Meta’s fourth-quarter and full-year 2025 results are due after the close on January 28, 2026, with an earnings call at 4:30 p.m. ET.

Meta earnings land at an awkward moment for Meta stock: investors want proof that AI is still improving operating leverage, even as the company signals another step-up in infrastructure spending. The market is no longer debating whether Meta can grow revenue. The debate is how long margins can hold as AI compute demand pushes capital intensity higher.

With consensus clustered around $58.43 billion in revenue and $8.17 in EPS, the bar is not the quarter itself. It is 2026 capex, expense growth, and whether AI-led ad performance continues to offset the depreciation wave that follows.

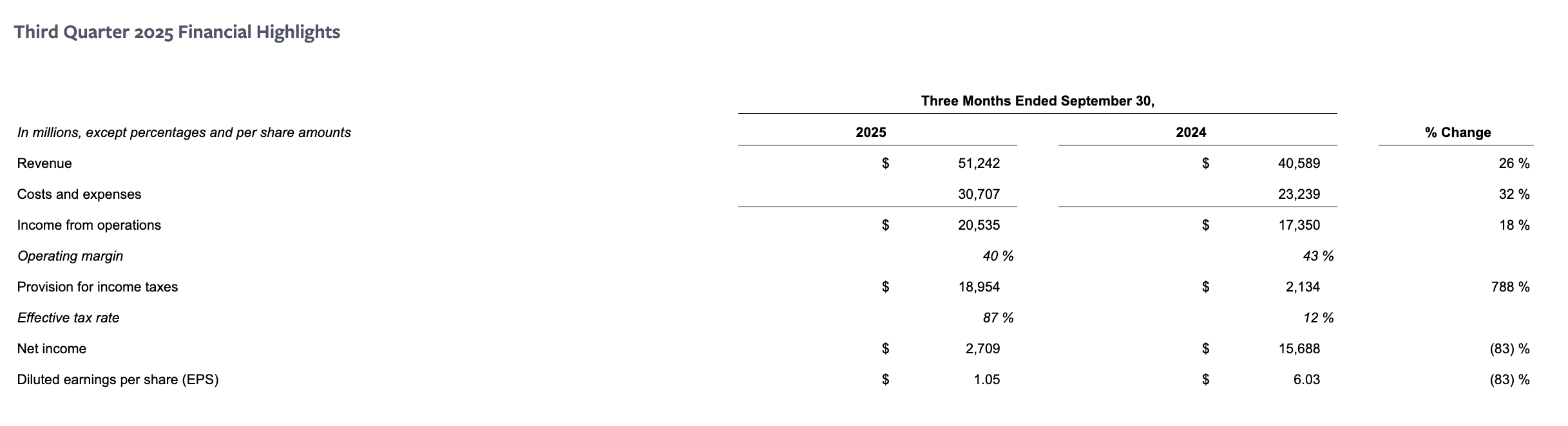

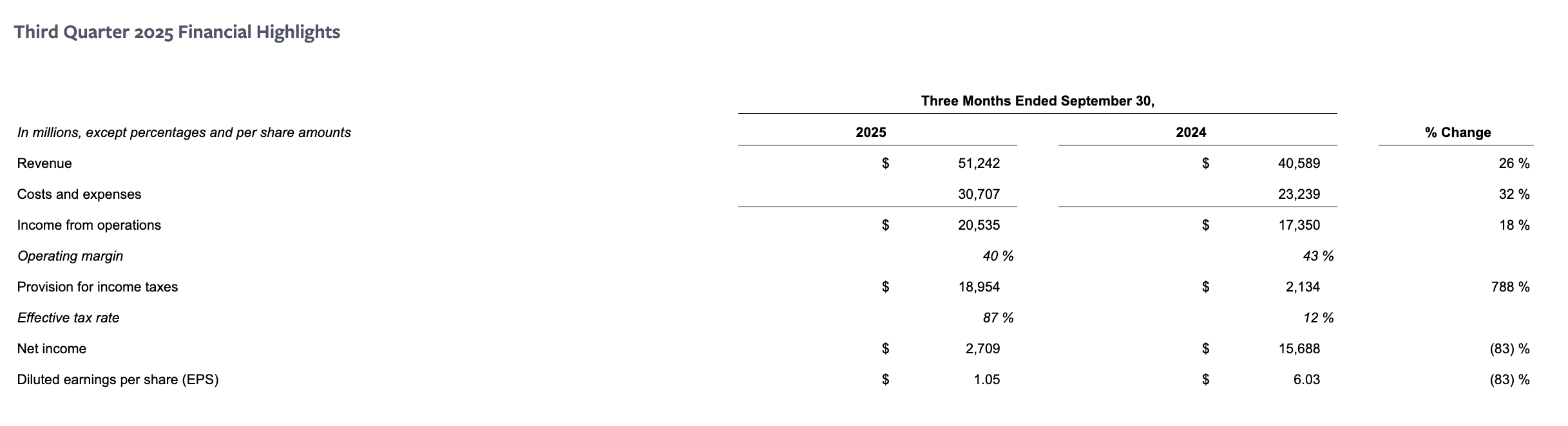

Meta Earnings Forecast

| Metric |

Q4 2025 (pre-report) |

Q3 2025 (actual) |

Q4 2024 (actual) |

QoQ (vs Q3 2025) |

YoY (vs Q4 2024) |

| Revenue |

Guidance: $56B to $59B; Consensus: ~$58.43B |

$51.24B |

$48.39B |

+$7.19B (+14.0%) using consensus |

+$10.04B (+20.8%) using consensus |

| EPS (diluted, GAAP) |

Consensus: ~$8.17 |

$1.05 (reported); $7.25 excluding one-time tax charge |

$8.02 |

+$0.92 (+12.7%) vs $7.25 adjusted |

+$0.15 (+1.9%) |

*Q3 2025 diluted EPS was $1.05 due to a one-time, non-cash tax charge. Meta disclosed diluted EPS would have been $7.25 excluding that charge.

The Q4 2025 Setup: What the Guidance Implies

Revenue math that frames the quarter

Meta’s fourth-quarter revenue outlook of $56 billion to $59 billion provides a broad but informative range. Compared to third-quarter 2025 revenue of $51.24 billion, this guidance suggests sequential growth of approximately 9% to 15%, aided by seasonal factors.

Relative to fourth-quarter 2024 revenue of $48.39 billion, the outlook implies year-over-year growth of approximately 16% to 22%.

Why “beat or miss” might matter less than the 2026 slope

