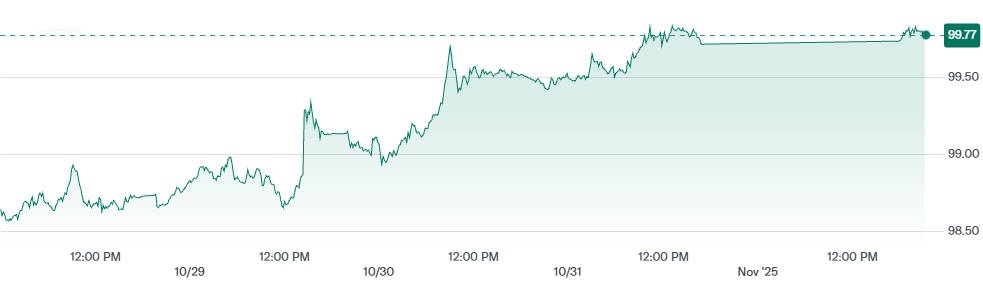

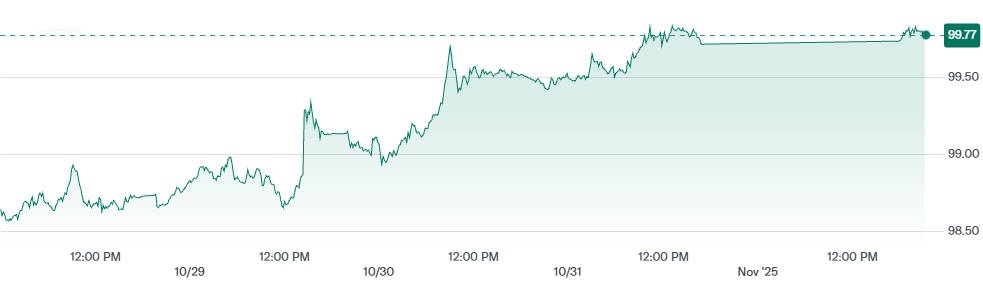

The U.S. Dollar Index has risen to about 99.80. marking its strongest level in roughly three months as markets reassess the timing of Federal Reserve easing and react to relative policy divergence among major central banks.

U.S. Dollar Index Reasserts Short-term Strength

The U.S. Dollar Index has reasserted short-term strength, advancing to approximately 99.8 and touching the highest level seen in around three months. Investors have effectively pushed back on expectations for prompt Federal Reserve rate cuts after a string of Fed commentary and mixed macro signals, while policy divergence and weakness in some peer currencies have amplified the move.

The result is renewed attention on how upcoming U.S. data and central bank messaging could either cement the rally or prompt a rapid retracement.

Recent Performance of the U.S. Dollar Index

On the most recent trading sessions the index climbed into the high 99s, a rise that places it at its loftiest point since mid-August.

Intraday ranges have been relatively tight, but the trend has been upwards across the last few days as markets absorbed central bank signals and prepared for a busy data calendar. Futures and spot readings are consistent in showing the index near the 99.7–99.9 area.

Key Performance Statistics of the U.S. Dollar Index

| Indicator |

Latest Reading / Comment |

| Current DXY Level |

~99.80 (recent spot/futures data) |

| Daily Performance |

Slightly positive intraday gain with upward bias |

| Monthly Change |

Around +1.7% month-to-date |

| Three-Month Range |

Top of the recent 3-month trading band |

Primary Drivers Behind the Rise of the U.S. Dollar Index

1. Federal Reserve Communication and Rate Path Repricing

Comments from senior Fed officials have reduced the likelihood of an imminent rate cut, strengthening the dollar through higher expected yields. Markets are now reassessing the timeline for policy easing, providing a structural lift to the index.[1]

2. Global Policy Divergence Among Major Central Banks

The Bank of Japan's ongoing yield-curve control and the ECB's slower tightening trajectory have widened interest-rate differentials. The resulting gap has pressured the yen and euro, key components of the DXY basket.[2]

3. Cautious Positioning Ahead of U.S. Economic Data Releases

With upcoming non-farm payrolls and inflation reports, traders have added long-dollar exposure as a defensive measure. This behaviour reflects the dollar's continued appeal during uncertain macro periods.

