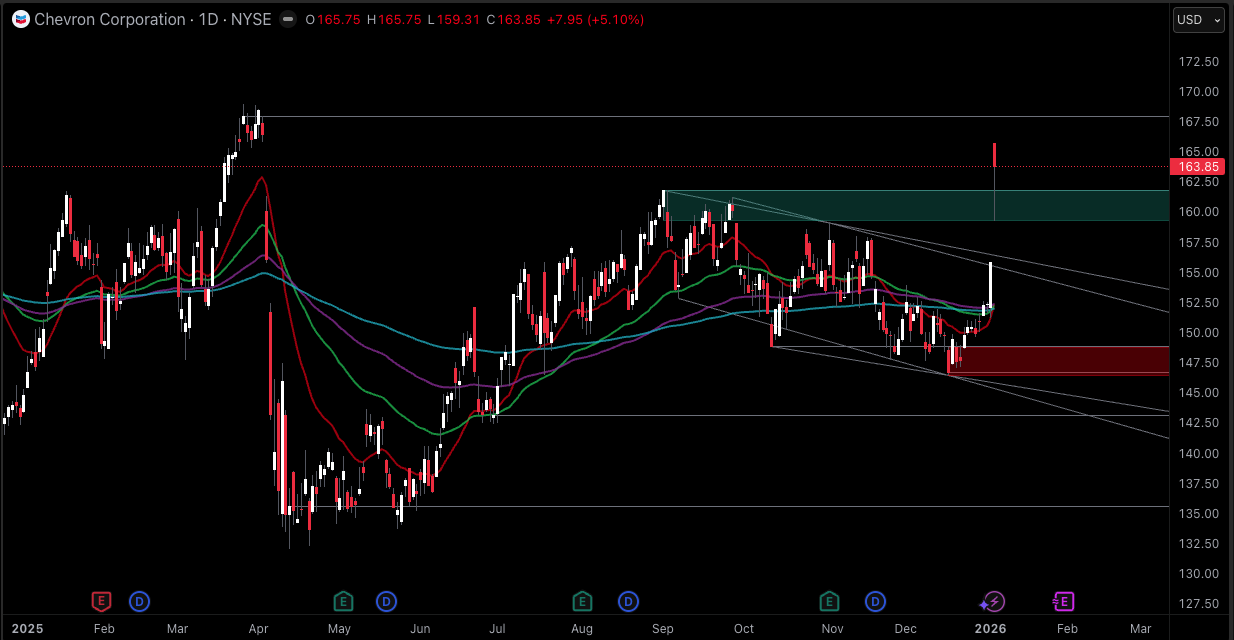

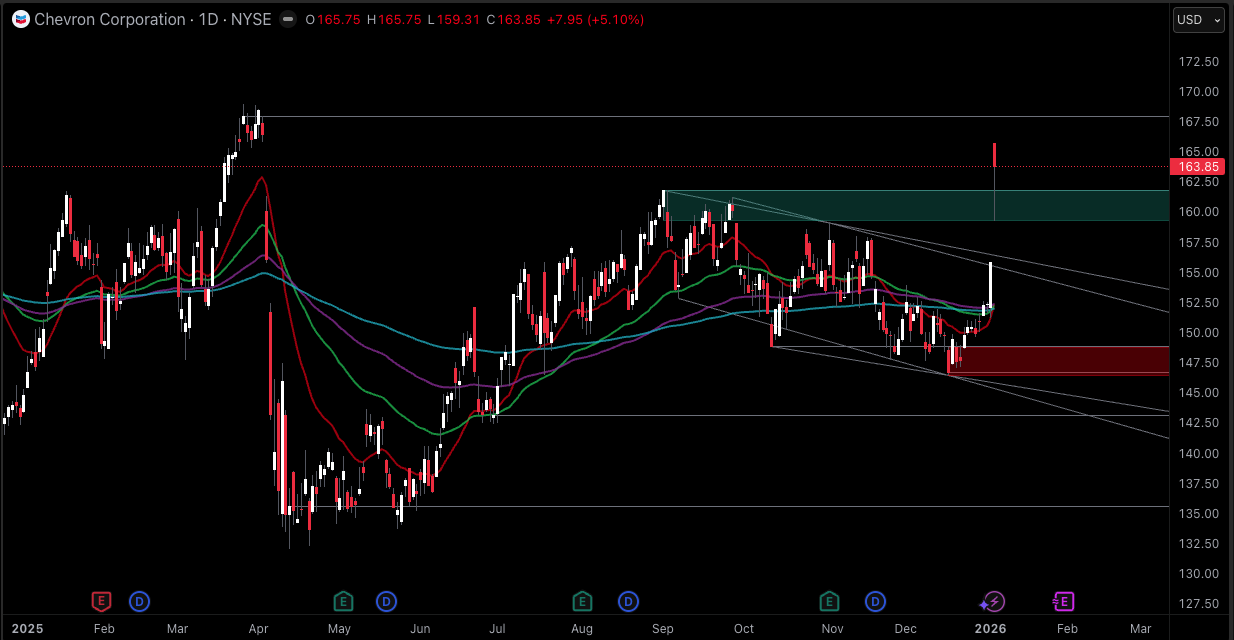

Chevron stock is trading like a "strong-trend but stretched" tape right now. The most recent session ended at $163.85 (January 5, 2026, close, 21:00 GMT), with the day's range between $159.31 and $165.75, bringing the price close to the upper limit of its 52-week range.

The one level that matters most right now is the $165 to $169 supply zone. It is where breakouts either turn into a clean continuation or stall into a sharp "air pocket" pullback. This zone is a well-known inflexion point, aligning with its recent swing highs and the 52-week resistance near $168.96.

The bias is bullish above $165.75, bearish below $159.31, and neutral while the price is trapped between those two levels.

Key H4 Levels For CVX Stock 2026 Positioning And Near-Term Volatility

| Level |

Price |

Why It Matters (H4 Timeframe) |

| Resistance 2 |

$168.96 |

52-week high, clear supply and breakout test |

| Resistance 1 |

$165.75 |

Recent session high, first "prove it" level for buyers |

| Pivot Zone |

$164.50 |

Midpoint and retest band, decision area after spikes |

| Support 1 |

$159.31 |

Session low, first demand zone if momentum cools |

| Support 2 |

$153.40 |

Deeper pullback area near key trend support (MA cluster) |

*Sources for the level anchors include the latest session range and the 52-week range, plus the longer moving-average structure.

