Today's Bowman hearing is one of those occasions that traders discreetly highlight on their calendars. It's not an FOMC decision, but it does sit right on top of a key question for this cycle: how far can the Fed ease rates if it is also loosening the screws on bank regulation?

Ahead of the hearing, the Fed has already posted Michelle Bowman's full prepared remarks for the House Financial Services Committee's session on "Oversight of Prudential Regulators".

That text, plus live Q&A later, will help shape how investors think about bank capital, stablecoins, de-banking, and the broader risk appetite in the financial system.

When and Where Is Fed Bowman's Speech Today?

Bowman will appear today before the House Financial Services Committee at 10:00 a.m. Washington time (ET) in a hearing titled "Oversight of Prudential Regulators."

Her testimony lands just one week before the December 9–10 FOMC meeting, where markets now price roughly 80–90% odds of a 25 bp rate cut, according to Fed funds futures and recent commentary.

Crucially, the Fed is already in its pre-meeting blackout period (November 29–December 11), which bars FOMC participants from talking about monetary policy. Bowman explicitly reminds lawmakers she cannot discuss rates in this hearing.

So any "signal on rates" will be indirect: it will come through her stance on bank capital, liquidity, and risk, the plumbing that determines how easily lower policy rates can flow into actual credit growth.

Inside Bowman's Prepared Speech: What She Will Say

The Fed has already released the full text of Bowman's testimony. This is your anchor; it's what she will read before any live Q&A adds colour. [1]

1. Banking System: "Sound and Resilient"

Bowman opens by leaning heavily on the Fall 2025 Supervision and Regulation Report:

She says the U.S. banking system "remains sound and resilient", with strong capital ratios and significant liquidity buffers.

Lending keeps growing, non-performing loans are down, and profitability is "strong" across most categories.

Why This Matters for Investors

It validates the recent rally in bank indices like BKX, which now trades near the top of its 52-week range after recovering from tariff- and CRE-driven sell-offs earlier in the year.

It gives the Fed more room to cut rates without giving the impression it's panicking about bank health.

For equity and credit desks, a "sound and resilient" framing tends to keep tail-risk premiums in check, even if growth data wobbles.

2. Nonbanks, Fintech, and Stablecoins

Bowman devotes meaningful space to competition from nonbanks and digital assets:

She notes that nonbank financial institutions are steadily gaining share in lending, competing with regulated banks without facing the same capital and liquidity rules.

She highlights ongoing work with other regulators on a capital, liquidity and diversification framework for stablecoin issuers, as required by the new GENIUS Act.

She pushes for clear rules for banks engaging in digital asset activities, with an emphasis on "permissibility" to give regulatory feedback on new use cases.

Implications

For crypto-adjacent banks and fintechs, this is a signal that the U.S. is moving toward a formal stablecoin rulebook, rather than stealth bans through supervision.

For large, diversified banks, clearer rules on digital assets and stablecoins could unlock new fee streams, but also introduce additional operational and compliance costs.

3. Community Banks: Less One-Size-Fits-All, More Tailoring

Bowman leans into her community-bank background:

She argues that rules designed for the largest banks should not be pushed down the stack to smaller, simpler institutions.

She supports raising outdated statutory asset thresholds that, due to inflation and balance-sheet growth, now pull more small banks into big-bank regimes.

She backs updating AML/BSA thresholds (Currency Transaction Reports and Suspicious Activity Reports) that haven't changed in decades, to reduce the disproportionate burden on community banks while still helping law enforcement.

She also points to recent Fed proposals to:

Adjust the community bank leverage ratio to give smaller banks more flexibility, and

Introduce new capital instruments for mutual banks that can qualify as Tier 1 capital.

