Tokenized T-bills are digital tokens that represent a claim on short-term U.S. Treasury bills, usually held through a regulated-style fund or a dedicated vehicle that owns the underlying bills.

As trading collateral, tokenized T-bills can be pledged to support margin for futures, options, or other leveraged positions, much like cash or high-quality securities. The practical appeal is that the collateral can remain “cash-like” while still earning a short-term government rate, potentially reducing the cost of keeping margin posted.

The key is that eligibility, haircuts, and liquidity depend on the specific product structure and the rules of the trading venue.

What Are Tokenized T-Bills

A tokenized T-bill is a digital token that represents an investor’s claim to the value and interest of short-term U.S. Treasury bills, usually through a regulated fund, trust, or special-purpose vehicle that holds those T-bills.

The token is held and transferred on a blockchain, and its price generally reflects the value of the underlying Treasury holdings plus accrued yield, net of fees and cash management. This structure makes it a cash-like instrument suitable for investing, settlement, or use as trading collateral, subject to the product’s legal structure and transfer restrictions.

Types of Tokens

1) Fund-share tokens: a money market fund in digital form

These tokens represent shares in a vehicle that holds T-bills, repurchase agreements, and cash equivalents. The token’s value tracks the fund’s net asset value. Yield is reflected through price appreciation, distributions, or both. This structure is often preferred by risk management teams because the underlying assets are familiar: short-term government exposure within a regulated framework.

2) Debt-note tokens: a claim on a vehicle holding T-bills

Here the token represents a claim on an issuer or a special vehicle that owns the bills. The investor is exposed to the legal strength of the structure, including whether assets are ring-fenced and how claims will be enforced if something goes wrong.

3) Cash-like tokens that include T-bills: read the details

Certain products are designed to function similarly to cash while providing short-term exposure to government securities. Key considerations include the legal nature of ownership, redemption procedures, and applicable transfer restrictions.

It is important to note that while U.S. government credit is robust, the legal and operational structure of the tokenized product remains critical. Two tokens backed by Treasuries may perform very differently under stress conditions.

Why Trading Desks Care: Collateral That Earns While It Works

Margin is a cost center. Even in liquid markets, a desk often holds collateral in low-yielding locations, or it incurs the hidden cost of moving cash between venues.

Tokenized T-bills offer a practical alternative: post high-grade collateral and keep earning a short-term rate. That can improve the net return of trades where profits are measured in basis points, not headlines.

The benefit is most visible in three places:

1) Lower opportunity cost of margin

If collateral continues to generate a Treasury-linked return while posted, the effective financing cost for the trading desk decreases. This benefit is amplified for strategies that maintain positions over extended periods.

2) Smaller idle buffers across venues

Many active firms maintain surplus cash in multiple accounts as a precaution. If a single collateral instrument is recognized across venues, firms may reduce redundant buffers, assuming robust operational controls are in place.

3) More flexibility in collateral management

Traditional Treasury collateral is excellent, but moving it through legacy settlement systems can be slow and time-bound. Tokenization can shorten some steps, although redemption windows and transfer rules still apply.

How To Use T-bills As Trading Collateral

There are two common ways to use tokenized T-bills as margin. The difference is simple: where the collateral sits.

1) Post it directly on the exchange (on-exchange collateral)

You deposit the tokenized T-bill asset into your exchange account or an exchange wallet.

The exchange counts it toward your margin, usually with a haircut (it may value $1 of collateral at less than $1 for safety).

Your available margin is updated in accordance with the exchange’s rules, including concentration limits and the frequency of price updates.

If your position moves against you, the exchange can sell (liquidate) the collateral in accordance with its liquidation process.

Why people use it: simple setup and fast margin recognition.

Main trade-off: your collateral is held inside the exchange perimeter.

2) Keep it in custody and still trade (off-exchange collateral)

You hold the tokenized T-bill asset in a custody setup, not inside the exchange.

The trading venue gives you margin credit based on that collateral value, often described as a “mirrored” value inside the trading account.

If margin is needed, collateral is topped up, moved, or partially liquidated in accordance with agreed rules between the venue and the custody layer.

The primary benefit is a reduction in the amount of collateral held on the exchange while still enabling active trading.

The main trade-off is increased operational complexity, as effective functioning depends on reliable custody operations, controls, and settlement procedures.

Two recent steps show this model moving into the mainstream:

Binance and tokenized Treasury collateral: Binance announced an integration allowing VIP and institutional users to hold a tokenized Treasury fund off-exchange with custody partners while using it as collateral for trading.

