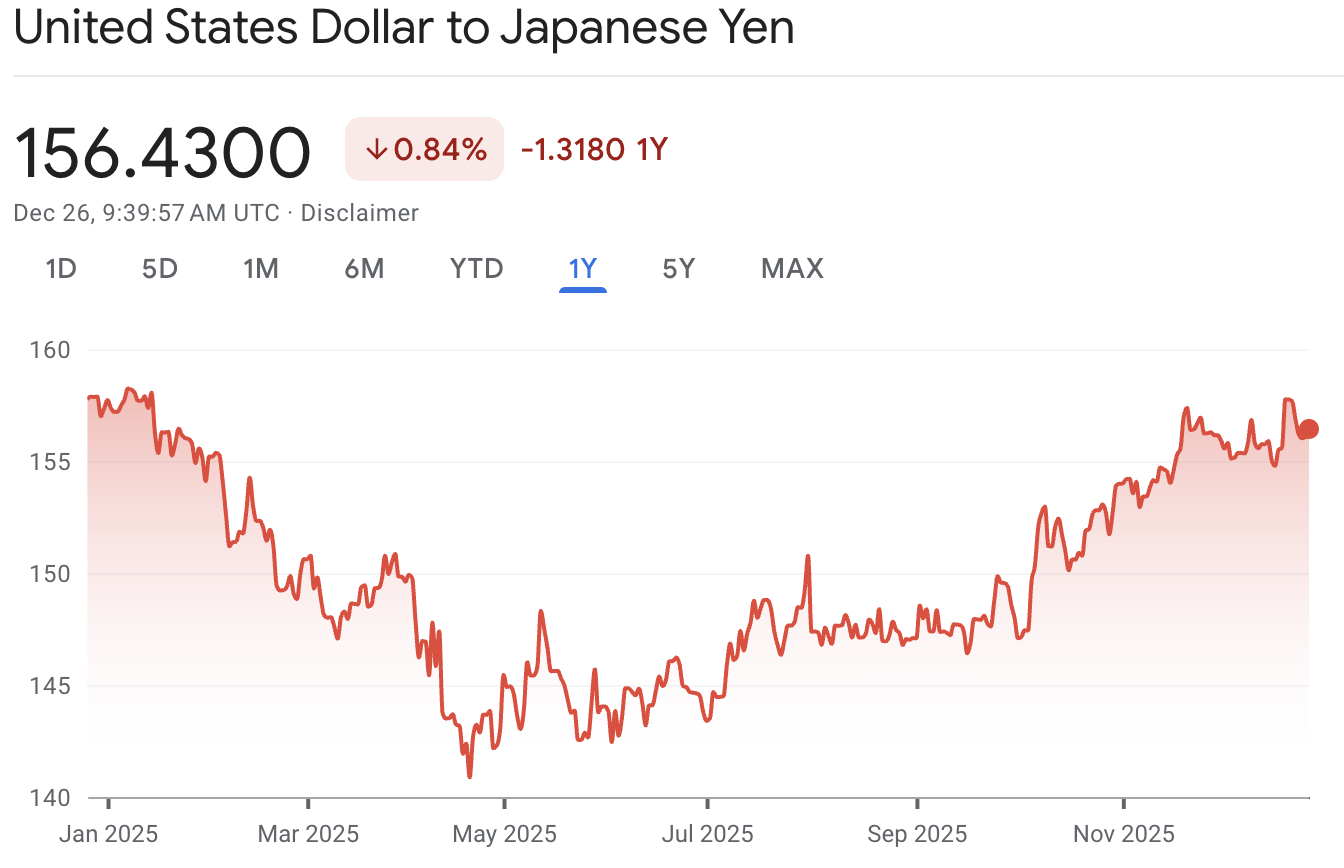

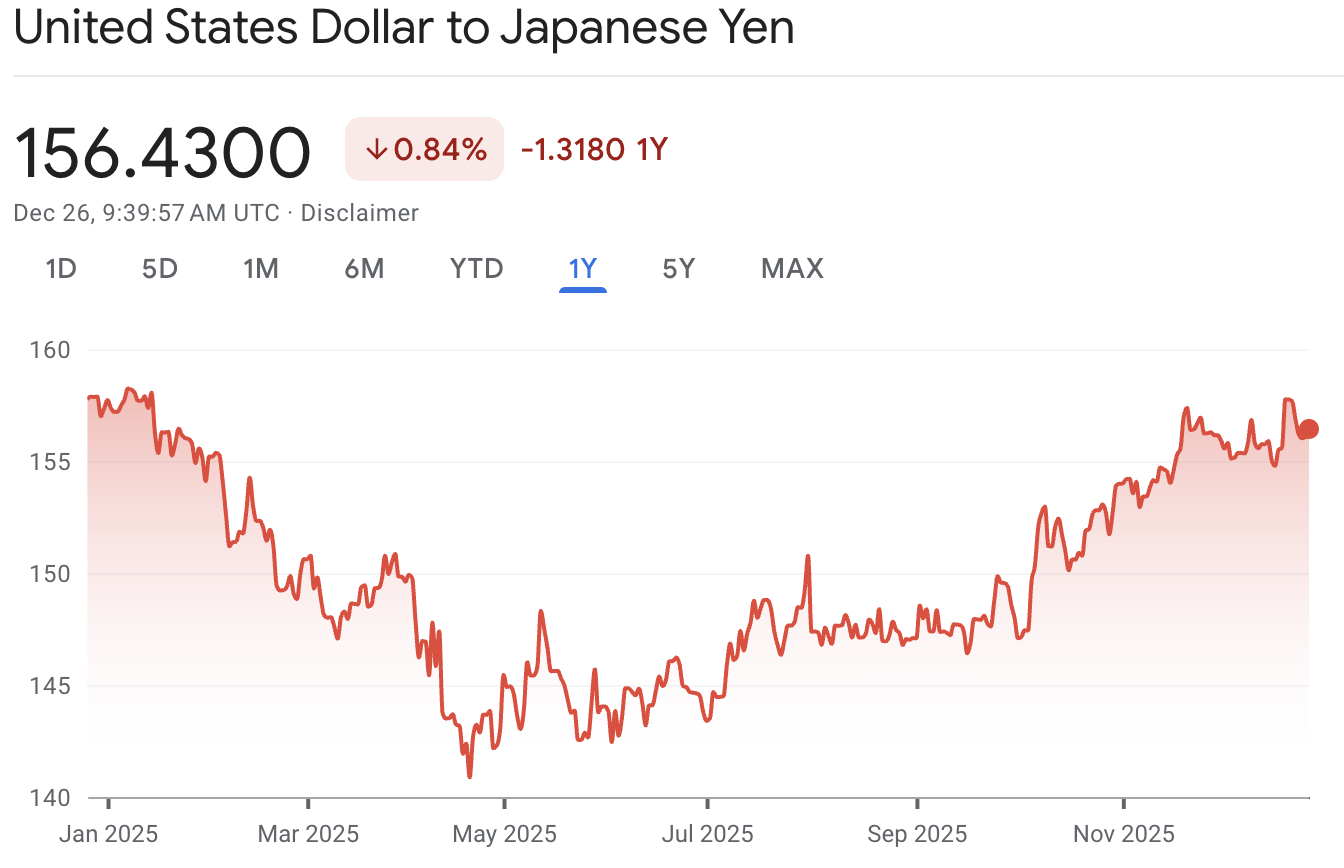

The Japanese yen is under pressure again. USD/JPY is trading around the mid-150s in late December 2025, with the yen still near the weaker end of its yearly range.

This combination of interest-rate differentials, political factors, energy costs, and market dynamics drives this action. Japan currently faces its highest interest rates in years, yet the yen remains weak, complicating the narrative beyond just a straightforward "low rates" explanation.

Historically, JPY strength has been a go-to safe haven in times of turmoil, so its current weakness has attracted scrutiny. With the Bank of Japan lifting rates again in December and the Fed still keeping rates far higher, the market is focusing on whether Japan can narrow the gap quickly enough to change capital flows.

