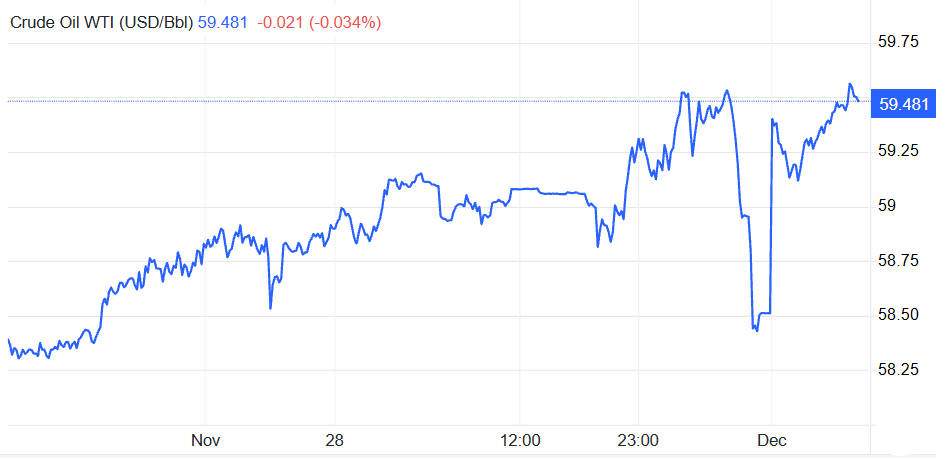

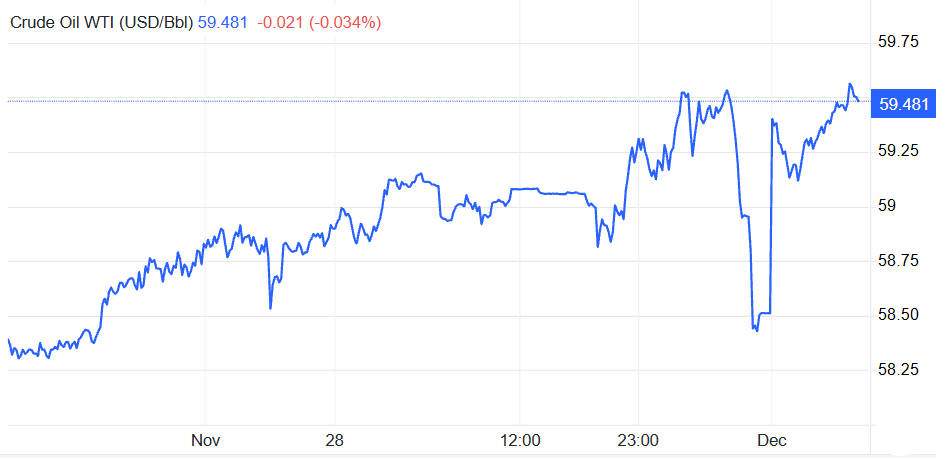

Oil prices have staged a relief rally following the latest OPEC+ decision to pause planned production increases. While still well below the highs of previous years, Brent crude has recovered to the low-$60s, and WTI is trading near $60. driven by the alliance's renewed commitment to preventing a supply glut in early 2026.

Current Oil Market Performance: Brent and WTI Analysis

Despite a bearish year, prices have ticked upward following the December 1 OPEC+ meeting.

Market Momentum:

The recent 1.5% daily gain reflects a "relief rally." Traders had feared an oversupply, but the confirmation of extended cuts has stabilized the floor price.

Yearly Context:

Prices remain lower year-on-year (down ~15%), struggling to break the $70 resistance level due to broader macroeconomic headwinds.

The Core Driver of Oil Price Rising: OPEC+ Policy Shift

The primary factor supporting the current price floor is the OPEC+ alliance's defensive strategy against a potential 2026 surplus.

Q1 2026 Production Pause

OPEC+ has officially agreed to pause oil output hikes for the first quarter of 2026 (January–March).

Previous Plan:

The group had intended to gradually return barrels to the market.

New Decision:

Citing "market risks" and seasonal demand weakness, the 2.2 million barrels per day (bpd) of voluntary cuts will largely remain in place.

Impact:

This decision removes millions of barrels of potential supply from the Q1 balance, preventing the inventory builds that many analysts had forecast.

