Asia markets tumbled on Thursday as a wave of risk aversion swept across global equities, hitting technology-heavy indices the hardest. Sharp foreign outflows and stronger dollar pressure drove a rapid unwinding of positions across the region.

Asia Stocks Fall Across the Board on Market Uncertainty

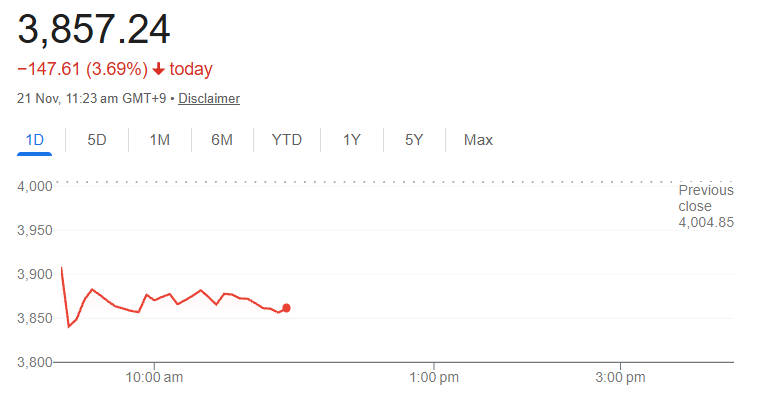

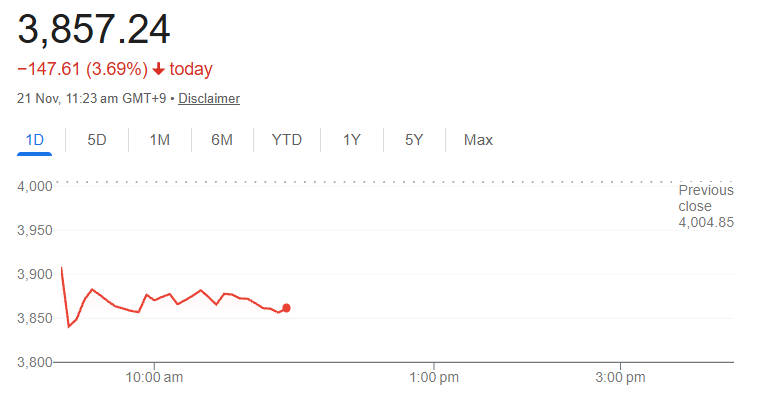

Korea's KOSPI led regional declines, plunging 3.69% to close at 3.857.24. marking one of its steepest single-day drops in recent months.

The index fell below key psychological support levels as heavy foreign selling pressured large-cap technology and semiconductor stocks.

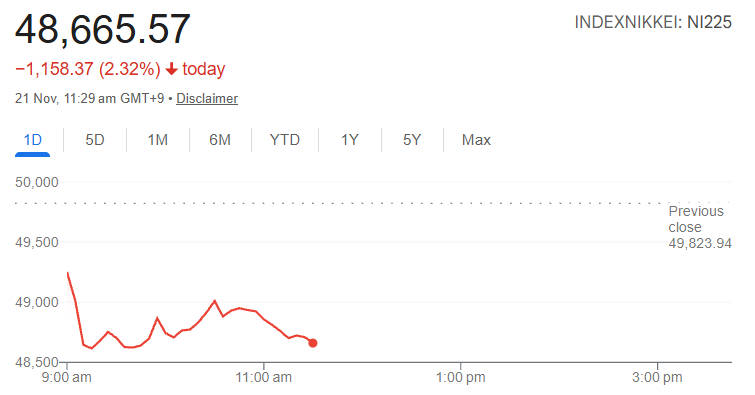

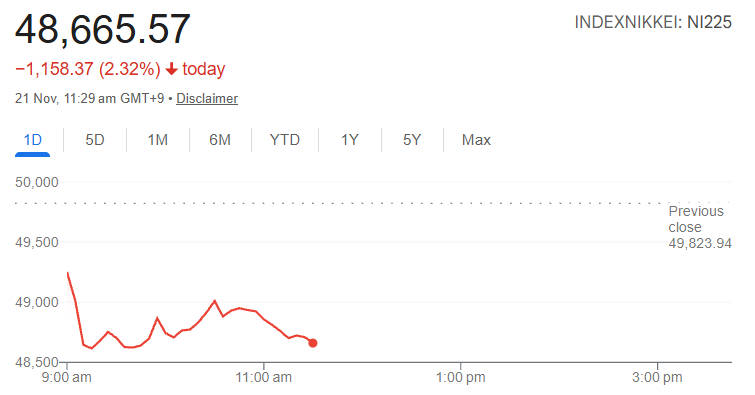

The rout extended beyond Korea, with Japan's Nikkei 225 dropping 2.35% to 48.653.80. Hong Kong's Hang Seng Index shedding 2.36% to 25.226.30. and Taiwan's Weighted Index slumping 3.20% to 26.548.12.

