CoStar stock (CSGP) closed at $58.49 on January 9, 2026, extending a three-session slide and leaving shares roughly 40% below the $97.43 high set on August 5, 2025. The drop is best understood as a discount-rate reset applied to one part of the story: Homes.com’s cash burn and the length of its payoff window, not a sudden collapse in CoStar’s core subscription model.

The timing matters. On January 7, 2026, CoStar published a full-year 2026 outlook that pairs strong headline growth with a long-dated profitability milestone for Homes.com. Management guided $3.78 to $3.82 billion of 2026 revenue and $740 to $800 million of adjusted EBITDA, while also stating that Homes.com is expected to reach positive adjusted EBITDA in 2030.

Investors are re-pricing CSGP because “2030” changes how much today’s market will pay for tomorrow’s earnings, even if the top-line trajectory remains intact.

Key takeaways

The selloff is about time and trust, not demand collapse. The market is treating Homes.com as a longer-duration project, which mechanically compresses valuation multiples when rates stay elevated.

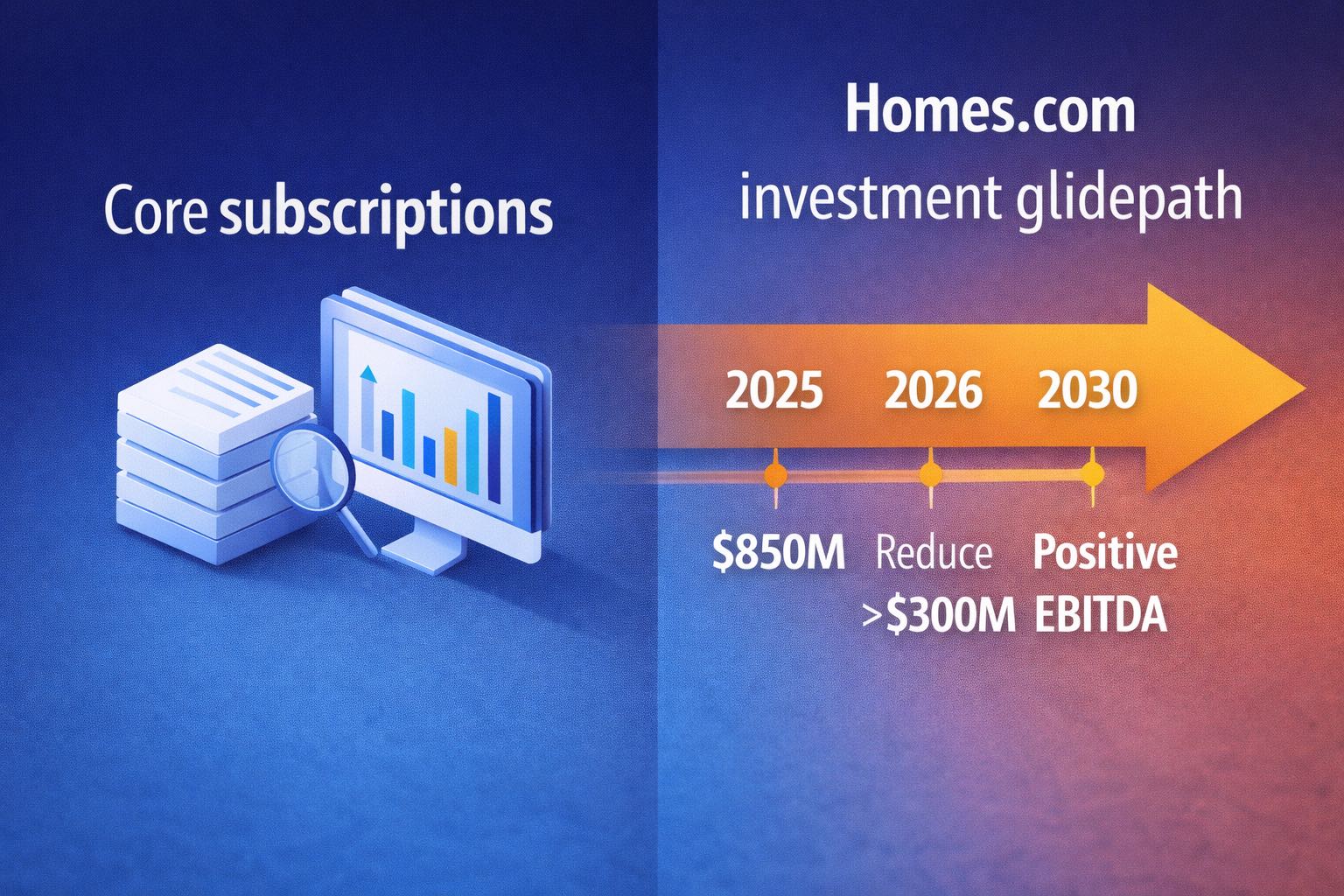

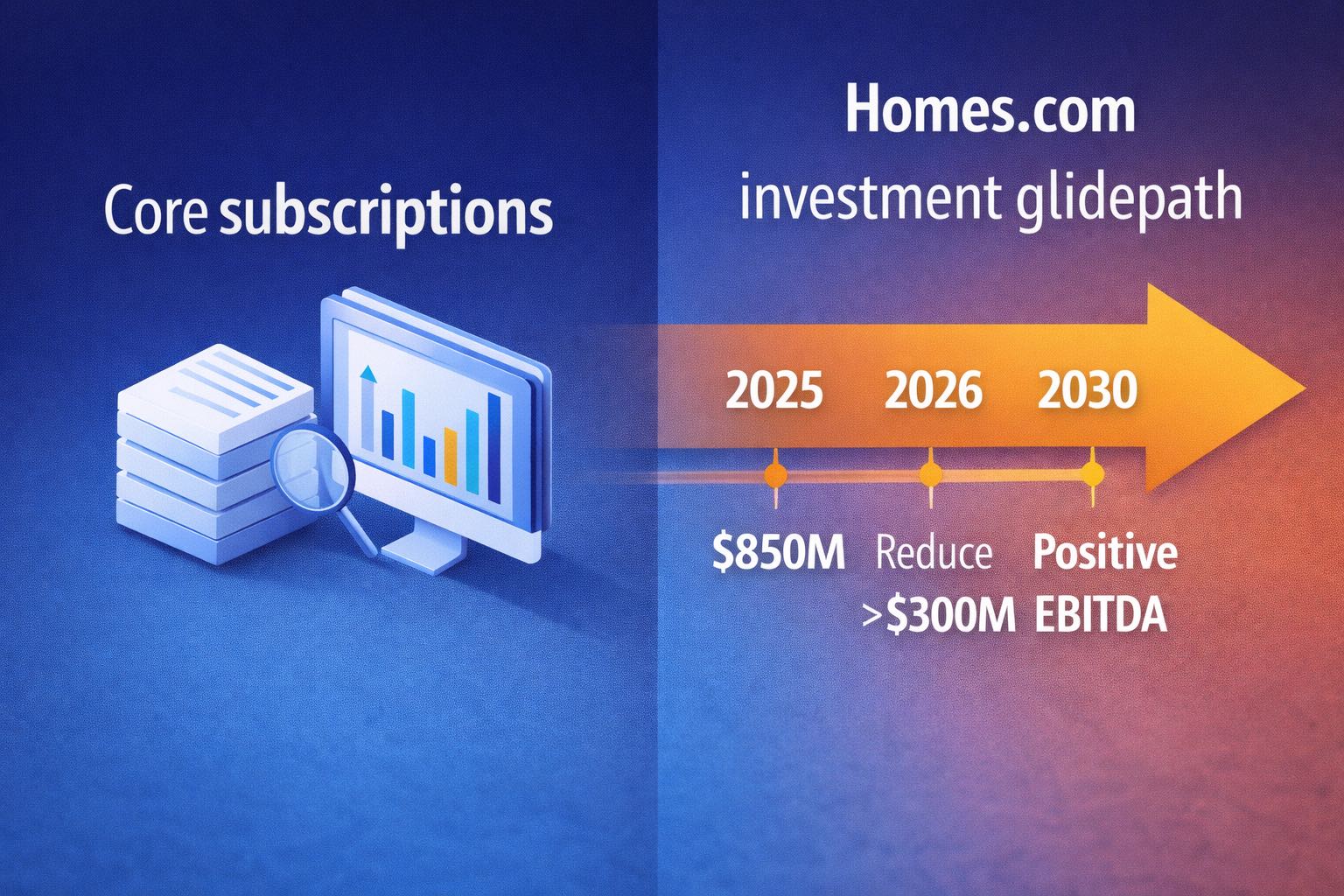

CoStar is promising two hard things at once. It plans to cut Homes.com's net investment by more than $300 million in 2026 (from $850 million in 2025) while still scaling the platform. The fear is that lower spending slows momentum before monetization is mature.

2024 shows how sensitive profits are to marketing intensity. In 2024, selling and marketing expenses reached $1.364 billion, or 50% of revenue, leaving operating income close to flat, even on $2.736 billion of revenue. That history makes investors skeptical until the spending glidepath shows up in margins, not just in slides.