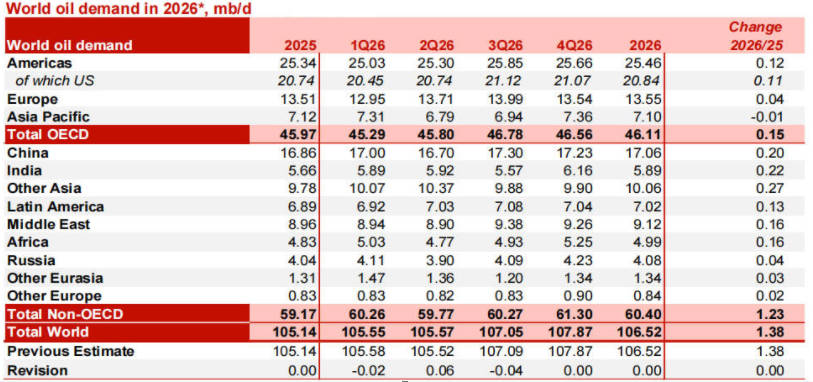

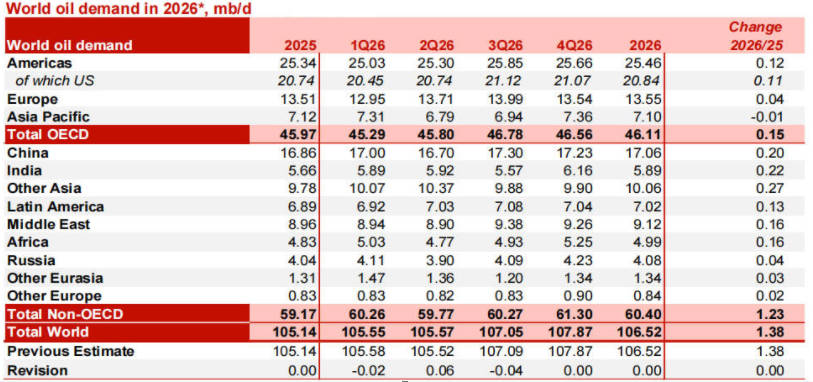

Oil Demand Fundamentals

Unlike the "firm demand" narrative of previous quarters, current data highlights a divergence between regions.

Sluggish Growth:

Global demand growth is weaker than expected, projected at just 0.8–0.9 million bpd for 2025.

China Slowdown:

Industrial activity in China has softened, leading to lower-than-anticipated imports and high commercial inventories.

Bright Spots:

Aviation demand remains robust with high passenger numbers, and seasonal winter heating demand in the Northern Hemisphere is expected to provide short-term support for distillates.