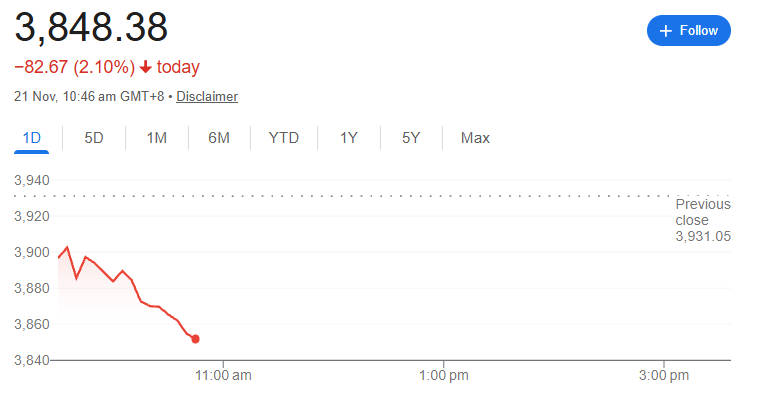

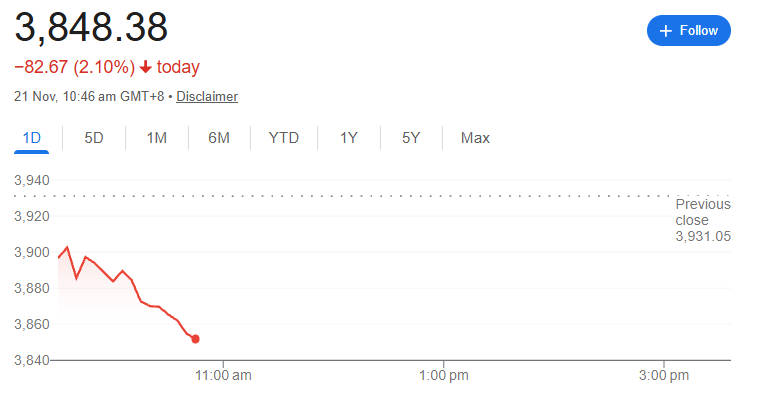

Meanwhile, China's Shanghai Composite fell 2.10% to 3.848.38 at the time of writing, reflecting renewed concerns over domestic demand and persistent weakness in property-related sectors.

Why Asia-Pacific Stocks Fell: The Key Drivers Behind the Sell-Off

Several forces converged to trigger the latest wave of selling across Asia-Pacific markets. Central to the decline was a broad shift into risk-off positioning, driven by a mixture of external macroeconomic catalysts and region-specific vulnerabilities.

Below are the primary factors weighing on investor sentiment.

1. Strengthening US Dollar and Higher Treasury Yields

A resurgent US dollar exerted pressure on Asian markets as investors sought safe-haven assets amid growing global uncertainty. Rising US Treasury yields complicated the environment for emerging markets and Asia's export-focused economies, making local currencies more vulnerable and amplifying capital outflows.

The stronger dollar also dampened commodity prices and weighed on sectors reliant on global trade demand. For many investors, the combination of tighter financial conditions and currency volatility signalled reduced risk appetite across the region.

Tech-related equities bore the brunt of the downturn, a trend particularly evident in markets like Korea and Taiwan, where semiconductor manufacturers and electronics exporters dominate market capitalisation.

A sharp decline in global chip demand forecasts, coupled with concerns over oversupply in the semiconductor industry, triggered broad-based selling.

Major US and European tech stocks had already come under pressure earlier in the week, creating a spill-over effect across Asia, where markets are especially sensitive to changes in global tech cycles.