Why Is the Japanese Yen Dropping Right Now?

Currently, the yen is declining primarily because worldwide investors regard it as an inexpensive funding currency. Elsewhere, Tokyo's policymakers are giving mixed messages regarding the speed of their response to this weakness.

Here are the main drivers of the Yen Drop:

Policymakers are now threatening intervention and hinting at rate hikes. However, thus far, the market is still testing how far it can push USD/JPY, with many analysts watching the 160 level as a trigger for stronger action.

USD to JPY Exchange Rate 2025

| Level |

Date |

Value |

| Year High (Weakest Yen) |

Jan 8–10, 2025 |

158.35–158.87 |

| Year Low (Strongest Yen) |

Apr 21–22, 2025 |

139.89–140.72 |

| 2025 Average |

Full year |

~149.50 |

| Year-end Close |

Dec 25, 2025 |

155.87 |

To note: The dollar weakened ~1.0% against the yen over the full 2025 year, with the yen strengthening significantly from April onwards due to escalating Bank of Japan rate hike expectations and diminishing yield differentials between U.S. and Japanese rates.

Why Is the Yen So Weak? Key Drivers Explained

1. Monetary Policy Divergence & Yield Differentials

1. Monetary Policy Divergence & Yield Differentials

The Bank of Japan remains cautious and has yet to embark on aggressive rate hikes, while U.S. yields, especially on 10-year Treasuries, remain significantly higher.

As of late December 2025, Japan's 10-year government bond yield is around 2.0%, while the U.S. 10-year yield is around 4.1%, leaving a gap that still favours dollar assets for many global investors.

This yield differential is the single biggest driver of yen weakness today.

2. Strong U.S. Dollar / Safe-Haven Flow Reversal

USD strength in 2025 is driven by yield, macroeconomic attractiveness, and capital flows.

The dollar's rally has put general pressure on emerging, export, and "carry trade" currencies, including the yen.

Even after the Fed's December move, the policy range remains 3.50% to 3.75%, which still makes the dollar attractive in a world where many investors want income and liquidity.

3. Fiscal & Political Signals (New Leadership, Stimulus Bias)

Japan may lean toward more fiscal stimulus under new leadership, weakening JPY expectations.

Following Sanae Takaichi's victory in the LDP leadership, markets reported USD/JPY dropping below 150, attributing the move to expected fiscal loosening and diminished hawkish influence on the BOJ.

Since then, fiscal headlines have stayed in focus. Japan's cabinet has approved a record-sized budget plan for the next fiscal year, while also trying to limit new bond issuance. Markets have been sensitive to what this means for debt supply and long-dated yields.

4. External Trade & Current Account Pressures

Japan's import-heavy structure (energy, raw materials) hurts the JPY when trade conditions worsen. With energy and commodity prices volatile, Japan's import costs rise, reducing net exports and putting the JPY under pressure.

A weaker yen can also keep "cost-push" inflation sticky, because imported food and fuel become more expensive in yen terms. That matters because it can squeeze households even when exporters benefit.

5. Investor Risk Premium & Capital Flows

Foreign and domestic capital flows favour dollar or higher-yielding currencies. If JPY assets yield less or growth looks weaker, capital may depart, especially in volatile global regimes.

This is where positioning matters. When investors fund trades in yen and buy higher-yield assets elsewhere, the unwind can be sharp, but the build-up can last for months while the yield gap stays wide.

6. Structural Constraints & Demographic Trends

Japan's ageing population, low productivity growth, and high public debt issues had dampened confidence as weak structural growth limits Japan's ability to "outgrow" currency pressure.

This backdrop also makes fiscal debates more market-sensitive, because Japan has less room for policy mistakes when debt is already high, and the economy is not growing quickly.

7. Limited Central Bank Leverage & FX Intervention Constraints

BOJ has constraints in countering the JPY weakness aggressively. Large interventions may be politically constrained or require foreign coordination, and consistent intervention can deplete reserves or invite international criticism.

