ABNB just gave traders a classic mixed signal. The company missed eps, but it also lifted the tone for 2026 and pointed to faster growth ahead. That is why the stock reaction has been so choppy. One part of the market is focused on the EPS miss, and the other part is focused on the guide and the demand picture.

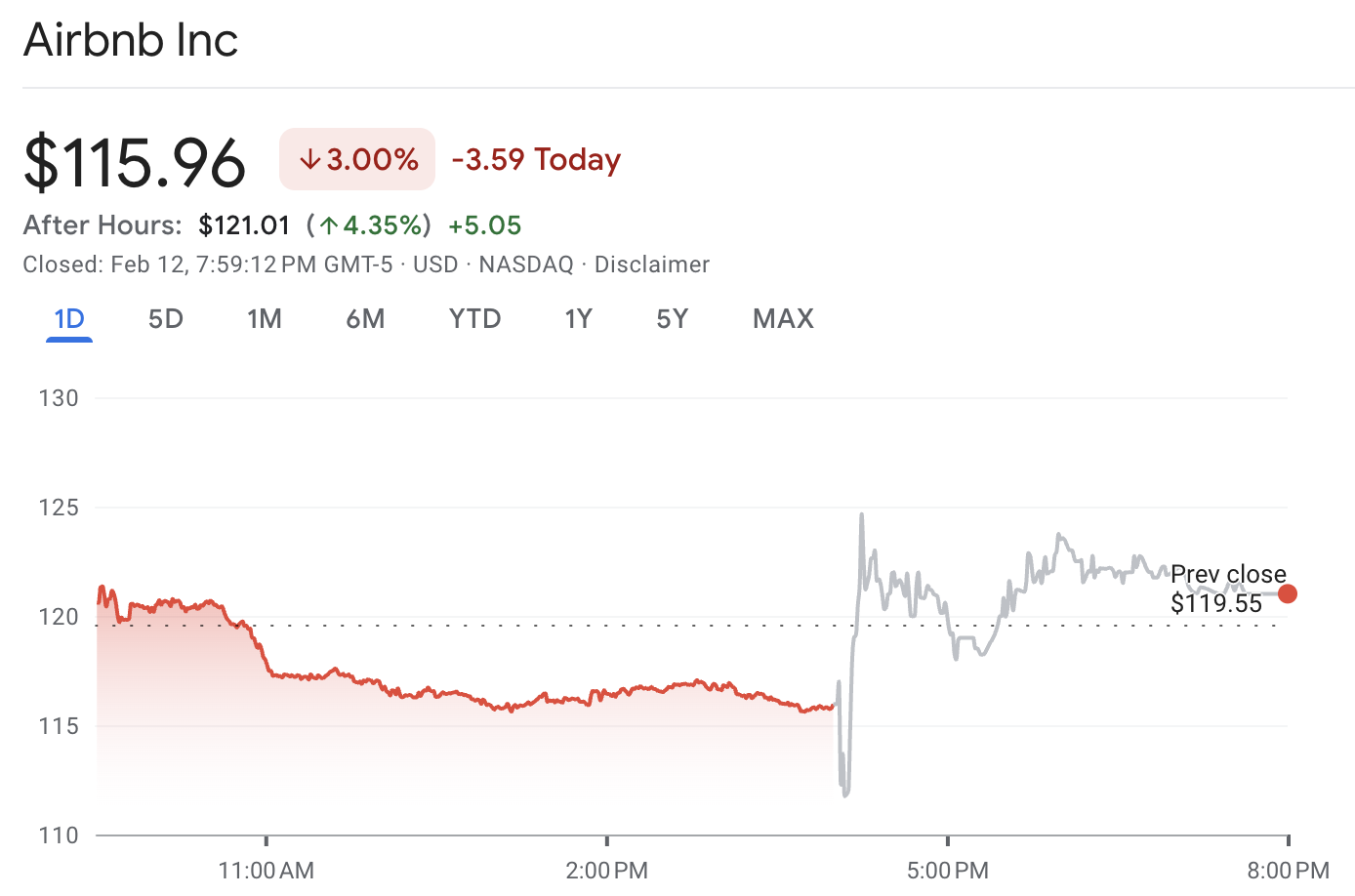

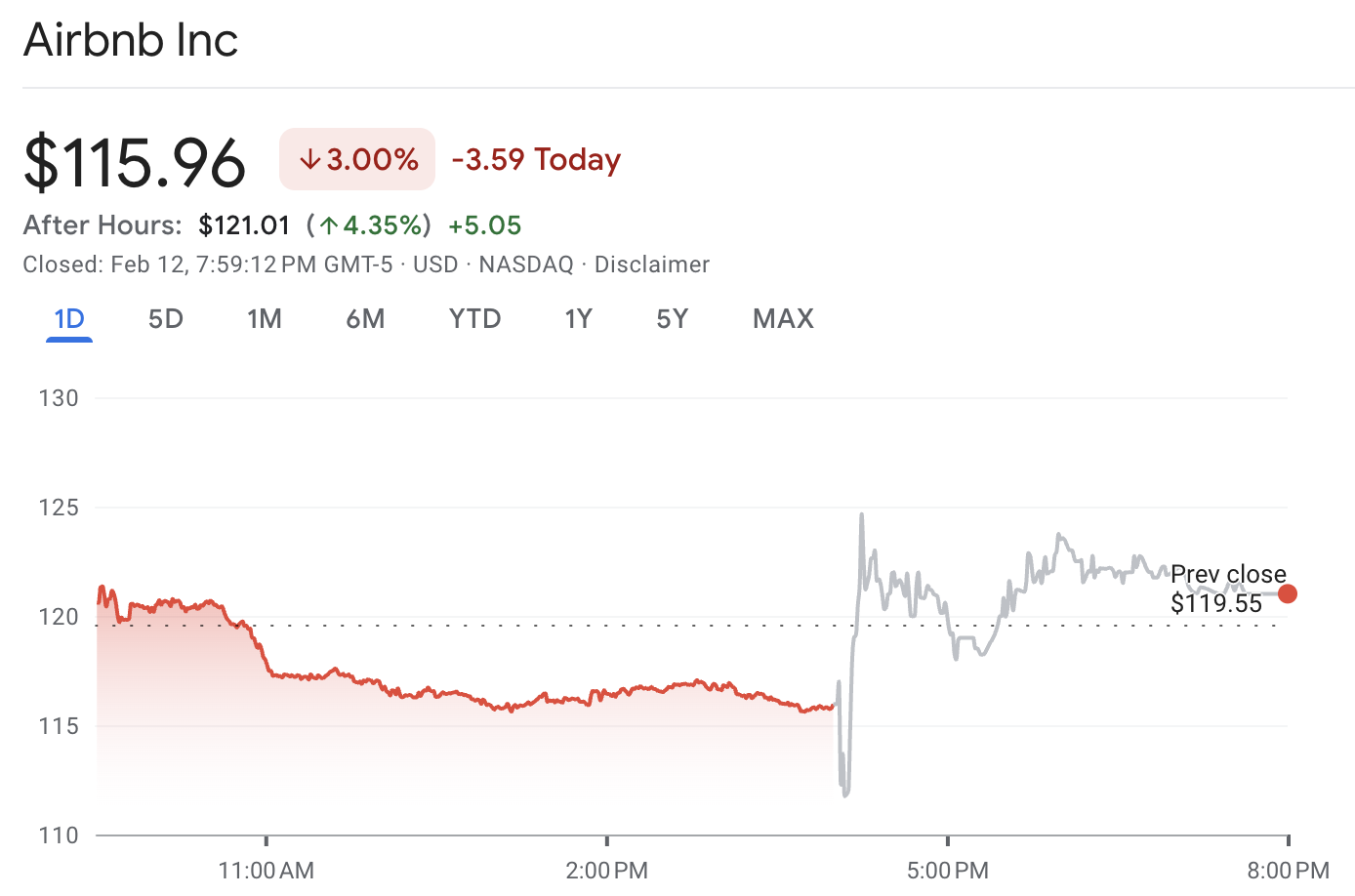

The stock has traded with a wide intraday range, with the latest print around $115.96 after a session that saw a high of $124.64 and a low of $110.89.

If you trade earnings, you already know the rule: price usually follows the next three to six months, not the last quarter. In this report, the main question is simple. Does the 2026 guidance beat matter more than the EPS miss, and is ABNB stock a buy after this move?

