated estimate, equivalent to the third estimate, will be released on 22 January 2026.

Q3 2025 US GDP Release Time and What to Expect

| Item |

Detail |

| Release |

US GDP, Q3 2025 (Initial Estimate) + Corporate Profits (Preliminary) |

| Date |

Tuesday, 23 December 2025 |

| Time |

8:30 a.m. ET |

| Why it is delayed |

The autumn shutdown disrupted the normal release cycle. |

| Next major update |

BEA plans an updated Q3 GDP estimate on 22 January 2026. |

As noted above, the Bureau of Economic Analysis (BEA) will release the initial estimate of Q3 2025 GDP on Tuesday, 23 December 2025, at 8:30 a.m. ET.

This report is not only about headline growth. BEA has stated it will release "Gross Domestic Product, 3rd Quarter 2025 (Initial Estimate) and Corporate Profits (Preliminary)" together.

Why This US GDP Print Is Unusual

Normally, BEA publishes GDP in three stages: advance, second, and third estimates. This time, that standard cadence has been disrupted.

BEA postponed the advance estimate schedule and rearranged the quarter because the shutdown delayed the gathering and processing of source data.

BEA confirmed it will release two estimates for Q3 2025, not three, with the January update serving as the third-estimate equivalent.

The market implication is simple. When a print is late and condensed, traders can react more aggressively because there is less time for "softening revisions" and more focus on the first headline.

Market Recap: What Happened Before Today's Release

The US economy has already produced one of the clearest "distortion stories" in years.

