Boeing reports fourth-quarter 2025 earnings today, with the earnings conference call scheduled for 10:30 a.m. ET.

For BA stock, the market has been willing to look past near-term losses because the real debate is about the shape of the recovery and whether management can credibly outline a path to higher 737 MAX output, steadier deliveries, and meaningfully better cash generation after a year when deliveries improved but operational confidence is still being rebuilt.

Therefore, the Boeing earnings report today is less about the headline EPS number and more about whether management can back a stronger 2026 trajectory with measurable production, delivery, and cash-flow milestones.

Why This BA Earnings Report Feels Like a "Trust Test"

BA's equity story has shifted from "survive the next quarter" to "prove the factory is stabilising." You can see it in three places:

1) Deliveries Have Already Increased Higher

BA delivered 160 commercial aircraft in Q4 2025 and 600 for the full-year 2025, with 737 deliveries doing most of the heavy lifting.

2) Supply Chain Control Is Being Rebuilt

BA completed the acquisition of Spirit AeroSystems on December 8, 2025, bringing key structures work back in-house, which is directly tied to quality and throughput.

3) Regulatory Pacing Still Controls the Speed Limit

The FAA has capped 737 output in the past, and reports indicate the agency allowed production to rise from 38 to 42 per month, which is constructive.

However, it still underscores that output is not solely a management decision.

This is why BA can rally on a loss and sell off on "good" revenue if the call sounds like the ramp is meeting friction again.

Boeing Earnings Expectations: What Wall Street Is Looking for in Q4

| Item |

Street expectation (approx.) |

| EPS |

-$0.44 |

| Revenue |

$22.6B |

Consensus expectations frame the baseline, but they are not the primary catalyst. The market is likely to react more to delivery and cash-flow guidance than to a small EPS variance.

Additionally, investors want clarity on future delivery and production plans, with the broader goal of returning to profitability for the first time since 2018.

What Results Will Move BA Stock the Most?

1) Free Cash Flow and Working Capital Discipline

For BA, cash is the truth serum because aircraft manufacturing is a balance-sheet business. Investors will focus on whether inventory is converting into deliveries and whether customer payments and advances support liquidity.

What traders will listen for:

Any commentary that reinforces the path toward positive free cash flow in 2026, which management has discussed as an objective in recent coverage.

Signals that abnormal costs, rework, and bottlenecks are easing rather than migrating through the system.

If cash burn is smaller than feared, BA can rise even on a headline EPS loss. If cash burn looks sticky, the multiple can compress quickly because the market stops "bridging" the story.

2) Commercial Airplanes Delivery Cadence and Mix

BA already disclosed Q4 deliveries, so the focus shifts to what those deliveries imply for margins and the forward cadence.

Q4 2025 Deliveries (Commercial):

737: 117

787: 27

777: 12

767: 4

Total: 160

The mix matters because widebodies and higher-spec aircraft can lift revenue per delivery, while narrowbody volume drives the scale effect.

Regardless, investors will want evidence that the ramp is not just "more units," but "cleaner units" that do not drag margins with post-delivery fixes.

3) 737 Production Rate and FAA Relationship

If BA's ramp narrative has a single choke point, it is the 737 line. The market will watch whether management frames production as:

For example, the FAA approved an increase to 42 737s per month, which is a meaningful milestone because it signals a pathway back to higher output if quality controls continue to improve.

4) Certification Timelines: MAX 7, MAX 10, and 777X

Certification is not just a product roadmap item. It serves as both a revenue timing mechanism and a credibility-building tool.

Investors will want any concrete progress markers on:

MAX 7 and MAX 10, which are widely viewed as necessary to the medium-term product line.

777X, which has faced repeated delays. For instance, delays pushing the first delivery into 2027 have also been referenced, along with significant program charges tied to the timeline.

A "same story, same dates" update is usually no longer enough. The market tends to reward specificity and penalise vague reassurance.

5) Spirit Aerosystems Integration and Quality Messaging

Because BA completed the Spirit acquisition in December 2025, this earnings cycle is an early window into integration priorities and near-term costs.

What matters most:

Whether the integration is framed as a measurable improvement in "build quality per unit," not just an organisational reshuffle.