Franklin Templeton and Binance: The firms announced a program where eligible institutions can use Benji-issued tokenized money market fund shares as off-exchange collateral, with the collateral value mirrored within the trading environment while assets remain in regulated custody.

Adoption Signals: When Collateral Eligibility Becomes Real

Tokenized Treasuries transitioned from being solely yield products to recognized margin instruments when major trading venues began accepting them as collateral.

On June 18, 2025, Securitize announced that BlackRock’s tokenized Treasury fund would be accepted as collateral on Crypto.com and Deribit. That matters because it created a clear use case beyond holding for yield: using Treasury exposure to support trading activity.

On Nov 14, 2025, Binance disclosed its own move to accept the same type of instrument as off-exchange collateral for institutional clients. The industry direction is consistent: when short-term yield is meaningful, collateral that earns becomes more attractive than collateral that simply sits.

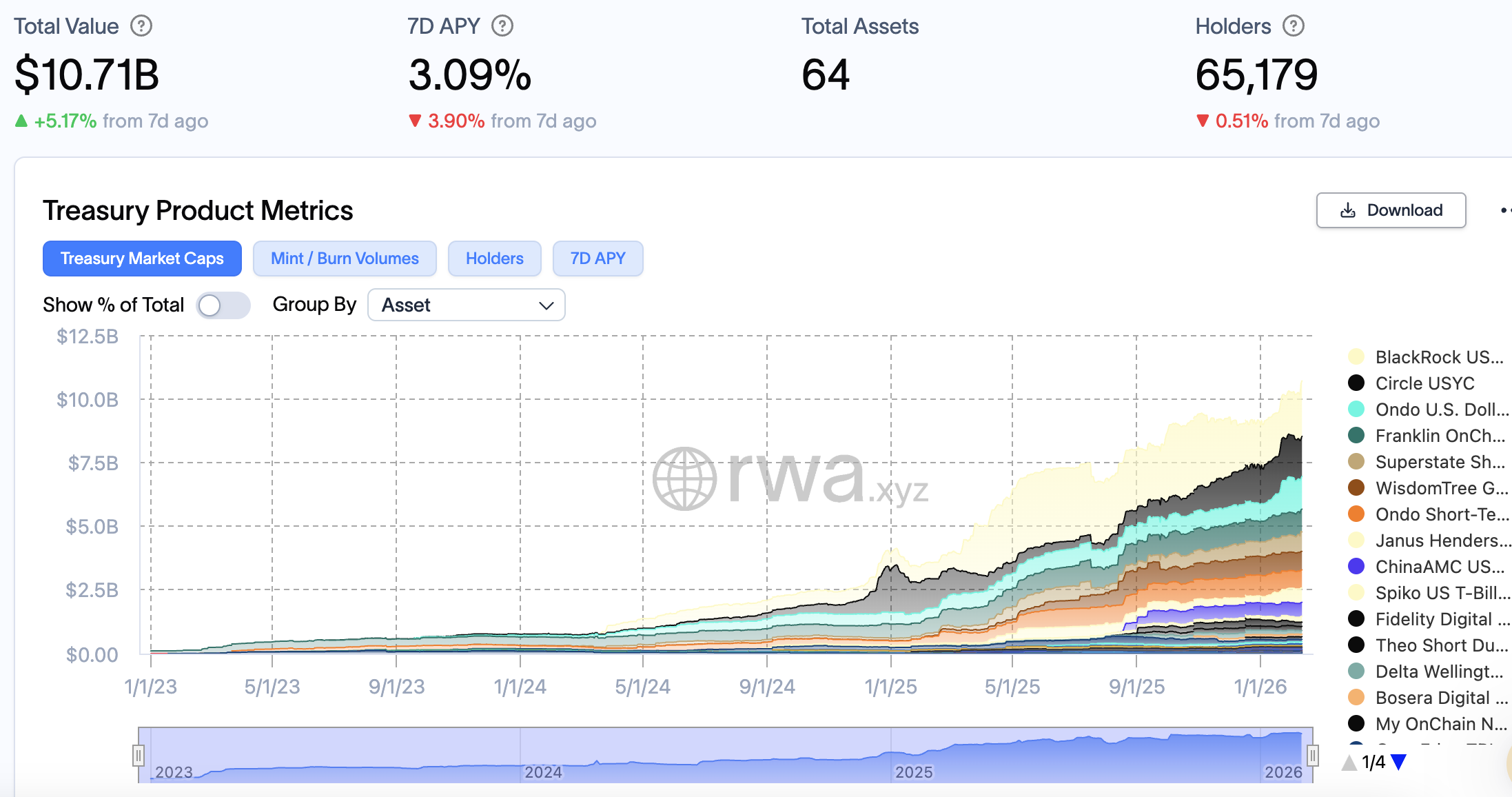

Market Snapshot: Yield Anchor versus Tokenized Yield

| Metric |

Latest reading |

Why it matters for collateral decisions |

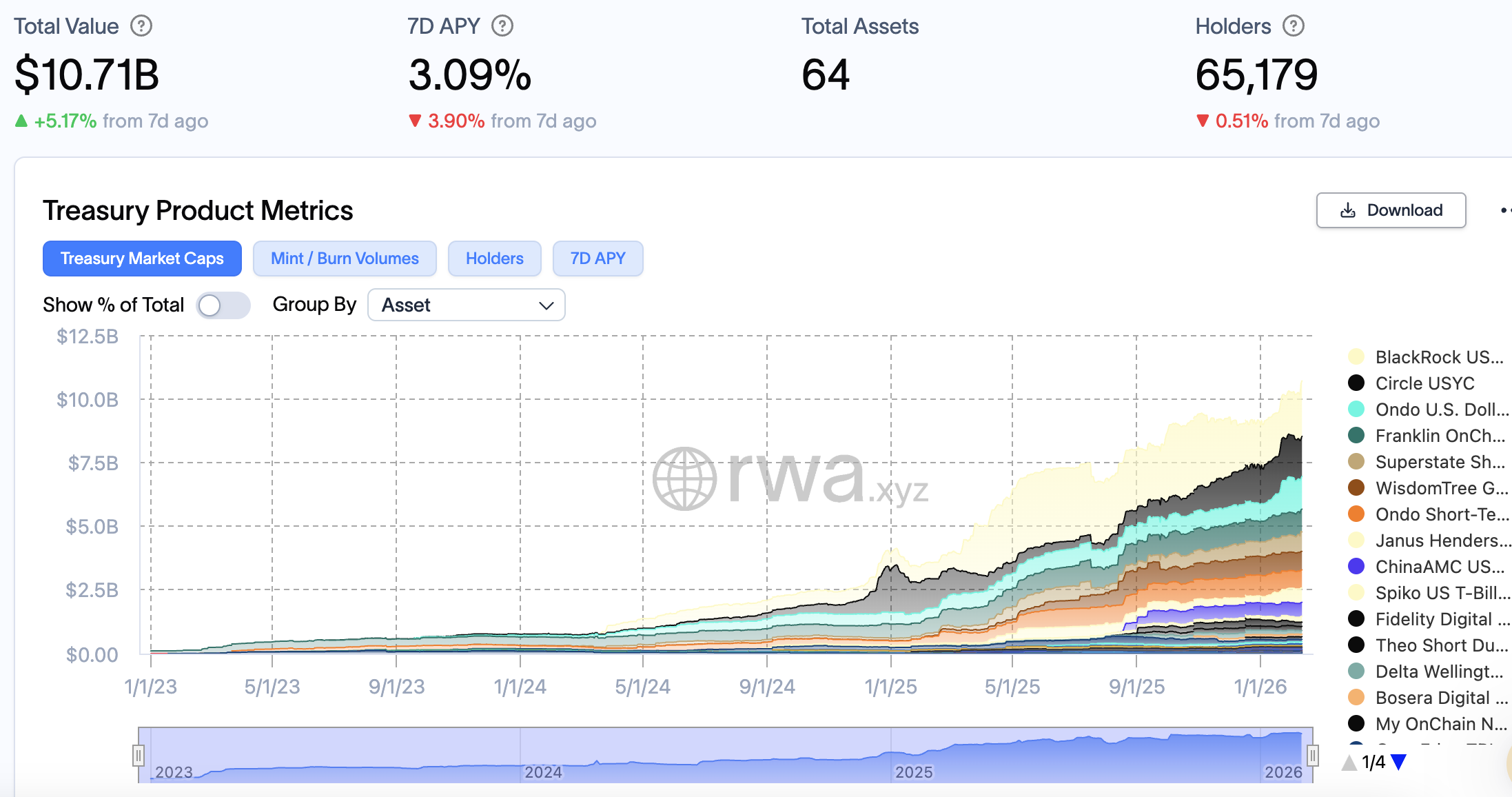

| Tokenized U.S. Treasuries total value |

$10.00B |

Indicates category scale for institutional use |

| Tokenized U.S. Treasuries holders |

59,004 |

Suggests broad adoption and growing market depth |

| Tokenized U.S. Treasuries 7D APY |

3.15% |

Short-term yield indicator for the category, net of product mechanics |

| 3-month U.S. Treasury yield (2026-02-10) |

3.69% |

Benchmark for cash-like return in traditional markets |

A gap between the benchmark yield and a tokenized category reading is not automatically good or bad. It often reflects fees, cash buffers, operational costs, and how the product distributes income.

What Can Go Wrong and How Desks Manage It

Tokenized T-bills reduce volatility compared to crypto-native collateral but introduce additional risks. It is essential to identify these risks clearly and outline professional risk mitigation strategies.

