Intel (INTL) stock has finally done what most investors had written off two years ago: it's behaving like a momentum stock again. After doubling off its 2025 lows, the shares have just pushed to a fresh 52-week high around $44, with Wednesday's close sitting near $43.76.

That move hasn't come out of thin air. You've got a clean mix of hard fundamentals (margin recovery and positive EPS again), big strategic money (US government, Nvidia, SoftBank), and speculative upside (Apple 18A foundry rumours, Malaysia expansion) all hitting the tape together.

The real question now is simple: after this kind of run, is Intel stock still a buy, or are you late to the party?

Intel Stock Recent Performance: Current Price, 52-Week Range, and 12 Month Performance

Listed below is a simple table of Intel's recent stock trading data:

| Metric |

Value (approx.) |

Source / Comment |

| Last close |

$43.76 |

As of Dec 3. |

| 52-week high |

$44.02 |

Hit this week, new high. |

| 52-week low |

$17.67 |

Set in early 2025. |

| 50-day moving average |

~$36.7 |

Well below spot, confirms strong uptrend. |

| 200-day moving average |

~$25–26 |

Long-term trend has flipped decisively bullish. |

| 12-month performance |

+90–110% |

One of 2025’s better large-cap recoveries. |

You're no longer looking at a quiet value stock. You're looking at a high-beta turnaround name sitting right at the top of its recent range.

What Caused Intel's 2025 Comeback?

1) Q3 2025: Real Margin and EPS Recovery

Intel's Q3 2025 results, released October 23, are the backbone of this rally:

Revenue: $13.7 billion, up ~3% YoY and above guidance.

GAAP gross margin: 38.2% (vs 15.0% a year earlier).

Non-GAAP gross margin: 40.0% (vs 18.0% a year earlier).

Non-GAAP EPS: $0.23, ahead of roughly $0.01 consensus and a clear swing back into positive territory.

Operating cash flow: ~$2.5 billion, with positive adjusted free cash flow of ~$900 million despite heavy capex.

Guidance for Q4 2025 is cautious but not disastrous:

Revenue outlook $12.8–$13.8 billion, essentially flat to slightly down vs Q3.

Non-GAAP EPS guided at $0.08, with gross margin around 36.5% as the foundry build-out continues.

The takeaway: Intel is no longer haemorrhaging cash and margin. It's back to posting positive EPS, shrinking losses in foundry, and stabilising the core PC and data-centre business.

2) Apple 18A Foundry Rumours

Another catalyst that lit the fuse recently is the Apple foundry chatter:

Top Apple analyst Ming-Chi Kuo now expects Apple to use Intel's 18A process for its lowest-end M-series chips from around 2027, as a second source alongside TSMC.

Tech outlets have all picked up the story, noting that Apple has taken 18A process design kits and is actively qualifying the node.

Outlets highlighted double-digit percentage pops in the stock on the days these rumours hit, with Intel leading the S&P and Nasdaq.

It's still just a rumour plus analyst expectation as Apple and Intel haven't confirmed anything. But even the possibility of Apple as a foundry customer is a major vote of confidence in Intel's 18A roadmap.

3) Massive Strategic Capital Backing

Intel isn't funding this turnaround alone:

The US government has taken roughly a 9.9–10% equity stake in Intel for about $8.9 billion, accelerating promised CHIPS Act support and adding national-security-linked funding.

Oulets also note $2B from SoftBank and $5B from Nvidia in recent quarters, as part of broader strategic partnerships around AI and manufacturing.

That capital does two things:

4) Malaysia Expansion and Global Capacity Build-Out

On top of the 2021 decision to build a $7B advanced packaging plant in Penang, Malaysia, Intel has just announced another $208M (RM860 million) investment in Malaysian assembly and testing.

This matters because:

Advanced packaging remains a critical bottleneck in the production of high-end AI chips and CPUs.

A diversified manufacturing footprint across the US, Malaysia, and Europe mitigates geopolitical risks relative to a single-region fab strategy.

Investors are reading this as proof that Intel's foundry and AI plans are being backed by real steel in the ground, not just slides.

5) Valuation vs Peers: Expensive on Earnings, Cheap on Sales

Valuation is where the story splits:

Forward P/E remains elevated at 60–70x by some estimates, driven by currently minimal earnings relative to Intel's substantial market cap.

Intel is valued at 3.3–3.9x on a price-to-sales basis, which is considerably lower than numerous AI and semiconductor competitors, which are in the double digits.

In other words, the market is paying up for the turnaround and foundry optionality, but you're not in Nvidia-style valuation territory yet.