Whether management suggests the move reduces out-of-sequence work and stabilises fuselage flow.

6) Defense and Fixed-Price Program Surprises

BA's Defense segment has been a recurring source of headline risk, particularly around fixed-price development and production programs.

Any new charges can outweigh good commercial news in the short term because they change investor confidence in consolidated margin recovery.

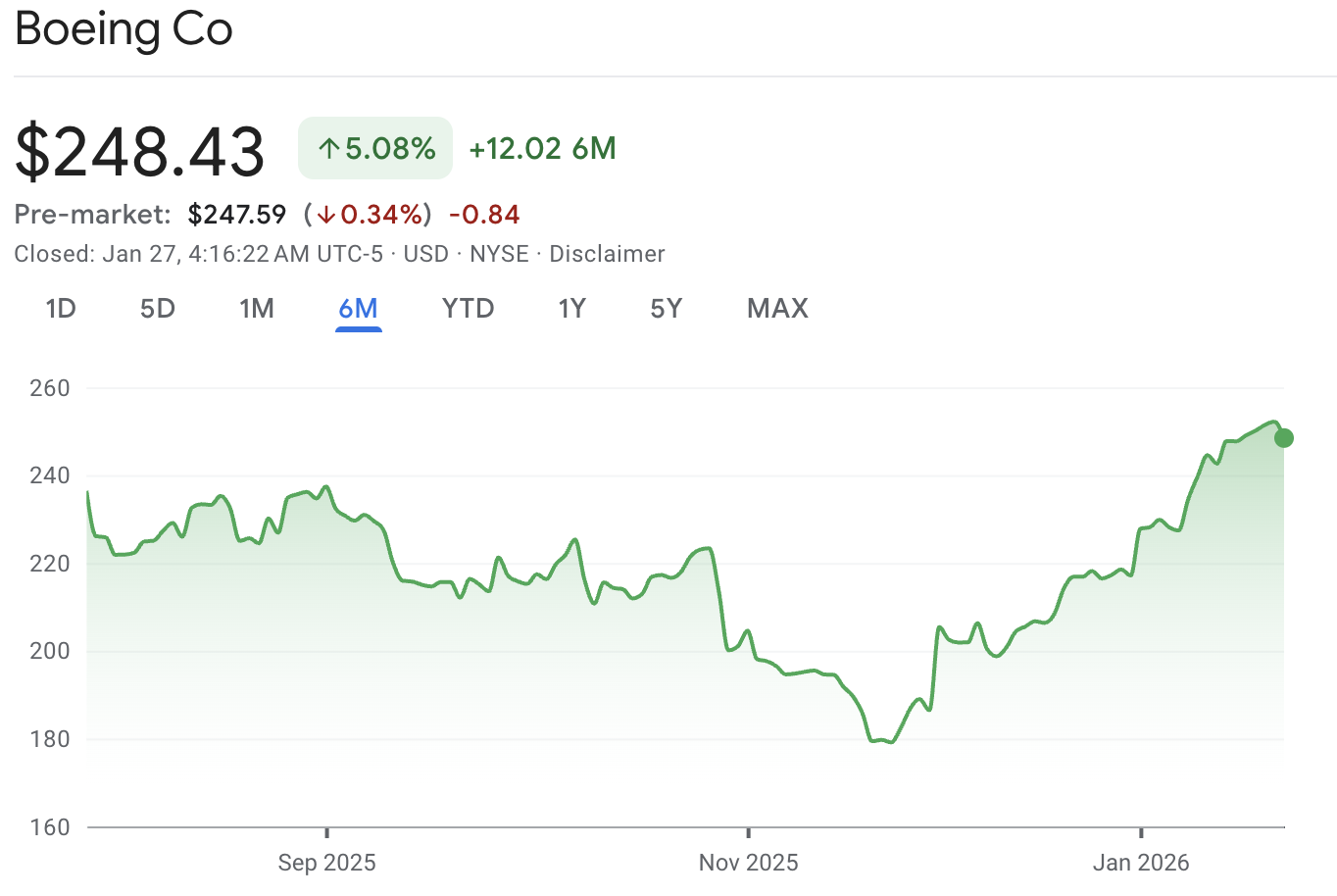

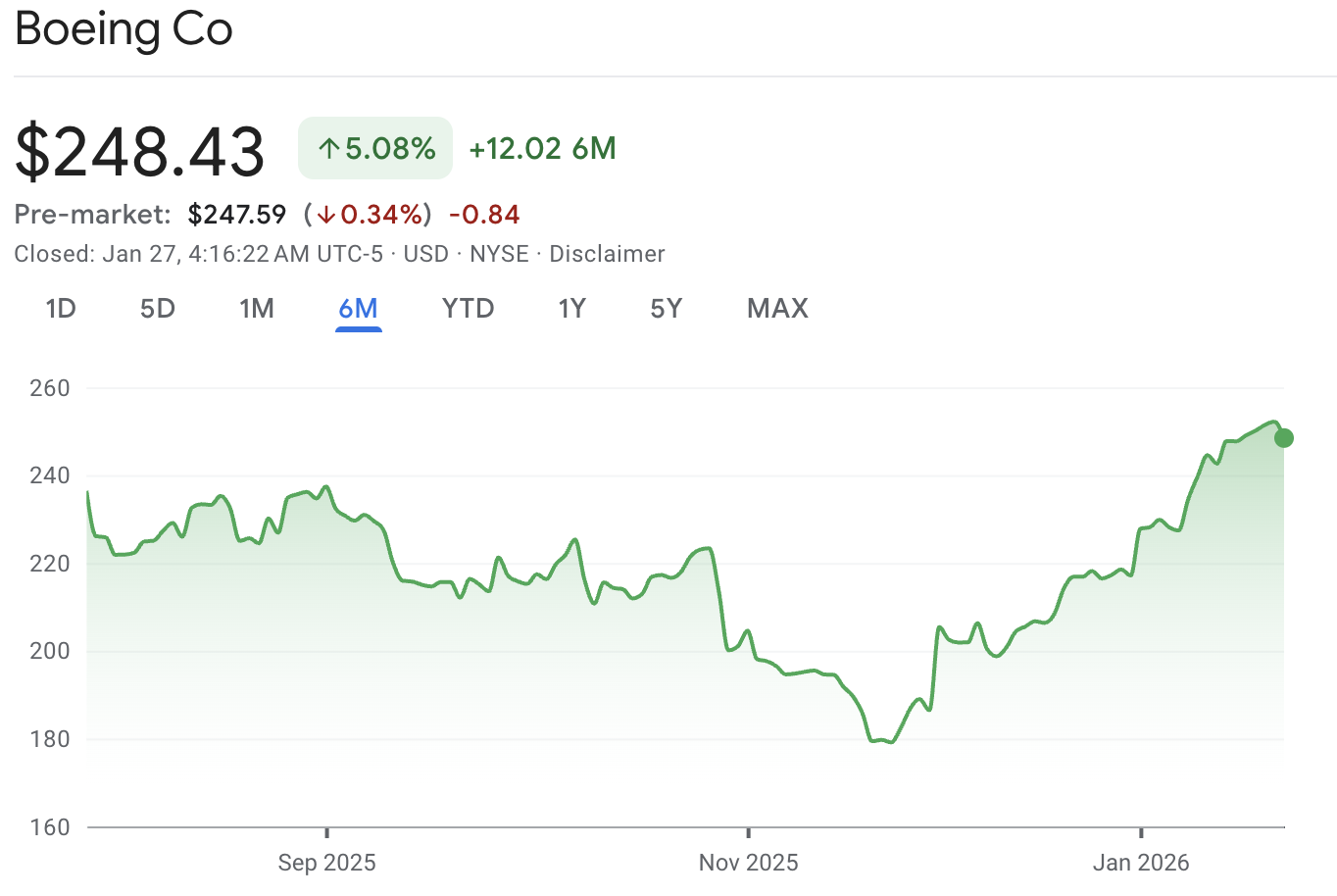

Recent Performance of BA Stock: 1 Week, 1 Month, 6 Months

BA stock has rallied into earnings, which raises the bar for execution and guidance clarity.

| Period |

Performance |

| 1 week (5 trading days) |

+1.65% |

| 1 month |

+14.35% |

| 6 months |

+5.08% |

As of the most recent market close on January 26, 2026, Boeing (BA) stock was priced at approximately $248.

