The cockroach theory means that when one piece of bad news appears, there are usually more to follow, leading to a loss of confidence. This can rapidly influence price movements, often preceding the full revelation of underlying issues.

In the market, a single negative disclosure can significantly expand the range of perceived outcomes, shifting sentiment from a contained issue to concerns about substantial financial distress. Historical cases demonstrate that restatements, audits, funding pressures, executive resignations, and, in severe instances, bankruptcy often follow initial warnings.

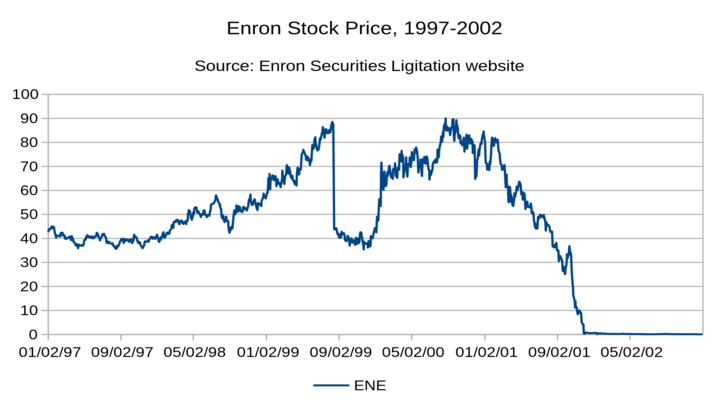

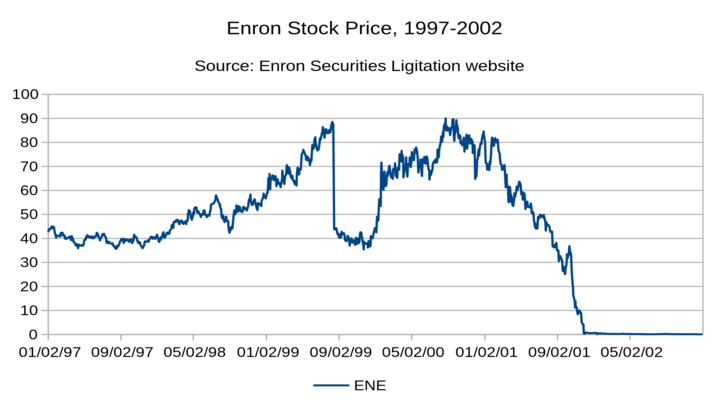

A well-known example is Enron. As accounting concerns intensified, investor trust eroded quickly. The stock fell from a peak of $90.75 in August 2000 to $0.26 by November 30, 2001, and the company filed for bankruptcy on December 2, 2001.

Key Takeaways

An initial negative disclosure can result in a “trust discount”, in which valuations decline as investors price the risk of further adverse developments.

Cockroach theory applies both at the individual company level, addressing firm-specific issues, and at the industry level, where similar vulnerabilities may exist among peers.

The advantage in trading lies in a disciplined process rather than in prediction. Traders should establish criteria for confirming additional problems, manage risk conservatively, and refrain from increasing positions during periods of headline-driven volatility.

Not every “first cockroach” leads to disaster. Some problems are isolated, and prices can rebound sharply if later facts prove the issue is contained.

What the Cockroach Theory Means in Investing

Cockroach theory posits that a single negative revelation may indicate the presence of further undisclosed issues. Such initial disclosures can include delayed reports, restatements, lawsuits, regulatory investigations, unexpected guidance withdrawals, or any event that prompts investors to question management's transparency.

Cockroach theory is not a predictive formula and does not constitute evidence of fraud. Instead, it describes a behavioural pattern in markets. When credibility is compromised, investors perceive a greater likelihood of further negative developments, leading to price declines that reflect both current and anticipated risks.

How The Cockroach Theory Works

The initial negative headline often has a greater impact than the underlying financial figures, as it alters the market's perspective. Four rapid shifts typically occur:

1) Trust breaks, and valuation resets

Companies with transparent financial reporting are valued based on investor trust. When this trust deteriorates, investors require a lower price to justify the same expected cash flows. Consequently, stock prices may decline before analysts revise their financial models.