Numerous previews emphasise the market’s focus on the magnitude of Meta’s 2026 artificial intelligence investment trajectory, which will significantly influence margins and overall spending.

Increased capital expenditures in the present typically result in higher depreciation expenses in subsequent periods, which can negatively impact operating margins even if revenue remains robust.

More third-party cloud spend and AI talent costs can raise the “run rate” of expenses.

If Meta continues to pursue aggressive investment while industry peers also increase spending, investors are likely to require more explicit evidence that incremental AI expenditures are enhancing monetisation rather than solely driving user engagement.

What The Market Needs From META

Meta earnings typically move the stock on three lines: revenue growth, margin, and buybacks. In this cycle, a fourth variable dominates: how quickly AI infrastructure expands and how clearly Meta can monetise it across ads, messaging, and emerging devices.

The setup is complicated by Meta’s Q3 2025 print, which included a very large one-time, non-cash tax charge that pushed reported EPS to $1.05 while EPS excluding that charge was $7.25.

That disconnect matters because investors are trying to isolate sustainable unit economics, not accounting noise, ahead of a guidance-heavy quarter.

The earnings date itself is no longer “just another quarter.” Meta has confirmed it will release results after market close on January 28, 2026, and the tone of the call will likely be interpreted as a referendum on whether 2026 becomes a second straight year of heavy reinvestment or a year where AI benefits finally outpace the cost curve.

Ads Are Still Paying The Bills

Even with heavy spending on AI and data centres, Meta can fund itself because its ad business remains highly efficient (see Meta’s Q3 2025 results for the latest operational KPIs).

Ad demand looks healthy.