Japan has intervened before, including in 2022 and 2024, and officials have again warned they are ready to act if moves become excessive.

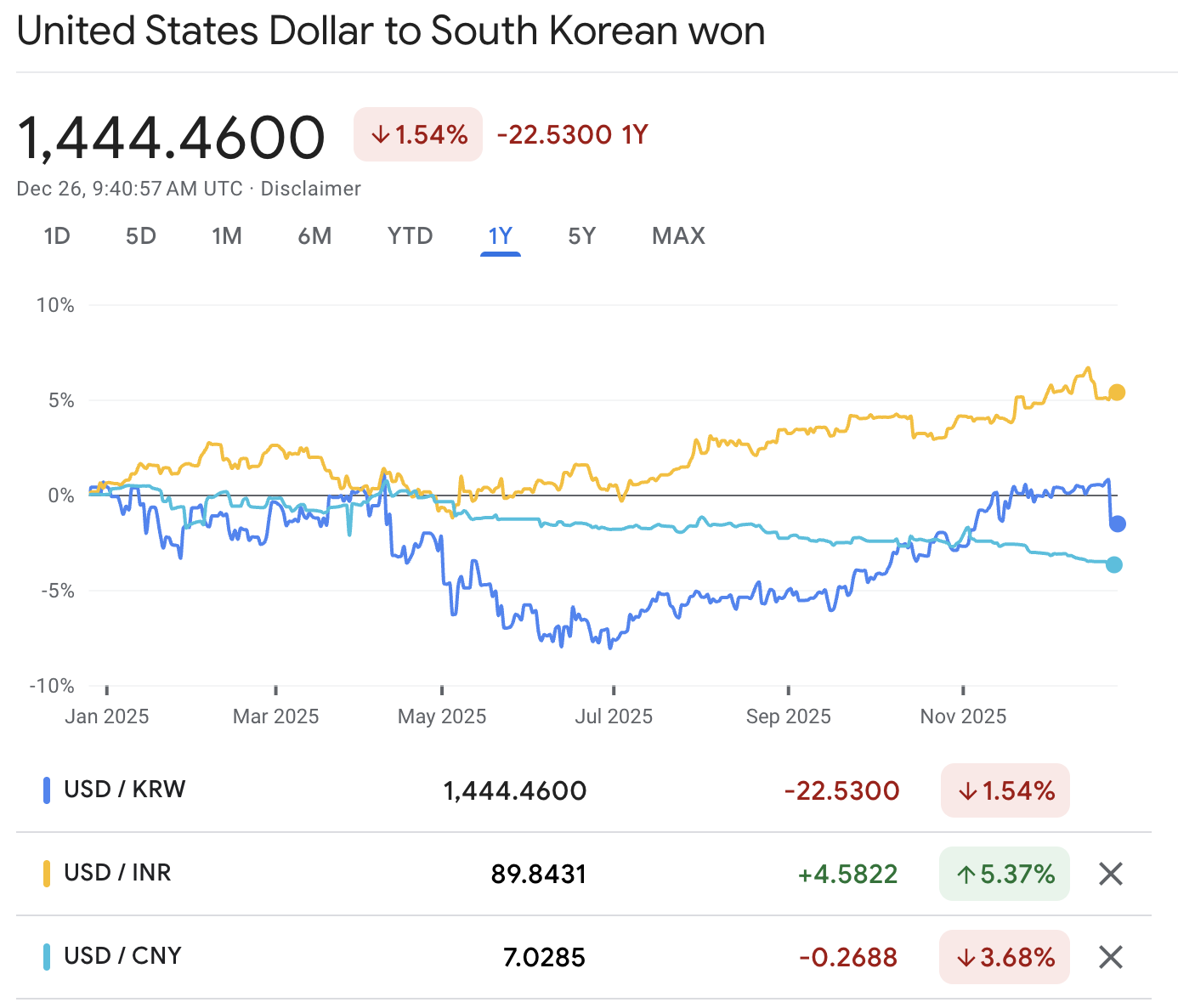

8. Relative Weakness vs Regional Peers

Some regional currencies are also weaker, but the yen's weakness is sharper due to Japan-specific factors.

