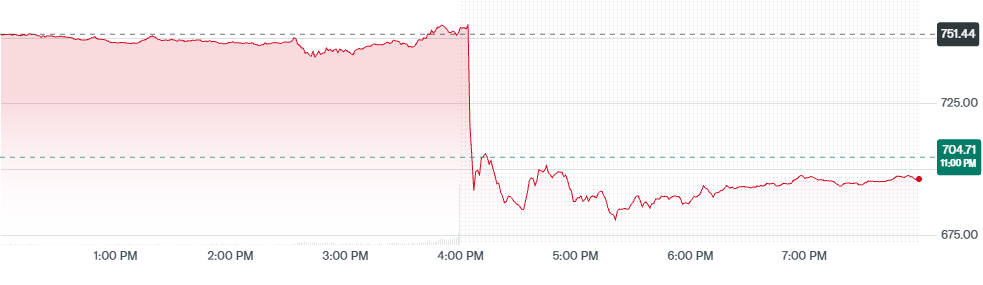

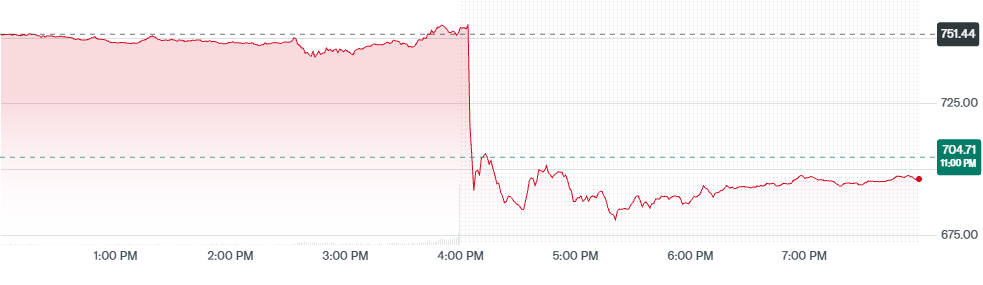

Meta's stock plunged more than 7% after reporting robust Q3 revenue but revealing a $15.9 billion one-time tax expense and sharply higher AI-related capital spending for 2026.

Despite record revenue and user growth, investors were spooked by the sudden hit to profits and the prospect of surging costs.

Meta Q3 2025 Financial Snapshot: Key Metrics and Highlights[1]

| Metric |

Figure |

Notes |

| Stock movement |

-8% in after-hours trading |

Following Q3 results |

| Q3 revenue |

$51.2 billion |

+22% YoY growth |

| Reported EPS |

0.5 |

Down sharply due to one-off tax |

| Adjusted EPS |

516.00% |

Excluding one-time charge |

| One-time tax charge |

$15.9 billion |

Accounting adjustment |

| 2025 capex |

$70–72 billion |

AI infrastructure & data centres |

| Reality Labs loss |

$3.7 billion |

Continued investment in VR/AR |

Meta's Financial Overview: Navigating Revenue Strength and Earnings Distortion

Meta's third quarter demonstrated compelling top-line momentum: revenue reached US $51.24 billion, up ~26 % year-on-year, while Daily Active People across its apps rose to ~3.54 billion, an 8 % increase. Advertising metrics also held sturdy, with impressions up ~14 % and ad price gains of ~10 %.

Yet the headline earnings picture was anything but straightforward. The company recorded a US $15.93 billion one-time tax provision, pushing reported EPS down to US $1.05. an ~83 % decline year over year.

Excluding that charge, adjusted EPS would approximate US $7.25. suggesting the core business remains healthy. The reported effective tax rate hit 87 %, but it falls to ~14 % on an adjusted basis.

Three observations merit attention:

Revenue growth remains robust:

Though it must be compared with historical trends and peer performance to judge whether momentum is slowing.

Margin sustainability is now the centre of gravity:

Cost growth surprised the market, and investors are questioning how far margin contraction might continue.

The tax charge has a forward tax benefit component:

The charge is primarily non-cash and stems from U.S. tax reform. Meta expects future reductions in cash tax obligations, which helps offset some investor concern.

In short, Meta's underlying business is still scaling — but investor focus has rightly shifted toward how capital deployment and accounting oddities will impact long-term returns.

Why the Meta Stock Fell

Market moves reflected three related investor concerns.

1. The one-time tax charge

The $15.93 billion non-cash tax item reduced GAAP profitability and created headline shock. Investors often react to large, unexpected accounting items because they change near-term earnings-per-share comparators and can complicate model forecasts.

2. Bigger capital and operating commitments for AI

Management said capital expenditure expectations have risen and that costs associated with hiring, data-centre build-out and specialised AI talent will remain elevated into 2026. This increases uncertainty about free cash flow and margins in the medium term even if revenue continues to grow.[2]

3. The gap between headline GAAP figures and adjusted metrics

Although adjusted EPS excluding the tax item was strong, the headline GAAP numbers are what frequently drive short-term market sentiment. Some investors reacted to the accounting hit without fully adjusting for its non-cash nature, prompting steep after-hours selling.

