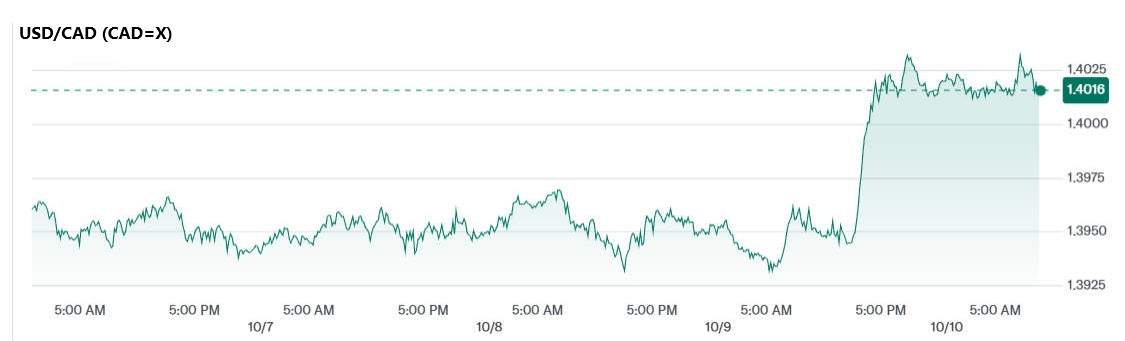

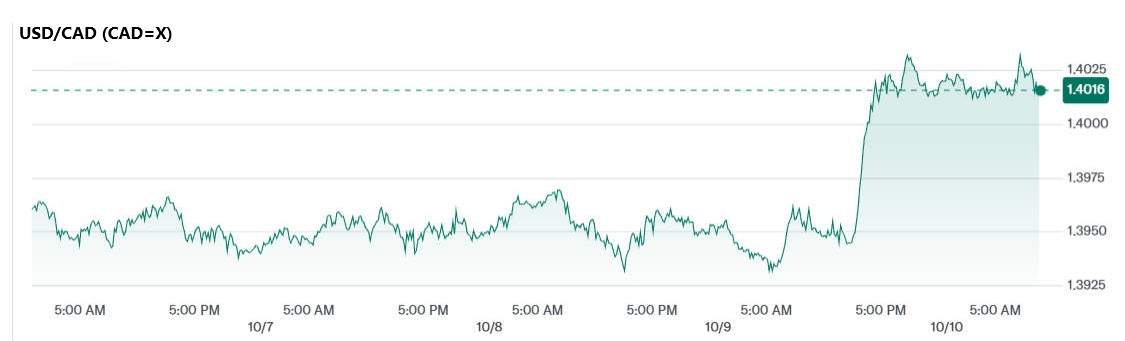

USD/CAD recently pierced the 1.40 level as weaker oil and a firmer US dollar combined with expectations of further Bank of Canada easing to weigh on the loonie.

The move reflects a mix of commodity sensitivity, central-bank differentials and technical momentum; traders should watch oil, Canadian labour data and the 1.401–1.405 zone for clues to the next leg.

Market snapshot for USD/CAD

Item

|

Detail |

| Latest spot (approx.) |

1.4020 USD/CAD (recent intraday prints around 1.401–1.403). |

| Today's trading range |

~1.4013 – 1.4034 (intra-day). |

| Bank of Canada policy rate |

2.50% (cut in September; BoC signalled readiness to cut again if risks rise). |

| Key technical cluster |

1.401–1.405 (cluster resistance/support; 1.4014 cited as an important retracement cluster). |