2) Unknown liabilities move to the front of the line

Upon the emergence of a single problem, investors begin to scrutinize for additional risks, such as weak internal controls, aggressive accounting practices, hidden leverage, off-balance-sheet exposures, or unverifiable cash positions.

3) Funding can tighten at the worst time

Market confidence functions as a form of liquidity. When lenders and counterparties become concerned, credit availability contracts, covenants become restrictive, and refinancing costs increase. For highly leveraged firms, the primary concern may shift from profitability to solvency.

4) Forced selling can amplify the move

Institutional mandates, risk management models, and index inclusion criteria may compel investors to reduce exposure when volatility increases or governance risks escalate. This selling pressure can transform an isolated negative event into a prolonged downward trend, even before fundamentals are fully quantified.

What Counts As a “First Cockroach” In The Real World

Not all negative news indicates systemic issues. The most significant 'first cockroach' events typically involve breaches of trust, verification challenges, or cash concerns. Common triggers include:

Delayed financial statements or repeated reporting delays

Auditor resignation, auditor dispute, or inability to verify cash balances

Restatement of prior results

Guidance withdrawal or sudden, unexplained margin collapse

Regulatory probe, major lawsuit with unclear exposure, or subpoena

Funding stress: covenant warnings, missed payments, forced asset sales

Senior finance leadership exits under pressure, especially the Chief Financial Officer (CFO) or controller

These events share a common characteristic: they increase the likelihood that the initial disclosure does not reflect the full extent of the underlying issues.

Real Trading Examples: When One Cockroach Led To More

This pattern recurs across market cycles, sometimes resulting in recovery and other times in insolvency. While not every case follows the same trajectory, the initial sequence of events frequently exhibits similar characteristics.

| Case |

Early “cockroach” |

What followed |

Market impact snapshot |

| Enron (2001) |

Accounting concerns and restatements escalated in late 2001 |

Credit pressure, confidence collapse, bankruptcy (Dec 2, 2001) |

Stock fell from a peak of $90.75 (Aug 2000) to $0.26 by Nov 30, 2001

|

| New Century Financial (2007) |

Announced it would restate 2006 results (Feb 2007) |

Late filings, lending stopped, delisting, bankruptcy (early Apr 2007) |

Stock fell 36% to around $19 after the restatement news, and later traded below $1

|

| Wirecard (2020) |

Auditors could not confirm €1.9 billion in cash (June 2020) |

CEO resignation, results withdrawn, insolvency proceedings |

Shares fell more than 60% on 18 June 2020 after the missing-cash disclosure |

| Luckin Coffee (2020) |

Internal probe found fabricated sales (April 2020) |

Leadership fallout, trading suspension, delisting process |

Shares fell about 75% in a day on the fraud disclosure |

1) Enron: accounting questions became a solvency crisis

Enron’s collapse remains one of the clearest examples of trust turning into a liquidation event. The stock peaked at $90.75 in August 2000. As accounting concerns deepened in 2001, confidence deteriorated, and the stock closed at $0.26 on November 30, 2001. The company filed for bankruptcy on December 2, 2001.

A key trading insight is that when accounting credibility is compromised, valuation shifts from earnings to concerns about survival. In such circumstances, perceived undervaluation may persist or worsen, as investors lack confidence in reported figures.

2) New Century Financial: one lender's problem revealed a sector problem

New Century was a subprime mortgage lender that ran into funding stress as the credit cycle turned. After it announced in February 2007 that it would restate 2006 financial statements, its stock fell 36% to around $19. The situation worsened quickly, with delayed filings, frozen operations, and a bankruptcy filing in early April 2007, after the stock had fallen below $1.

The situation worsened quickly, with delayed filings, frozen operations, and bankruptcy on April 2, 2007, after the stock had fallen below $1.

A key trading insight is that cockroach theory extends beyond individual companies. When multiple firms share a business model, a single failure can trigger widespread risk aversion and selling across the sector.

