U.S. Stock Market Today: Futures Rebound Before Holiday Break

U.S. stock futures rose strongly on Monday as investors positioned for a rebound ahead of the shortened Thanksgiving trading week. Markets are increasingly hopeful of a December interest-rate cut from the Federal Reserve, a shift that is encouraging a revival after a sharp November pullback. Tech stocks and cyclical names are gaining support, though investors remain cautious amid thin liquidity and valuation risks.

U.S. Market Context & Recent Performance

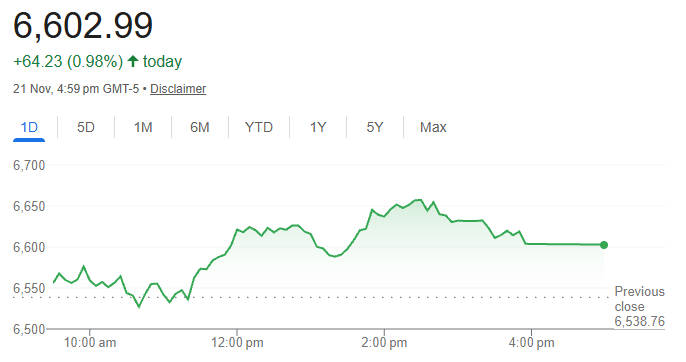

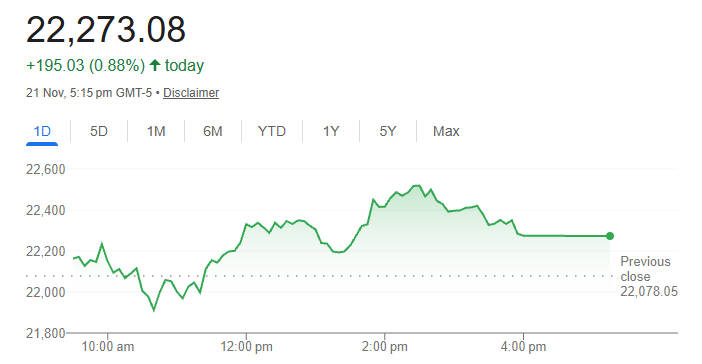

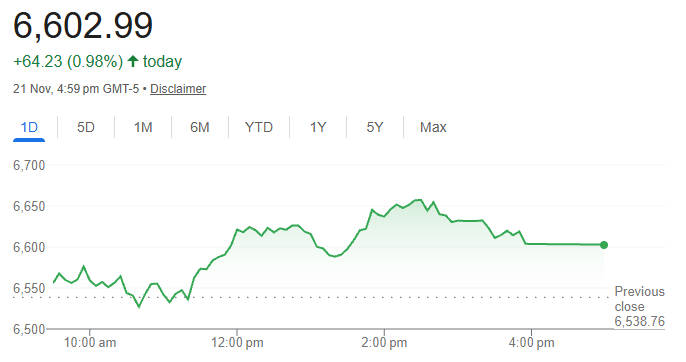

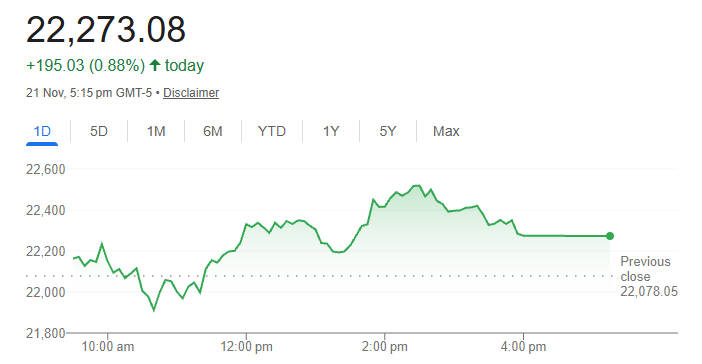

Over the past week, major U.S. equity indices suffered notable declines. S&P 500 futures rose by approximately 0.5 percent on Monday morning, while Nasdaq-100 futures climbed 0.7 percent.

This rebound attempt follows a broader November correction, particularly in growth and AI-related stocks, as traders reassess lofty valuations and the policy rate outlook.

The rebound is occurring in a thin-volume environment: with Thanksgiving on Thursday and a shortened session on Friday, liquidity is expected to be constrained.

Market Drivers Shaping U.S. Stock Performance Today

1. Rate-Cut Expectations

Markets are boosting expectations for a December rate cut after New York Fed President John Williams signalled that "room" remains for easing. His remarks helped lift the implied probability of a rate cut to around 68 per cent, according to some sources.

