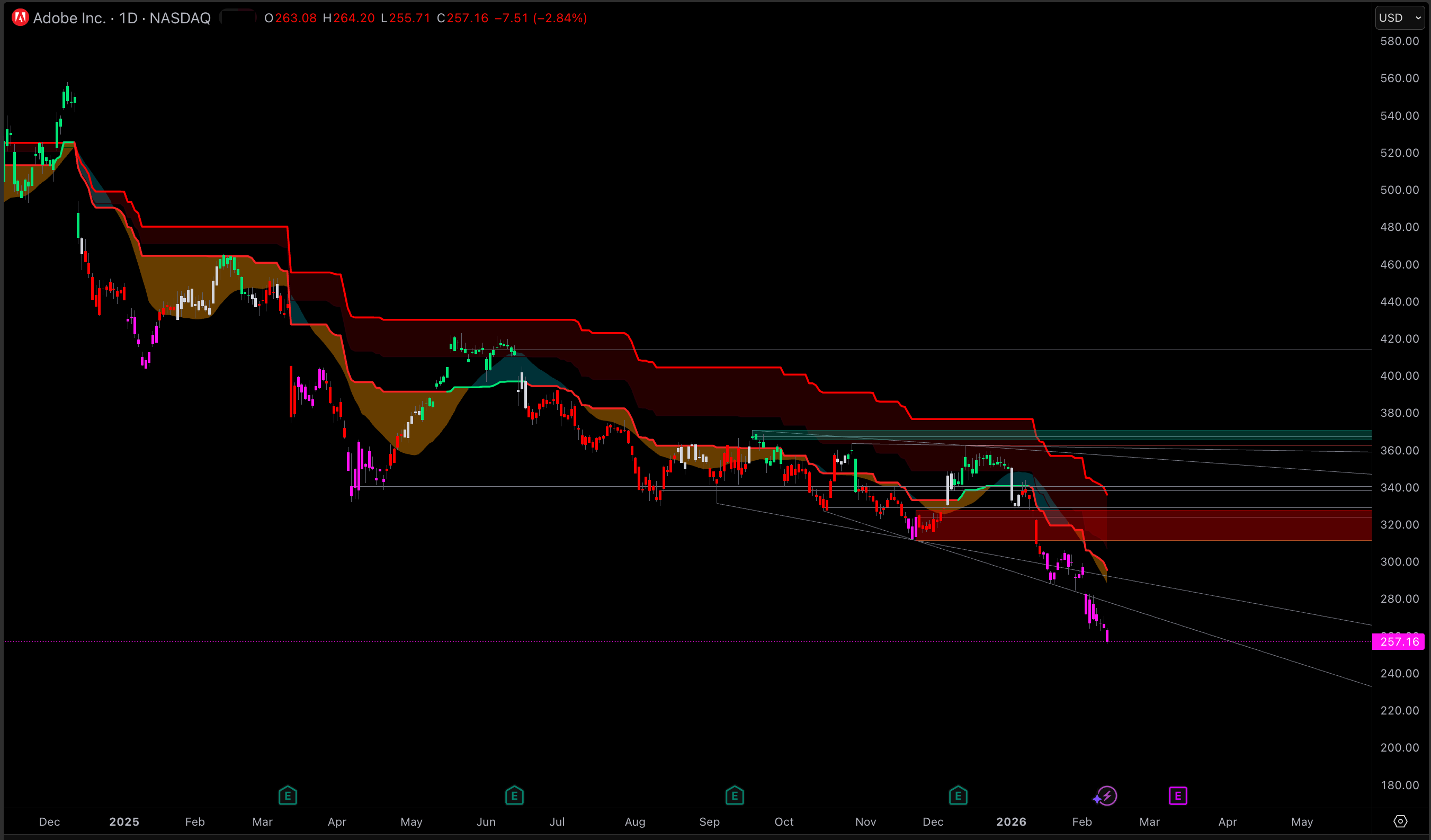

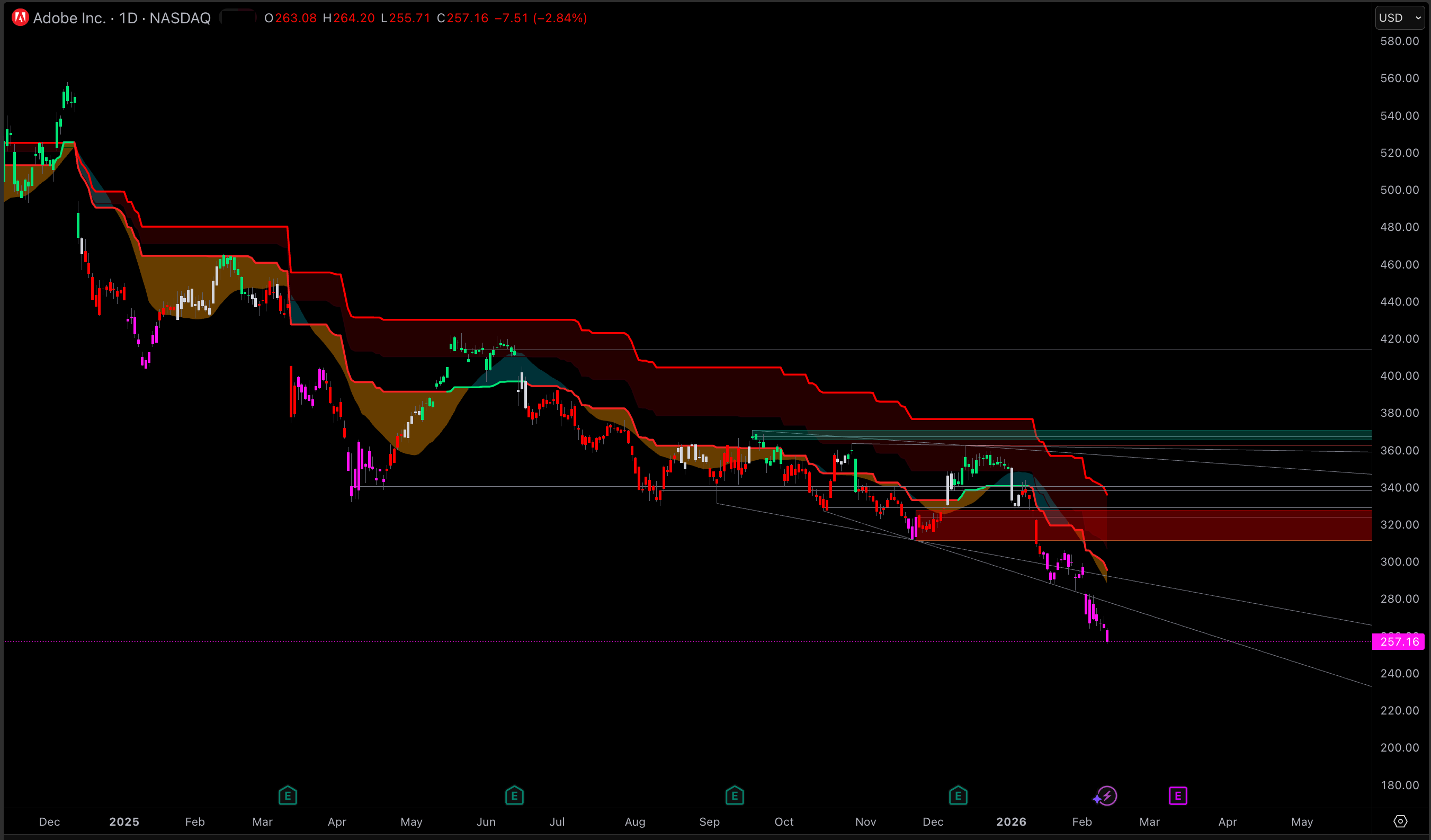

Adobe’s stock has dropped to roughly $257, almost 45% below its 52-week high of $465.70, even as the company posts record revenue and cash flow.

The current valuation disconnect does not stem from Adobe’s past earnings, but rather from investor concerns regarding the impact of generative AI on the economics of creative software over the next three years. Key considerations include pricing power, customer churn, and the potential migration of value from feature-rich suites to more affordable, model-driven creation workflows.

