Global growth is losing momentum, and the latest Purchasing Managers' Index (PMI) readings confirm what markets have been sensing for weeks: the world economy is bending under the pressure of weaker demand, persistent inflation pockets, and cautious business sentiment.

From the U.S. to Europe to Asia, PMIs are slipping closer to contraction territory. And while many indicators still show resilience, the direction of travel is uncomfortably clear: growth is slowing, and investors everywhere are asking the same question:

Is this the early stage of a global economic downturn?

In this in-depth analysis, we break down the latest PMI data, map out where the slowdown is most pronounced, and unpack what investors should expect next.

What's Driving Today's PMI Slowdown? A Snapshot of Global Signals

| Region |

Manufacturing PMI |

Services PMI |

Overall Growth Signal |

Key Notes |

| United States |

52.5 |

~54.8 |

Moderate growth |

Manufacturing orders strong; export and inventory concerns |

| Eurozone |

50.0 |

~52.6 |

Mild expansion |

Manufacturing flat; services driving growth |

| United Kingdom |

~49.7 |

~52.3 |

Mixed/slowing momentum |

Manufacturing contracting; services holding up |

| China |

50.6 |

~52.6 |

Mild expansion |

Domestic demand steady; export markets weak |

| Japan |

48.2 |

53.1 |

Modest expansion |

Cost pressures; tourism/exports weak |

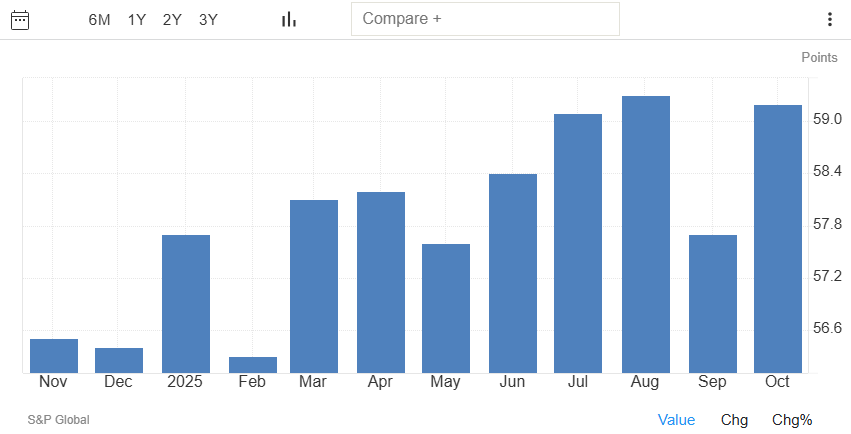

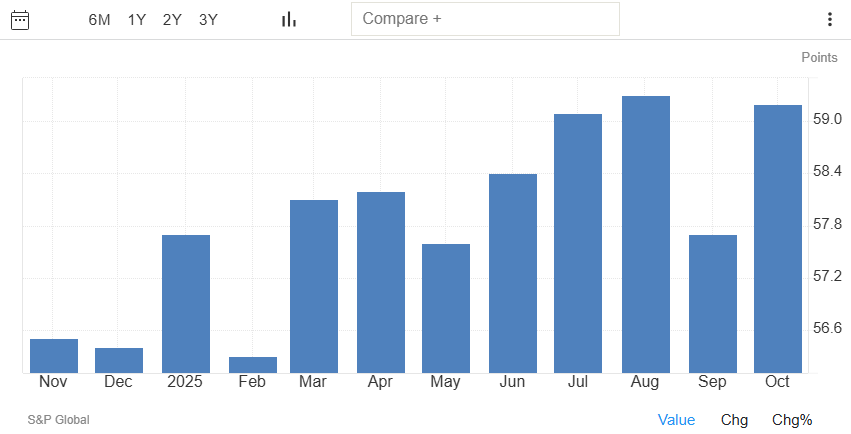

| India |

59.2 |

58.9 |

Strong growth |

Services strong; manufacturing growing |

| Mexico |

49.5 |

— |

Growth |

Supported by U.S. reshoring trends |

The PMI is one of the fastest indicators of economic health. It captures real-time data on business activity, new orders, hiring, and supply-chain conditions, often shifting earlier than GDP or employment figures.

Across major economies, three themes stand out in the latest PMI releases:

Demand is moderating across manufacturing and services.

Supply-side pressures are no longer improving as quickly.

Forward-looking components (new orders, hiring intentions) are softening.

