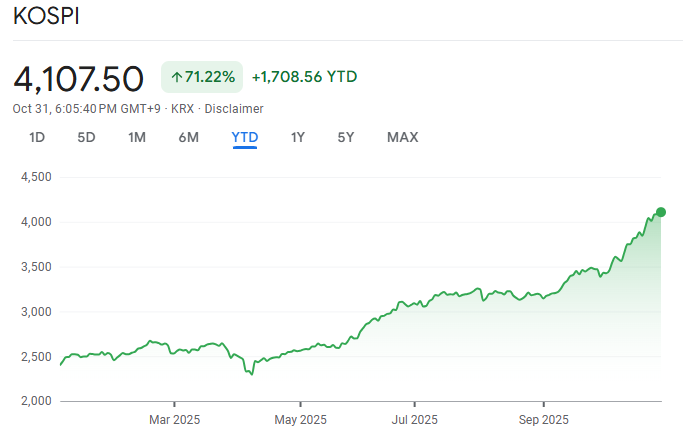

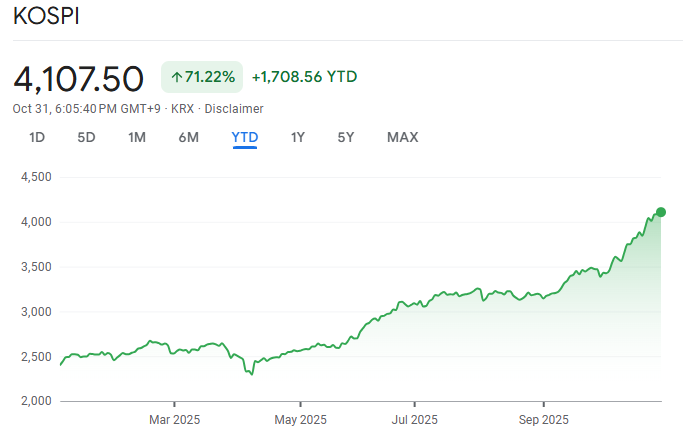

South Korea's equity market has surged past regional peers and captured global attention. After closing at 3,814.69 on 20 October 2025, the benchmark KOSPI shattered resistance and posted an all-time closing high of 4,107.50 on 31 October 2025.

This rally is driven by surging AI-related semiconductor demand, improving U.S.–China trade relations, strong institutional inflows, and stable inflation that continues to support corporate margins.

The rally has transformed Korea's equity market from a regional player into a global powerhouse, attracting investors worldwide.

Samsung and SK Hynix Lead Kospi's Surge

Semiconductor manufacturers have emerged as the primary drivers behind the Kospi's historic ascent, with SK Hynix delivering extraordinary returns that have reshaped portfolio performance across the board. [1]

| Key Stock Performance |

YTD Gain (2025) |

Recent Performance |

| SK Hynix |

+145 % |

+4.3 % (Oct 20) |

| Samsung Electronics |

+58 % since Jan |

+0.2 % to +3.5 % daily |

| KOSPI Index |

+66 % YTD |

4,107.50 (Oct 31) |

Why chip stocks are dominating the rally:

At the heart of the rally are Samsung Electronics and SK Hynix, both integral to memory, logic, and AI infrastructure:

In early October, Samsung and SK Hynix struck strategic supplier agreements/letters of intent to support OpenAI's "Stargate" initiative, fueling investor optimism around high-bandwidth memory (HBM) demand.

SK Hynix reported record Q3 revenue of ₩24.45 trillion (+39.1% YoY) and operating profit of ₩11.38 trillion (+61.9% YoY), crossing the ₩10 trillion profit mark for the first time.

Reuters reports SK Hynix shares have surged ~200% YTD 2025, outpacing Samsung's ~87% gain and the KOSPI's ~67% rise. [1]

How Kospi Compares to Global Markets

South Korea's stock market has emerged as the world's best-performing major index in 2025, significantly outpacing both developed and emerging market peers.

| Index |

YTD Performance (2025) |

Recent Level |

Key Driver |

| KOSPI (S. Korea) |

+66 % |

4,107 |

AI chip boom + foreign inflows |

| S&P 500 (U.S.) |

+18 – 20 % (est.) |

Near records |

Tech rotation |

| Nikkei 225 (Japan) |

+20 % (est.) |

39,000 + |

Corporate reforms |

| Hang Seng (Hong Kong) |

−2 to +8 % |

Volatile |

China growth concerns |

| MSCI EM Index |

+14 – 16 % |

Mixed |

Rate cuts theme |

The KOSPI's roughly 66% gain more than doubles most global benchmarks, driven largely by strong exposure to semiconductors and artificial intelligence.