4. Cross-Asset Dynamics Reinforcing Dollar Strength

The stronger dollar has weighed on commodities priced in U.S. currency, especially gold, while U.S. Treasury yields have edged higher, reinforcing a cycle of inflows toward dollar-denominated assets.

Market-Wide Impact of the Stronger U.S. Dollar Index

1. Major Currency Pairs:

The euro and pound have weakened notably, while the yen remains under pressure, driving a broad-based dollar advance.

2. Fixed Income and Yields:

Treasury yields are modestly higher, extending the yield advantage that supports the dollar's position.[3]

3. Commodities and Equities:

A firmer dollar has constrained gold's upside potential and introduced mild volatility into commodity-linked equities.

Key U.S. Dollar Index Levels and Momentum Indicators

| Technical Level |

Analysis and Comment |

| Resistance |

100.00 (psychological ceiling and previous multi-month barrier) |

| Support |

99.2–99.4 range; below this zone, momentum could reverse |

| Momentum Reading |

Bullish but not overextended; traders watching for RSI divergence |

Technical indicators suggest the trend remains upward, yet a decisive move above 100.00 is needed to confirm continuation. Any weaker-than-expected economic data could trigger consolidation.

Economic and Policy Events Likely to Influence the U.S. Dollar Index

1. Upcoming U.S. Employment and Inflation Reports

Strong employment data could further strengthen the index, while a downside surprise might unwind gains.

2. Federal Reserve Commentary and Minutes

Markets will scrutinise tone and language from Fed officials for hints of future easing or caution.

3. Central Bank Actions Abroad

The yen's continued softness and the ECB's slower recovery pace both feed into the DXY's composition.

4. Geopolitical and Risk Events

Any rise in global risk aversion typically reinforces dollar demand; conversely, easing tensions could weaken the index.

What the Latest U.S. Dollar Index Surge Means for Investors

The recent three-month high signals renewed investor confidence in the U.S. economy relative to its peers. It also reflects a broader repricing of global monetary policy expectations.

For portfolio managers, a stronger dollar typically tightens financial conditions internationally, while exporters and commodity markets often adjust to reduced non-dollar purchasing power.

Frequently Asked Questions

Q1: Is the current rally a long-term breakout?

A1: No. It represents a medium-term rebound to a three-month high but remains below the major peaks recorded earlier this year.

Q2: What is the most important catalyst behind the move?

A2: The recalibration of Federal Reserve rate expectations remains the dominant driver, supported by yield differentials.

Q3: How might upcoming U.S. data affect the trend?

A3: Strong economic readings would likely extend dollar strength, while weaker data could trigger a corrective pullback.

Q4: Which currencies have contributed most to the index's rise?

A4: The yen, euro, and pound have shown the largest declines, accounting for most of the DXY's recent upward movement.

Q5: How can investors hedge exposure to a stronger dollar?

A5: Tactics include using currency-hedged ETFs, buying dollar call options, or diversifying into assets negatively correlated with the dollar.

Outlook and Conclusion

The U.S. Dollar Index's advance to a three-month high reflects a clear shift in sentiment regarding global monetary policy alignment.

Sustaining momentum beyond the 100.00 mark will depend on the strength of incoming economic data and whether the Fed maintains its cautious approach.

Investors should watch for volatility spikes around key U.S. releases and remain alert to changes in risk appetite that could rapidly alter the dollar's trajectory.

Sources:

[1]https://www.reuters.com/world/india/gold-slips-fed-rate-caution-boosts-dollar-set-3rd-monthly-rise-2025-10-31/

[2]https://www.reuters.com/world/asia-pacific/dollar-three-month-high-markets-puzzle-over-outlook-2025-10-31/

[3]https://tradingeconomics.com/united-states/currency

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.