That combination sets the overall tone: slowing growth, rising caution, and growing vulnerability to downside shocks.

U.S. PMIs: Growth Still Positive, But Momentum Fading

The U.S. economy remains more resilient than most global peers, but the latest PMIs suggest signs of cooling.

U.S. Manufacturing PMI Is Sliding Again

The U.S. manufacturing PMI edged down toward 50.1, barely above the contraction line. This marks the third consecutive monthly deceleration, driven by:

Companies are indicating that consumers have grown more sensitive to prices, and the demand for durable goods is stabilising after a robust mid-2025.

U.S. Services PMI: Cooling From Midyear Highs

The services PMI dipped to around 51.5, reflecting softer consumer spending and rising price sensitivity among households. Travel and hospitality remain stable, but financial services and business services show noticeable slowing.

What This Means for the U.S. Outlook

The U.S. is not contracting, but the rate of growth is clearly slowing. The broader narrative is shifting from "resilient expansion" to "slowing momentum," especially as businesses anticipate tighter lending conditions into late 2025.

Eurozone PMIs: Contraction Pressures Intensify

Europe continues to face the steepest slowdown among major developed economies.

Eurozone Manufacturing PMI Is Still in Contraction

The manufacturing PMI remains firmly below 50, hovering around 48, reflecting weak export demand, subdued industrial activity in Germany, and persistent energy-related cost pressures.

Germany's manufacturing PMI remains one of the lowest in the bloc.

France shows stagnation across both manufacturing and services.

Italy and Spain are undergoing slight contraction, yet are still relatively stronger than Germany.

Eurozone Services PMI Is Losing Support

Services, once the stabiliser for Europe, slipped to around 49.8, signalling broad-based softness in:

Consumer spending

Tourism-related demand

Business investment

Price pressures have eased, but businesses report weaker forward bookings and softer hiring intentions.

What This Means for Europe

Europe faces greater downturn risks than the U.S., with clear indications that its mid-2025 economic rebound has now stalled.

UK PMIs: A Mixed but Worrying Picture

The UK continues to oscillate between growth and contraction. The latest PMIs paint a picture of an economy losing steam but not yet entering a broad recession.

Manufacturing PMI: ~49

Services PMI: ~51

The services sector is doing most of the heavy lifting, but weakening consumer confidence and high cost pressures are weighing on business sentiment. Hiring has slowed meaningfully, especially in finance and real estate.

China PMIs: Stabilising, But Not Accelerating

China's PMIs show stabilisation, but not the kind of acceleration global markets had hoped for.

Manufacturing PMI Is Just Above 50

China's manufacturing PMI sits at roughly 50.4, indicating mild expansion. Demand from domestic markets is holding up, but exports remain weak due to slowdowns in Europe and other major partners.

Services PMI: Mild Expansion but Slowing

Services PMI has eased to around 51.2, reflecting cooling consumer activity and cautious spending.

China's Policy Support Is Preventing a Larger Downturn

Stimulus measures, including rate cuts, liquidity injections, and targeted support for manufacturing and property, are helping stabilise growth. However, these efforts have not yet sparked strong momentum.

Japan PMIs: Modest but Slowing Expansion

Japan's PMIs remain above 50, but the rate of expansion continues to slow:

Manufacturing: ~50.6

Services: ~52.0

Higher input costs, weakening tourism growth compared to early 2025, and softer export demand are key contributors to slowing momentum.

Emerging Markets: A Diverging Story

Emerging markets show mixed performance.

Strengthening PMIs

Struggling PMIs

Brazil: Manufacturing contracting around 49.

South Africa: Weak new orders and power-supply instability.

Turkey: Volatility in inflation continues to impact business operations.

The divergence reflects differing exposures to global demand, commodity cycles, and monetary policies.

Are Global PMIs Signalling an Economic Downturn?

The key question: Is the global economy headed for a downturn?

PMIs alone cannot declare a recession, but they can reveal turning points in the business cycle. Currently, the signals are significant.

Five Indicators Suggesting Downside Risk Is Rising

1. Forward-looking PMI components are weakening.

New orders, export demand, and hiring intentions are falling across major economies.

2. Manufacturing is stagnating worldwide.

The global manufacturing PMI is dangerously close to contraction.

3. Services are no longer strong enough to offset industry weakness.

4. Business confidence surveys are declining.

Firms are delaying investment and inventory restocking.

5. Financial conditions are tightening globally.

Lending appetite is weakening just as demand cools.

Does This Mean a Recession Is Imminent?