Investor Angle

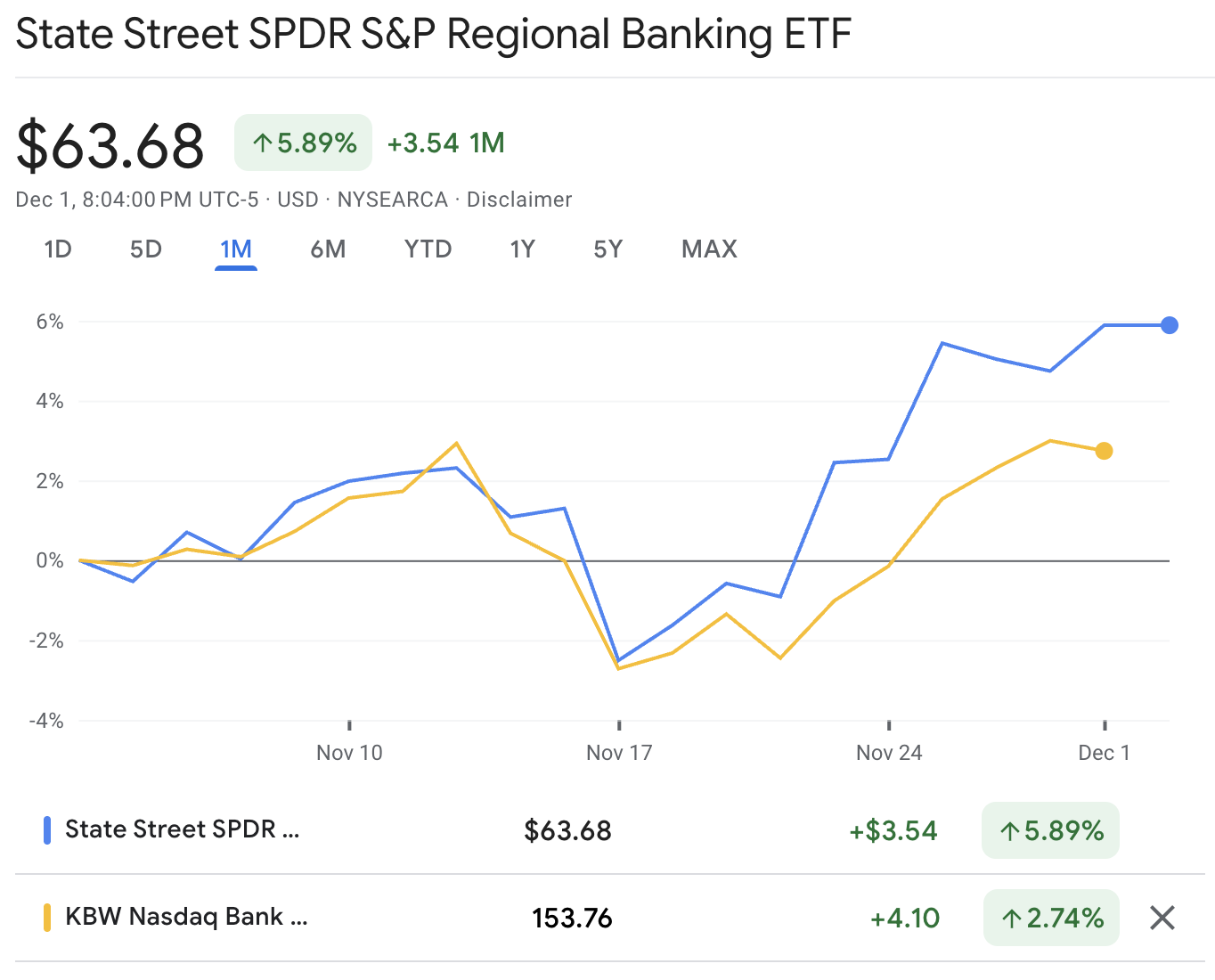

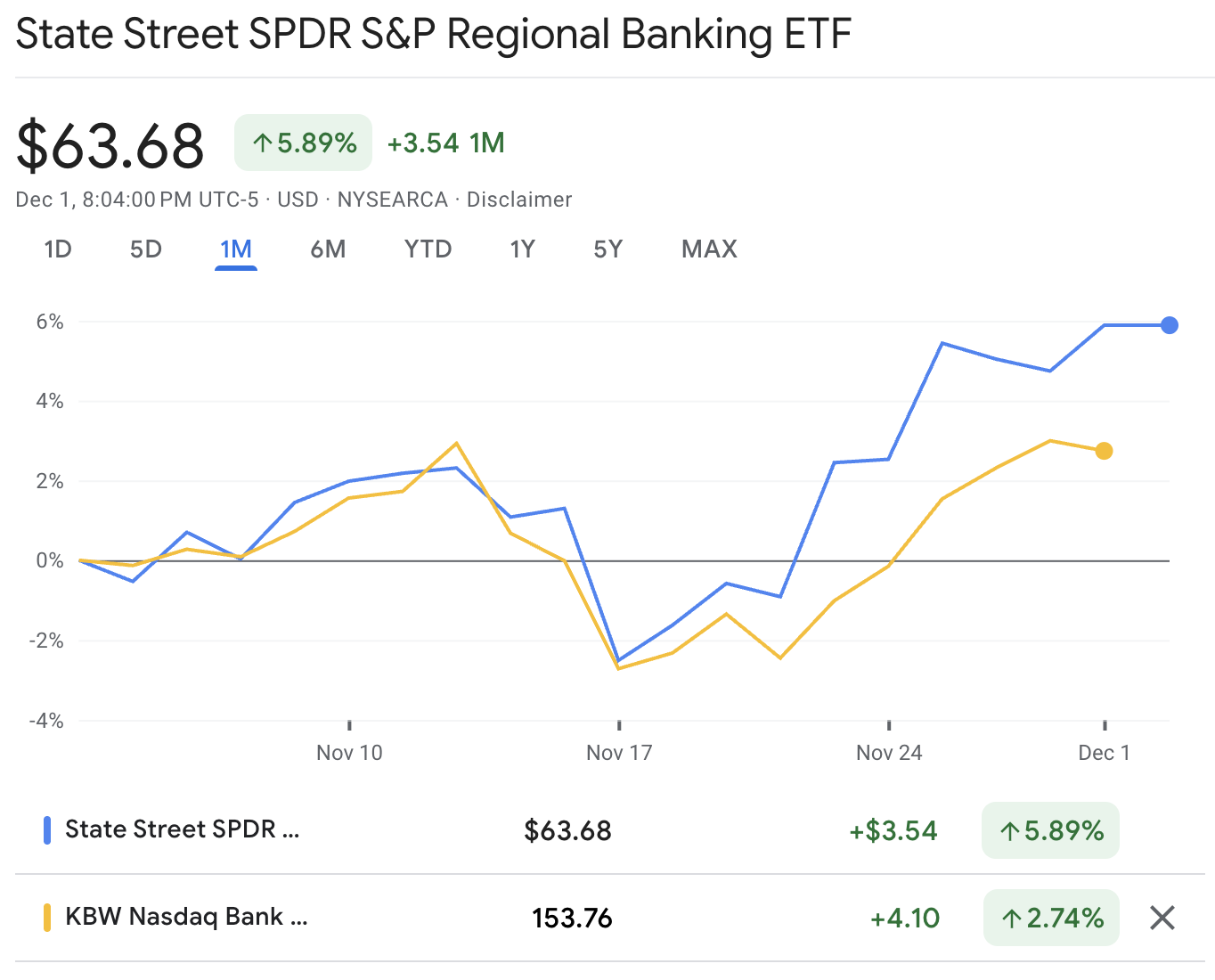

Regional bank ETFs like KRE, now trading around $63–64 with a 52-week range of roughly $47–68, sit in the upper half of their yearly band as the market starts to price in regulatory relief plus lower rates.

Tailored rules and higher AML thresholds lower structural cost pressure for smaller banks and can support ROE normalisation after a tough 2023–24 period.

4. Big Banks: Basel III, Leverage Ratio and G-Sib Surcharge

On large banks, Bowman outlines a broad capital framework reset. The Fed is looking at all four pillars:

Firstly, she backs more transparent stress tests: public model disclosures, scenario frameworks, and advance notice of major changes, targeted for the 2026 stress test cycle.

Regarding the SLR, she endorses recent modifications to ensure that leverage capital acts as a genuine backstop rather than a limiting factor that deters banks from retaining Treasuries and other low-risk assets.

On Basel III, she mentions "bottom-up" calibration, especially around mortgages and mortgage-servicing assets, to avoid over-penalising core housing finance.

In the background, external analysis suggests that the emerging U.S. approach could free up trillions in lending capacity and reduce capital intensity for big banks. However, it is a higher systemic risk.

Investor Angle

For large U.S. banks, this looks like a moderate deregulatory drift: still high capital and liquidity, but fewer blunt constraints on low-risk assets and more predictable stress tests.

If combined with a rate-cutting Fed, that mix tends to be constructive for net interest margins, buybacks and dividends over a 12- to 24-month horizon, as long as credit quality holds.