Key Takeaway: A stock that is up sharply over one month often reacts less to the past quarter and more to whether management confirms that the next two quarters are building toward a credible 2026 step-up.

Options Market Positioning: How Big Will BA Stock Move?

Options pricing can establish expectations for volatility, but it does not forecast direction.

Options AI data cited an expected move of about 5.2% around the earnings event, and it also shows recent realised post-earnings moves that were often smaller than what options implied.

If BA moves less than the implied range, the market often shifts quickly from "event risk" to "trend trading," which can create a second move after the initial reaction.

BA Stock Technical Analysis: The Levels Traders Are Watching

| Metric |

Latest |

What it implies for BA |

| Last price |

$248.43 |

The market is sitting just under the $250 handle, which is a common magnet level around earnings. |

| Intraday high / low |

$252.12 / $247.41 |

Volatility is already elevated, so a gap-and-run or gap-and-fade is plausible. |

| Volume (intraday) |

8,469,160 |

Volume is active, which usually increases the odds that levels get respected during regular hours. |

| 14-day RSI |

73.88 |

This is overbought territory, which raises the risk of a "sell-the-news" pullback even if results are decent. |

| 14-day ATR |

$5.32 |

A typical daily swing near $5 implies price can move 2%+ without needing a major surprise. |

| 20-day moving average |

$235.93 |

This is the first meaningful "trend catch" zone if the stock drops and then tries to stabilize. |

| 50-day moving average |

$213.36 |

BA is well above this, which confirms the uptrend but also shows how extended the rally has become. |

| 200-day moving average |

$211.25 |

This is the deeper trend floor that typically matters only if the earnings reaction becomes a larger reset. |

| Pivot (Classic) |

$249.71 |

A clean reclaim above this level often improves intraday tone after a weak open. |

| Support / Resistance (Classic) |

S1 $248.49 / R1 $250.32 |

These are the closest "first reaction" levels. If BA is trading between them, the market is waiting for direction. |

BA stock is currently in an extended upward trend, as it is significantly above its 20-day, 50-day, and 200-day moving averages. However, this also indicates that the stock is priced for continued positive developments.

The momentum is stretched since the RSI is already in the overbought range. This situation can make the market more sensitive to signs of production issues, delivery delays, or slower cash flow improvements.

Support and Resistance Map (Event-Driven)

These are the levels that are most likely to show up in trading decisions immediately after the print, because they sit close to where BA is already trading.

Immediate Support (Downside Levels to Watch):

$248.49 (S1)

$247.88 (S2)

$246.66 (S3)

Immediate Resistance (Upside Levels to Watch):

$250.32 (R1)

$251.54 (R2)

$252.16 (R3)

How to Read It

Traders should expect that earnings can skip levels in a gap, then use the nearest pivot bands as "retest" zones rather than perfect turning points.

Frequently Asked Questions

1. What Time Does BA Report Earnings Today?

Boeing's earnings report is scheduled for Tuesday, January 27, 2026, before the market opens, followed by a conference call at 10:30 a.m. ET.

2. What Is Wall Street Expecting for Boeing's Q4 Results?

Major previews report consensus expectations of roughly a $0.44 per-share loss on about $22.6 billion of revenue, driven by much higher deliveries than a year ago.

3. Why Do 737 Production and FAA Updates Move BA Stock So Much?

The 737 line is the main volume engine, so changes in production constraints directly shift delivery timing, revenue, and margin recovery. FAA oversight also affects how quickly BA stock can raise output, which is why production-rate commentary often drives the stock reaction.

4. How Large a Post-Earnings Move Do Options Price?

The options dashboard indicates that the expected price movement for this earnings event is approximately 5.2%.

Conclusion

In conclusion, Boeing's Q4 2025 earnings report serves as a test of credibility as much as it does a financial update.

Higher deliveries have already improved the revenue outlook. However, BA stock is more likely to respond to management's evidence that production can rise safely, deliveries can stay steady, and cash conversion can improve durably.

Investors should watch the 737 MAX rate path, delivery cadence by program, and any clear explanation of what drives free cash flow in 2026.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.