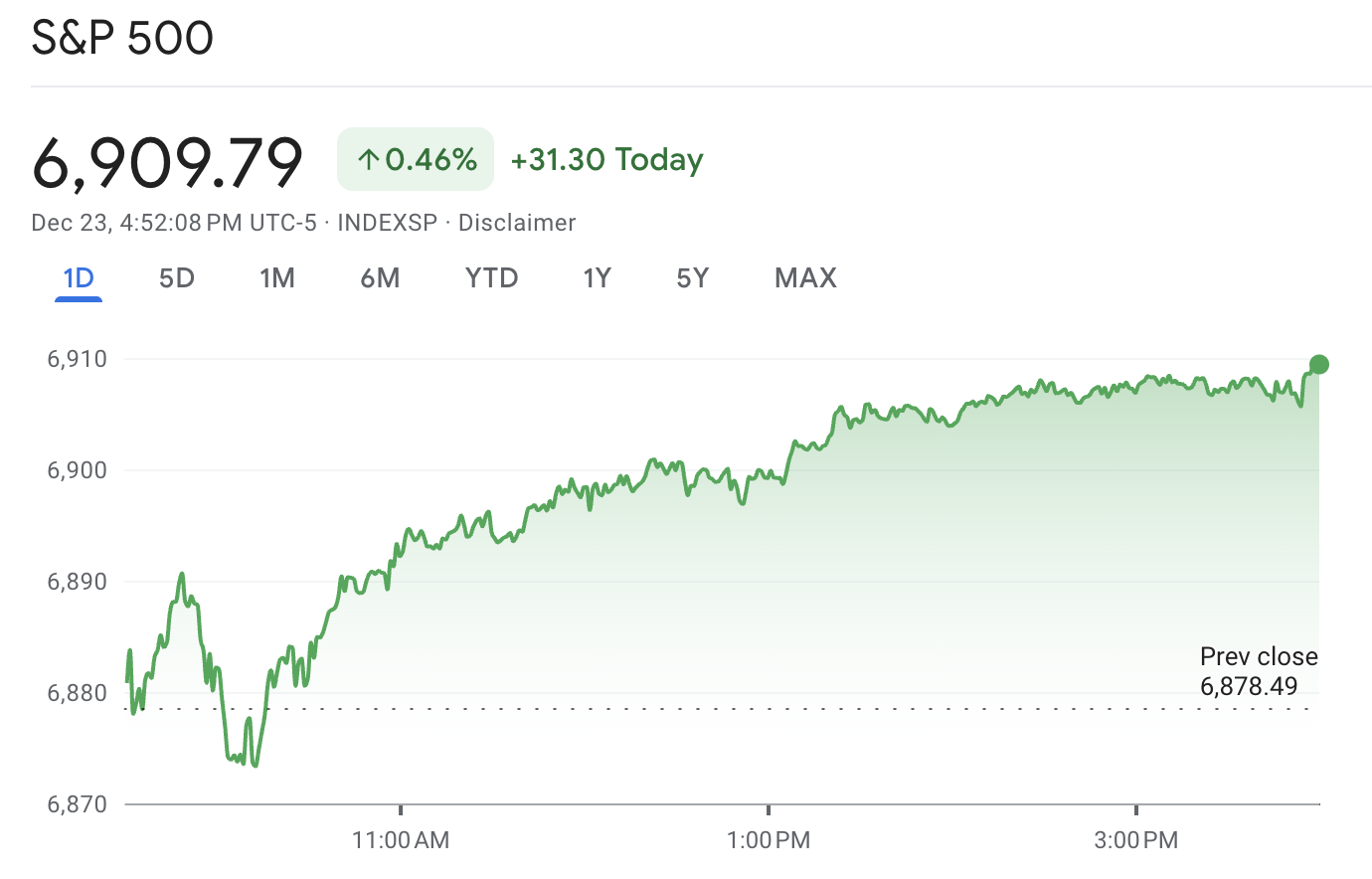

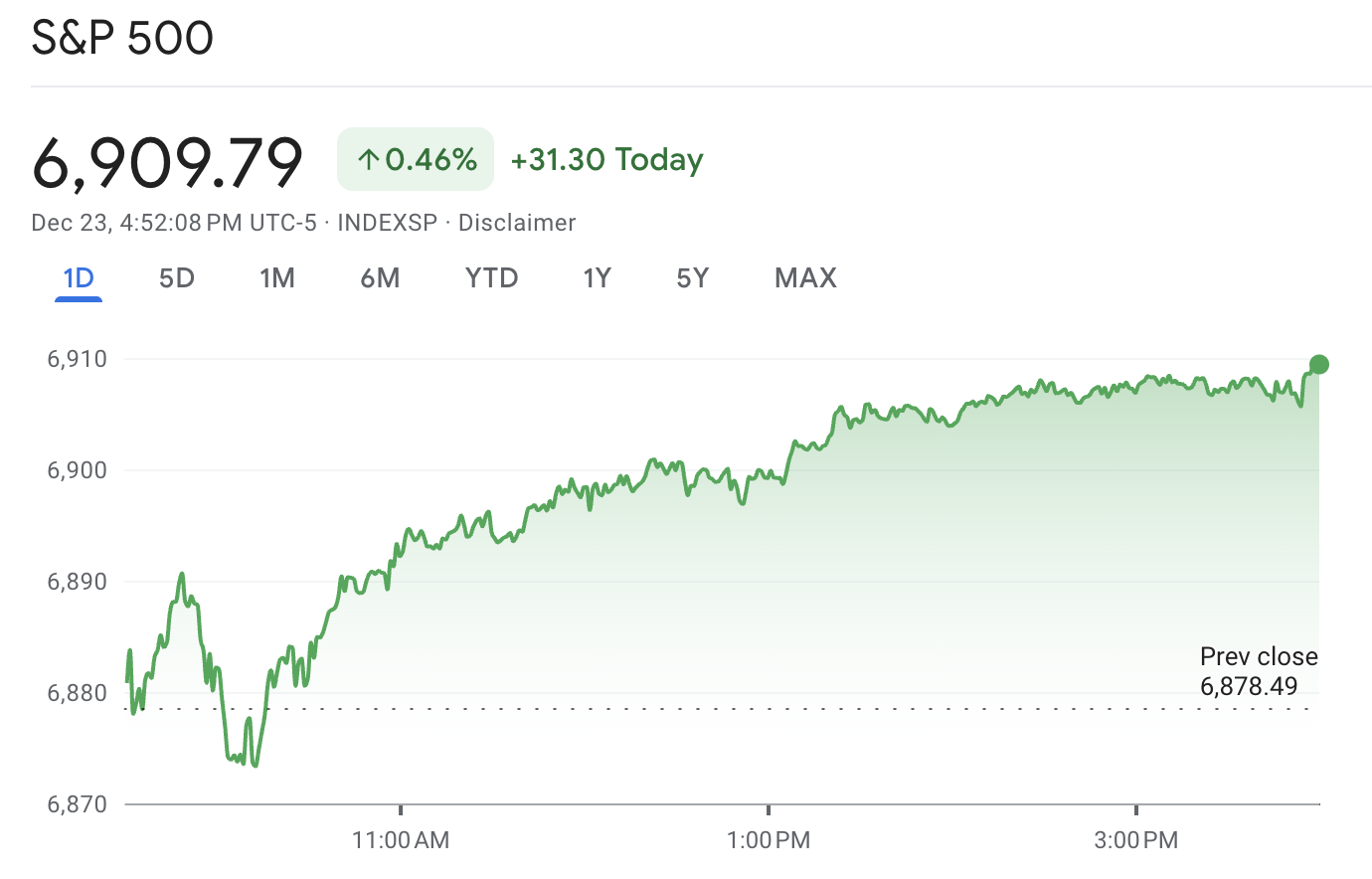

The S&P 500 finished the latest U.S. session (Tuesday, December 23, 2025) at a fresh record close of $6,909.79, up about 0.5% on the day.

It also traded near record territory intraday, with the day's range reported around $6,868.81 to $6,910.88, which kept the index pinned close to the top of its recent band.

The headline looks like a simple "stocks up" day, but the tape had two important tells:

The rally was top-heavy. Big growth names did most of the lifting while many stocks inside the index fell.

Small caps did not confirm the move. The Russell 2000 dropped roughly 0.7%, which is significant since general risk-on days typically boost smaller stocks as well.

S&P 500 Record High and Close Market Snapshot

| S&P 500 |

Latest session reading |

| Close |

$6,909.79 |

| Day move |

+31.30 points (+0.46%) |

| Open |

$6,872.41 |

| High |

$6,910.88 |

| Low |

$6,868.81 |

| Prior close |

$6,878.49 |

| Market tone |

Growth led, value lagged |

| Liquidity |

US exchanges volume ~14.01bn vs ~16.67bn 20-day average |

That mix tells you something important about where the market's mind is right now: traders are paying up for earnings momentum and crowding into index-heavy leaders, even as the rate-cut dream gets pushed further out.