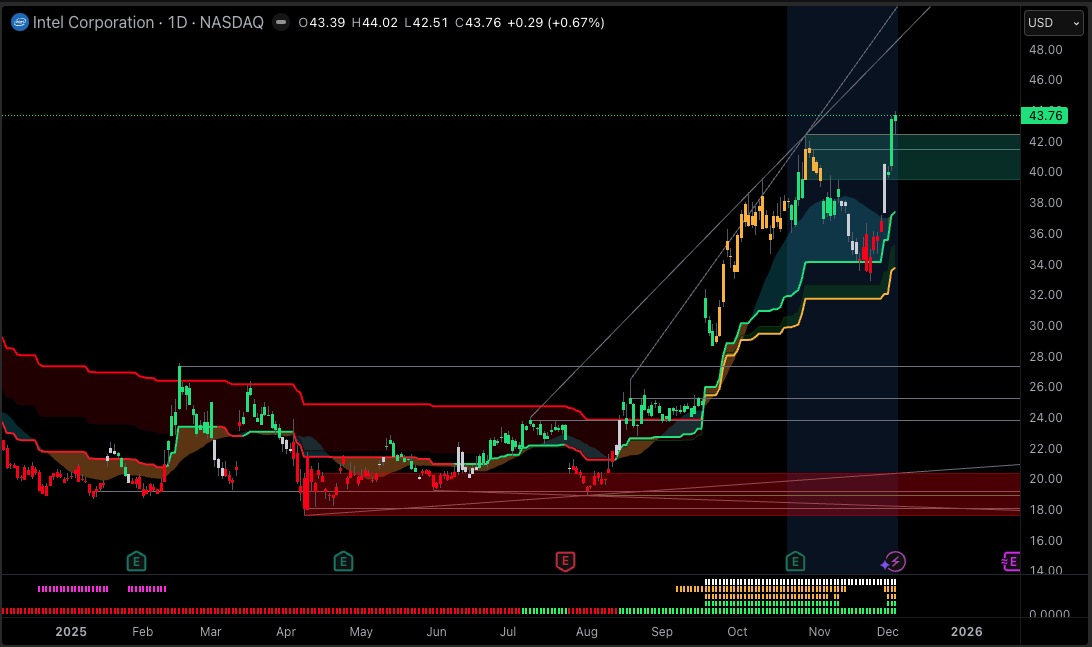

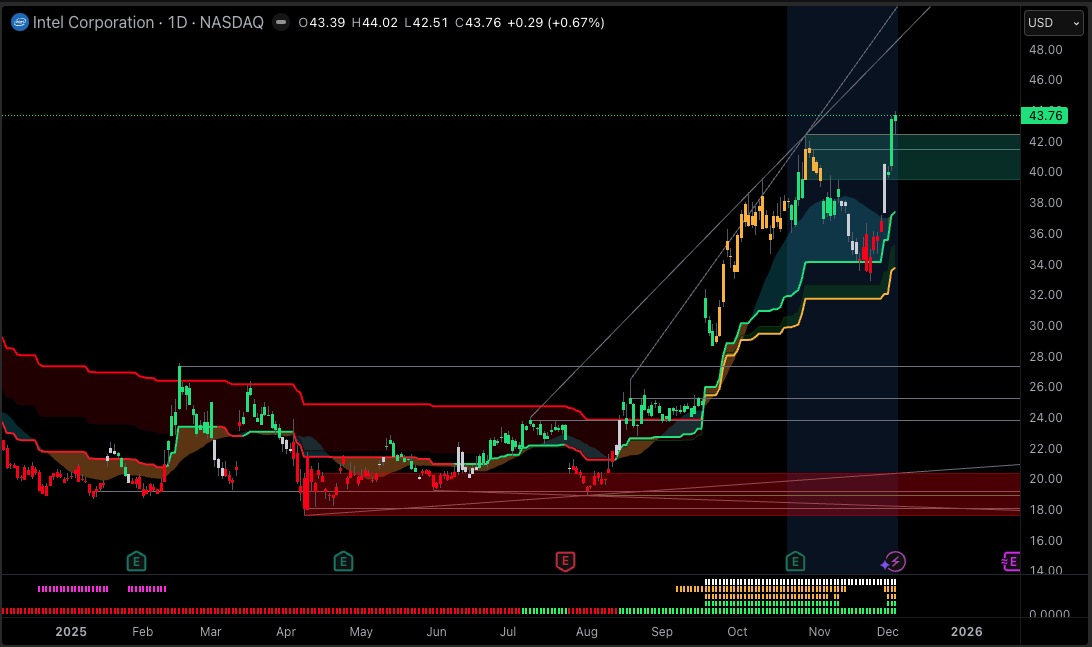

Technical Analysis: Intel Stock at a 52-Week High

| Indicator / Level |

Approx. Value |

Interpretation |

| Last price |

$43.76 |

At/near 52-week high; very strong tape. |

| 52-week high / low |

$44.02 / $17.67 |

Price has more than doubled off the low. |

| 50-day moving average |

~$36.7 |

Price ~20% above 50-DMA. Extended but still trending. |

| 200-day moving average |

~$25–26 |

Long-term trend has flipped bullish; massive distance below spot. |

| RSI (14-day) |

~75–80 on some feeds; ~70 on others |

Consistently overbought, warns of pullback risk. |

| MACD (12,26) |

~0.6–1.4, positive |

Bullish momentum; trend-followers still long. |

| ADX (14) |

~53 |

Strong trend. Not a weak, choppy move. |

| Williams %R / Stochastics |

Overbought zone |

Short-term stretched. |

Key levels traders are watching:

Support: $40 (gap/breakout area), then the mid-$30s near the 50-day MA.

Resistance: The $44–45 band (fresh highs). A clean breakout and hold above that would force shorts to rethink again.

Trend: Strong, confirmed uptrend. Intel printed a "golden cross" earlier this year when the 50-day MA moved above the 200-day MA, and the price has since run well above both.

Momentum: RSI and other oscillators are in classic "too hot" territory; several services tag INTC as overbought on daily timeframes.

Volatility: ATR is moderate; the stock is moving, but this isn't meme-stock chaos.

From a pure chart point of view, Intel is in a strong uptrend that's currently overbought. That usually argues for buy-the-dip, not "all-in at the spike".

Is Intel a Good Stock to Buy, Hold or Take Profit Now?

Let's break it down by mindset rather than pretend there's a single answer.

For Long-Term, Fundamentals-Driven Investors

What You're Buying:

A company that has survived a brutal downcycle, repaired its balance sheet, and is now posting positive EPS and much better margins.

A strategic asset supported by the US government and major AI industry players, making an outright collapse highly improbable.

Optionality on a major Apple foundry deal and broader 18A/advanced packaging ecosystem from 2027 onwards.

What You're Risking:

You're paying for a turnaround that is not yet fully reflected in earnings, which means multiple compression risk if execution wobbles.