What moved the pair — the primary drivers

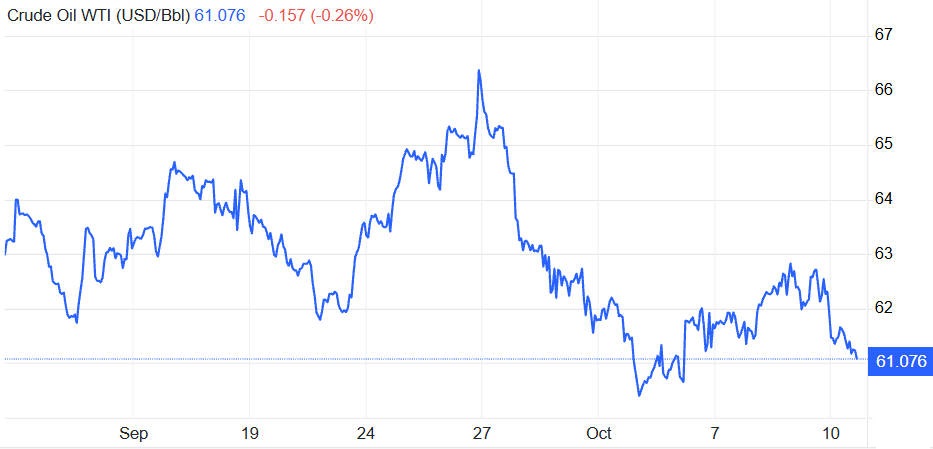

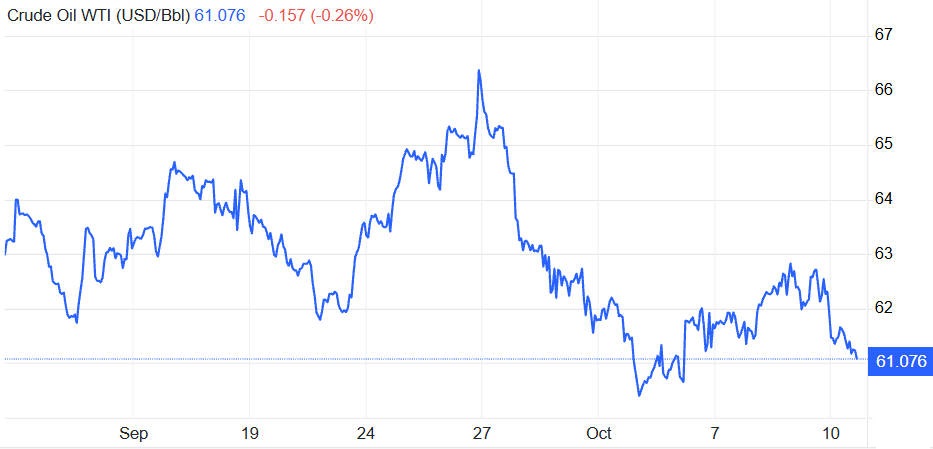

1) Oil prices (commodity channel)

Canada is a major oil exporter; a fall in crude reduces CAD demand. Recent headlines note a roughly 1.8% drop in oil after a Middle East ceasefire development, which removed some risk premia and trimmed crude prices — a direct headwind for the loonie.

2) Monetary policy and rate differentials

The Bank of Canada cut its policy rate to 2.50% in September and left the door open for further easing should economic risks mount; markets have priced additional cuts. A lower Canadian rate versus the US increases the incentive to hold dollars rather than loonie-denominated assets.

3) US dollar strength / risk flows

Broader safe-haven or USD-positive flows (linked to geopolitics and global risk sentiment) have supported the US dollar across G10 FX, contributing to USD/CAD's break above 1.40.

4) Technical momentum and positioning

The breach of the 1.40 psychological mark invited momentum buyers and triggered technical repositioning; analysts note a key cluster at ~1.4014 whose sustained breach would argue for a stronger rally.

Drivers vs probable short-term impact on USD/CAD

| Driver |

Short-term effect on USD/CAD |

| Lower oil prices |

Weakens CAD → pushes USD/CAD higher. |

| BoC easing expectations |

Weakens CAD relative to USD as rate differential narrows. |

| USD safe-haven bids |

Supports USD against CAD (and most commodity currencies). |

| Break of 1.4014 technical cluster |

Could attract momentum sellers/buyers depending on confirmation — sustained break implies further upside. |

USD/CAD: key levels to watch

Scenarios for USD/CAD

USD/CAD holds just above 1.40 as oil remains subdued and markets price marginally more BoC easing. Expect range trading between 1.385 and 1.415 while traders wait for Canadian jobs and central-bank signalling.

Sustained USD strength (or a further fall in oil) pushes USD/CAD toward the 1.42–1.44 area; a daily close above the 1.4014 cluster would give technical conviction for this leg.

Stronger-than-expected Canadian labour data, a rebound in oil above key thresholds, or less BoC easing priced in would tighten interest-rate differentials and support the loonie, pulling USD/CAD back toward 1.36–1.38.

Near-term news flow and data to monitor

Canadian jobs / unemployment data (next monthly release) — the single most likely short-term catalyst.

Bank of Canada communications — speeches and the October Monetary Policy Report for clues on further cuts.

Oil market headlines (OPEC+, supply shocks, demand signals) — direct channel to CAD.

US macro and Fed commentary — any stronger-than-expected US data or hawkish Fed commentary can support USD.

Risks and cautions

Volatile commodity moves: Oil can swing on geopolitical headlines; a sudden rebound would quickly reverse CAD weakness.

Policy surprise: A less-dovish BoC or an unexpectedly aggressive Fed pivot would upset current positioning.

Technical whipsaws: Breakouts around psychological levels are prone to false moves; watch for daily-close confirmations.

Practical implications for market participants

FX traders: Look for disciplined setups around the 1.401–1.405 cluster; use tight risk management because leverage amplifies whipsaws.

Importers / exporters: Canadian importers should consider hedging exposure if CAD weakness persists; exporters benefit from a weaker loonie but should plan for volatility.

Macro investors: Interest-rate differentials and oil exposure should be explicitly modelled when sizing CAD risk.

Conclusion

USD/CAD's hold above the 1.40 mark is a succinct expression of three converging forces: lower oil, a softer Canadian rate outlook after the BoC's recent cuts, and sporadic USD strength driven by global risk flows.

The pair is now trading in a sensitive zone where macro data (notably Canadian employment), oil headlines and the technical 1.401–1.405 cluster will determine whether the rally broadens or stalls.

Traders and businesses should plan for intermittent volatility and use clear triggers — data prints and central-bank commentary — to guide decisions.

Frequently Asked Questions

1. Why did USD/CAD rise above 1.40?

The pair climbed as falling oil prices weakened the Canadian dollar and markets anticipated further Bank of Canada rate cuts, while the US dollar strengthened on safe-haven demand.

2. How do oil prices affect the Canadian dollar?

Canada is a major oil exporter, so lower crude prices typically reduce export revenues and investor demand for CAD, pushing USD/CAD higher.

3. What role does the Bank of Canada play in USD/CAD movements?

Interest-rate decisions directly influence currency values. A dovish BoC, signalling rate cuts, usually weakens CAD versus the US dollar.

4. Is 1.40 a key psychological level for USD/CAD?

Yes. The 1.40 mark often acts as strong resistance or support. A sustained break above it can attract further bullish momentum.

5. What data should traders watch for next?

Canadian employment figures and inflation reports

Bank of Canada policy announcements

US Federal Reserve communications

Global oil market developments

6. Can the Canadian dollar recover soon?

A rebound is possible if oil prices rise sharply or if BoC slows its easing pace. However, near-term pressure remains unless global demand improves.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.