This optimism is rooted in a broader concern that growth may be softening. Some market participants are interpreting weaker economic data and labour-market signals as strengthening the case for more accommodative monetary policy.

2. Valuation Pressures & Reassessment in Tech

The technology sector, especially AI-related companies, has come under pressure in recent weeks. Investors are rethinking prior exuberance in high-growth names. The November pullback reflects concerns that valuations may have run ahead of fundamentals.

3. Holiday Shopping & Retail Sentiment

The upcoming holiday shopping season is now a central macro story. With Black Friday, Thanksgiving and early shopping data approaching, investors will look closely at retailer earnings, foot-traffic indicators and consumer demand trends.

These retail dynamics could provide clues about consumer resilience in a potentially slower macro environment.

4. Liquidity Risks & Volume Dynamics

Because of the holiday schedule, trading volumes are likely to remain light. This reduced liquidity could magnify any headline-driven moves, creating sharper swings than usual. The risk of exaggerated price action is real, particularly for risk assets.

Sector Moves in the U.S. Stock Market Today

Technology / Growth:

The Nasdaq-100 futures are leading the rebound, as AI and growth names see short covering and renewed interest after steep November losses.

Consumer Discretionary / Retail:

These names may benefit if holiday spending proves strong. Investors are focused on same-store sales, inventory levels and consumer demand commentary from large retailers.

Cyclicals / Industrials:

Some industrial and cyclical names are gaining support as rate-cut optimism boosts risk appetite.

Safe Havens:

With equities rallying, demand for traditional safe-haven assets like gold is easing slightly; however, positioning remains sensitive to macro surprises.

Key Data and Earnings Influencing Today's Trading

Key Data Influencing Today's US Market

| Index / Instrument |

Recent Move (Futures) |

Key Drivers |

| S&P 500 futures |

+0.5 % |

Rate-cut optimism, tech rebound |

| Nasdaq-100 futures |

+0.7 % |

Short covering, valuation reset |

| Dow Jones futures |

+0.2 % |

Select cyclicals, risk-on sentiment |

| Gold futures |

Slight decline |

Reduced safe-haven demand |

| Crude oil futures |

Mild weakness |

Soft demand outlook, macro risk |

Key Earnings Influencing Today's US Market

| Catalyst |

Event |

Why It Matters |

| Retail earnings |

Several major retailers to report |

Key indicator of consumer strength during holiday season |

| Consumer data |

Black Friday foot-traffic, retail sales |

Provides early read on demand resilience |

| Fed commentary |

Speeches from Fed officials or minutes |

Could shift expectations on future rate cuts |

| Trading liquidity |

Shortened week due to Thanksgiving |

May lead to higher volatility and exaggerated moves |

Risks Investors Should Watch in Today's Market

There are several risks that could derail the current rebound:

Inflation surprises:

If inflation data comes in hotter than expected, the case for rate cuts may weaken sharply.

Disappointing retail results:

Weak retailer earnings or lower-than-expected holiday spending could undermine the rebound.

Tech concentration risk:

With much of the move driven by a handful of large tech names, any renewed weakness in that cohort could drag the entire market.

Liquidity risk:

Thin market participation during the holiday week could amplify reversals and limit execution.

These factors mean that, while optimism is growing, it is not without meaningful risks.

Frequently asked questions

Q1: Why did U S futures rise today?

Futures climbed because markets priced in a higher likelihood of a Federal Reserve rate cut following dovish comments from a senior Fed official and softer economic signals that suggest policy easing may be warranted.

Q2: Will the Thanksgiving holiday affect market volatility?

Yes. The holiday results in thinner trading volumes and a shortened schedule which can amplify price moves and broaden bid ask spreads, increasing intraday volatility and execution risk.

Q3: Which sectors should investors watch this week?

Investors should watch technology for valuation risk, consumer discretionary and retail for holiday spending signals, and selective industrials for demand commentary during earnings.

Q4: Does a higher probability of a Fed rate cut guarantee a sustained market rally?

No. Markets often react quickly to changes in rate expectations but a sustained rally requires confirmation across earnings, macro data and liquidity conditions rather than only central bank signals.

Q5: How can traders manage risk during the week ahead?

Traders should reduce position sizes in thin markets, use limit orders to manage execution, and set disciplined stop loss rules to protect against sudden moves driven by low liquidity.

Conclusion

The US market reopened the holiday week with encouraging moves in futures as investors adjusted to an increased probability of an early rate cut and prepared for the holiday shopping season.

That said, the market remains vulnerable to headline risk, earnings surprises and the liquidity effects of the shortened trading calendar. Readers should treat the current rally as tentative and monitor retail and inflation related data closely for confirmation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.