Chevron Stock Technical Dashboard (H4 Timeframe)

| Metric |

Current Value |

Signal |

Practical Read |

| Price (Close) |

$163.85 |

- |

This price is the reference point for all levels and scenario triggers. |

| RSI (14) |

85.54 |

Bullish |

This reading is strongly bullish but stretched, which often precedes either consolidation or a pullback that resets momentum. |

| MACD (12,26,9) |

2.79 vs 1.85 |

Bullish |

This setup is bullish because the MACD line is above the signal line and above zero, which typically supports trend continuation. |

| ADX (14) |

44.88 |

Trending |

This reading signals a strong trend environment, which often rewards break-and-retest entries over mean-reversion entries. |

| ATR (14) |

3.02 |

High |

This level implies wide intraday movement, so stops usually need more room and targets must be realistic relative to volatility. |

| Williams %R (14) |

-0.25 |

Overbought |

This reading is extremely overbought, so upside can still continue, but chasing strength often carries poor reward-to-risk. |

| CCI (14) |

218.21 |

Bullish |

This reading confirms strong momentum, but it also increases the odds of a momentum cooldown phase. |

| MA20 |

157.02 |

Above |

Price is above the fast trend average, and pullbacks toward it often attract dip buyers when the slope is up. |

| MA50 |

153.40 |

Above |

Price is above the swing filter, which supports a “buy dips, not rips” posture while it holds. |