The buyback helps sentiment but does not erase execution risk. A $1.5 billion repurchase authorization supports the stock at the margin, but it does not shorten the Homes.com timeline.

2026 is a narrative year for CSGP. If CoStar can show improving Homes.com unit economics while core subscriptions keep compounding, the stock can re-rate. If growth slows as spending moderates, the market will keep discounting the residential option value.

What Is Driving The CoStar Stock Drop Right Now

The market is discounting the Homes.com payoff further into the future.

CoStar explicitly framed Homes.com as a multi-year build that reaches revenue exceeding expenses exiting 2029 and positive adjusted EBITDA in 2030. That is not a fatal outcome, but it is a longer runway than many investors want to underwrite at a premium multiple, especially when the federal funds target range is still 3.50% to 3.75%.

A simple way to see the valuation impact is to treat Homes.com like a call option whose “expiry” moved out. When the expiry extends, the option can still be valuable, but today’s price becomes more sensitive to the discount rate and execution uncertainty.

That is why a stock can fall even as management raises medium-term EBITDA targets.

Spending moderation creates a growth anxiety.

CoStar said it intends to reduce Homes.com's net investment by more than $300 million in 2026, down from $850 million in 2025, and then cut by $100 million or more annually until 2030.

That path implies a 2026 net investment of around $550 million or less, then stepping down further over time. The market’s immediate question is not “Can CoStar spend less?” It is “Can CoStar spend less without losing the growth flywheel that justifies spending in the first place?”

CoStar highlighted rapid subscriber growth for Homes.com, but investors want to see durability when spending is no longer rising.

The 2024 financials remind investors how thin reported profitability can be during land-grabs

CoStar’s 2024 results show the strategic trade-off in black and white:

Revenue: $2.736 billion

Selling and marketing expense: $1.364 billion

Operating income: $4.7 million

Net income: $138.7 million

This is the unique pressure point in the CSGP story. CoStar can produce a strong gross profit profile, yet an aggressive marketplace push can absorb the profit pool. Investors have learned that “growth” is not the scarce resource here. Efficient growth is.

CSGP 2026 Guidance And What It Signals

CoStar’s January 2026 outlook did two things simultaneously: it re-anchored expectations higher for consolidated profitability, and it made the residential timeline explicit.

2026 consolidated targets

Revenue: $3.78 to $3.82 billion

Net income: $175 to $215 million (also $0.42 to $0.52 per diluted share, based on 416 million shares)

Adjusted EBITDA: $740 to $800 million (about a 20% margin at midpoint)

Adjusted EPS: $1.22 to $1.33

Medium-term target: Adjusted EBITDA $1.25 billion in 2028 and revenue of about 15% CAGR from 2025 to 2028

These are not weak numbers. The stock reaction tells you the market is choosing to price the risk of the path rather than the appeal of the destination.

Homes.com targets

Net investment reduction: more than $300 million in 2026 versus $850 million in 2025

Continued reductions: $100 million or more annually until 2030

Milestones: revenue exceeding expenses exiting 2029, positive adjusted EBITDA in 2030

The key is that the plan shifts the story from “growth at any cost” to “growth with a burn-down schedule.” Markets reward that only when quarterly results show the burn-down is real and the demand side stays stable.

A unit economics lens that explains the selloff better than headlines

Most coverage treats this as a simple conflict: “investors dislike spending.” That misses the more precise issue.

CSGP is being valued on two separate engines:

The stock falls when investors believe Homes.com CAC is becoming a permanent tax on the business rather than a temporary investment.

Three metrics matter more than traffic headlines in 2026:

Net investment per incremental subscriber

If subscriber growth continues but requires nearly the same net investment, the model is not improving. If net investment falls while subscriber growth holds, confidence rises quickly.

Retention and upsell on the residential side

A marketplace can buy users once, but it must monetize them repeatedly. Early subscriber additions are only valuable if churn stays low when promotional intensity moderates.

Contribution margin progression

CoStar’s 2026 outlook implies consolidated margin expansion, but investors will look for proof that Homes.com losses are shrinking on schedule and that the core business is not being cannibalized by the build.

This is why the stock can drop even with a stronger consolidated EBITDA guide. Investors are effectively saying: “Show me the slope of improvement, not the endpoint.”

Macro Backdrop For Real Estate Demand In 2026

Housing and real estate portals trade like rate-sensitive assets because transaction activity and advertising budgets track affordability and confidence.

The federal funds target range is 3.50% to 3.75% in early January 2026, with the effective fed funds rate around 3.64% in the same period.

The average 30-year fixed mortgage rate is 6.16% as of January 8, 2026.