In Q3 2025, ad impressions rose 14%, and the average price per ad rose 10%. When both volume and pricing climb together, it usually signals stronger engagement and improved ad targeting, often supported by AI-driven ranking and measurement upgrades.

Margins are easing, but still strong.

Meta’s operating margin was 40%, down from 43% a year earlier. The key issue is whether margins can stay resilient as costs rise from depreciation, cloud services, power, and compute.

Q4 guidance sets expectations, but 2026 is the real story.

Meta guided $56–$59 billion in Q4 2025 revenue. Hitting that range may not move the stock much. Investors will focus more on what Meta says about 2026 capex and expense growth.

How CapEx Guidance Can Push Meta Stock Up or Down

This is a simplified “if-then” map of how the market often reacts, not a prediction.

More likely to support the stock (all else equal):

The 2026 CapEx range is high but in line with market expectations, and Meta shows confidence that ad tools and engagement improvements continue.

Management explains how spending converts into capacity and product improvements, with specific pacing and fewer unknowns.

More likely to pressure the stock (all else equal):

The 2026 CapEx range is well above what investors have been braced for, with limited added clarity on timing or ROI.

Expense growth guidance accelerates sharply, and management emphasises multi-year pressure from depreciation and cloud costs.

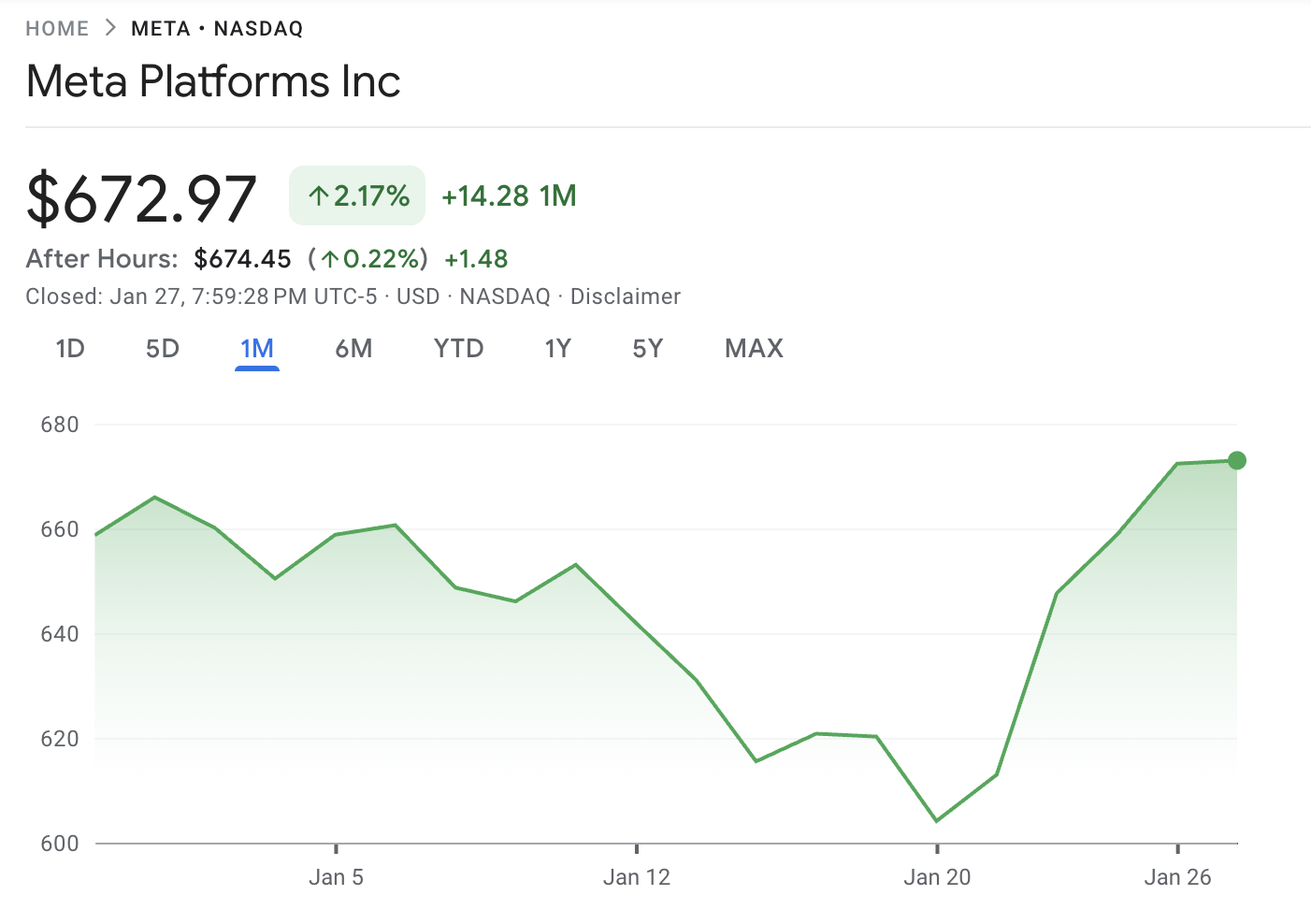

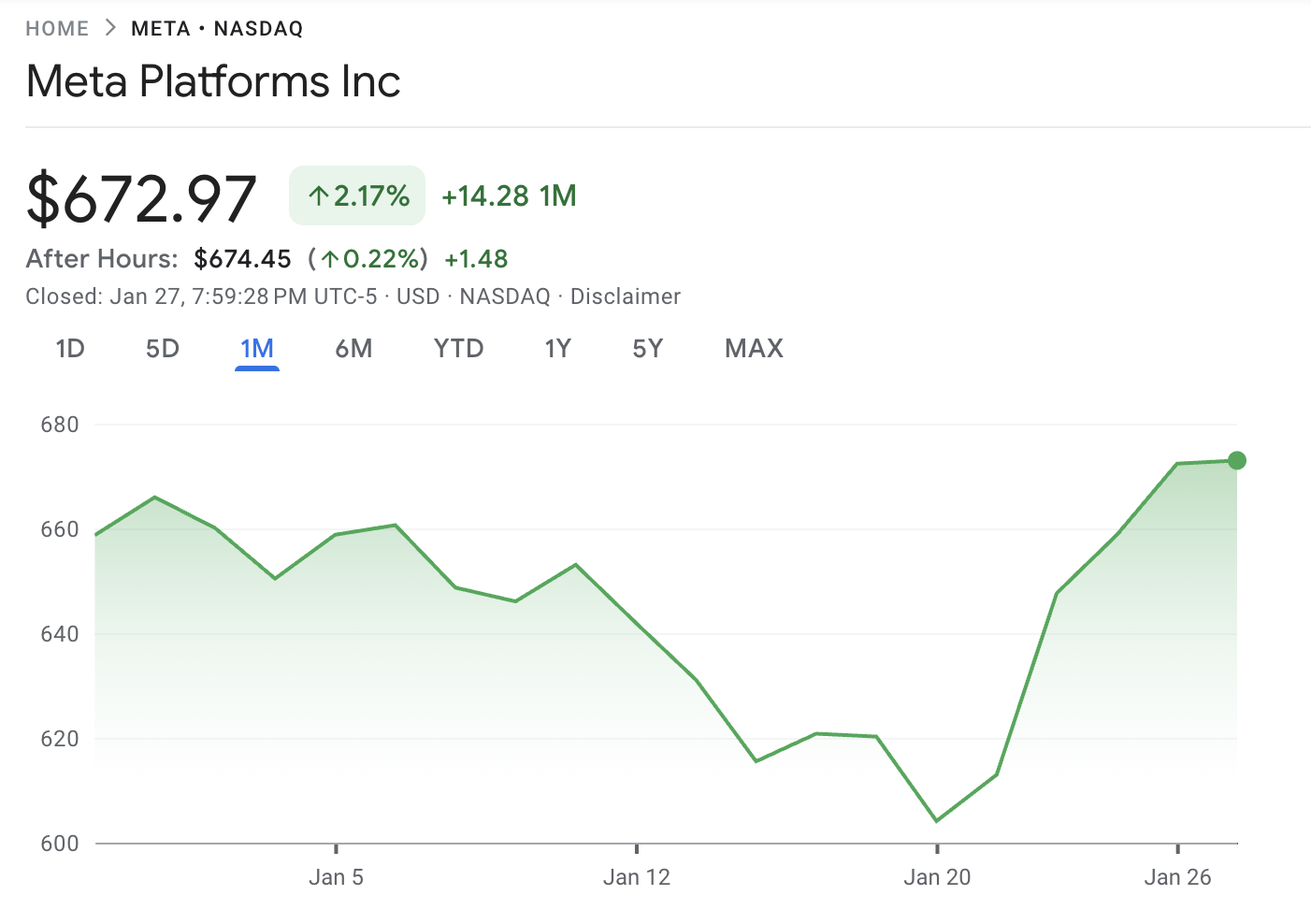

Meta Stock Recent Performance (1 week, 1 month, and 6 months)

The weekly jump shows strong near-term momentum into earnings, but the smaller 1-month gain and negative 6-month trend suggest investors are still weighing Meta’s growth against higher spending and other longer-term concerns.

