Tesla reports Q4 2025 and full-year 2025 results today, January 28, 2026, after the U.S. market close. The company will post its update on its Investor Relations site and then host a live Q&A webcast at 5:30 p.m. Eastern Time.

This Tesla earnings print is more than a check on quarterly profitability. The upcoming referendum will determine whether TSLA can maintain its profit margins.

Additionally, as electric vehicle (EV) demand becomes more cyclical, it raises questions about whether non-automotive aspects, such as energy storage and autonomy, which can significantly influence the company's valuation.

Why This Tesla Earnings Report Can Move TSLA Stock More Than Usual?

Tesla's earnings will have two narratives that can pull the stock in opposite directions.

At the time of writing, TSLA's stock price was approximately $430.90. This is important because the stock is currently below several key moving averages and is approaching its earnings report, which presents heightened event risk.

That combination sets up a market reaction that can hinge on a small number of lines in the shareholder deck and an even smaller number of sentences during the Q&A.

The Hard Data Investors Already Know: Tesla Q4 Deliveries and Energy Deployment

TSLA published its Q4 2025 operating snapshot on January 2, 2026:

Q4 2025 deliveries: 418,227 vehicles.

Q4 2025 production: 434,358 vehicles.

Q4 2025 energy storage deployments: 14.2 GWh (record).

Full-year 2025 deliveries: 1,636,129 vehicles.

Full-year 2025 energy storage deployments: 46.7 GWh.

Since these figures are public, the price movement today is expected to be influenced by the "translation layer," which refers to how deliveries translate into gross margin, operating margin, and cash flow, along with management's commentary on the upcoming quarters.

Wall Street Consensus: The Baseline Tesla Needs to Clear

| Line item (Consensus Average) |

Q4 2025 estimate |

| Automotive revenue |

$17,292M |

| Energy generation & storage revenue |

$3,825M |

| Services & other revenue |

$3,376M |

| Total revenue |

$24,493M |

| Gross margin |

17.0% |

| Operating margin |

4.3% |

| EPS (GAAP) |

$0.30 |

| EPS (non-GAAP) |

$0.44 |

| Operating cash flow |

$3,162M |

| Capex |

-$2,812M |

| Free cash flow |

$350M |

TSLA publishes a company-compiled earnings consensus, which is a useful anchor because it breaks out revenue by segment and includes cash flow estimates.

We also align with the same broad picture, pointing to revenue near the mid-$24B range and EPS near the mid-$0.40s, and highlighting that energy could be the standout segment.

4 Main Results That Could Move TSLA Stock After Earnings

Tesla can beat EPS and still fall if the quality of earnings is poor. It can miss EPS and still rally if margins, cash flow, and the outlook sound better than feared. These are the four buckets that most often decide the move.

1) Automotive Margins: The Fastest "Trust" Signal in the Report

For Tesla, margin is the cleanest signal on pricing power and cost control.

In Q3 2025, Tesla reported:

For Q4, the analyst consensus Tesla published points to:

Gross margin: 17.0%

Operating margin: 4.3%

What Tends to Lift TSLA: Margins that come in above these expectations, or clear commentary that margins are set to improve as 2026 progresses.

What tends to hit TSLA: Margins that fall short, especially if management links it to weaker pricing or higher costs that will carry into the next few quarters.

2) Cash Flow and Capex: The "Reality Check" Behind EPS

Accounting choices can shape earnings, but cash is harder to fake. This is why traders monitor free cash flow, calculated as operating cash flow minus capital expenditures.

In Q3 2025, Tesla reported:

For Q4, Tesla's compiled consensus expects:

That is a big step down from Q3, at least on paper, and it is one reason the market is tense.

3) Energy Is the Quiet Driver That Can Change the Tone

Tesla's energy business has been growing so fast that it is now a real swing factor for sentiment.

Tesla reported record Q4 energy storage deployments of 14.2 GWh and said 2025 deployments were 46.7 GWh.

The analyst consensus Tesla published expects Q4 energy generation and storage revenue of $3.825 billion.

What Traders Should Listen For:

Whether deployments are translating into a stronger gross profit

Any constraints in production or project timing

The 2026 outlook for Megapack demand and margins

A strong energy beat can help TSLA even if the auto side is soft, because it reinforces the idea that Tesla has more than one engine.