Mortgage rates near 6% are an improvement versus the prior year, but they are still high enough to restrain churn in housing supply and keep consumer decision cycles longer. That macro friction does not kill the Homes.com thesis, but it raises the bar for marketing efficiency and monetization.

Valuation Framing for CoStar Stock In 2026

At $58.49 and with CoStar’s own 416 million diluted share count assumption, the implied equity value is roughly $24.3 billion (58.49 × 416m). Against the midpoint 2026 revenue of about $3.80 billion, that is roughly 6.4 times sales.

A multiple near this level tells you the market is no longer paying primarily for “platform mystique.” It is paying for two things:

If the market begins to believe Homes.com has a credible path to improving contribution margins sooner than 2029, the multiple can expand. If the market believes Homes.com needs repeated reinvestment to stay relevant, the stock can trade like a mature subscription company with a capital-hungry side project.

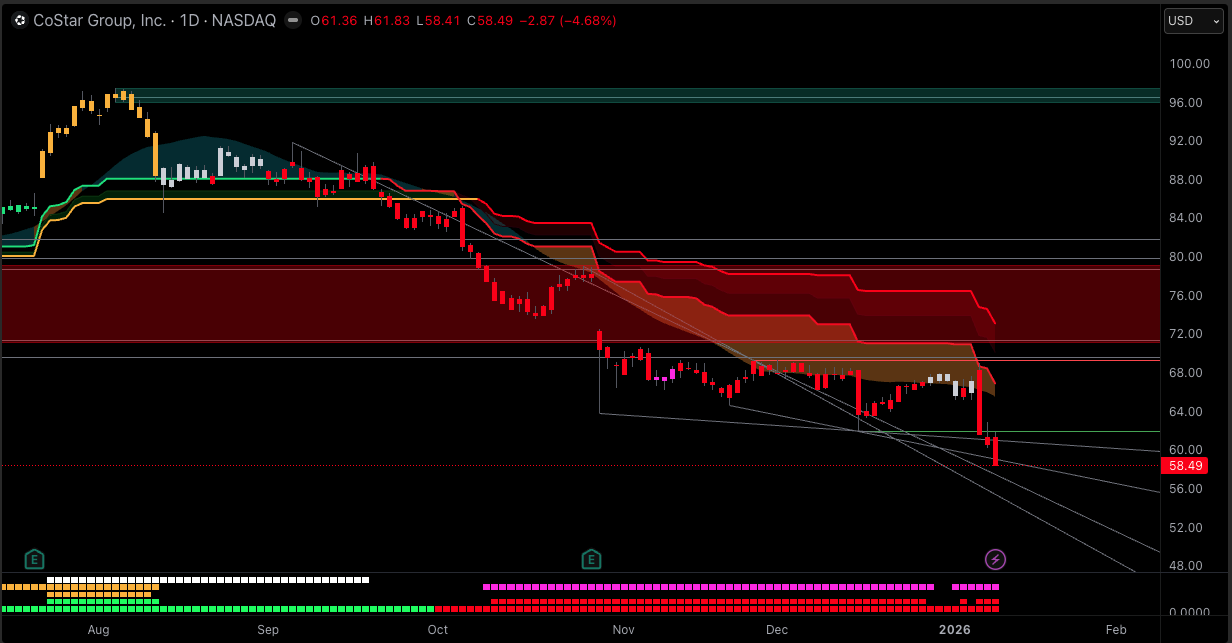

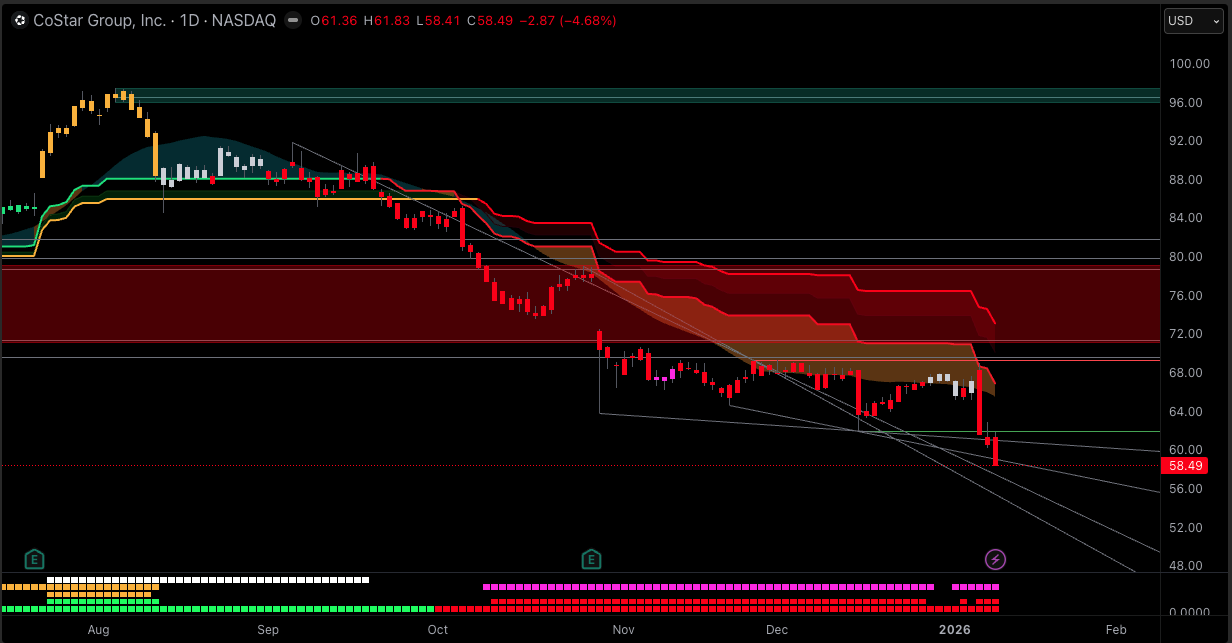

Technical picture for CSGP

CSGP is trading in a weak structure with heavy overhead supply:

Recent close: $58.49 on January 9, 2026, after three consecutive down sessions.

Key reference: $97.43 52-week high (August 5, 2025).

From a trading standpoint, the burden of proof is on bulls until the stock reclaims prior breakdown zones and can hold higher lows. From an investing standpoint, the technicals reinforce the same message as fundamentals: the market wants evidence, not promises.

What Would Change The Narrative In 2026

Bull case

Homes.com's growth holds while net investment drops meaningfully in 2026

Core subscription businesses sustain high retention and pricing power.

Consolidated margins expand toward the guided 2026 profile, validating the efficiency story

Base case

CoStar hits consolidated guidance, but Homes.com's progress is steady rather than dramatic.

The stock stabilizes, then trades range-bound as investors wait for cleaner unit economics.

Bear case

Spending cuts slow residential momentum before monetization is proven.

Investors treat Homes.com as structurally expensive, pushing the stock toward a lower multiple anchored on the core business alone.

Frequently Asked Questions (FAQ)

1. Why is CoStar stock dropping if revenue is still growing?

