Global markets ended last week looking calm on the surface, but the cross-asset message was anything but quiet.

The S&P 500 closed around 6,870 on Friday, just below record highs, with the MSCI World also near year-to-date peaks. VIX volatility slid back to about 15, less than two weeks after trading above 23.

At the same time, the US 10-year yield climbed from roughly 4.0% to 4.14%, the steepest weekly sell-off in Treasuries since April, while gold stayed above $4,200 and Brent crude oil held near $63-64 a barrel.

That trio of higher yields, expensive gold, and equities at all-time highs, is the real story. It tells you investors are betting on a Fed rate cut this week, yet still paying up for inflation and fiscal hedges.

This Week’s Cross-Asset Keypoints

1. Fed Rate Cut with High Market Hopes

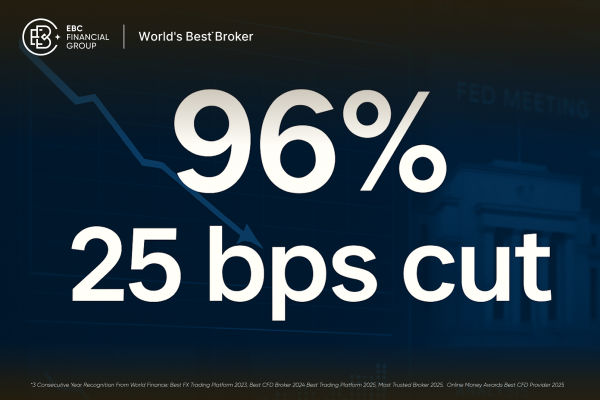

Markets price an estimated 85% to 87% chance that the Fed cuts the funds rate from 3.75-4.00% down to 3.50-3.75% on 9-10 December. The real trade is not the cut itself, but how divided the committee is and what its guidance suggests for 2026.

2. US Yield Curve Back to Normal Shape

The 2-year yield sits near 3.56%, the 10-year at 4.14% and the 30-year around 4.8%. This gives a positive 10s to 2s spread of roughly 60 basis points. Earlier in the cycle, the curve was deeply inverted. Now markets are no longer shouting “recession”. They are warning that the inflation and fiscal story is not finished.

3. Gold Price Is More Than a Rates Trade

Gold above $4,200 while nominal yields rise breaks the old textbook link between higher yields and lower gold. Recent studies show the correlation between gold and real yields has weakened. Fiscal worries, reserve diversification and central bank buying now take centre stage.

4. Stock Market Rally Is Spreading Across Sectors

Last week’s move was small, with the S&P 500 up about 0.3%, but more stocks now trade above their 50-day average and the Russell 2000 small-cap index has hit fresh highs. The index is no longer driven only by the big AI names.

Gains are spread more evenly across sectors such as technology, financials and industrials. Cyclical sectors and smaller companies are attracting fresh demand, and that shift supports more pro-growth positioning in FX and key commodities.

5. VIX Volatility: Calm Now, Risk Later

VIX dropped from the mid-20s in November to around 15.4 on Friday, while VIX futures still price higher volatility into early 2026. Spot volatility is saying “all clear”.

The term structure is saying “not so fast”, which still limits how aggressively investors want to add growth and long duration trades.

Last Week’s Markets: What Really Happened

1. Equities: New highs, but a different kind of rally

The S&P 500 closed on Friday around 6,870, up roughly 0.3% on the week and only a touch below its record high.

The MSCI World Index finished near 4,419, broadly flat on the week after steady gains through late November, keeping the global stock market outlook firm.

November’s wobble pulled money out of crowded AI and growth leaders and into defensive and value sectors such as healthcare and materials.

Early December has added a second leg, with cyclical sectors and small caps now leading as rate-cut hopes support domestic demand themes.

So the current equity rally is not just about the index sitting near a new high. It is a broadening bull market, which tends to be more durable, but it is also more sensitive to any Fed message that challenges the soft-landing story.