4) Deliveries, Pricing, and the "Quality" of Growth

Tesla revealed that it shipped 418,227 vehicles in Q4 and manufactured 434,358 cars.

Thus, Tesla's earnings report is about what those deliveries were worth in terms of revenue and profit.

The main follow-up questions tend to be:

Did average selling prices fall again, or stabilise?

How much did incentives and financing support demand?

Did regulatory credit revenue help or fade?

What does management say about demand in 2026?

In short, the market is braced for a weak quarter amid concerns about deliveries, even as investors focus heavily on longer-term AI and autonomy plans.

Other Results That Can Shift TSLA Stock

1) Autonomy and Robotaxi Updates

For TSLA, earnings calls often move the stock because investors are trading the future story as much as the current P&L.

The recent attention on robotaxi activity in Austin has raised investor questions around Full Self-Driving progress, rollout plans, and safety practices.

What can move TSLA: Any update that reduces uncertainty about timelines, validation, and scaling constraints can drive a sharp re-pricing, especially if the quarter itself is merely "fine."

2) AI and Optimus

Market previews have emphasized that investors want updates on AI-linked initiatives such as robotaxis, Full Self-Driving, and Optimus.

The market tends to reward TSLA stock when management provides:

Concrete deployment milestones.

Clear statements about scaling constraints, such as compute, approvals, and fleet readiness.

Economic framing: How the company expects these initiatives to monetise over time.

The market tends to punish vague optimism, especially when margins are already under pressure.