What Just Drove the S&P 500 to a Record High Close

1) GDP Surprised Higher, and the Market Read It as Earnings Fuel

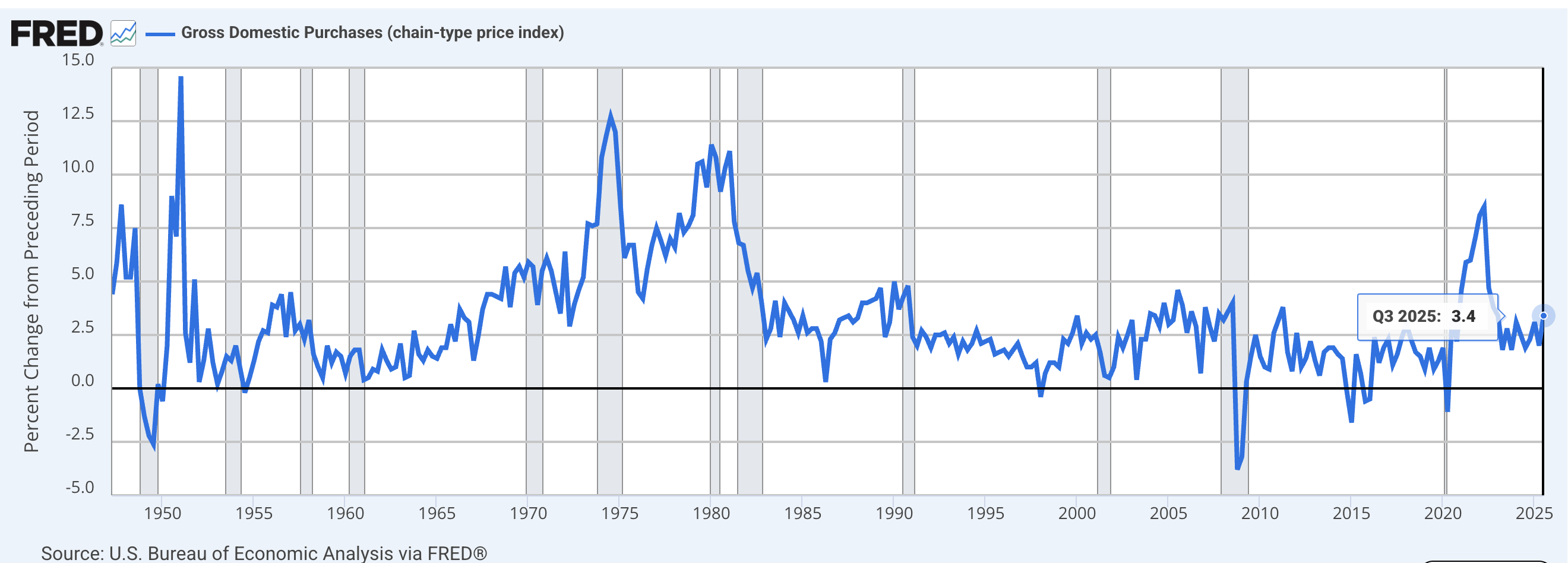

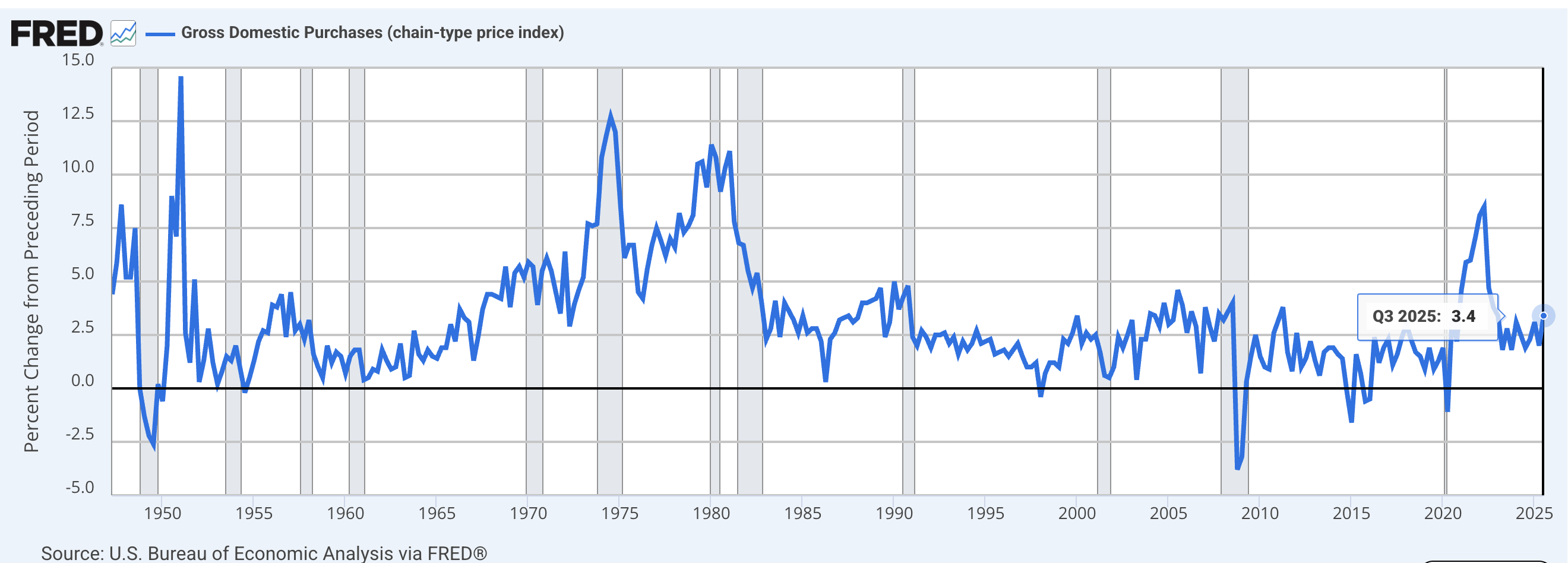

The biggest macro driver was the delayed Q3 2025 GDP initial estimate, which printed 4.3% annualised, up from 3.8% in Q2. The BEA stated that growth was supported by consumer spending, exports, and government expenditure, while investment dropped and imports decreased.

Here's the part equity traders liked: real final sales to private domestic purchasers (a cleaner measure of demand) rose 3.0%, slightly above the previous quarter's 2.9%.

That is not a "one-off trade fluke" signal. It points to steady private demand, which supports the idea that 2026 earnings can still expand. The GDP report indicated that profits from current production increased by $166.1 billion during the quarter.

That does not translate one-for-one into index earnings, but it reinforces the same direction of travel: profit growth is still alive.

Unique Angle That Matters:

A strong GDP print can push yields up and still lift stocks if the market believes growth is durable enough to carry earnings. That is precisely what happened here.

2) "Big Weight" Growth Names Did the Heavy Lifting Again

The session was led by growth, with the growth side of the index outperforming the value.

A cluster of large technology and AI-linked stocks rose strongly, and that matters because the index is top-heavy. When those names move together, the S&P 500 can print a record even if the average stock is not having a great day.