| MA100 |

150.25 |

Above |

Price is above mid-term structure, which reduces the probability of a sustained downtrend unless support breaks. |

| MA200 |

150.79 |

Above |

Price is above the long trend reference, and reactions around this zone often determine whether a selloff is a correction or a regime change. |

| Volume vs 20D Avg |

3.79x |

Strong |

Volume is meaningfully above average, which often validates the move but can also reflect headline-driven volatility. |

| Earnings Window |

Jan 30, 2026 |

Near |

Earnings are close, so technical levels can be overrun by a single report-driven gap. |

| Gap Risk |

Elevated |

High |

Gap risk is high because volatility is elevated and a major scheduled catalyst is near. |

*Indicator values and moving averages are from the latest technical snapshot, and price and volume figures reflect the consolidated quote.

Chevron's stock 2026 upside case works best when the chart stays in a "strong trend, shallow pullbacks" regime, because that is the regime where buybacks can mechanically tighten the float and where dividend-focused investors tend to buy dips rather than chase highs.

The risk is that momentum is currently stretched, so the cleaner play is usually to wait for either a controlled pullback into support or a decisive close above resistance, instead of buying into an extended candle.

Momentum And Structure: Trend Strength vs "Overheat" Risk

RSI and MACD are aligned to the bullish side, which typically supports continuation. However, the extreme RSI and overbought oscillator readings increase the probability of a digestion phase rather than a straight-line rally.

From a structure perspective, Chevron stock is behaving like a strong trend that is pausing near the upper end of its recent range, which means pullbacks are more likely to be treated as entries until the range floor fails decisively.

A failed breakout that slips back under the pivot zone tends to shift flow from momentum buying to profit-taking, especially if crude prices soften at the same time.

Execution should respect volatility rather than opinions. With ATR elevated, the market is currently pricing wider swings, so entries are usually cleaner on a break-and-retest of $165.75 or on a rejection-and-hold from the $159.31 area, instead of mid-range guessing.

Chevron Dividend And Buybacks: The Built-In "Support Bid"

| Item |

Estimate |

What Traders Tend To Watch |

| Dividend Yield |

~4.17% |

This yield often acts as a “valuation anchor,” especially during broad-market risk-off phases. |

| Buyback Yield Range |

~3.51% to ~7.02% |

This range reflects how aggressively the float could be reduced under the stated repurchase framework. |

| Total Shareholder Yield Range |

~7.68% to ~11.19% |

This range is the combined support mechanism that can tighten downside and amplify upside in strong tapes. |

| Implied 2026 P/E (Using 2026 EPS Estimate) |

~13.1x |

This multiple often expands or compresses with crude expectations and refining margin trends. |

*Market cap and price are based on the latest quote, while repurchase guidance and EPS estimates are based on published consensus and corporate guidance references.

The 2026 support narrative relies on two shareholder-return pillars that tend to matter most when oil is rangebound.

The quarterly dividend is $1.71 per share, which annualises to $6.84, and that translates to an estimated yield near 4.17% at $163.85.

The board has authorised a large open-ended repurchase program, and the company has been actively repurchasing shares under that authorisation.

Management guidance has outlined a framework that targets $10 billion to $20 billion of annual repurchases through 2030, depending on the oil price environment, which can materially increase total shareholder yield in stronger commodity tape conditions.