3) Wirecard: “cash that cannot be verified” is often the loudest alarm

Wirecard’s decisive break came when auditors said they could not confirm €1.9 billion in cash balances. That kind of disclosure can shift the market from “messy” to “uninvestable” in a single session. On June 18, 2020, shares fell more than 60% after the missing-cash disclosure.

A key trading insight is that persistent delays and verification issues often outweigh management reassurances. When concerns involve cash, markets tend to prioritize potential negative outcomes.

4) Luckin Coffee: the first admission wiped out years of optimism

Luckin disclosed that an internal investigation found fabricated transactions tied to about CNY 2.2 billion (about $310 million) in reported sales, and the stock fell about 75% in a day.

A key trading insight is that following a significant collapse, risk becomes asymmetric. Short sellers may face sharp rebounds, while buyers seeking to capitalise on price declines face risks such as trading halts, legal challenges, and potential delisting.

How To Trade With The Cockroach Theory

This approach emphasises disciplined trading in the face of uncertainty, rather than attempting to predict future headlines. It is an educational framework, not investment advice. The key principle is that initial negative news often prompts the market to reprice trust, rather than solely adjusting earnings expectations.

-

Label the first bad news.

Determine whether the event represents a routine business setback, such as changes in sales, costs, or guidance, or a breach of trust, such as restatements, delayed filings, auditor concerns, or regulatory actions. Cockroach theory is most applicable when credibility is compromised.

-

Write down the next “truth dates”

List the next events that can confirm or deny more problems: earnings, filing deadlines, auditor statements, debt covenant dates, lender updates, court milestones, or regulator announcements. Trades are cleaner when a deadline forces clarity.

-

Start with lower risk.

Adopt smaller position sizes than usual and establish exit strategies before entering trades. Stocks influenced by headlines can experience significant price gaps, and stop orders may not execute at the levels anticipated, especially in fast markets.

-

Trade confirmation, not hope

Refrain from attempting to purchase assets at perceived lows during the initial negative shock. Bearish traders often monitor for weak rebounds that do not sustain, while bullish traders should wait for indications that selling pressure is diminishing and disclosures are stabilizing.

-

Do not average down

When information is incomplete, increased exposure to a losing position can turn a manageable loss into a substantial one.

-

Only go long after credibility improves.

Seek clear indicators of improvement, such as timely financial reporting, completion of independent reviews, stable funding, and reduced frequency of unexpected disclosures. As verification strengthens, concerns about additional problems typically diminish.

Practical tips traders use

Respect gaps: a stock that gaps down on governance news is not trading like a normal earnings miss.

Avoid overnight concentration: most “second cockroaches” hit outside market hours.

Separate company risk from market noise: a broad market rally can hide weak stocks for a day, but it rarely fixes credibility damage.

Take partial profits on panic moves: when fear spikes, prices can overshoot in both directions.

Cockroach Theory and AI Stocks: Why The Theme Can Unravel Fast

AI (artificial intelligence)-related stocks are frequently valued based on future expectations rather than current earnings. Consequently, a single negative development, such as a reporting delay, unexpected margin pressure, or reduced customer spending by a prominent AI company, can rapidly affect the entire sector.

Investors may question whether such issues are isolated or indicative of broader challenges. This dynamic exemplifies cockroach theory: a loss of confidence in the AI sector's growth prospects can turn a routine price correction into a widespread selloff.

Why AI Stocks Are More Exposed To “Trust Shocks”

Leading AI companies typically face three key vulnerabilities that amplify the impact of initial negative headlines. First, their valuations often reflect expectations of robust multi-year growth, so any uncertainty regarding demand or pricing can prompt rapid downward adjustments in valuation multiples.

Second, AI supply chains are often characterized by concentrated vendors and extended lead times, making them susceptible to disruptions. A single delay or quality issue can significantly impact the company's guidance.

Third, AI companies frequently derive substantial revenue from a limited number of large customers, such as hyperscalers and major enterprises. Consequently, a pause in purchasing by one major customer can have repercussions across the sector.