3) Volatility Stayed Calm, Which Keeps Dip-Buyers Confident

The volatility index stayed near the mid-teens, with recent closes around 14 and near the lowest levels seen in about a year.

Low volatility is not a bullish guarantee, but it does two practical things:

It reduces forced de-risking from volatility-targeting strategies.

It reduces the cost of hedging, potentially leading investors to maintain their exposure.

4) Seasonality and Positioning Helped

The market is entering the traditional late-December period that traders link to a "Santa rally," and the holiday schedule is also reducing liquidity, which can amplify momentum.

U.S. markets also have an early close (1 p.m. ET) today, and are closed on Christmas.

Thin liquidity often turns into a simple game: if there is no bad news, momentum can drift higher because fewer sellers are willing to stand in the way.

The Macro Reality Check: Growth Hot, Inflation Hotter

This is where the "twist" sits.

Inside the same GDP release, inflation measures rose:

Gross domestic product price index: 3.4% (from 2.0% in Q2)

PCE price index: 2.8% (from 2.1%)

Core PCE (ex-food and energy): 2.9% (from 2.6%)

That is not the kind of inflation profile that screams "fast rate cuts." In fact, after the data, pricing in the rates market shifted towards a lower chance of a near-term cut, and shorter-dated yields moved higher.

Trader Takeaway:

The market is currently saying, "We can live with higher-for-longer rates as long as earnings growth holds up."

That is positive while it endures, but it also raises the chance of a sudden pullback if yields continue to rise.

