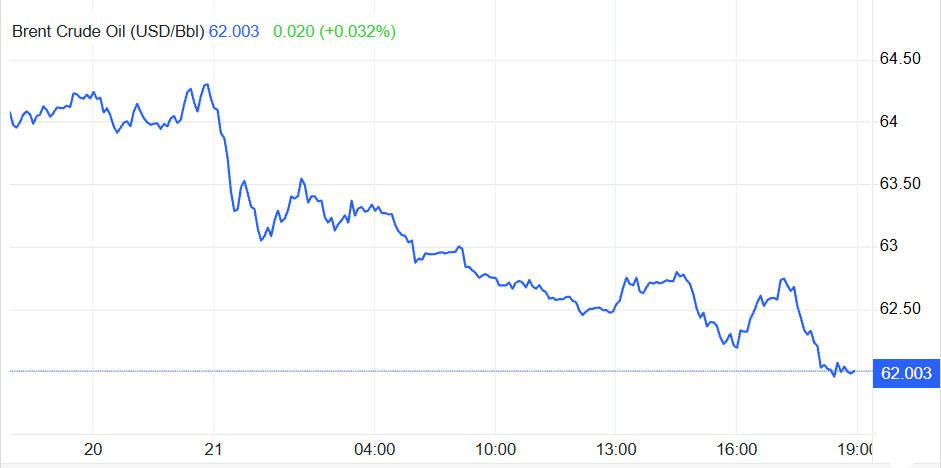

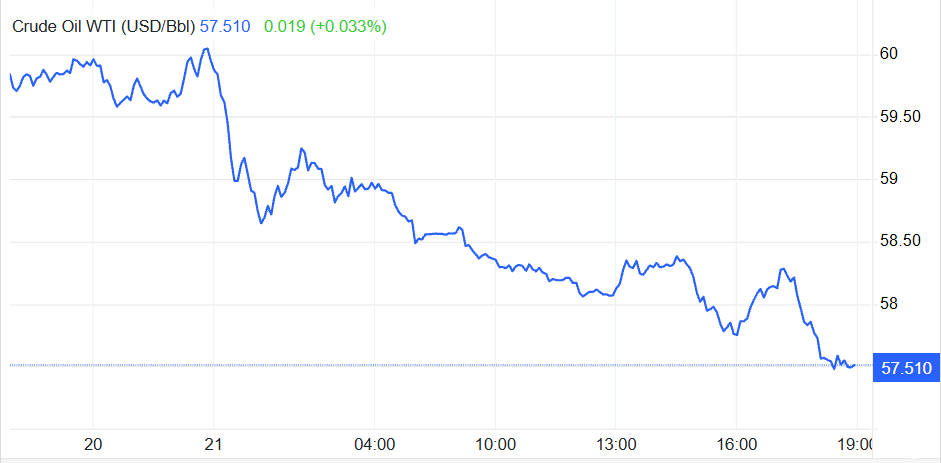

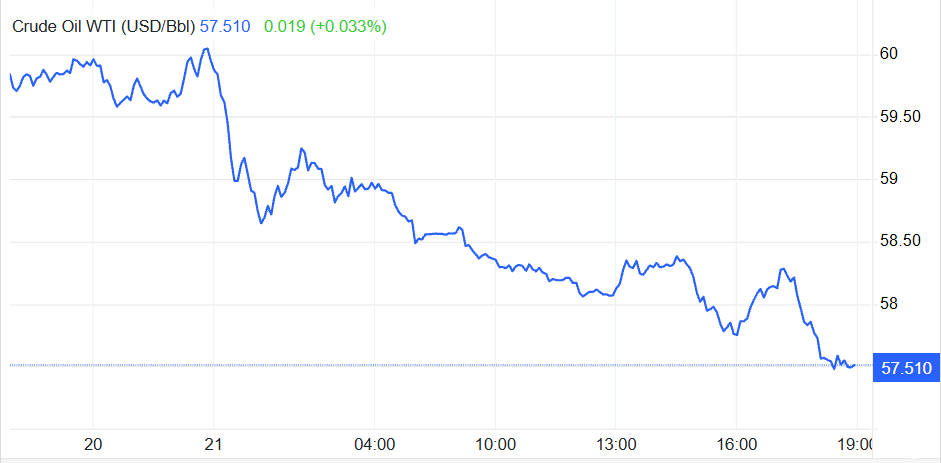

The latest data show that the crude oil price benchmark for Brent crude oil sits at approximately US $60 per barrel, reflecting a drop of around 1.78 % today. Simultaneously, the benchmark for West Texas Intermediate crude oil (WTI) is at US $57.51 per barrel, down about 2.00 %.

These moves reflect heightened volatility in oil markets as traders weigh conflicting signals around supply, demand and geopolitics. The drop in the crude oil price captures investor caution amid expectations of a growing inventory overhang and a lack of immediate bullish triggers.

Below is a professional, in‑depth analysis of the crude oil price move, covering inventory developments, supply dynamics, technical analysis, market impact.

Supply & Inventory Indicators Supporting the Crude Oil Price Drop

Several key fundamental indicators underpin today's drop in the crude oil price.

Global inventory data and forecasting show that supply growth is outpacing demand. Analyst reports indicate an expected surplus for 2026 in oil markets.