Apple rumours may never materialise into a large, profitable contract, or could be scaled back if Intel misses technical milestones.

Competition from TSMC, Nvidia, AMD and ARM remains fierce across every major product line.

For that type of investor, Intel can still make sense as a long-term position, but it's cleaner to think in phases:

Phase 1 (now): Accept that you're buying after the easy contrarian entry; size smaller, leave room to add on pullbacks.

Phase 2 (next 12–24 months): Watch 18A milestones, Apple confirmation or denial, and whether foundry losses continue to shrink.

For Shorter-Term Traders and Swing Players

If your horizon is months rather than years, the logic is different:

You're trading a chart where momentum is strong but stretched.

Technical indicators such as RSI, stochastics, and divergence from the 50-day moving average suggest a near-term shakeout or consolidation is likely.

Over-owned, headline-driven semiconductor stocks can quickly retrace 10–20% on any negative rumours or weak earnings guidance.

For that crowd, Intel up here often looks more like a "hold/trim/buy dips" name than a fresh high-conviction entry.

Frequently Asked Questions

1. Is Intel Stock Overvalued After This Rally?

On simple P/E, yes. The forward multiple around 60–70x looks steep because earnings are still depressed.

2. What Are the Realistic Next Price Targets for INTC?

If Intel holds above $40–$41 and the breakout continues, near-term resistance sits around $45–$46, followed by a wider $49–$50 target zone.

3. Can I Trade Intel With EBC Financial Group?

Yes. Traders can access Intel (INTC) through EBC by CFDs.

Conclusion

In conclusion, Intel at its 52-week high is not the same Intel you were offered at $18. The balance sheet is stronger, margins are back, the US government and big AI names have written real cheques, and there's a credible (if still unproven) path to becoming a serious foundry again. On that score, the rally is grounded in more than just hype.

But price has moved much faster than reported earnings. The stock is technically overbought, consensus targets lag the move, and many hope is now pinned on 18A execution and a still-hypothetical Apple deal.

For many investors, that argues for respecting the turnaround, but being disciplined on entry.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.