Why Adobe Stock Is Down: Key Takeaways for ADBE Investors

The market is reassessing Adobe’s valuation based on AI-driven unit economics rather than historical performance. Generative tools devalue basic content creation, encouraging users to seek lower-cost alternatives and increasing the risk of long-tail customer churn.

The monetization of AI introduces timing challenges. Adobe is integrating AI into its subscriptions through generative credits and pay-per-use models, which may obscure short-term revenue visibility even as usage increases.

Computational expenses have become significant. AI inferencing and hosting costs are now a direct component of subscription costs of revenue, meaning that scaling AI features may compress gross margins if pricing and packaging do not keep pace with usage growth.

Changes in financial reporting may increase uncertainty. Beginning in FY2026, Adobe will shift its guidance to focus on customer-group subscription revenue and total ending annual recurring revenue (ARR) growth, while consolidating into a single operating segment, thereby reducing segment-level transparency.

Adobe’s fundamentals remain robust. In FY2025, revenue increased to $23.77 billion, operating cash flow reached $10.03 billion, and total annual recurring revenue (ARR) ended at $25.20 billion, representing an 11.5% increase.

ADBE's stock valuation multiple has contracted significantly. Based on the FY2026 non-GAAP earnings per share (EPS) target of $23.30 to $23.50 and the current share price, the market is valuing Adobe more like a slower-growth software company than a premium franchise.

The AI Narrative Pressuring Adobe Stock

1) Value Is Shifting From Tools To Models And Workflows

Historically, Adobe’s competitive advantage has been its professional-grade tools integrated into established workflows. Generative AI alters this dynamic by enabling rapid creation of concepts, layouts, or variants, thereby reducing the cost of initial drafts. As a result, differentiated value increasingly resides in downstream processes such as brand control, rights management, collaboration, production pipelines, and auditability.

This distinction is significant because a substantial segment of Adobe’s user base pays for comprehensive functionality but utilizes only a limited set of features. AI reduces the effort needed to achieve satisfactory results, thereby increasing price sensitivity among less-engaged users.

Adobe acknowledges that AI, including generative and agentic systems, is transforming user content creation and editing processes. Concurrently, competition is intensifying as rivals adopt AI technologies at varying speeds and in different ways.

2) “Good Enough” Design Raises Churn Risk In The Low-End Funnel

Adobe’s creative franchise is strongest where professional output quality, compatibility, and reliability are non-negotiable. The market’s worry is the layer below that: students, freelancers, small businesses, and casual creators who may accept simpler tools if they produce acceptable output quickly.

Adobe describes broad competition across web- and mobile-first design platforms, easy-to-use creation apps, and AI-first creativity tools, including embedded tools within larger apps and social platforms.

That competitive set is expanding faster than traditional software cycles. The market is treating that as a structural headwind, even if Adobe’s near-term retention remains solid.

3) AI Packaging Changes The Revenue Story Before It Changes The Revenue

AI monetization is not only “how much,” but also “how.” Adobe’s model increasingly blends subscription tiers with included generative credits and pay-per-use approaches.

This creates a transition phase that equity markets typically punish:

If AI is bundled into existing tiers, adoption rises, but monetization looks muted.

If AI is unbundled too aggressively, price increases can trigger churn or downgrade behavior.

If usage-based pricing expands, revenue may become less linear than classic subscription ARR narratives.

Adobe is also changing guidance emphasis toward total ending ARR growth and customer-group subscription revenue, which can be strategically sensible but still increases investor uncertainty during the transition.

Fundamentals: What Adobe Is Delivering

Despite the stock weakness, Adobe’s FY2025 operating engine did not break.

FY2025 revenue reached $23.77 billion, up 11%.

Total Adobe ARR exited FY2025 at $25.20 billion, up 11.5%.

Operating cash flow was $10.03 billion.

Adobe repurchased $11.281 billion of stock in FY2025.

Shares outstanding were 410.5 million as of Jan. 9, 2026.

Adobe fundamentals: FY2025 results vs FY2026 targets

| Metric |

FY2025 actual |

FY2026 target / guide |

| Total revenue |

$23.77B |

$25.90B to $26.10B |

| Total Adobe ARR (ending) |

$25.20B |

Ending ARR growth 10.2% |

| Operating cash flow |

$10.03B |

Not guided |

| FY EPS (non-GAAP) |

$20.94 |

$23.30 to $23.50 |

| Stock repurchases |

$11.281B |

Depends on execution |

The “Commercially Safe AI” Moat Is Real, But It Is Not Free

Adobe positions Firefly as “commercially safe,” trained on data it has the rights to use, and designed to provide provenance for generated content. That matters most in enterprise and regulated environments, where IP risk and attribution are not academic issues.