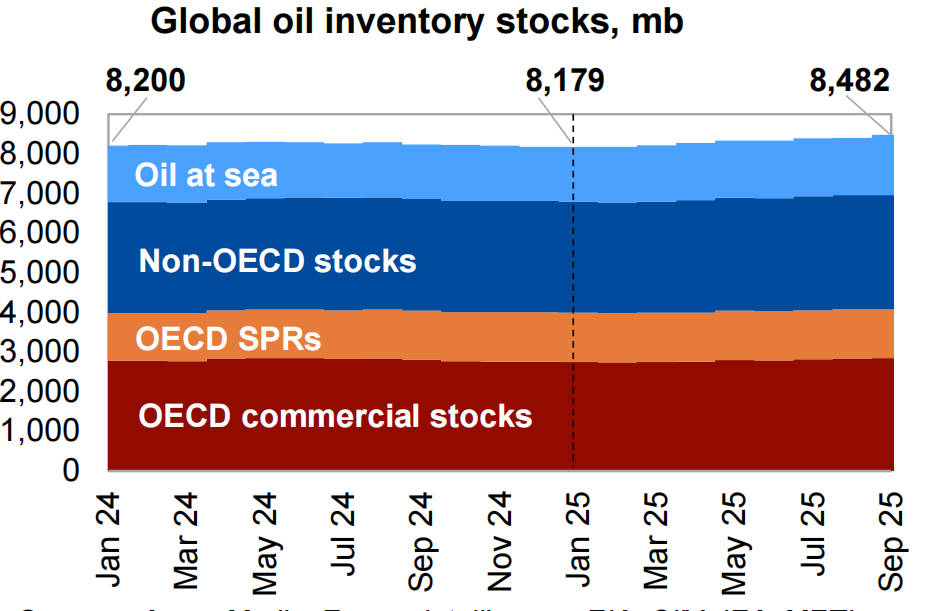

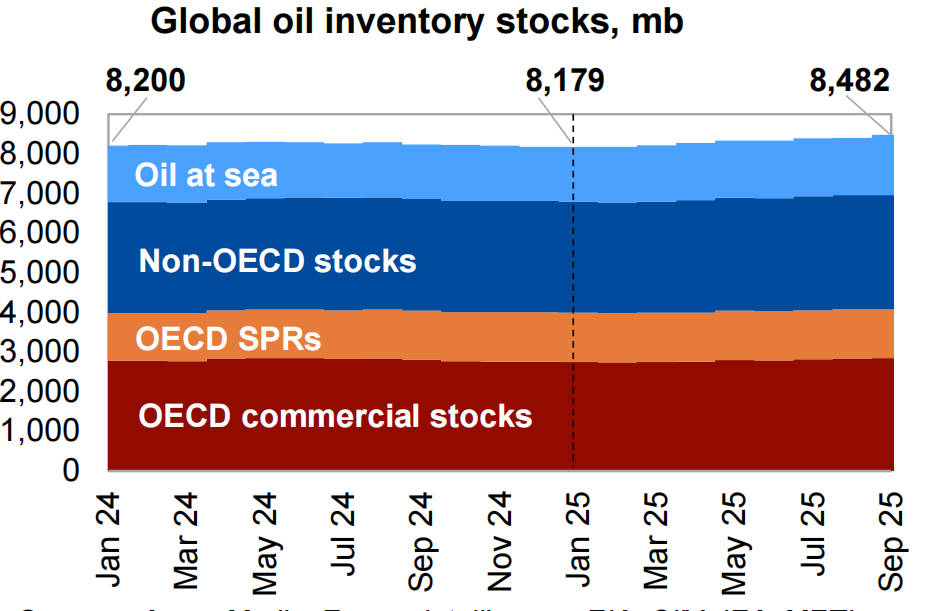

Inventory Levels:

Global inventories have seen builds in late 2025. contributing to the price slide earlier in the year. However, the latest US inventory reports show stabilizing levels at Cushing, OK, helping to firm up WTI structure. [1]

Geopolitical Risk:

Tensions in the Middle East continue to provide a "risk premium" floor. Without these geopolitical risks, fundamental models suggest prices could be trading $5–$10 lower.

Crude Oil Future Outlook: Scenarios for 2026

The outlook for 2026 has been revised downward by major agencies, reflecting the comfortable supply cushion.

The Baseline Scenario (Most Likely):

Brent averages $58–$66 per barrel. This assumes OPEC+ successfully manages supply to match tepid demand growth.

The Bullish Scenario:

If global GDP growth accelerates unexpectedly or geopolitical supply disruptions occur, Brent could re-test the mid-$70s.

The Bearish Scenario:

If OPEC+ discipline fractures or non-OPEC supply (from the US, Brazil, Guyana) surges further, prices could slip toward $50–$55.

Key Risks to the Current Oil Price Trend

US Shale Output:

US production hit record highs in late 2025 (approx. 13.8 million bpd). Further growth here could negate OPEC+ cuts.

Compliance:

The market is watching closely to see if all OPEC+ members adhere to the extended quotas, specifically Iraq and Kazakhstan.

Dollar Strength:

A resurgence in the US Dollar would act as a headwind for commodity prices in 2026.

Tracker: Essential Indicators to Watch

To forecast the next move in oil prices, keep a close eye on these data points:

OPEC+ Compliance: Monthly JMMC meeting reports.

China PMI: Manufacturing data for signs of stimulus impact.

US Inventory: EIA Weekly Petroleum Status Reports (Wednesdays).

Floating Storage: Increases in oil stored on tankers often signal a glut.

Conclusion

The recent rebound to $63 highlights the market's sensitivity to OPEC+ supply management. While the "mid-80s" price environment is gone for now, the alliance's proactive cuts for early 2026 have successfully put a floor under the market, preventing a slide into the $50s.

Frequently Asked Questions

1. Why have oil prices increased recently?

Oil prices have risen mainly due to OPEC+ maintaining strict supply discipline, tighter physical market conditions, and supportive macro sentiment. Strong refinery activity and steady demand in Asia have further reinforced upward momentum in Brent and WTI benchmarks.

2. How is OPEC+ influencing the current oil market?

OPEC+ has reinforced price stability by keeping production levels unchanged and signalling its readiness to adjust output if required. This deliberate approach provides traders with confidence that supply will remain controlled despite uncertain global economic conditions.

3. Are current inventory trends supportive of higher oil prices?

Yes. Rising refinery utilisation in the United States and Asia has led to several weeks of draws in gasoline and middle-distillate stocks. This tightening in product inventories has strengthened crude demand and contributed to firmer benchmark prices.

4. What role does global demand play in the price rebound?

Global demand has shown resilience, especially across China, India, and Southeast Asia. Industrial activity and improving aviation flows have supported consumption, although some regions continue to face softer economic conditions that limit broader demand strength.

5. How do geopolitical tensions affect oil prices?

Geopolitical risks, particularly in the Middle East, continue to add a risk premium by threatening potential supply disruptions. Sanctions and uncertainties surrounding maritime routes increase market sensitivity to external shocks, supporting higher crude benchmarks.

6. How has the macroeconomic environment supported oil prices?

A softer US dollar and improving investor sentiment have lifted commodity markets. Stabilising global equities and expectations of gradual monetary easing have contributed to better risk appetite, which supports crude prices despite mixed economic data.

7. Could oil prices continue rising in the coming months?

Higher prices are possible if OPEC+ maintains discipline and physical-market tightness persists. Any strengthening in global demand or renewed geopolitical disruptions could add upward pressure. However, sustained gains depend heavily on macroeconomic performance.

Sources:

[1] https://www.opec.org/monthly-oil-market-report.html

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.