| Period |

Performance |

| 1 Week |

+$68.85 (+11.40%) |

| 1 Month |

+$9.68 (+1.46%) |

| 6 Months |

-$39.71 (-5.57%) |

As of the most recent market close on January 27, 2026, Meta stock was priced at approximately $672.92.

Key takeaway: When a stock is up sharply in the last week but only slightly over one month and still down over six months, the post-earnings move often comes down to whether management confirms a clear, credible path for the next two quarters, especially on spending and returns.

Risks and Watch Items That Could Come Up On The Call

1) The 2026 capex number, and what is inside it

Meta has guided 2025 CapEx at $70 billion to $72 billion (including principal payments on finance leases).

The stock-moving issue is how management translates “notably larger” into a 2026 range, and whether that range is closer to “incremental” or “step-change.”

2) Whether management connects spend to measurable ad outcomes

Investors will likely reward spending if Meta ties it to monetisation improvements, such as better ranking, measurement, and conversion. If the story stays mostly technical, the market tends to default to “higher spend equals lower near-term margins.”

3) Threads monetisation roadmap

If Meta provides clearer signals on ad load, brand tools, or pricing approach for Threads, it can affect 2026 ad growth assumptions even if Q4 is still early.

4) Reality Labs: spending discipline versus product ambition

Q4 is the seasonal quarter for devices. Even without a big revenue surprise, investors will watch whether Meta frames its Reality Labs investment as steady, rising, or more selective than AI infrastructure.

Frequently Asked Questions (FAQ)