2. Bonds and Yields: A stealth bear steepener

The 10-year US Treasury yield rose from about 4.02% on 28 November to 4.14% on 5 December. More important than the move itself is the shape of the curve:

2-year yield: about 3.56%

10-year yield: about 4.14%

30-year yield: around 4.79%

The old yield-curve inversion has almost completely unwound. That is a quiet regime shift. Earlier in the cycle, an inverted curve pointed clearly to recession risk. Now, a positive 10s to 2s spread with elevated long yields signals term-premium, fiscal and inflation risk instead.

This is the kind of backdrop where equity indices can still grind higher, but valuation multiples become more vulnerable to any hawkish nuance from the Fed.

3. FX: Dollar soft, but not collapsing

The US Dollar Index (DXY) ended Friday around 98.99, down from 99.44 a week earlier. That marks a second weekly decline, but the move is modest at about 0.5%.

Selling in the dollar has been orderly, with no sign of panic or forced liquidation.

Carry currencies such as AUD, NZD and some emerging market FX have outperformed as traders lean into the global rate-cut story.

The dollar index is still sitting near a key technical and psychological area around 99, just ahead of the Fed decision.

This set-up leaves clear room for a short squeeze if the Fed delivers a hawkish cut or pushes back against the current 2026 easing path.

4. Commodities: Gold vs yields, oil vs geopolitics

Gold price: spot and front-month futures spent most of the week a little above $4,200 per ounce, very close to record highs.

Oil price: Brent crude closed on Friday around $63.5 and WTI near $59.5, giving WTI a weekly gain of about 1.5%, its second rise in a row.

Gold’s behaviour is striking. The price is rising even as real and nominal yields move higher. Recent research links this to fiscal concerns, central bank buying and geopolitical hedging, rather than day-to-day inflation data.

Oil’s floor is now driven more by politics than by demand. OPEC+ has kept supply tight, while talk of replacing the Russian price cap with tougher shipping sanctions and rising tension around Venezuela is adding a clear geopolitical risk premium.

5. Cross-Asset Weekly Snapshot (to 5 December 2025)

| Asset / Index |

Latest Close (Fri) |

Change vs Prior Fri |

Takeaway |

| S&P 500 |

6,870 |

~+0.3% |

New highs with broader participation. |

| MSCI World |

4,419 |

Slight gain |

Global risk sentiment is steady. |

| DXY (US dollar index) |

98.99 |

~–0.5% |

Gentle dollar drift lower. |

| Gold (spot / front) |

Just over $4,200 |

Little changed |

Still trading like a regime hedge. |

| Brent crude (front) |

~$63.5/bbl |

+1–2% |

Fed hopes + supply risks. |

| US 10-year yield |

4.14% |

+12 bps |

Worst week for bonds since April. |

| VIX |

15.41 |

Sharply lower vs late Nov |

Volatility back to pre-wobble levels. |

*Approximate week-on-week changes based on closing levels.

Week Ahead - Fed, FX and Macro Traps to Watch

Fed decision: More about message than move

This week’s Fed rate decision is the key event for global markets and for every multi-asset trader.

Markets currently price a strong chance of a 25 bp Fed rate cut to 3.50 to 3.75%, which would be the third cut of 2025. Independent research and many bank strategists also warn that there may be more dissent, with some members wanting no cut and others arguing for a larger move.

The Fed is not only choosing a new interest rate level. It is choosing which risk it wants to lean against:

Growth and labour risk: Cut now, hint that more easing in early 2026 is possible, and accept firmer asset prices.

Inflation and fiscal risk: Cut once, stress patience, and highlight term-premium pressures in long-dated bonds.

For the stock market, the forex market and key commodities such as gold and oil, this choice matters more than the size of the Fed interest rate cut.

The first path supports equities, EM FX and commodities. The second path supports the dollar and the long end of the US yield curve and could trigger the first real test of the new bull market narrative.