Not necessarily. But the probability of a slowdown and potentially a mild global downturn is rising.

The global economy is entering a vulnerable phase, especially if:

The world is not in crisis, but it is losing momentum.

Key Drivers Behind the Slowdown

1. Slowing Global Demand

Consumers worldwide are becoming more cautious as inflation remains uneven and wage growth slows. This is directly weighing on new orders across PMIs.

2. Softening Industrial Production

Manufacturing hubs such as Germany, South Korea, Japan, and China all face similar challenges:

Weaker export demand

Inventory overhangs

Slower investment cycles

3. Tight Financial Conditions

Banks in the U.S. and Europe continue to tighten corporate lending standards, affecting small and medium enterprises.

4. Geopolitical Uncertainty

Rising tensions in key regions are affecting trade routes and investment decisions.

5. Fragmented recovery across economies

Some emerging markets are accelerating while developed economies are losing steam.

What Investors Should Watch Next

| Region |

PMI Type |

Release Date |

Release Time (Local) |

| United States |

Flash Manufacturing |

Nov 21, 2025 |

09:45 EST / 14:45 UTC |

| United Kingdom |

Flash Manufacturing |

Nov 21, 2025 |

09:30 GMT |

| Eurozone |

Flash Manufacturing |

Nov 21, 2025 |

~09:30 CET |

| Eurozone |

Flash Services |

Nov 21, 2025 |

~09:30 CET |

| Germany |

Flash Manufacturing |

Nov 21, 2025 |

~09:00 CET |

| France |

Flash Manufacturing |

Nov 21, 2025 |

~08:30 CET |

| UK |

Flash Services |

Nov 21, 2025 |

09:30 GMT |

| United States |

Flash Services |

Nov 21, 2025 |

09:45 EST / 14:45 UTC |

| India |

Flash Manufacturing |

Nov 21, 2025 |

05:00 IST |

| India |

Flash Services |

Nov 21, 2025 |

05:00 IST |

| Japan |

Flash Manufacturing |

Nov 21, 2025 |

05:00 JST |

| Japan |

Flash Services |

Nov 21, 2025 |

05:00 JST |

1. The Next PMI Release

Forward-looking components matter more than headline numbers. Watch:

New orders

Export orders

Output expectations

Supplier delivery times

2. Central Bank Signals

Markets will closely monitor whether slower PMIs influence:

Fed rate path

ECB forward guidance

Bank of England policy

PBOC stimulus measures

3. Corporate Earnings

Firms might begin to reduce forecasts if PMIs continue to decline.

4. Consumer Spending Data

In the absence of resilient consumers, services PMIs may fall beneath the expansion threshold.

5. Global trade volumes

Weak PMIs typically indicate a subsequent decrease in freight and logistics operations.

What It Means for Markets

Equities

Slowing PMIs typically lead to:

Defensive sectors tend to outperform:

Utilities

Healthcare

Consumer staples

Cyclicals remain vulnerable:

Industrials

Tech hardware

Materials

Bonds

A slowdown increases demand for safe-haven assets such as U.S. Treasuries. Bond yields may drift lower if markets start pricing in rate cuts for mid-2026.

Currencies

The USD may stay firm if the global slowdown is sharper outside the U.S. Emerging market currencies could see renewed pressure.

Commodities

Oil and industrial metals typically weaken during PMI downturns unless supported by supply constraints.

Conclusion

In conclusion, the global economy is clearly losing momentum, but not collapsing. PMIs are signalling a phase of reduced growth, increased caution, and heightened sensitivity to disturbances.

Whether this slowdown becomes a full downturn depends on three factors:

For now, the signal is clear: watch PMIs closely. They are the first indicators flashing yellow as the world economy enters a more fragile phase.

Frequently Asked Questions

1. Are Global PMIs Already Signalling a Recession?

No single reading predicts a recession. Current PMIs indicate a varied outlook for overall activity growth across several areas, yet with declining confidence.

2. Which PMI Components Are Most Important?

New orders (forward demand) and employment (labour market response) are the most forward-looking. Supplier delivery times and inventories help explain current production dynamics.

3. Which Regions Look Most at Risk of Slowdown?

The UK and parts of Asia still show sub-50 PMIs, while the eurozone is only modestly above 50. The U.S. remains more resilient but is not immune.

4. Is This PMI Weakness a Repeat of Past Downturns?

Not exactly. The current environment shows more divergence (services holding up while manufacturing softens), and inflation patterns differ from previous cycles.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.