1) When is Meta’s Q4 2025 earnings release?

Meta will release fourth-quarter and full-year 2025 results after market close on January 28, 2026, followed by a conference call at 4:30 p.m. ET.

2) What are investors watching most in Meta earnings?

The market is watching 2026 capex and expense growth guidance, as well as whether AI-driven ad performance is strong enough to protect margins amid rising depreciation and cloud costs. Meta has already signalled that 2026 capex growth will exceed 2025 levels.

3) What should investors watch besides revenue and EPS?

The most decision-relevant items are ad impressions and average price per ad, Daily Active People (DAP), Reality Labs losses, and management guidance on 2026 expenses and capex. Those elements can change the interpretation of the quarter even if headline numbers beat.

4) What is Meta’s current 2025 CapEx outlook?

As of its Q3 2025 results, Meta said it expects 2025 capital expenditures, including principal payments on finance leases, to be $70 billion to $72 billion.

Conclusion

Ahead of Meta’s fourth-quarter 2025 earnings, the outlook appears robust. Revenue guidance suggests strong year-over-year growth, and recent advertising key performance indicators indicate a favourable combination of impression growth and pricing.

The likely deciding factor for the stock reaction is not whether Meta beats consensus by a small margin, but whether management can put credible boundaries around 2026 capex and expense growth and explain how that spending translates into durable monetisation gains.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

Meta Q3 2025 earnings call transcript (PDF)

Federal Trade Commission: “FTC Appeals Ruling in Meta Monopolisation Case” (Jan. 20, 2026)