5. Supervision Overhaul and the End of "Reputational Risk"

One of the sharpest parts of Bowman's testimony is about how the Fed supervises banks:

She pushes for risk-based supervision, focusing on issues that actually tie to bank failures and financial stability, not box-ticking.

She notes ongoing work to clarify when supervisors can bring enforcement actions, especially around "unsafe or unsound practices" and Matters Requiring Attention (MRAs).

She announces that the Fed has formally ended the use of "reputational risk" as a component in examinations, echoing similar moves from the OCC. She is also considering rules to stop Fed staff from pressuring banks to "de-bank" lawful customers based on political or religious views.

This speaks directly to the de-banking debate and will be closely watched by politically exposed sectors (energy, firearms, crypto-adjacent, certain NGOs).

For markets, this reduces the perceived regulatory headline risk for banks that choose to serve controversial but lawful industries, while still leaving plenty of scope to challenge firms on real safety-and-soundness concerns.

How This Ties Back to the Rate Path

1) What Bowman Can't Say Tonight

Because of the blackout, Bowman states she cannot disclose monetary policy in this hearing.

That means:

No explicit comments on December's cut, the terminal rate, or future path.

No guidance on inflation risks or how the Fed balances weaker growth with the need to keep inflation anchored.

Yet the hearing still matters for rates because regulation shapes the transmission of policy:

A banking system seen as well-capitalised and well-supervised can digest rate cuts more easily without spooking bond markets.

-

A lighter-touch regulatory stance (as described by the FT and others) may encourage banks to expand lending faster once funding costs fall, which in turn feeds back into how far and how fast the Fed can safely ease.

What Markets Are Already Pricing In

Going into Bowman's testimony, the macro picture looks roughly like this:

| Asset / Index |

Latest Level* |

52-Week Range |

Position in Range |

Comment |

| DXY (US dollar index) |

~99.4 |

N/A (here) |

Below 100 |

Dollar under pressure as rate-cut odds rise. |

| US 2-Year Yield |

~3.5% |

~3.38–4.43% |

Mid-range |

Front-end anchored by December cut expectations. |

| US 10-Year Yield |

~4.1% |

~3.86–4.82% |

Upper-middle |

Term premium still elevated; sensitive to “higher for longer” narratives. |

| BKX (KBW Bank Index) |

~153–154 |

99.68–156.05 |

Near top |

Banks have largely retraced tariff- and CRE-driven drawdowns. |

| KRE (SPDR Regional Banks) |

~$63–64 |

$47.06–$67.58 |

Upper band |

Regionals pricing in both regulatory relief and a softer Fed. |

*Levels are indicative, based on the latest available data ahead of the hearing.

In short, markets are leaning dovish on policy but constructive on banks. Bowman's testimony is more about validating that set-up than shifting the curve on her own.

What to Watch in the Live Hearing and Q&A?

Use the prepared text as your baseline. The real trading edges usually come from:

Basel III calibration details

Stablecoins and GENIUS Act timing

De-banking and lawful but controversial sectors

Community bank failures and CRE

Frequently Asked Questions (FAQ)

1. Will Bowman Talk About Interest Rate Cuts or the December FOMC Meeting?

No. The Fed is in its blackout period, which runs from November 29 to December 11 around the December 9–10 FOMC meeting. During this window, FOMC participants cannot discuss monetary policy. Bowman explicitly says she will not comment on rates in this hearing.

2. Why Does This Hearing Matter for Bank Stocks?

Because it spells out how the Fed plans to calibrate capital and supervision.

3. How Does This Affect the Outlook for U.S. Rate Cuts?

Directly, it doesn't, as blackout rules keep Bowman away from rate talk. However, markets have already priced a high chance of a December cut.

Conclusion

Going into today's hearing, the setup is straightforward: banks are strong, the dollar is soft, the curve is still mildly inverted, and markets expect a December cut.

For investors, the main task is to watch the Q&A for deviations from the script. Remember, this is not a rate-setting event, but it shapes the runway for the Fed's easing cycle.

A credible, pro-market supervisory stance from Bowman makes it easier for the FOMC to cut rates into 2026 without triggering another confidence shock in the banking sector, and that's precisely what bank and macro traders will be listening for tonight.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Source

[1] https://www.federalreserve.gov/newsevents/testimony/bowman20251202a.htm