Because the market is discounting the cash flows further out. CoStar guided solid 2026 revenue growth, but also set Homes.com profitability at 2030. A longer payoff window reduces today’s valuation, especially when rates are still elevated.

2. What is CoStar guiding for 2026?

CoStar guided 2026 revenue of $3.78 to $3.82 billion, net income of $175 to $215 million, and adjusted EBITDA of $740 to $800 million. It also set a medium-term target of $1.25 billion adjusted EBITDA in 2028.

3. When will Homes.com be profitable?

CoStar expects Homes.com to deliver revenue in excess of expenses exiting 2029 and to reach positive adjusted EBITDA in 2030. The stock’s weakness reflects skepticism about the timeline and the risk that the platform needs more reinvestment.

4. How big is the Homes.com spending reduction plan?

CoStar plans to reduce Homes.com net investment by more than $300 million in 2026 from $850 million in 2025, then reduce net investment by $100 million or more annually until 2030. That glidepath is central to the 2026 re-pricing. [1]

5. Is CSGP more sensitive to mortgage rates than before?

Yes. The larger the residential ambition becomes, the more CSGP trades with housing activity and affordability. With 30-year mortgage rates around 6.16% and policy rates still 3.50% to 3.75%, demand is improving but not loosening, which raises the premium on marketing efficiency. [2]

6. What is the single most important thing to watch next?

Watch whether Homes.com can keep scaling while the company reduces net investment. The stock likely needs proof of improving unit economics, not just subscriber growth, to re-rate meaningfully in 2026.

Conclusion

CoStar stock is dropping because the market is re-pricing CSGP around a longer and riskier cash-flow timeline for Homes.com. The 2026 guidance is not weak, and the buyback adds support, but investors are demanding evidence that net investment can fall sharply without breaking momentum.

In 2026, CoStar’s upside is less about headlines and more about execution: measurable unit economics, visible margin progression, and a steady core subscription engine that can fund the residential build without permanently diluting profitability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Source

[1] https://www.costargroup.com/press-room/2026/costar-group-provides-full-year-2026-and-medium-term-outlook-significant-adjusted

[2] https://www.freddiemac.com/pmms