Market Internals: Why This Record Close Was Not Broad

This is the part many traders miss when they only look at the index level.

Decliners slightly outnumbered advancers on one major exchange, and the imbalance was larger on the tech-heavy exchange.

The S&P 500 logged 35 new 52-week highs and 5 new lows.

One widely followed breadth gauge indicated 61% of S&P 500 stocks were trading above their 50-day average.

Small caps underperformed on the day, even as the large-cap index made records.

Another report noted that most stocks in the index fell even though the index itself rose.

How to Interpret as Traders and Investors

This was a "leader-driven" record, not a "everybody wins" record.

Leader-driven rallies can persist longer than anticipated, yet they tend to be more vulnerable, as the entire movement relies on a cohesive group maintaining its strength.

S&P 500 Technical Analysis: Trend, Momentum, and Structure

1) The Trend Is Firmly Up

The index is above every major moving average, and the spacing between them still looks healthy.

| Trend gauge |

Level |

Distance from close |

| 20-day average |

$6,834.23 |

+1.11% |

| 50-day average |

$6,779.23 |

+1.93% |

| 100-day average |

$6,658.69 |

+3.77% |

| 200-day average |

$6,253.94 |

+10.49% |

When the price is above rising averages, trend-followers tend to keep buying dips until the market proves them wrong.

2) Momentum Is Strong, but It Is Getting Stretched

Common momentum indicators sit in "hot" territory:

RSI (14): ~72.9 (bullish, but near overbought)

StochRSI (14): 100 (overbought)

ADX (14): ~42.9 (strong trend)

MACD (12,26): ~24.1 (bullish)

How to Read as a Trader:

Strong trend + overbought momentum usually points to one of two paths:

3) Volatility-Based "Normal Move" for Planning Trades

A 14-day average true range estimate sits near 69–70 points, which is about a 1% daily move.

That gives a practical planning range:

It is not a forecast. It is a sizing tool. If you are risking 15 points in a market that often swings 70 points, you are likely to get chopped.

Key Support and Resistance Levels

These are calculated from the latest session's high, low, and close.

| Level |

Price |

| Pivot (P) |

$6,896.49 |

| Resistance 1 (R1) |

$6,924.18 |

| Resistance 2 (R2) |

$6,938.56 |

| Resistance 3 (R3) |

$6,966.25 |

| Support 1 (S1) |

$6,882.11 |

| Support 2 (S2) |

$6,854.42 |

| Support 3 (S3) |

$6,840.04 |

The Levels Most Traders Must Watch Monitor

If you only remember three levels, make it these:

$6,910–$6,911: the fresh high area. A clean break and hold above it keeps momentum traders engaged.

$6,878: the prior close area. A drop below it raises the odds of a deeper pullback.

$6,834–$6,835: the 20-day zone. If the trend is healthy, buyers often defend it.

What to Watch Next

If the Rally Is Healthy

The index holds above $6,905 (pivot) and continues to defend the $6,869–$6,902 band (20-day to 5-day zone).

Volatility remains close to the low teens, and breadth enhances as additional sectors join in.

If the Rally Is Getting Tired

Price fails to hold above the pivot and loses the 20-day average area around $6,869.

Yields rise rapidly, prompting a reassessment of valuations, particularly for growth-oriented leadership.

Small caps continue to underperform, indicating that the appetite for risk is contracting rather than growing.

Frequently Asked Questions (FAQ)

1. Why Did the S&P 500 Hit a Record High Today?

The index rose because traders focused on strong growth and profit signals.

2. What Economic Data Drove the S&P 500's Record Close?

The key catalyst was the Q3 2025 US GDP report, which showed faster growth and rising corporate profits, giving investors more confidence in earnings momentum.

3. Does a Record Close Mean the S&P 500 Will Keep Rising?

Not always. A record close confirms momentum, but the next move depends on whether buying stays broad and whether bond yields and inflation expectations stay contained.

4. Is the Rally Broad or Driven by a Few Large Stocks?

Recent action has been more leader-driven than broad-based, which means the index can rise even when many stocks are flat or down.

Conclusion

In conclusion, the S&P 500 reached a new high as the market opted to emphasise growth and earnings momentum rather than the narrative of "rate cuts approaching."

The rally was real, but it was not broad, and that is why risk management matters more than bravado at record highs.

Technically, the trend is still strong, momentum is hot, and pullbacks towards the support bands are more likely to be bought than sold until proven otherwise.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.