Big Tech is gearing up for the spotlight—and traders are on edge. As July drifts into August, the world's largest technology companies are about to deliver their latest earnings, putting billion-dollar market moves on the line. With Meta and Microsoft up on Wednesday, followed by Amazon and Apple on Thursday, this “tech earnings season” has the power to make or break current market sentiment. So, can blockbuster results—or surprise stumbles—send a jolt through global markets this week?

Why Tech Earnings Matter More Than Ever

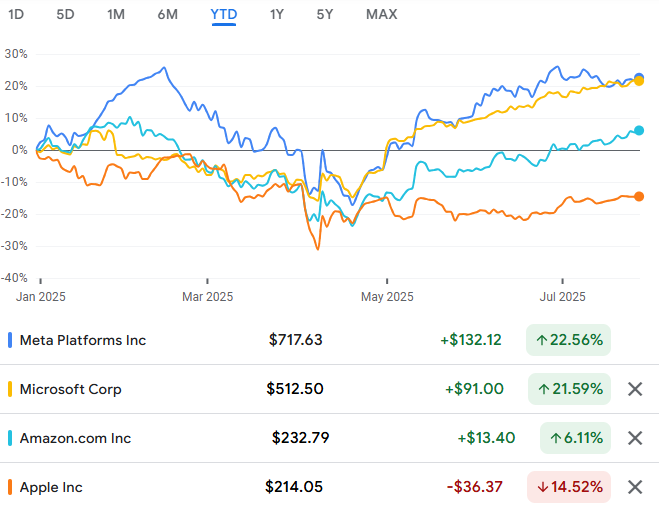

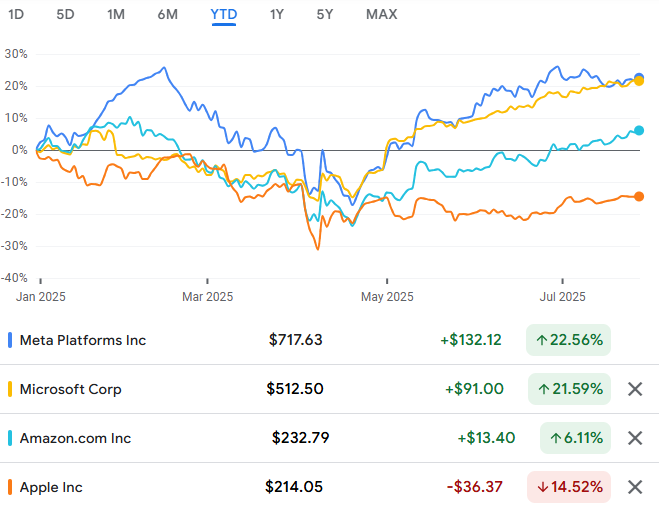

After a stretch of record highs in the S&P 500 and Nasdaq, markets have hit a patch of caution, largely due to a muted Monday session and the recent US-EU trade deal that left some investors underwhelmed. The next major catalyst? Tech sector results. Together, Meta, Microsoft, Amazon, and Apple (“The Magnificent Seven” group, which also includes Alphabet, Nvidia, and Tesla) wield enormous influence, accounting for over 27% of the S&P 500's total market value.

-

Meta Platforms (META): Expected to report Q2 revenue of $38.6 billion, up 19% year-on-year. Ad revenue trends and AI-driven engagement will be keenly watched.

-

Microsoft (MSFT): Forecast Q2 sales at $65.6 billion, driven by Azure cloud and AI solutions, with year-on-year growth of almost 15%.

-

Amazon (AMZN): Anticipated Q2 revenue at $151.8 billion, a roughly 10% increase, amid assessments of AWS cloud margins and consumer demand.

Apple (AAPL): Projected to post $84.9 billion in revenue, though analysts warn of sluggish iPhone upgrades and soft China sales.

With about 37% of S&P 500 companies scheduled to report this week, the stage is set for high drama on Wall Street.

What's Different This Earnings Season?

This reporting cycle comes at a crucial juncture:

-

Market highs but fragile confidence: The S&P 500 sits near its record peak (closing at 6,308 Monday), but momentum has waned with the Dow Jones down 0.2% and trading volumes light.

-

Mega-cap concentration: The “Magnificent Seven” have led much of 2025's market gains. If they falter, the entire market risks a larger correction.

Macro headwinds: Fresh US-EU tariffs, global supply chain realignments, and emerging inflation in markets like Brazil (now running at 4.0% YoY) are weighing on sentiment.

Chips, Contracts, and Trade Turbulence

Fanning the flames, Tesla just announced a $16.5 billion chip supply deal with Samsung, aimed at securing AI power for its vehicles. The long-term agreement, running until 2033, not only cements Samsung's status as a critical chip supplier but also signals that big auto and big tech are doubling down on in-house innovation, potentially rattling chip rivals like TSMC and reshaping global supply chains.

Samsung's shares leapt as much as 6.8% on the news, while analysts flagged likely spillover effects for related suppliers and competitors. The message is clear: contracts and partnerships announced during earnings season can move whole industries, not just the reporting firms themselves.

At the same time, a newly announced US-EU trade deal has settled (for now) at a 15% tariff rate on EU exports to the US—lower than the feared 30%, but still adding friction for car makers, chip equipment firms, and other global businesses. The agreement includes $600 billion in EU investment in the US and $750 billion in energy purchases, but markets are digesting whether it's enough support to offset higher costs and competitive risks.

What Are Investors Watching?

-

Guidance and surprises: Wall Street is laser-focused on forward-looking statements. Any hint of softer outlooks—especially after such a strong run—could trigger sharp reversals.

-

AI and cloud: With AI the buzzword of 2025, Microsoft and Amazon will be scrutinised for evidence of accelerating cloud adoption and new AI-driven revenue streams.

-

China exposure: Both Apple and semiconductor suppliers face questions over weakening Chinese consumer demand, compounded by ongoing trade jitters.

Profit margins: After a strong first quarter for Big Tech profitability, analysts are alert to signs of cost inflation or supply chain delays creeping into the margins.

Global Market Ripples

The tech sector's results land as global stocks move cautiously. European and Asian indices have struggled to maintain momentum, with the Stoxx 600 slipping on Monday and the MSCI Asia Pacific Index off 0.7% as investors position for high volatility.

Currency markets are watching closely, too—the dollar rallied sharply at the start of the week, its best one-day move since May, as the euro dipped on tepid European sentiment.

Looking Beyond the Headlines

Don't overlook the knock-on effects:

Supply chain winners (like Samsung suppliers in Korea and the US) could get a tailwind from blockbuster deals.

Weaker results or shaky guidance could spark a broader sell-off, especially given tech's outsized role in recent market gains.

Developments outside tech—such as resurgent inflation in Brazil or slowdowns signalled by China's latest Caixin PMI (now at 49.8, indicating contraction)—may amplify volatility if signals point in the wrong direction.

Conclusion

The convergence of tech earnings, giant chip deals, and shifting trade rules creates a recipe for volatility. With so much riding on the fortunes of just a handful of companies, traders and investors need to stay alert. Will Big Tech wow the markets yet again—or will fresh surprises finally puncture the optimism that's fuelled this year's rally? Strap in for a week where headlines and numbers alike could reshape the global risk landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.