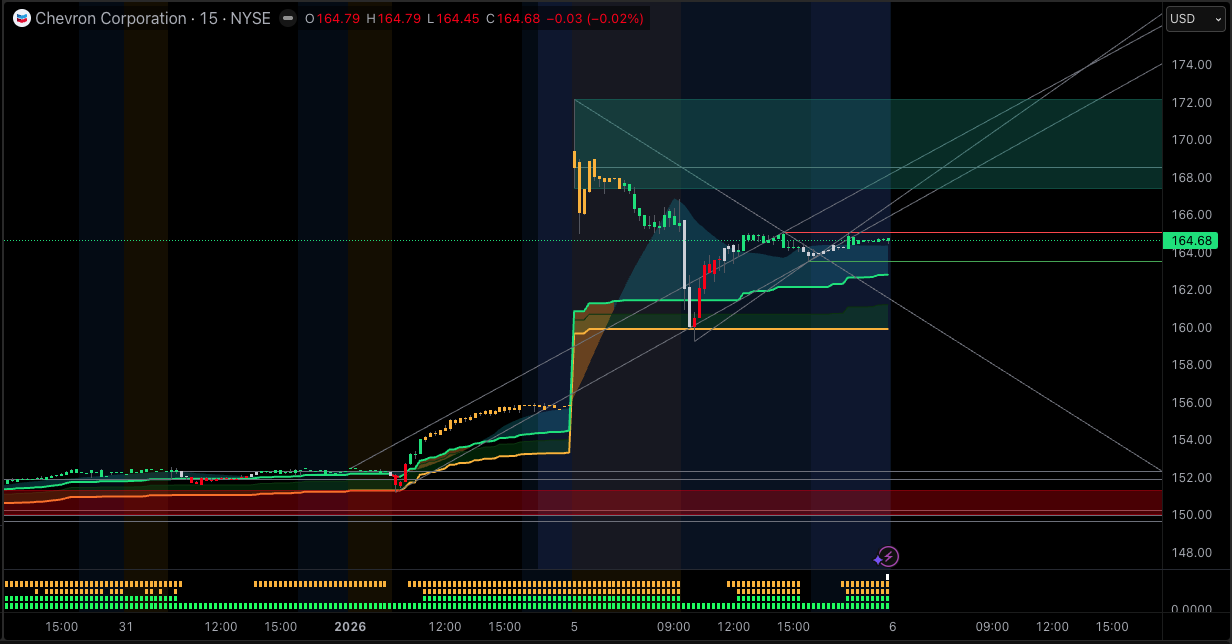

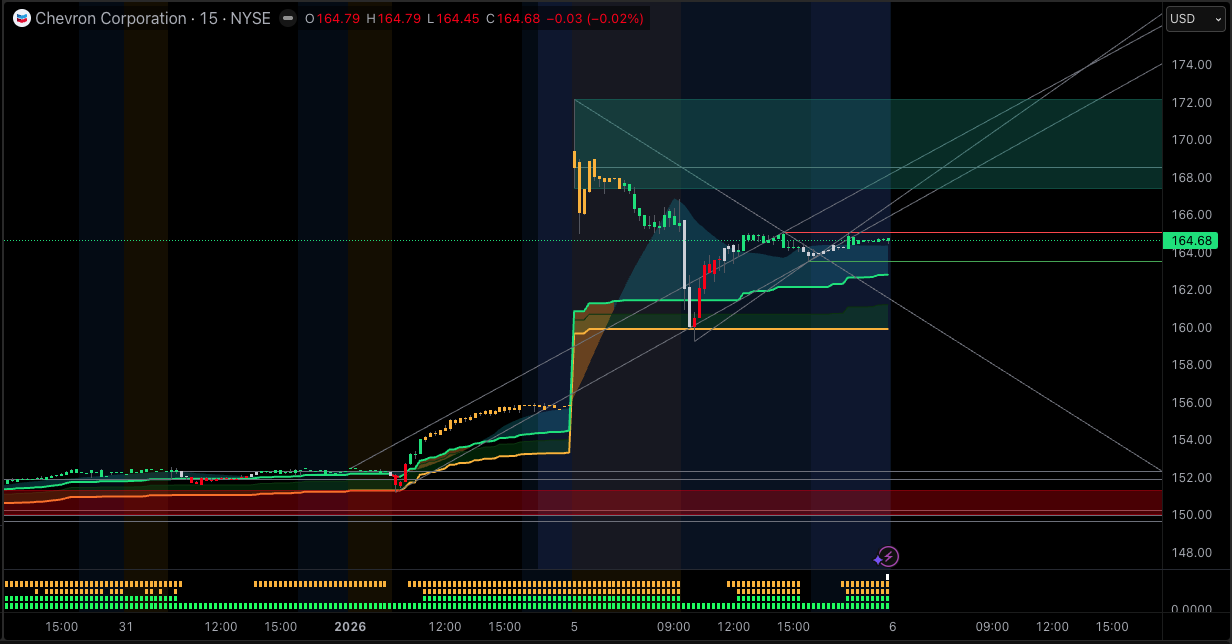

What Lower Timeframe Charts Are Saying (15M to 2H)