1) Liquidity and redemption: when “cash-like” is not the same-day cash

Some products redeem on set schedules or have cut-off times. In calm markets, that is fine. In stress, secondary liquidity can thin, and the bid can disappear. Risk teams often respond with haircuts, product-by-product limits, and pre-agreed liquidation steps.

2) Legal rights: who owns what, and who can seize collateral

Collateral only works if a pledge is enforceable. Readers should understand that “backed by Treasuries” is not the same as “you have direct title to a Treasury bill.” The instrument might be a fund share or a claim on an issuer. That affects what happens in a dispute.

3) Operational risk: custody, transfers, and system failures

Even high-quality assets can become unusable as collateral if settlement systems fail, transfers are delayed, or controls malfunction. Off-exchange models reduce exchange custody risk but require robust operational coordination between custody providers and trading venues.

4) Concentration risk: one “safe” asset used everywhere

If multiple venues rely on the same collateral instrument, a product-specific issue can generate widespread margin stress. Institutions typically set issuer limits and mandate multiple eligible collateral options.

Due Diligence Checklist Before Using Tokenized T-bills as Collateral

| Area |

What to check |

Why it matters |

| Legal structure |

Is the token a fund share, a note, or another claim? |

Determines enforceability and recovery in disputes |

| Transfer rules |

Are transfers restricted to approved wallets? |

Affects mobility during margin calls |

| Pricing and valuation |

How often is it priced, and by what method? |

Impacts intraday margining and risk calculations |

| Redemption terms |

Cut-offs, settlement timing, and any gates |

Defines worst-case liquidity under stress |

| Haircuts and limits |

Venue haircuts, concentration caps, wrong-way rules |

Protects against forced selling and liquidity shocks |

| Custody setup |

Segregation, control rights, rehypothecation terms |