Despite some regional inventory draws (for example in the U.S.), the broader supply‑demand balance remains weak. Weekly historical data for WTI futures show consistent negative changes.

The Organisation of the Petroleum Exporting Countries + (OPEC+) has signalled only modest production changes, which markets interpret as insufficient tightness to support a higher crude oil price.

In short, although the crude oil price is reacting to short‑term indicators, the fundamental backdrop remains tilted toward oversupply, hence the market's bias lower.

Technical Outlook for the Crude Oil Price(WTI as Proxy)

From a charting perspective, the crude oil price for WTI demonstrates key support and resistance zones that traders are monitoring:

Support: Around US $57.10–57.50. A decisive break below this could open the next leg down (towards US $56 or lower).

Resistance: Around US $60.40–61.00. A breakout above could shift sentiment, but given current fundamentals that scenario appears less likely.

Technical indicators reflect a bearish to neutral bias — momentum is weak and the crude oil price remains under pressure from the broader supply story.

Thus, the technical structure supports today's drop in the crude oil price and presents a range‑bound environment with downside potential unless a strong catalyst emerges.

Market Impact and Outlook for the Crude Oil Price

1. Impact

Energy stocks and oil‑linked equities are likely to face headwinds given the fall in the crude oil price, particularly for companies with higher breakeven costs.

Downstream effects:

A lower crude oil price can ease input cost pressures for transportation and manufacturing, yet also signals weaker demand which may dampen economic growth indicators.

For consumers/fuel markets:

While a lower crude oil price may translate into lower pump prices eventually, the lag and local taxes mean benefits may not be immediate.

2. Outlook

In the near term:

Expect the crude oil price to fluctuate in the US $57–61 band, with bias toward the lower end unless demand surprises or supply is unexpectedly constrained.

In the medium term:

Without a meaningful reduction in output, a demand recovery or a geopolitical disruption, the crude oil price may be challenged to return significantly higher.

Key drivers to watch:

OPEC+ policy statements, weekly inventory data (especially from the U.S. Energy Information Administration), global demand data (especially from China/India), and major supply disruptions.

Strategic Considerations in Light of the Crude Oil Price Decline

Given the slide in the crude oil price, market participants should consider the following:

1. Hedging risks:

If you are exposed to oil price risk (e.g., energy companies, transport sectors), ensure adequate hedges or stop‑loss protocols given current vulnerability.

2. Selective positioning:

Entry into long crude oil positions may need to await a clear breakout above resistance or a material shift in fundamentals rather than attempting to catch a bottom.

3. Diversification and scenario planning:

Build scenarios — for example, base case (price range holds), bearish case (break below US $56), bullish case (geopolitical shock pushes price up).

4. Monitor cost pressures:

For companies reliant on crude oil, a lower price benefits cost structure but may signal slower end‑demand, so balance both angles.

Crude Oil Price Three‑Month Forecast

| Time Period |

< US$56 |

US$56‑60 |

> US$60 |

Commentary Summary |

| Month 1 (Next ~4 weeks) |

35% |

50% |

15% |

With the crude oil price currently around US$57.51 (WTI), the most likely is to stay in the US$56‑60 range, while a break below US$56 is quite possible (35% chance) given oversupply risk; a rally above US$60 is less likely. |

| Month 2 (4‑8 weeks) |

40% |

45% |

15% |

As inventory builds may become more visible and OPEC+ cautious stance persists, downside risk increases slightly; thus the <US$56 range chance grows to 40%. |

| Month 3 (8‑12 weeks) |

45% |

40% |

15% |

If fundamentals don't change meaningfully, market may drift downwards; probability of staying >US$60 remains low unless a surprise occurs. |

Conclusion

In summary, the crude oil price has come under pressure today, with Brent at US $60 and WTI at US $57.51. reflecting market concerns over persistent supply growth and a cautious OPEC+ stance.

While modest U.S. inventory draws offer temporary support, the broader global supply-demand imbalance limits significant upside potential.

Technical indicators reinforce a near-term bearish-to-neutral bias, suggesting WTI may fluctuate within the US $57–61 range unless a major catalyst emerges.

Frequently Asked Questions

Q1: Why is the crude oil price for WTI falling even if supply cuts are suggested?

The crude oil price is falling because markets perceive that any supply cuts are modest or delayed, while global production and stockpiles continue rising, undermining confidence in near‑term tightness.

Q2: What would trigger the crude oil price to rise significantly?

A sharp rise in the crude oil price would likely be triggered by a major supply disruption (geopolitical or natural), a policy‑driven production cut, or a sudden surge in global oil demand.

Q3: How do inventory numbers affect the crude oil price?

Inventory data influence the crude oil price by showing whether supply is building or drawing‑down; rising stockpiles suggest oversupply and weigh on price, while draws can support price momentum.

Q4: How should energy companies respond to the current crude oil price environment?

Energy companies should manage operational costs, reconsider investment in high‑breakeven projects, hedge exposure to price declines, and monitor longer‑term demand trends closely.

Q5: What range should I expect for the crude oil price in the short term?

In the short term, expect the crude oil price to trade between roughly US $57 to US $61 per barrel, with downside risk if support breaks, pending a clear bullish catalyst.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.