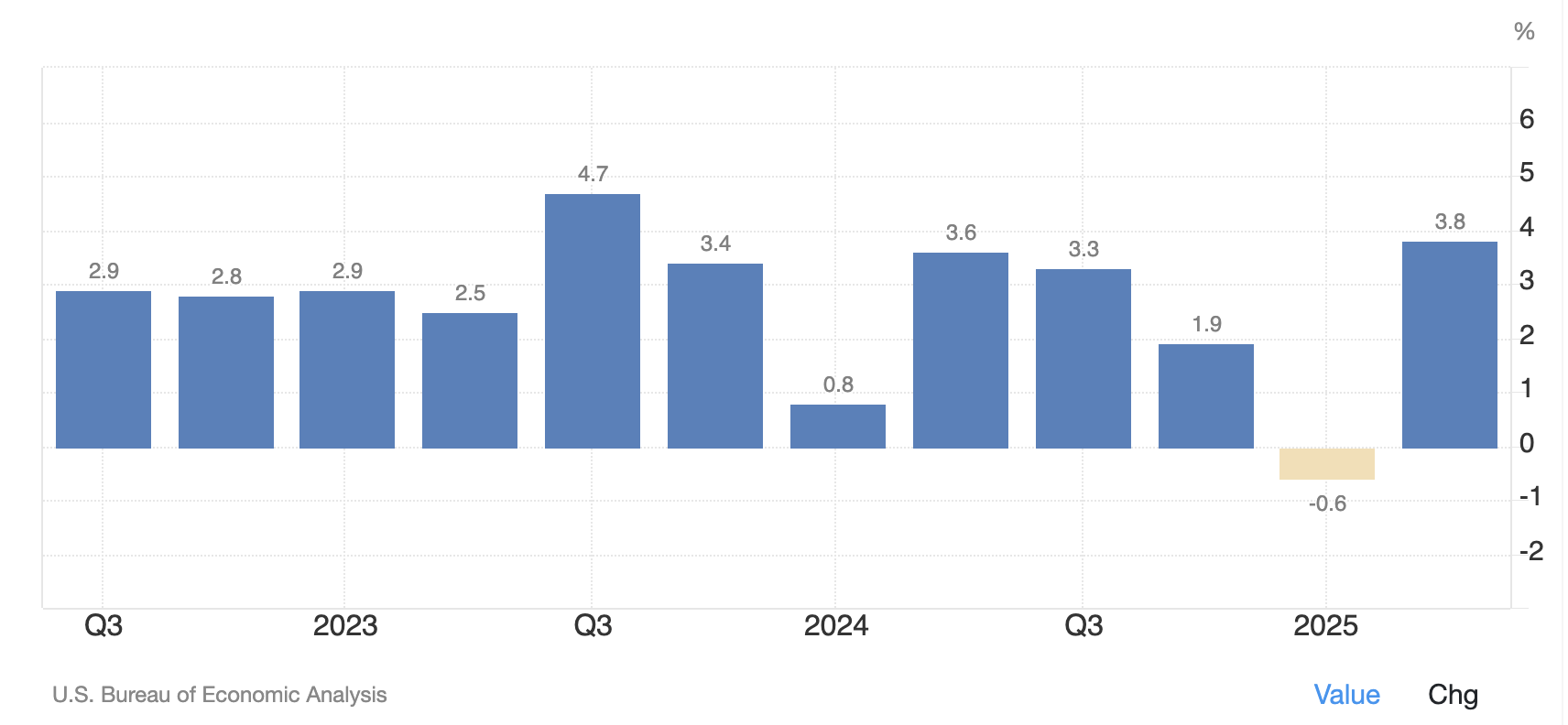

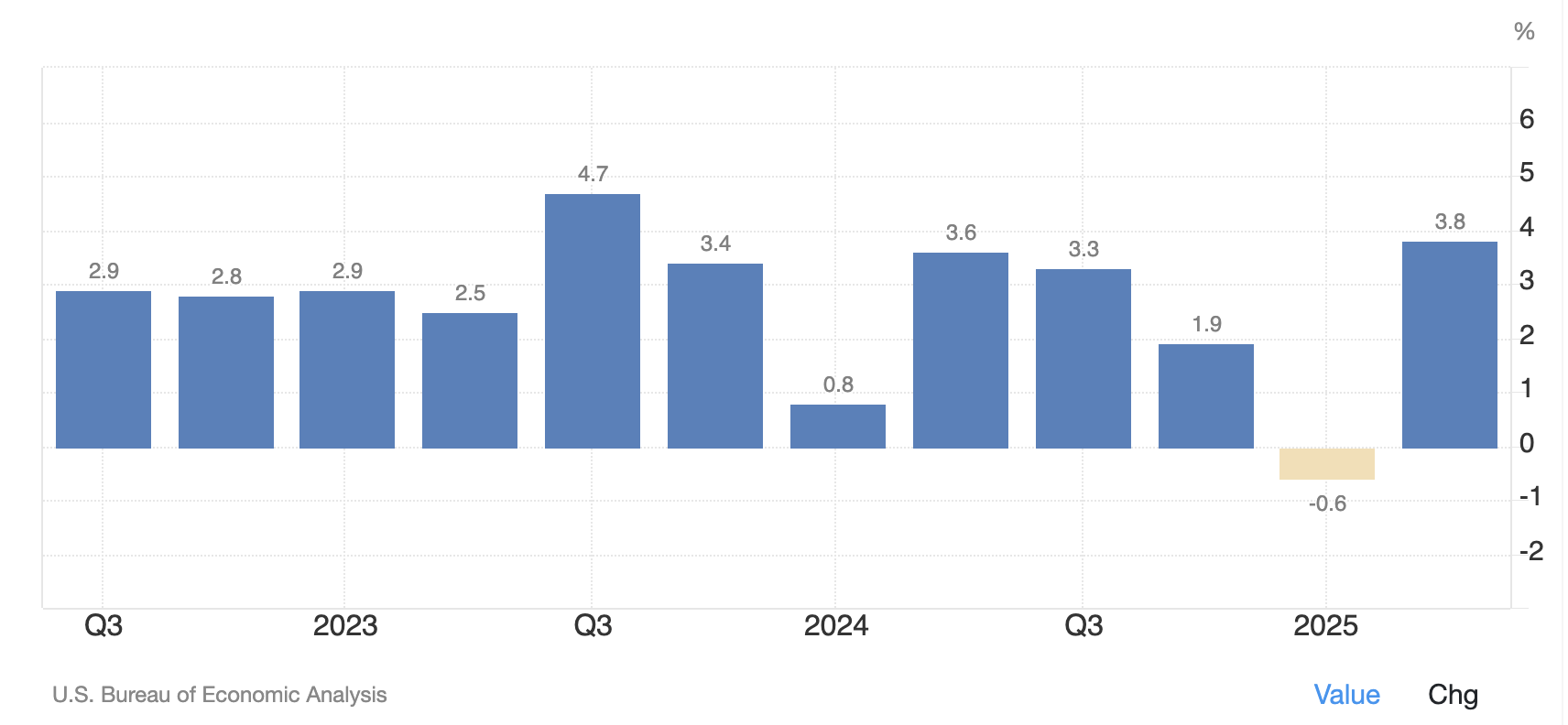

Q1 2025 contracted, with BEA reporting -0.6% in later estimates, largely because imports surged and subtract from GDP arithmetic.