What a “first cockroach” looks like in AI names

Common triggers that may affect the broader AI sector include:

Late filings, internal control issues, auditor disputes, or restatements, which hit credibility first and numbers later.

Guidance cuts tied to data center orders, server shipments, or cloud demand, especially if management cannot explain whether the issue is timing or true demand.

Gross margin pressure from price cuts, mix changes, or higher component costs.

Export controls and licensing uncertainty for advanced chips and related hardware, which can hit demand visibility overnight.

Concerns regarding capital expenditures among major buyers can also serve as a trigger. If increased spending by large technology firms is driven primarily by rising component prices rather than accelerating unit demand, investors may begin to search for additional vulnerabilities within the supply chain.

A real AI-stock example: Supermicro’s filing delay

A clear example of the “what else is wrong” phenomenon occurred with Super Micro Computer, an AI server manufacturer. The company disclosed a late Form 10-K filing, received an exception period from Nasdaq, and later filed the overdue report and related 10-Qs.

The episode also highlighted internal control deficiencies, which can keep the market focused on verification risk even after filings catch up.

Even after issues are resolved, the initial delay often prompts investors to reassess governance risk and consider the possibility of additional negative disclosures.

How traders can apply this to AI stocks

In the context of AI stocks, trading advantage typically arises from distinguishing company-specific issues from broader sector implications. When the initial negative event pertains to credibility, such as late filings, internal control weaknesses, or cash concerns, many traders remain cautious until verification improves.

If the initial negative event is demand-related, such as changes in capital expenditure guidance, order timing, or margins, traders monitor whether peer companies report similar issues.

When multiple companies report similar challenges, the market often interprets this as a broader trend rather than an isolated incident, leading to simultaneous repricing across AI stocks.

When The Cockroach Theory Fails

Some first cockroaches are isolated problems:

A one-off product recall with insured costs

A contained lawsuit with capped exposure

A temporary margin squeeze with clear drivers

A single bad quarter in an otherwise transparent business

The key differentiator is verification. If management provides transparent financial data, third-party validation, and evidence of stable funding, the presumption of additional problems diminishes.

Frequently Asked Questions (FAQ)

1) Is cockroach theory the same as “where there’s smoke, there’s fire”?

While the concepts are related, cockroach theory is more specifically applied to financial markets. It emphasises how a single negative disclosure alters investors' assumptions about undisclosed risks, particularly in areas such as accounting, cash management, and governance.

2) Does cockroach theory apply to whole sectors, not just one stock?

Yes. When a company reveals stress associated with a shared business model, investors frequently sell peer firms preemptively. The early failures among subprime lenders in 2007 demonstrated how quickly funding stress in one firm can ripple through an entire sector.

3) What is the biggest warning sign traders watch for?

The most significant warning signs are issues that undermine verification, such as delayed reports, auditors unable to confirm cash balances, or frequent revisions to prior financial statements. These problems increase uncertainty, often resulting in price declines before all details are disclosed.

4) Can the market overreact to the first cockroach?

Yes. Cockroach theory does not guarantee the emergence of additional negative news. Markets may occasionally overreact by pricing in worst-case scenarios that ultimately prove unfounded. For this reason, traders emphasize 'truth dates' that provide clarity, rather than relying solely on prevailing narratives.

5) How do traders avoid getting trapped in a headline stock?

Traders mitigate risk by reducing position sizes, avoiding averaging down, and establishing exit strategies before entering trades. Stocks influenced by headlines can experience significant price gaps overnight, and trading halts may prevent timely responses. The primary objective is to limit losses while information remains uncertain.

Conclusion

Cockroach theory remains relevant among traders because it effectively characterizes market behavior following a loss of trust. A single negative disclosure may trigger a series of adverse events, not because of inevitable failure, but because heightened uncertainty prompts investors to demand a greater margin of safety.

The practical advantage lies in maintaining discipline: categorise the issue, identify forthcoming events that may provide clarity, reduce trade size when credibility is uncertain, and await verification before interpreting low prices as genuine value.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.