ABNB Earnings Recap: The Quarter Was Better Than the EPS Headline

The cleanest way to read this report is to separate business momentum from accounting noise.

| Metric |

Q4 2025 |

FY 2025 |

| Revenue |

$2.8 billion |

$12.2 billion |

| Net income |

$341 million |

$2.5 billion |

| Diluted EPS |

$0.56 |

$4.03 |

| Adjusted EBITDA |

$786 million |

$4.3 billion |

| Free cash flow |

$521 million |

$4.6 billion |

| Gross booking value |

$20.4 billion |

$91.3 billion |

| Nights and seats booked |

121.9 million |

533.0 million |

*(Values are from the company's reported results.)

ABNB's Q4 showed acceleration in activity and bookings, and it finished 2025 with sizable cash generation:

Revenue: $2.8 billion in Q4, up 12% year over year.

Gross booking value: $20.4 billion in Q4, up 16% year over year.

Nights and seats booked: 121.9 million in Q4, up 10% year over year.

Adjusted EBITDA: $786 million in Q4, with a 28% margin.

Free cash flow: $521 million in Q4, and $4.6 billion for full-year 2025.

Those are not "survival" numbers. They are "operating leverage plus durable demand" numbers.

Why EPS Missed: It Was Not a Demand Problem

Q4 diluted EPS was $0.56, versus $0.73 a year earlier. Net income decreased YoY to $341 million. The company attributed this decline to planned investments, policy initiatives, and various changes in costs and taxes.

This is the headline number that triggers automated selling and fast money repositioning.

However, an EPS miss is not always a demand problem. For example, ABNB states that Q4 net income was pressured by planned investments and roughly $90 million of non-income tax matters.

That is a very different message than "pricing is collapsing" or "demand is rolling over."

Even better for longer-horizon investors, management flagged that the long-term effective tax rate is expected to decline to the mid-to-high teens starting in 2026, tied to recent tax-law changes. If that guidance holds, it is a quiet tailwind for forward earnings power.

Why the 2026 Guidance Supports an ABNB Stock Buy Narrative?

Traders often pay a premium for forward visibility, especially when the stock has been declining, and market positioning is cautious.

For Q1 2026, ABNB guided:

Revenue of $2.59 billion to $2.63 billion, which implies 14% to 16% year-over-year growth.

A modest foreign exchange tailwind (after hedging), and an implied take rate slightly up year over year.

For full-year 2026, ABNB expects:

That combination explains why the stock could trade higher in extended hours right after the release, even with a weaker EPS line.

Key Takeaway

Demand appears stable enough for management to discuss growth opportunities rather than express caution.

Margins are being managed, not sacrificed in a panic.

Take rate is not collapsing, even with FX and timing noise in the quarter.

In Q4, the implied take rate decreased to 13.6%, down from 14.1% the previous year. This decline was primarily due to foreign exchange fluctuations and a mismatch in the timing between booking and stay dates.

That is not ideal, but it is also not a structural break. If the Q1 take rate is "slightly up," that tends to calm the market's biggest fear.

Our Perspective: ABNB Stock Is Trading Like a Tired Stock While Operating Like a Cash Machine

Here is the disconnect traders are leaning into:

Cash generation is still exceptional. Full-year free cash flow was $4.6 billion.

Share count pressure is being managed. ABNB repurchased $1.1 billion of stock in Q4 and still has $5.6 billion authorized under its buyback program.

The stock is currently trading close to the lower end of its annual range. Over the past year, ABNB's 52-week range has been $99.88 to $163.93.

Here's a simple valuation check derived from the reported numbers: Using the full-year diluted EPS of $4.03 and a price near $115.96, the trailing P/E ratio is approximately 28.8.

Using a full-year free cash flow of $4.6 billion, and considering the reported diluted share count, the free cash flow amounts to approximately $7.38 per share.

This translates to a free cash flow yield of about 6.4% at current prices. While this calculation is rough, it provides a useful directional insight.

This is why "EPS miss" did not automatically kill the stock. The cash story is still there.

ABNB Stock Technical Analysis

| Indicator |

Latest value |

Read |

| RSI (14) |

30.12 |

Bearish / near oversold |

| MACD (12,26) |

-1.25 |

Bearish momentum |

| ADX (14) |

26.376 |

Trend strength is meaningful |

| ATR (14) |

1.2692 |

Higher volatility |

| Williams %R |

-93.824 |

Oversold |

| CCI (14) |

-136.0214 |

Bearish |

Right now, the technical picture reads like a classic post-earnings hangover:

RSI (14): 30.12, which is near oversold territory.

MACD (12,26): -1.25, still bearish.

ATR (14): 1.2692, pointing to elevated volatility.