Q2 2025 rebounded to +3.8%, with the BEA noting that reduced imports and increased consumer spending contributed to the surge.

If Q3 holds above 3%, it suggests the economy did not merely "bounce" from a trade distortion. It suggests momentum stayed firm even after the easiest base effects faded.

Policy also matters for the reaction function. The Federal Reserve's target range is currently 3.5% to 3.75%, indicating that today's growth figures can still significantly influence rate forecasts.

What Economists Expect for Q3 Growth

| Source |

Q3 2025 real GDP forecast |

What the market uses it for |

| Economists (reported consensus) |

~3.2% |

Baseline expectation into the print |

| Barron's "around" estimate |

~3.0% |

Quick framing for traders and headlines |

| Atlanta Fed GDPNow |

3.5% |

A higher-end model anchor |

| NY Fed estimate (as cited) |

2.3% |

A lower-end model anchor |

The consensus view is that Q3 growth remains solid, although it has slowed down from the rate of the prior quarter.

Economists expect about 3.2% annualised growth in Q3 2025, which would be slightly slower than Q2 but still above the post-2021 average.

Barron's outlines expectations near 3%, highlighting that the range varies significantly based on the model or desk.

Model-based estimates vary from the consensus, but they impact positioning as they are revised with fresh information.

Atlanta Fed GDPNow pegged Q3 2025 at 3.5% (as of 16 December).

The New York Fed's more conservative estimate is around 2.3%, highlighting the uncertainty in net trade and inventories.

Regardless, the spread between 2.3% and 3.5% is large enough to move bonds, the dollar, and equities, especially in a thin pre-holiday session.