3. Heightened Geopolitical Tensions

Geopolitical developments involving East Asia and the Middle East have added another layer of risk, prompting global investors to reduce exposure to risk assets. Rising concerns over supply chain disruptions, cross-strait tensions, and trade policy shifts have further dampened outlooks for regional exporters and manufacturing hubs.

4. Persistent Questions About China's Growth Trajectory

China's economic data has remained mixed, with persistent weaknesses in the property sector and softer-than-expected consumer demand continuing to undermine confidence.

The Shanghai Composite's decline reflected these structural challenges, which, in turn, impacted markets with high trade dependence on China. Investors remain cautious about Beijing's policy support measures, uncertain whether stimulus will be sufficient to stabilise the broader economy.

Sector Breakdown: Which Industries Led the Declines?

The sell-off was broad, but several sectors recorded outsized losses, reflecting their sensitivity to external shocks and shifting investor sentiment.

1. Technology and Semiconductors

Semiconductor and hardware manufacturers across Korea, Taiwan and Japan recorded some of the sharpest losses. Concerns about a slowdown in global chip demand weighed on giants across the region. The combination of weaker export orders and inventory pressures has made the sector a focal point for bearish positioning.

2. Financials and Banking

Banks and financial services firms declined as flattening yield curves and concerns over credit conditions impacted the sector. Investors remain wary of rising loan risks, especially in markets tied closely to real estate, such as China and Hong Kong.

3. Consumer and Retail

Consumer stocks fell amid concerns that slower global growth and higher interest rates would constrain spending. Tourism-linked sectors in Hong Kong, Japan and Korea also declined due to currency pressures and weakening demand indicators.

4. Energy and Materials

Energy producers and commodity-linked stocks came under pressure as concerns about global manufacturing activity and oil demand weighed on sentiment. The stronger US dollar added further downward pressure on commodity markets.

Market Impact: Broader Implications for Investors

The latest declines highlight the vulnerability of Asia-Pacific equities to any deterioration in global conditions. Currency volatility has re-emerged as a key theme, with several regional currencies weakening against the dollar.

Foreign capital outflows have become more pronounced, particularly in Korea and Taiwan, as investors rebalance toward safe-haven assets. The movements reinforce the challenges faced by markets heavily reliant on technology exports and sensitive to shifts in global risk appetite.

Bond markets across the region also showed signs of stress, with yields rising in reaction to global rate expectations. The decline in equities has led to increased demand for gold and US Treasury securities, signalling growing caution among global investors.

Outlook: Will Asia-Pacific Markets Stabilise?

While the scale of the sell-off has raised concerns about a deeper correction, analysts note that near-term stabilisation may depend on several variables. A pullback in the US dollar, moderation in Treasury yields, or stronger-than-expected global economic data could help ease pressure on the region.

Conversely, additional geopolitical developments or further weakness in technology demand could prolong market volatility.

Despite near-term challenges, some strategists argue that valuations across Asia-Pacific markets have become more attractive, especially in sectors tied to long-term structural trends such as AI, semiconductors and renewable energy.

However, investors are likely to remain cautious until greater clarity emerges on global monetary policy and geopolitical risks.

Frequently Asked Questions

Q1: Why did Asia-Pacific stock markets fall today?

Asia-Pacific markets dropped due to stronger US dollar conditions, rising Treasury yields, weakness in global technology shares, and heightened geopolitical tensions. Concerns over China's growth outlook and broad risk-off sentiment added further pressure, prompting widespread selling across regional benchmarks.

Q2: Which Asia-Pacific index recorded the steepest loss?

Korea's KOSPI posted the largest decline, falling 3.69% to 3.857.24 amid heavy foreign selling in large-cap technology and semiconductor stocks. Taiwan's Weighted Index also saw a significant drop, reflecting broad pressure on tech-heavy markets across the region.

Q3: What sectors were most affected by the sell-off?

Technology and semiconductor stocks led declines across Korea, Taiwan and Japan. Financials, consumer shares and energy companies also weakened as investors reduced exposure to risk assets due to global uncertainty, strong dollar conditions and concerns over slowing economic activity.

Q4: Will Asian markets recover soon?

A near-term recovery depends on moderating dollar strength, stabilising US Treasury yields and improved global economic data. However, continued geopolitical risks and weak technology demand could prolong volatility, meaning sentiment may remain cautious until clearer catalysts for stabilisation emerge.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.