For example, the Korean won or Chinese yuan show stress, but not with the same yield crowding and fiscal/political baggage.

Regional & Cross-Currency Perspective

To see if JPY weakness is unique or part of a broader pattern:

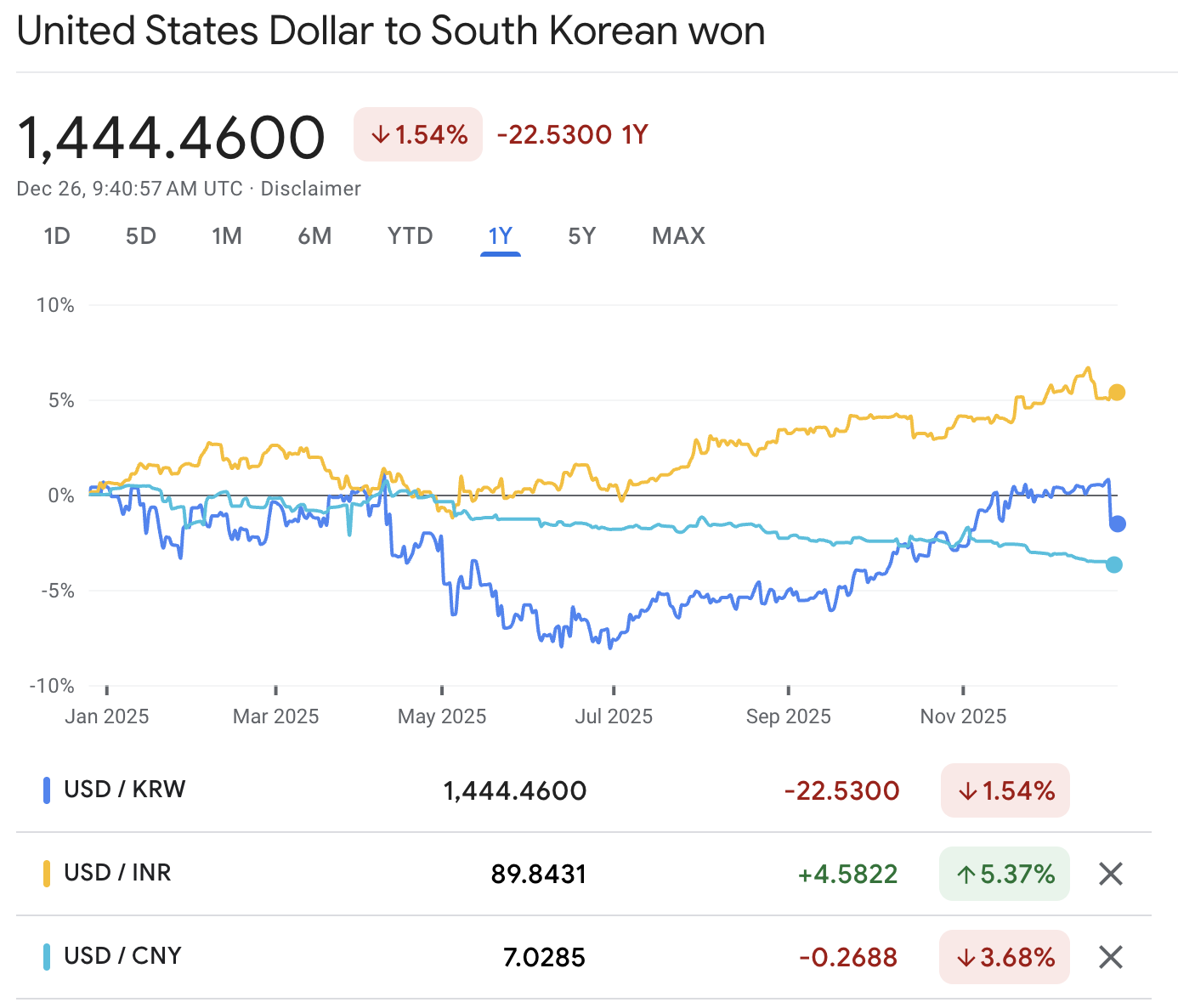

In 2025, the Korean won (KRW) and the Indian rupee (INR) have similarly weakened against the USD. However, their causes are more related to trade and capital flows rather than significant policy differences.