Moving Averages Table (Daily)

| Moving average |

Level |

Signal |

| MA20 |

118.99 |

Sell |

| MA50 |

120.71 |

Sell |

| MA200 |

130.51 |

Sell |

What It Means:

ABNB stock is trading below every key average listed here, which is why rallies can fail fast until the stock rebuilds structure.

Practical Support and Resistance Levels (Near-Term)

Pivot levels are tight right now, which usually happens after a fast drop:

| Level type |

Support |

Resistance |

| Classic pivot set |

$116.21 / $115.82 / $115.39 |

$117.03 / $117.46 / $117.86 |

How to Read This as a Trader:

RSI near 30 can trigger bounces, but as long as the price remains below $120.71 (MA50) and significantly below $130.51 (MA200), rallies may still trigger sell-the-pop actions. Oversold does not mean "cheap." It means "stretched."

How ABNB Stock Will Move From Here?

ABNB is tradable in both directions right now, and the next move will be decided by follow-through, not the headline beat or miss.

Scenario 1: Bull Case (Trend Reversal and Re-Rate)

This happens if the market starts treating the EPS miss as "spend today, grow tomorrow," and Q1 bookings data stays firm.

The trigger is price reclaiming the short-term moving averages and holding above them for several sessions.

The upside path usually targets the next big resistance zones near the 50-day and 100-day averages.

Possible Levels: Hold above ~$115, then reclaim ~$121–$122, next magnet is ~$130.

Our Recommendation: Only become aggressive after the stock stops making lower lows and starts closing strongly during the session, as earnings volatility can quickly mislead.

Scenario 2: Base Case (Range Trade)

This occurs when guidance supports the stock, but investors remain cautious due to flat expected margins and weak technical momentum.

Possible Levels: Range between roughly ~$110 and ~$125, with ~$121 acting as a decision point.

Our Recommendation: Reduce position size and concentrate on a clearer intraday structure, as range markets penalize stubborn trading.

Scenario 3: Bear Case (Guide Is Good, but Risk Mood Is Bad)

This occurs if macro risks increase, travel demand weakens at the lower end, or the market stops valuing growth.

A clear trigger occurs when the price breaks below support and volatility increases.

In that case, sellers usually press until they find a bigger prior demand zone.

Possible Levels: A break below $111 opens risk toward $100, which is near the 52-week low zone.

Our Recommendation: Respect stops quickly, because post-earnings air pockets can be brutal when RSI is already weak.

So, Is ABNB Stock a Buy Now?

It depends on your time horizon and your discipline.

For investors: The guidance tone, cash flow scale, and buyback capacity are the reasons to keep ABNB on the "accumulate on weakness" list. The EPS miss looks more like a tax and investment story than a demand story.

For traders: The technicals still say "downtrend," even if the stock is stretched. If ABNB cannot reclaim the $120–$121 area, oversold bounces can fail quickly.

The cleanest "buy setup" is usually not the first bounce after earnings. It is the second, when volatility cools, and the price starts holding above key moving averages.

Frequently Asked Questions (FAQ)

Why Did ABNB Stock Move Even Though EPS Missed?

The market focused more on forward guidance. Management projected Q1 revenue between $2.59 billion and $2.63 billion, stating that growth in 2026 should be at least in the low double digits.

What Is the Biggest Bullish Signal From the Earnings Report?

The strongest bullish signal is the combination of 16% GBV growth in Q4 and guidance for mid-teens Q1 revenue growth, which suggests demand is not fading.

What Is the Biggest Risk Near-Term?

The biggest near-term risk is technical. The stock is below all major moving averages, and several indicators still suggest a "strong sell" daily setup.

Is ABNB Stock a Buy Right Now for Long-Term Investors?

If you take a long-term view, the case relies on guidance strength, cash generation, and ongoing buybacks, rather than on the noise from one quarter's EPS. If you are risk-sensitive, you should wait for the price to stabilize and reclaim key moving averages before adding size.

Conclusion

In conclusion, ABNB delivered what traders call a "good business, messy quarter" print. The EPS miss is real, and the stock is still paying for it on the chart. Similarly, the guidance for 2026 was notably improved, and Q4 demand figures were strong.

If you want a clean swing entry, patience is your edge. Let the stock prove it can rebuild above key moving averages and hold support without wild intraday reversals.

If you are investing with a longer horizon, the cash flow profile and the 2026 growth message are the reasons ABNB stays on the buy list, even after a headline miss.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.