But this advantage comes with costs. AI inferencing and hosting sit inside subscription cost of revenue, and scaling generative usage can pressure margins if compute efficiency and packaging do not keep pace.

What the Stock Price Is Saying: Multiple Compression, Not Earnings Collapse

At about $257 per share, Adobe’s equity value is roughly $106 billion using the latest share count. Against FY2026 non-GAAP EPS guidance, this implies an approximate forward earnings multiple near the low teens, a stark reset for a franchise that historically traded at a premium.

This is the core point behind “Why is Adobe stock dropping?” The market is not pricing an immediate profit problem. It is pricing a durability problem:

Will Creative Cloud remain the default workspace, or will AI-native tools pull enough volume to cap pricing?

Will Adobe capture incremental AI value through tiering and usage, or will it be forced to include more AI for free to defend retention?

Will enterprise marketing software growth re-accelerate, or stay constrained by budget scrutiny and longer sales cycles?

Adobe’s own disclosures underscore that subscription revenue recognition is inherently lagged, so demand changes show up later, which can fuel investor caution during a tech transition.

Catalysts and Risks That Can Reverse or Deepen the ADBE Selloff

Potential Upside Catalysts

Clear evidence that AI features are driving net expansion, not just usage, through higher tiers and paid add-ons.

Improved visibility on ending ARR growth and customer-group subscription momentum under the new framework.

Margin resilience as AI inferencing becomes more efficient and pricing catches up with consumption.

Key Risks

Faster-than-expected erosion in the low-end creator base as AI-first tools reduce switching costs.

AI compute costs are scaling faster than monetization, compressing gross margin.

Reduced transparency from reporting changes and segment consolidation, increasing the discount rate investors apply.

Frequently Asked Questions (FAQ)

Why is Adobe (ADBE) stock falling right now?

ADBE is being repriced around AI-driven disruption risk. Investors are weighing whether generative tools weaken pricing power and increase churn, even as Adobe’s revenue, ARR, and cash flow remain strong. The stock is also far below its 52-week high, reflecting a broad multiple reset.

Is generative AI a threat to Adobe Creative Cloud?

It is a threat to the low end of creation, where “good enough” output is acceptable. For professionals and enterprises, Adobe’s workflow integration and commercially safe approach are meaningful advantages. The risk is that AI shifts value toward simpler, cheaper creation paths, thereby capping subscription expansion.

How is Adobe monetizing AI through Firefly?

Adobe ties AI into subscriptions through plan-specific generative credits, with free plans offering limited credits, and also supports pay-per-use models. The market is watching whether this becomes a durable revenue uplift or a defensive feature bundle that mainly protects retention.

Are Adobe’s fundamentals actually weakening?

Not in the reported FY2025 numbers. Revenue reached $23.77 billion, total ARR ended at $25.20 billion, and operating cash flow was $10.03 billion. The debate is about the next phase of growth and margins as AI changes customer behavior and cost structure.

What should investors watch in the next few quarters?

Track total ending ARR growth, customer-group subscription revenue, and whether AI features drive higher-tier adoption. Pay attention to subscription cost trends tied to hosting and AI, as well as to capital return discipline, since Adobe repurchased $11.281 billion in FY2025.

Conclusion

Adobe’s recent stock fall is best interpreted as a reflection of broader market economic debates rather than short-term performance. AI is reducing the perceived value of entry-level content creation, broadening the competitive landscape, and initiating a monetization transition in which usage may increase before revenue growth becomes apparent.

Simultaneously, Adobe continues to achieve double-digit subscription growth, increasing annual recurring revenue (ARR), and strong cash generation, while actively returning capital through share repurchases. The future trajectory of ADBE will depend on whether investors gain confidence that Adobe can translate AI adoption into sustainable net expansion without compromising margins or losing entry-level users to more agile, cost-effective AI-native platforms.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.