Trump's Tariff Remarks Boost Korean Stocks

A significant catalyst for the recent rally came from reduced trade conflict fears between the United States and China, providing relief to export-dependent Korean manufacturers.

President Donald Trump's conciliatory remarks in a Fox News interview on 19 October regarding tariffs on China gave markets substantial relief. Lee Jae-won, a researcher at Shinhan Investment & Securities, explained that "the Kospi has jumped on the rebound in the Asian stock market due to easing trade conflicts between the U.S. and China and reducing credit risks".

The improved trade environment particularly benefits South Korean semiconductor and automotive companies that rely on stable export channels to both the United States and China.

Unlike previous rallies concentrated solely in semiconductor stocks, the recent gains have spread across multiple industries, including automobiles, defence, shipbuilding, and securities.

Korea's PPI at 0.6%: Inflation Under Control

South Korea's producer price data has shown moderate inflation pressures that support corporate profitability without triggering aggressive central bank tightening, creating an ideal environment for equity appreciation.

| Producer Price Metric |

Latest (Sept 2025) |

Prior Period |

Trend |

| PPI YoY |

0.6 % |

0.6 % (Aug) |

Stable |

| PPI MoM |

−0.1 % (Aug) |

+0.4 % (July) |

Cooling |

| Export Prices YoY |

+2.2 % (Sept) |

−1.1 % |

Recovering |

| Import Prices |

Moderate |

Declining |

Benign |

Moderate producer price growth has helped preserve manufacturers' margins, allowing the Bank of Korea to maintain an accommodative policy stance.

Economists expect a slight increase to 0.9% YoY in September, still well below levels that might prompt monetary tightening. This environment continues to support equity gains and attract institutional investors. [2]

Institutions Buy ₩643 Billion as Rally Broadens Beyond Chips

Trading activity (October 20, 2025):

Institutional investors: Net buy ₩643 billion ($469 million)

Retail investors: Net sell ₩409 billion

Foreign investors: Net sell ₩251 billion

Strong institutional buying reflects long-term confidence that the rally is supported by solid fundamentals rather than speculative momentum.

The rally is now broad-based, spanning defence, aerospace, automobiles, and biotech, a sign of deeper market strength.

| Sector |

Top Performer |

Oct 20 Gain |

Market Driver |

| Defence |

Hanwha Ocean |

+6.1 % |

Export orders |

| Aerospace |

Hanwha Aerospace |

+4.5 % |

Gov’t contracts |

| Automotive |

Hyundai Motor |

+2.1 % |

EV momentum |

| Biopharma |

Samsung Biologics |

+1.6 % |

Drug approvals |

| Energy |

Doosan Enerbility |

+0.1 % |

Nuclear revival |

The improved performance across defence, aerospace, automotive, and biopharmaceutical sectors demonstrates that investor enthusiasm has extended well beyond the semiconductor concentration that characterised earlier 2025 gains.

Risks to Watch

Valuation Stretch: After a 66% rally, corporate earnings will need to catch up. Otherwise, profit-taking may set in.

Earnings Misses: SK Hynix or Samsung surprises could trigger corrections.

Geopolitical Risks: U.S.–China tensions or North Korea events could shift sentiment.

Tech Cycle Reversal: A pause in AI capex globally would hurt chip-heavy Korea.

Retail Profit-Taking: Selling by retail and foreign investors suggests growing concerns about valuations.

Can Kospi Hit 4,500 Next

Breaking the 3,800-point barrier removed major technical resistance. Momentum carried the index past 4,100 in late October, and analysts see potential for a test of 4,500 – 5,000 by mid-2026 if AI demand and reforms continue.

Yet profit-taking signals suggest a cooling phase may come first. Sustainability now depends on corporate earnings validating these valuations and foreign capital continuing to flow in.

Sources

[1] https://www.reuters.com/world/china/nvidia-supplier-sk-hynix-posts-record-q3-profit-meets-forecasts-2025-10-28/

[2] https://www.reuters.com/world/asia-pacific/south-korea-holds-key-rate-hot-housing-market-narrows-scope-easing-2025-10-23/