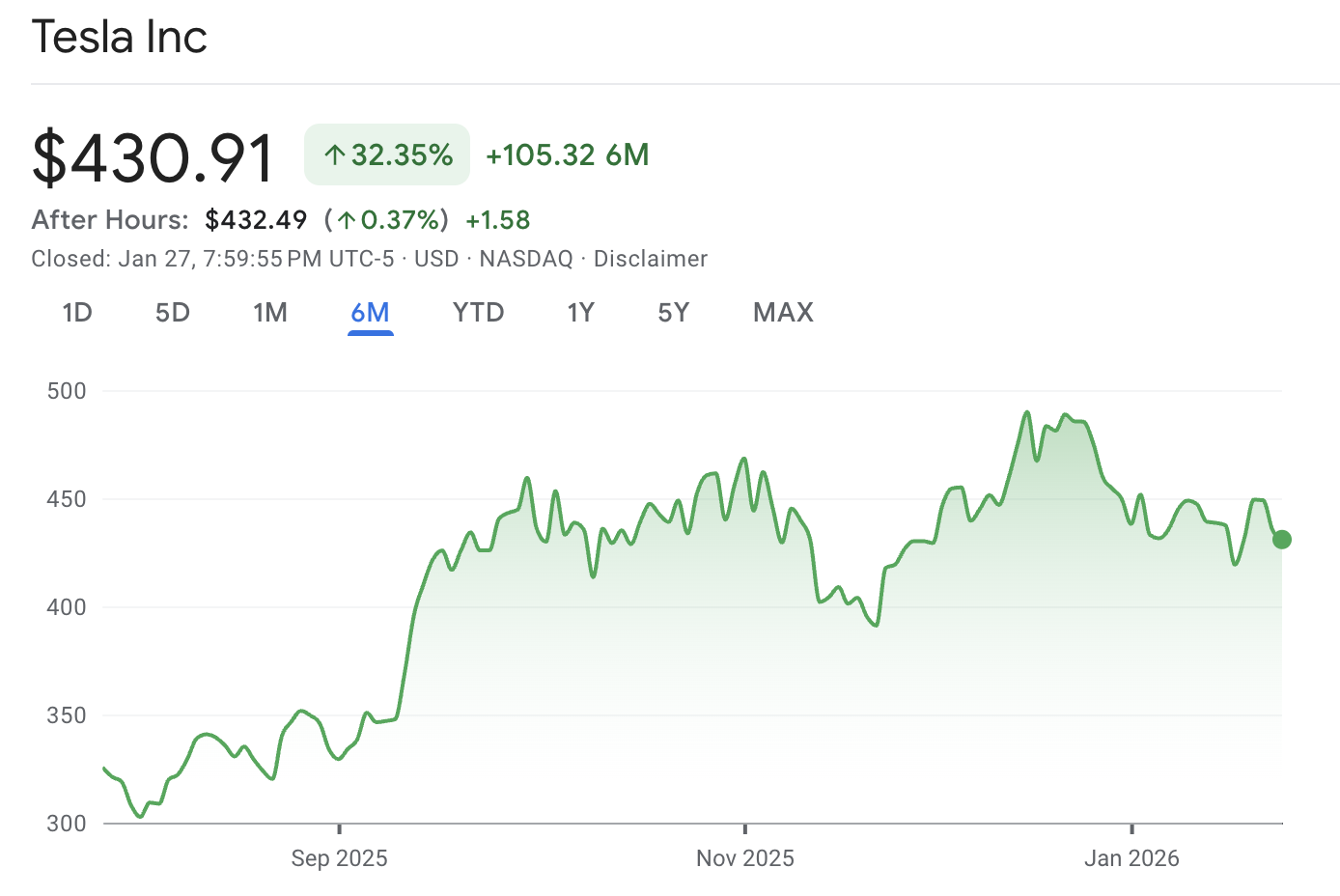

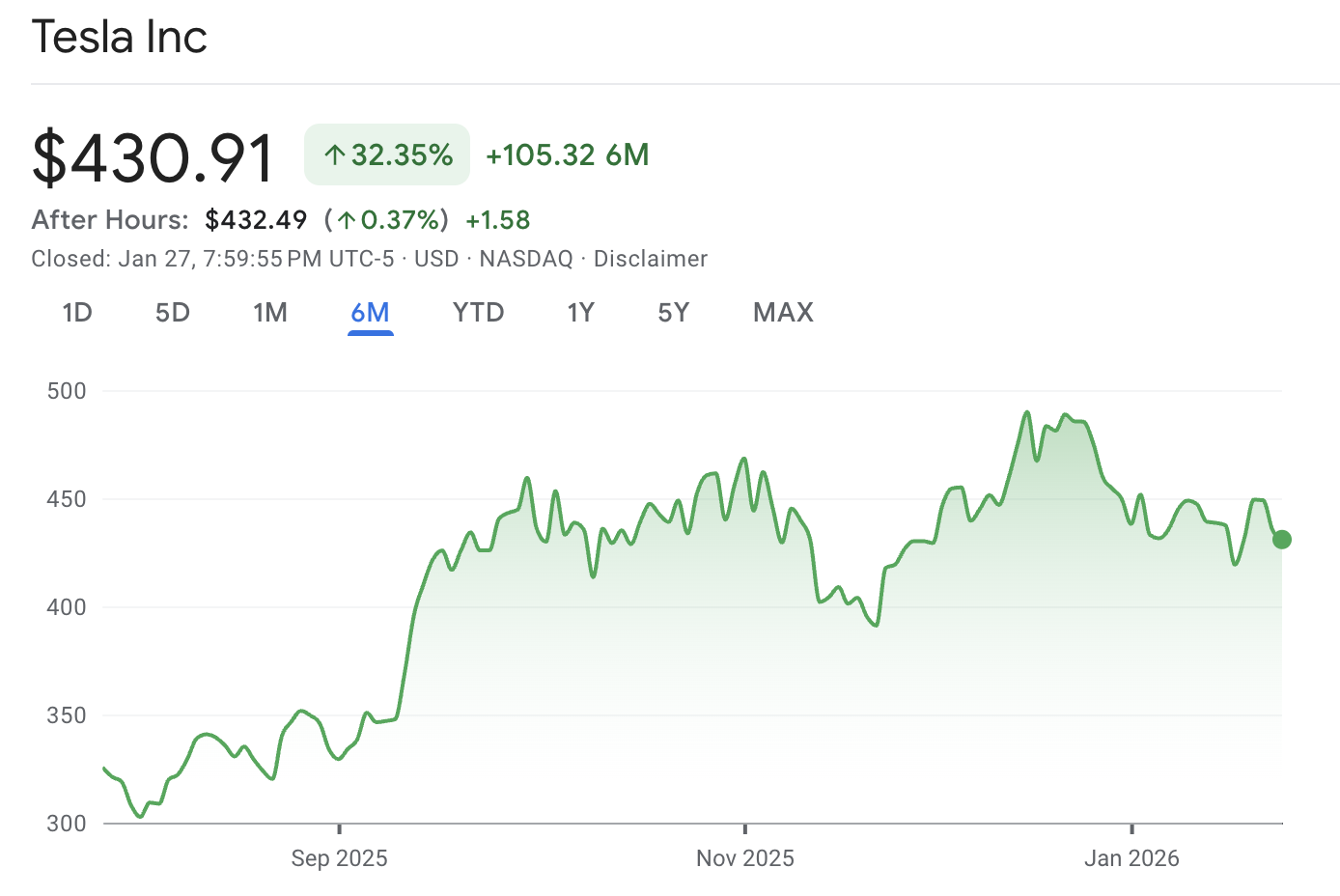

Recent Performance of TSLA Stock: 1 Week, 1 Month, 6 Months

TSLA is not going into earnings from a neutral position. The stock has experienced volatility, with recent returns indicating a mixed short-term pattern within a stronger, long-term trend.

| Period |

Performance |

Period reference (per Barchart) |

| 5-day |

+2.78% |

Since 01/20/26 |

| 1-month |

-9.32% |

Since 12/26/25 |

| 6-month |

+36.33% |

Since 07/25/25 |

Key Takeaway:

A stock that has shown substantial gains over the past six months but has declined in the past month tends to react strongly to the tone of the guidance.

The market often treats the quarter as a "reset point" for whether momentum can re-accelerate or whether the stock stays range-bound.

TSLA Stock Technical Analysis: The Levels Traders Are Watching

| Metric |

Latest |

What it suggests |

| Last price |

$430.90 |

TSLA is trading below several key moving averages into earnings. |

| RSI (14) |

37.398 |

Momentum is weak, which can amplify an upside surprise but

can also deepen a downside gap.

|

| MA20 (simple) |

$439.49 |

First trend "reclaim" level if the stock rallies on the call. |

| MA50 (simple) |

$436.22 |

A nearby reference that often acts as resistance in rebounds. |

| MA200 (simple) |

$454.43 |

A major trend line that can cap rallies if guidance does not change sentiment. |

| Classic pivot |

$432.05 |

A tight decision point for the first post-earnings retest. |

Technical positioning matters in earnings because it shapes where stops and dip-buying interest tend to sit.

Pivot Map (Support and Resistance)

| Pivot set |

S1 |

Pivot |

R1 |

| Classic |

431.28 |

432.05 |

433.36 |

| Fibonacci |

431.26 |

432.05 |

432.84 |

Options-Implied Move: What Volatility Is Priced in for Tsla Stock