The Chinese yuan (CNY / CNH) has experienced a controlled decline. But China's capital regulations and central oversight restrict free float movements.

Historically, during risk-off episodes, the yen typically appreciates. However, its current weakness suggests significant opposing forces at play.

This comparison highlights that yen's weakness isn't just an emerging-market trend; Japan's internal and policy conditions amplify it.

USD/JPY Forecast 2025 & Japanese Yen Outlook 2026

Listed below is an overview of potential trajectories for the yen in late 2025 and moving into 2026, informed by yield spreads, monetary policy, and institutional predictions.

| Scenario |

USD/JPY Range |

Key Conditions |

| Moderate Bearish (Yen Recovery) |

140 to 150 |

BOJ continues hiking, U.S. yields soften, and risk sentiment turns less USD-supportive. |

| Base Case / Range-Bound |

145 to 155 |

Japan tightens slowly, the Fed pauses, and markets trade the range with event-driven swings. |

| Strong USD / Deep Yen Weakness |

150 to 160+ |

Yield gap stays wide, fiscal worries return, and carry demand remains strong. |

MUFG has highlighted a 2026 scenario where the dollar weakens, and BOJ hikes continue, which would be consistent with a lower USD/JPY level by the end of 2026 in their published outlook work.

At the same time, the main risk to a cleaner yen recovery is straightforward. If U.S. yields remain elevated for an extended period, the carry appeal persists, allowing USD/JPY to remain high even amid gradual BOJ increases.

What to Monitor Next (for Yen Watchers & Traders)

BOJ rate decisions and policy statements

U.S. Treasury yields and forward rate expectations

Japan's inflation data, wage growth, and output gap

Trade balance and import cost pressures

FX interventions and announcements by BOJ / MOF

Political leadership cues (e.g. stimulus plans, tax policy)

Frequently Asked Questions

1. Why Is the Japanese Yen So Weak Against the U.S. Dollar in 2025?

The yen has weakened due to diverging monetary policies, with Japan's Bank of Japan tightening only gradually while the U.S. maintained much higher interest rates.

2. How Does Japan's Low Interest Rate Policy Affect the Yen's Value?

Japan's relatively low rates reduce the incentive to hold yen for yield. Many global investors borrow or fund in yen and buy higher-yield assets elsewhere. That flow tends to weaken the yen until Japan's rate path looks meaningfully higher.

3. Is the Yen Expected to Weaken Further or Recover?

If U.S. yields fall and BOJ hikes remain, the yen can recover. If the yield gap remains wide, yen weakness will persist.

4. What Impact Does Inflation in Japan Have On the Yen?

Inflation above 2% increases pressure on the BOJ to normalise policy, which can support the yen over time. However, if inflation is driven by a weak currency and higher import costs, it can also hurt growth and sentiment, which limits the yen's rebound.

Conclusion

In conclusion, the yen's weakness into year-end 2025 is not driven by one headline. It is mostly the result of the U.S. and Japan yield gap, persistent carry-trade demand, and renewed sensitivity to Japan's fiscal outlook, even as the BOJ continues its slow exit from ultra-loose policy.

A sustained yen recovery usually needs at least one of these shifts: lower U.S. yields, a faster BOJ hiking path backed by wage growth, or a clear improvement in Japan's external balance.

Until then, the USD/JPY is likely to remain prone to abrupt swings, especially in thin liquidity and when intervention risk is elevated.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

1. Monetary Policy Divergence & Yield Differentials

1. Monetary Policy Divergence & Yield Differentials