The Key Drivers That Will Likely Move Q3 GDP

1) Consumer Spending

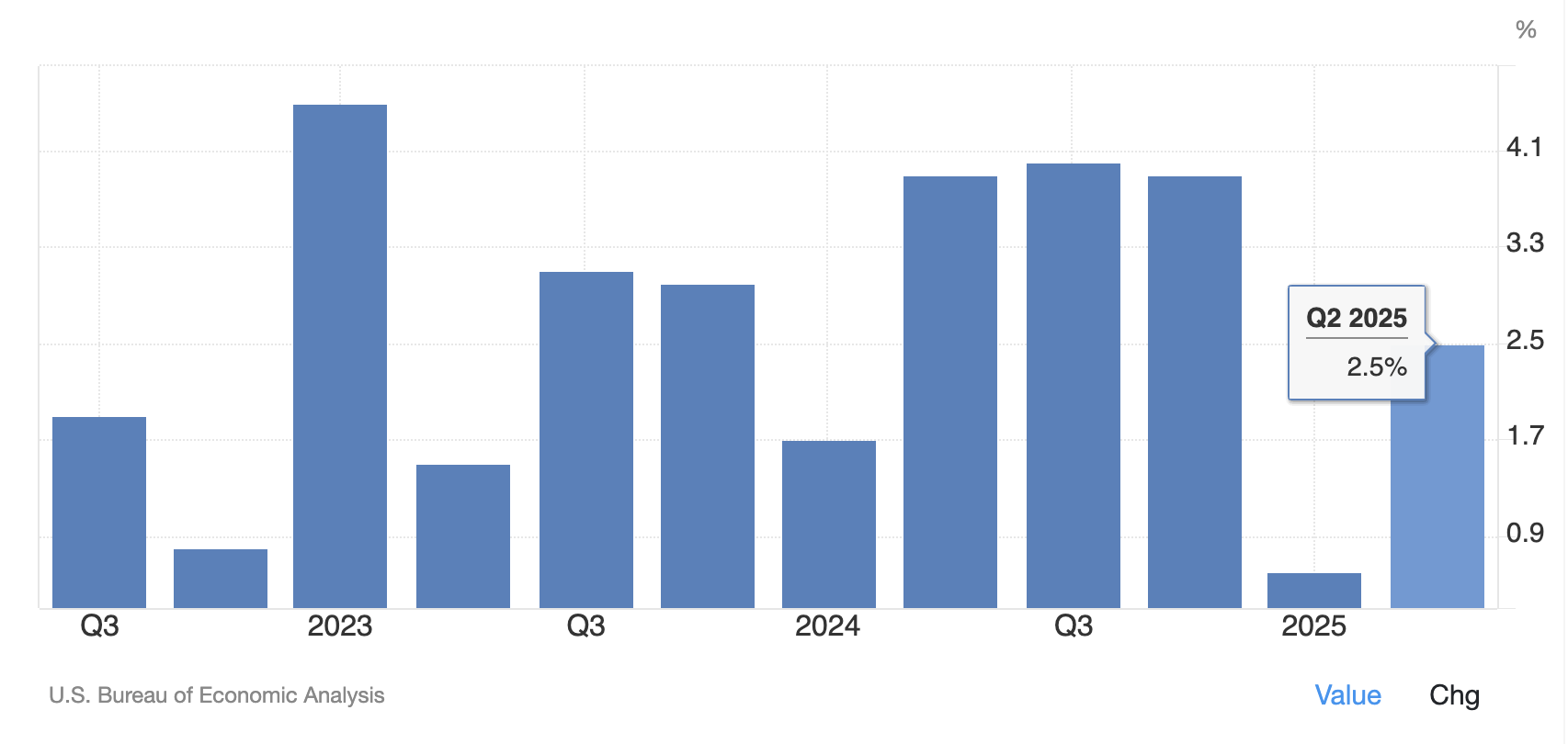

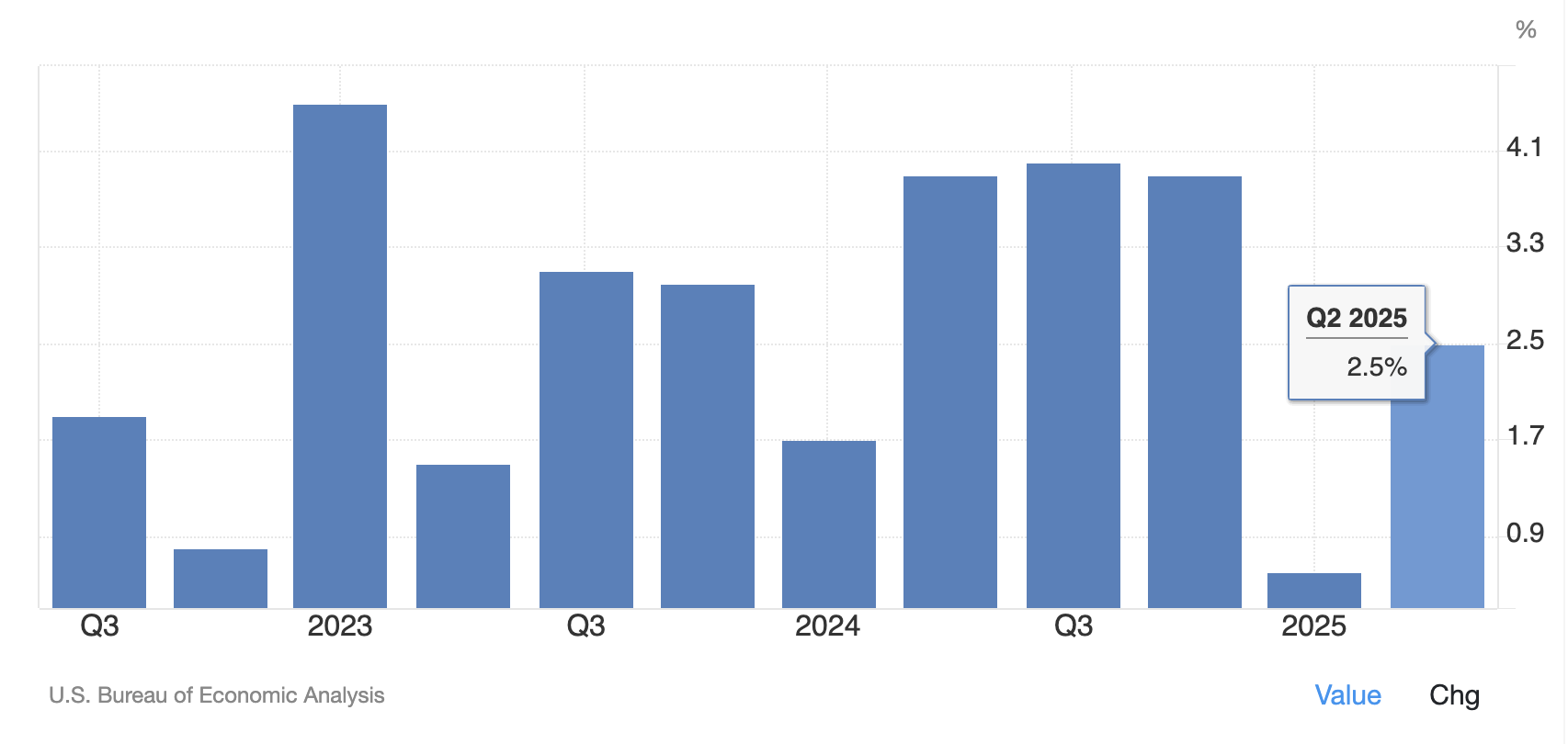

Consumers remain the key growth driver in Q3, with economists expecting consumer spending to rise by around 2.7%, a pace that would keep the expansion narrative intact even as labour-market momentum cools.

If consumer spending carries the report, markets tend to treat the growth as "high quality" because it is tied to domestic demand rather than accounting swings.

What to Watch Inside Consumption:

Spending on services versus goods, because the strength usually signals steadier demand.

Any sign that higher unemployment is starting to bite, because sentiment can turn quickly in late-cycle periods.

2) Net Exports and the Tariff After-Effects

In 2025, trade has added significant noise to the data, as tariffs have distorted the timing of imports and inventory flows.

Several previews argue Q3 growth is helped by a trade swing, with some suggesting net trade could add around 1.5 percentage points to GDP.

If that happens, it can make the headline look strong even if domestic demand is less impressive.

The Trader's Interpretation Rule:

If GDP beats mainly because imports fall, bond yields can still rise on the headline, but the move often fades if investors judge the strength as less durable.

3) Inventories

Inventories are often the "wild card: because they are hard to forecast and can flip the sign of GDP surprise.

A significant increase in inventory can boost GDP, but it may lead to slower growth in the future if companies reduce production to decrease stock levels.

An Effective Method for Verifying Inventories:

If inventories surge while final demand looks soft, traders often discount the headline and focus on underlying demand measures.

4) Business Investment (Tech, AI)

Business investment has been a bright spot in parts of 2025, particularly in equipment and intellectual property that aligns with AI-linked capex.

Economists anticipate that fixed business investment will stay favourable, even if it slows down from Q2.