The options markets can significantly influence the intensity of the initial reaction.

OptionCharts estimated an expected move of about ±$26.90 (about 6.01%) for options expiring shortly after the event, which implies a wide post-earnings range.

This does not predict direction. It does explain why TSLA stock can swing sharply even if the quarter is close to consensus, especially if the call shifts confidence on energy margins or autonomy timelines.

Frequently Asked Questions

1. What Time Is Tesla's Earnings Today?

Tesla will post its Q4 2025 results after market close on January 28, 2026, and host a live Q&A webcast at 5:30 p.m. Eastern Time.

2. What Are Analysts Expecting for Tesla's Q4 2025 Revenue and EPS?

Tesla's company-compiled consensus shows $24.493 billion in total revenue and $0.44 in non-GAAP EPS (with $0.30 GAAP EPS).

3. Which Metric Is Most Likely to Move TSLA Stock After Earnings?

Margins and cash flow often matter most. The consensus points to 17.0% gross margin and 4.3% operating margin, so that any surprise could drive a rapid repricing.

4. How Big a Move Is the Options Market Pricing for Tesla Earnings?

One options dashboard estimates an expected move of about ±$26.90, or roughly 6.0%, over the short-dated window around the event.

Conclusion

In conclusion, Tesla's Q4 report is likely to be judged on a short list of inputs: automotive margins, free cash flow, energy execution, and the credibility of the 2026 outlook. The market already knows the delivery count, so the surprise risk sits in pricing, costs, and the message management delivered on the call.

If Tesla shows steadier margins than feared and a clearer path to cash generation, TSLA can stabilise even if headline growth looks soft.

If margins slip and cash flow disappoints, the stock can reprice quickly because expectations on future businesses are already doing a lot of work.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.