Defines who controls collateral and what can be done with it |

| Operational resilience |

Contingency plans for outages and delays |

Prevents collateral from becoming trapped when it is needed most |

Frequently Asked Questions (FAQ)

1) Are tokenized T-bills the same as holding U.S. Treasury bills directly?

Not exactly. The underlying exposure may be to T-bills, but the token usually represents a fund share or a claim through a structure. That can affect transfer rules, redemption timing, and what happens in the event of a legal dispute.

2) Why would a trader use tokenized T-bills instead of stablecoins as collateral?

Stablecoins can move quickly, but they may not offer Treasury-linked returns. Tokenized T-bills are designed to provide short-term government yield while serving as margin, which can improve the economics of strategies that hold positions for longer than a day.

3) What does “off-exchange collateral” mean in everyday terms?

It means the collateral stays in custody rather than being deposited with the exchange, while the exchange still grants the trader margin credit against it. Programs describe the collateral value being mirrored inside the trading environment while the assets remain held off-exchange.

4) Does tokenized Treasury collateral remove counterparty risk?

No. It can reduce exposure to a single point of failure by changing where assets sit, but it introduces additional dependencies, such as custody operations, transfer controls, and the enforceability of the pledge under law.

Conclusion

Tokenized T-bills are increasingly adopted because they address a significant constraint in trading: the need for high-quality collateral that can be deployed efficiently. With tokenized U.S. Treasuries reaching $10.00 billion in total value as of January 2026, the market is now sufficiently large to support institutional workflows rather than limited pilot programs.

The benchmark yield remains significant, with the 3-month Treasury yield at 3.69% in early 2026, maintaining the practical advantage of earning returns while collateral is posted.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.