How the tax charge affects headline metrics

| Immediate impact |

Longer-term cash impact |

| Large reduction in reported profit this quarter |

Non-cash nature means no equivalent immediate cash outflow; may reduce future federal cash taxes. |

| Headline EPS falls, potentially triggering covenant or index effects for some investors |

Adjusted EPS remains strong; analysts will stress-test cash-flow models. |

| Short-term negative reaction and increased volatility |

Longer-term views hinge on AI returns and execution. |

What the Company Said and How Management Framed It

In prepared remarks and on the earnings call management emphasised that:

The tax charge is a consequence of recent US tax legislation and is non-cash, and the company expects it to reduce future federal tax payments in cash terms.

Meta remains committed to accelerated AI investment, including infrastructure and talent, which management argues will enable superior product offerings and long-term monetisation opportunities.

The business is still generating robust revenue growth and management pointed to continued momentum in certain ad formats and geographical markets.

Investors should note that management's tone was forward-looking and emphasised long-term return on the AI investments despite the near-term drag on accounting earnings.

Wider Implications for Meta Stock, the Sector and Investors

1. For the tech sector

Meta's willingness to accept larger short-term earnings volatility in order to build AI capacity may set a template for other large platform companies.

If multiple hyperscalers follow the same path, the market will have to price in a multi-year capital cycle for AI infrastructure.

Analysts are already discussing the possibility that heavy AI capex across the industry could compress margins in aggregate and increase capital intensity metrics for years.

2. For advertisers and small businesses

At present, advertising demand remains robust enough to deliver record revenue for Meta.

Advertisers will watch whether product changes and AI-enabled targeting improve return on ad spend.

Any deterioration in ad performance or a material slowdown in advertiser budgets would matter more if spending continues to rise on the cost side.

3. For investors: how to think about the risk and reward

If you are a long-term investor who believes Meta can monetise generative AI and new devices, the quarter may represent a temporary dislocation relative to long-term value.

If you are a nearer-term investor focused on earnings per share and cash generation in the coming 12 months, elevated capex guidance and headline accounting hits introduce meaningful uncertainty.

Careful investors will update discounted cash-flow models to reflect higher capex and explicitly model the tax charge’s cash timing and effects.

What to watch next for Meta Stock

Key near-term items that will help resolve market uncertainty include:

The detailed Q&A from the earnings call and any follow-up investor presentations that break down the tax item and show the cash tax schedule.

Confirmation of the 2026 expenditure cadence: how much of next year's spending is committed versus discretionary, and how quickly the company can scale returns from AI investments.

Product monetisation signals: updates on new ad formats, Threads monetisation, WhatsApp ads and any revenues attributable to AI-enabled features.

Analyst revisions to consensus estimates, price targets and margin forecasts in the days following the report.[3]

Conclusion

Meta's latest quarterly report combined a record revenue performance with headline pain. The near-term market reaction reflected understandable concern about a very large one-time accounting tax charge together with an escalation in planned AI-related capital and operating spending.

For long-term investors the core question is whether the company can convert this elevated investment into durable revenue streams and improved monetisation.

For more short-term or income-focused investors the period ahead will require close attention to free cash flow, capital allocation discipline and the timing of cash tax benefits.

The company's strategic intent is clear; the market is now pricing the risk that the path to that strategic prize will be more capital intensive and more volatile than previously expected.

Frequently Asked Questions

Q1. Why did Meta Stock fall after Q3 results?

Meta shares dropped due to a US$15.9 billion tax charge and management's warning of higher 2026 AI infrastructure spending, which raised investor concerns over profit margins and cash flow.

Q2. Is the tax hit a real loss or an accounting adjustment?

The tax charge is largely a non-cash accounting adjustment to deferred tax assets, meaning it affects reported earnings but has minimal immediate impact on Meta's actual cash flow or liquidity.

Q3. How does Meta plan to spend on AI?

Meta will invest in data-centre expansion, AI model training, and integration of AI tools across Facebook, Instagram, WhatsApp, and Quest, aiming to enhance recommendation systems and advertising efficiency.

Q4. Could Meta Stock recover soon?

Analysts foresee short-term volatility but maintain long-term optimism, expecting that Meta's AI and ad-technology investments could drive earnings growth and valuation recovery once capital expenditures stabilise.

Q5. How does Meta's valuation compare to other tech giants?

Meta trades at a lower forward P/E ratio than Microsoft and Nvidia, implying potential value if AI investments improve margins and long-term revenue growth materialises as expected.

Q6. What are the main risks for Meta Stock now?

Key risks include rising AI costs, potential ad-revenue slowdown, regulatory scrutiny, and challenges in monetising AI tools quickly enough to justify heavy infrastructure and talent spending.

Sources:

[1]https://s21.q4cdn.com/399680738/files/doc_financials/2025/q3/Earnings-Presentation-Q3-2025-Final.pdf

[2]https://www.reuters.com/business/metas-profit-hit-by-16-billion-one-time-tax-charge-2025-10-29/

[3]https://finance.yahoo.com/news/meta-shares-sink-16-bn-211108800.html

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.