On lower timeframes, the big tell is how the price behaves around the $164.50 pivot zone. When a stock is stretched, it often turns that pivot into a "trap door" level: below it, bounces get sold quickly; above it, dips get bought swiftly. The first hour after opening also tends to decide whether the prior day's high becomes support or stays a hard ceiling.

For breakout traders, the cleanest confirmation is a multi-hour close above $165.75, followed by a pullback that holds above $164.50 without heavy selling pressure. If that retest holds, the stock usually gives a more tradable push toward the upper resistance.

For dip-buyers, patience is the edge. In a stretched tape, the best dips are not the first red candle. They are the dips that stop going down and start building a base, ideally above $159.31.

Chevron Stock Forecast 2026: Yield Floor vs Commodity Cycle

| Scenario |

Trigger |

Invalidation |

Target 1 |

Target 2 |

| Base Case |

Holds above $159.31 and reclaims $164.50 |

H4-style close below $159.31 |

$165.75 |

$168.96 |

| Bull Case |

Clean push and hold above $165.75, then successful retest |

Close back below $164.50 |

$168.96 |

$175.00 |

| Bear Case |

Rejection near $165 to $166, then break below $162.89 |

Close above $165.75 |

$159.31 |

$153.40 |

Risk Considerations: Volatility And Event Catalysts

ATR around $1.91 means the stock has enough daily movement to punish tight risk. A practical stop approach is to avoid "just-below-level" stops and instead size positions so the trade can breathe.

Targets should also respect volatility: expecting a $10 move in a couple of sessions is usually unrealistic unless the market is in a full momentum surge.

Event risk is significant for 2026 as this stock is closely connected to energy pricing. At the time of the latest read, crude benchmarks were near the high-$50s to low-$60s area, which can shift quickly and spill into energy equities.

Frequently Asked Questions

1. Is Chevron Stock Bullish or Bearish on the H4 Chart Right Now?

Bullish trend conditions, but stretched. The trend is up, yet momentum is overheated, so entry timing matters more than the direction call.

2. What Are the Key Support and Resistance Levels for CVX?

Resistance sits at $165.75, then $168.96. Support sits at $159.31, then $153.40.

3. What Confirms a Breakout for Chevron Stock?

A strong push above $165.75 followed by a retest that holds above the pivot band near $164.50.

4. What Is Chevron's Dividend Outlook for 2026?

The current quarterly dividend is $1.71 per share, which annualises to $6.84. Future growth sustainability is more influenced by trends in free cash flow and commodity prices than by short-term chart formations.

5. How Important Are Buybacks to Chevron's Stock 2026 Upside Case?

Buybacks are a meaningful upside lever because management has outlined an annual repurchase framework of $10 billion to $20 billion through 2030 under certain oil price assumptions, which can lift per-share metrics even in a slower growth tape.

Conclusion

In conclusion, Chevron's 2026 chart setup remains clean and constructive, but the stock is running hot and pressing into overhead resistance. That mix is great for breakout continuation if buyers can hold above $165.75, but it is also the exact spot where failed breakouts can snap back to support fast.

For positioning, the playbook is clean. Breakout traders should insist on a clean close above resistance, then look to enter on a successful retest. Dip-buyers should wait for the price to confirm support before stepping in, and avoid trying to pick the bottom.

In both cases, ATR says risk control needs room, because this stock has enough daily range to shake out tight stops even when the bigger move stays bullish.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.