Other central banks and key data

Alongside the Fed, this week brings a cluster of central-bank meetings and inflation data:

| Day (Global) |

Event |

FX / Markets in Focus |

| Tue |

RBA rate decision |

AUD, ASX200 |

| Wed |

BoC decision; China CPI |

CAD, CNH, commodities |

| Wed–Thu |

Fed meeting & press conference |

USD, global indices, gold, yields |

| Thu |

SNB decision; US PPI |

CHF, EUR, US rates |

| Fri |

Eurozone and German inflation |

EUR, bund yields, DAX |

Market consensus: RBA, BoC and SNB all hold, leaving the Fed as the only major central bank likely to move this week. But any surprise - especially from the SNB facing a strong franc - could spark sharp FX moves in thin December liquidity.

Trade ideas and risk-reward by asset class

Note: This is not personal advice - think of these as scenario maps, not instructions.

1. FX / Forex forecast:

A hawkish cut, with a 25 bp move and cautious guidance, supports a short-term USD bounce, especially against JPY and CHF where positioning is crowded.

A clean dovish cut with hints of another move in early 2026 keeps the forex weekly outlook dollar-negative and supports AUD, NZD and high-carry emerging market FX.

2. Stocks / index outlook:

With VIX near 15 and the S&P 500 only a few tenths of a percent below its peak, further upside in the stock market outlook this week may depend on how clearly Powell supports the soft-landing story.

A mildly hawkish tone could offer traders the first meaningful buy-the-dip opportunity in weeks, especially in sectors that have just started to lead, such as cyclicals, small caps and selected value names.

3. Gold price outlook:

If the Fed talks openly about fiscal risk or term premia, gold can stay expensive or even break higher, even with yields moving up.

A growth-focused cut with only limited easing signalled for 2026 could trigger a $50-$100 drop, which longer-term buyers may see as a healthy reset rather than the end of the uptrend.

4. Oil price forecast:

Fed easing and a broader rally in equities support the outlook for oil demand into 2026. The key driver this week is geopolitics: talk of tougher rules on Russian exports and rising tension around Venezuela helps keep a firm floor under current prices.

Frequently Asked Questions (FAQ)

1. Is a Fed rate cut already fully priced into markets?

A 25 bp cut is largely priced across Fed funds futures and bond markets, with probabilities in the mid-80s percent range. The main uncertainty lies in the guidance for 2026 and the number of voting dissents.

2. Why is gold still near record highs with bond yields above 4%?

Recent research shows gold is now reacting less to real yields and more to fiscal stress, central-bank buying and geopolitical risk, which helps explain why prices remain above $4,200 even as the 10-year sits above 4%.

3. What does the steepening US yield curve mean for the economic outlook?

The move from inversion to a positive 10s-2s spread suggests markets see less immediate recession risk, but greater concern about longer-term inflation and fiscal pressures. That mix supports value and financials more than long-duration growth stocks.

4. Is the current equity rally still just about big tech and AI?

No. Sector and factor data show improving breadth: small caps, cyclicals and selected defensives have joined the move, while some AI leaders have seen profit-taking since October. That broadening is healthier, but also more exposed to any Fed-driven reversal in risk appetite.

5. Where is the main FX risk around the Fed this week?

The main short-term risk is a USD squeeze if Powell sounds less dovish than markets expect. Pairs with crowded short-dollar positioning such as USD/JPY, USD/CHF and some high-beta crosses - are most exposed to a sharp, temporary reversal.

Conclusion

The coming days are about how the Fed cuts, not whether it cuts. With:

Equities sitting near record highs

Bond yields rising and the curve steepening

Gold and oil pricing in long-term regime and geopolitical risk

This is a genuine two-way week for FX, stocks, commodities and yields.

For traders, the edge comes from:

Watching US yields and the dollar as the first and cleanest reaction

Accepting that low spot volatility can be misleading when event risk is high

Working with clear levels and scenarios, not just the headline of “cut” or “no cut”

If the Fed delivers a measured, data-led message, the global market outlook still leans towards a slow grind higher in risk assets, with opportunities in FX carry, cyclical stocks and selected commodities.

A more hawkish tone would not end the bull market, but it could finally produce the pullback that many traders have been waiting to buy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.