When business investment holds up, equity markets usually take it as a medium-term earnings support signal.

5) Housing and Government Spending

Housing tends to be rate-sensitive, so it often softens when borrowing costs remain restrictive.

Recent data suggest residential investment may be a modest drag on growth, while government spending is expected to show a moderate pickup.

Neither category is likely to be the main headline driver, but both can matter for the "composition" narrative.

What Comes Next After Today's GDP Print

As mentioned above, the BEA will publish an updated estimate of Q3 GDP on 22 January 2026, which is expected to serve a similar role to a later-round estimate in a normal release cycle.

Due to the shutdown interruptions, traders should consider that revision risk is elevated compared to a regular quarter and should concentrate on direction and composition rather than just the initial headline.

The BEA has also cautioned that broader scheduling issues are possible, including delays or rescheduling of other major releases when source data aren't available in time.

That background reinforces a sensible approach: trade the surprise, then re-price the story as the data flow normalises.

Frequently Asked Questions (FAQ)

1. What Time Is the Q3 2025 US GDP Release?

The BEA is scheduled to release Q3 2025 GDP (Initial Estimate) at 8:30 a.m. ET on 23 December 2025.

2. What Is the Consensus Forecast for Q3 2025 GDP?

Many economists expect around 3.2%–3.3% annualised growth, which would be slower than Q2's pace but still firm.

3. Will There Be a "Third Estimate" for Q3 2025 GDP?

BEA will publish an Updated Estimate on 22 January 2026, and it will serve as the equivalent of the third estimate for the quarter.

Conclusion

In conclusion, the US will release its delayed Q3 2025 GDP initial estimate today at 8:30 a.m. ET. Economists expect around 3.2%–3.3% annualised growth, driven mainly by consumer spending and trade dynamics.

Traders should focus on the surprise versus consensus and the quality of growth inside the components, especially private domestic demand.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.