Salesforce shares have slid back toward the lower end of their one-year range as investors reassess what AI means for the economics of enterprise software. The stock recently traded around $233.53, after touching an intraday low near $231.70, extending a drawdown that has left CRM meaningfully below its recent highs.

The price action matters because it is happening even as Salesforce is printing solid margins and cash flow, and even raised full-year revenue guidance in its latest quarter. This gap between operating performance and the share price is the clue to what is really driving the selloff.

Salesforce Stock Drop: Key Takeaways On The CRM Selloff

This is a narrative-led drawdown, not a balance-sheet panic. The market is discounting a future where AI compresses seat-based software pricing faster than it expands new AI consumption revenue. That uncertainty is hitting mature, large-cap software hardest.

Fundamentals are stable, but the growth mix is shifting. Q3 FY26 revenuewas $10.259B with cRPO of $29.4B (+11% YoY), pointing to a resilient backlog and pipeline.

AI momentum is real but still small relative to the base. Agentforce and Data 360 ARR reached nearly $1.4B (+114% YoY), strong growth that still has to prove durable at scale.

The Informatica deal is strategically logical, but it adds integration and “story risk.” Salesforce agreed to acquire Informatica for about $8B (at $25 per share), and guidance now includes its contribution, which changes reported growth optics.

Technicals are signaling capitulation conditions. RSI is around 26.7, with multiple moving averages flashing “sell,” suggesting the stock is oversold but still in a downtrend.

What is driving the CRM stock selloff?

1) AI is rewriting the software pricing model, and Salesforce sits at the crossroads

For two decades, CRM monetization has been dominated by per-seat licenses plus add-ons. AI agents challenge that model in two opposing ways:

License compression risk: If AI automates workflows, fewer human users may need full-featured seats, especially in service and sales ops. That caps seat growth and pressures expansion cycles.

Consumption upside: If AI agents become production-critical, spend can shift from seats to usage, data, orchestration, and trusted integration. That can expand revenue, but only if pricing is enforced and outcomes are measurable.

The selloff is the market demanding proof of the second path. When investor confidence tilts toward “AI substitutes software” rather than “AI increases software consumption,” multiples contract even if earnings hold up. Recent sessions have shown sharp single-day declines consistent with that kind of sentiment reset.

2) “Good results” are not enough when the market wants reacceleration

Salesforce’s latest quarter was operationally strong: $10.259B revenue (+9% YoY), subscription and support revenue of $9.7B, and GAAP operating margin around 21.3% with non-GAAP operating margin around 35.5% in the quarter.

It also delivered strong cash generation, with free cash flow of $2.177B for the quarter.

But the stock is not trading on whether Salesforce is a high-quality business. It is trading on whether Salesforce can move from “efficient single-digit grower” back toward “durable double-digit compounder” as AI becomes the buying driver.

3) Informatica changes the growth optics and raises execution sensitivity

The Informatica acquisition is designed to strengthen the data foundation required for agentic workflows, data governance, integration, and metadata-driven automation. Strategically, that aligns with the AI CRM thesis.

Financially, it changes reported growth and investor expectations:

Full-year FY26 revenue guidance was raised to $41.45B to $41.55B, with an indicated ~80 bps contribution from Informatica.

Q4 FY26 revenue guidance is $11.13B to $11.23B, including about 3 points of Informatica contribution.

The deal closed in mid-November 2025, pulling integration risk forward into the current operating narrative.

When a mega-cap stock is already under multiple pressures, any “integration and synergy” story tends to increase the market’s demand for clean execution.

4) Rotation and relative value have become a headwind for legacy software

Even strong operators can be sold when the market rotates toward parts of the AI stack perceived as more direct beneficiaries. In that tape, enterprise software gets treated as “AI disrupted” until proven otherwise, particularly when the stock is below key moving averages and momentum screens turn negative.

The unique angle: the market is pricing a “trust tax” for AI CRM

The most overlooked driver is not AI capability; it is trust economics.

Enterprise buyers will not deploy autonomous agents widely unless they can answer three questions cleanly:

Is the agent grounded in correct, permissioned data?

Can the workflow be audited end-to-end?

Can outcomes be tied to ROI and governance policies?

Salesforce is building toward this with Agentforce plus Data 360, and by tightening the data layer via Informatica. The market’s skepticism is about timing: the “trust stack” takes longer to standardize than the demos suggest, which delays the consumption ramp. That delay is what investors are discounting.

Notably, the backlog metrics do not show a collapse. cRPO was $29.4B, up 11% YoY, which is consistent with customers still committing to multi-period contracts, even as they reassess how fast they expand.

Fundamental snapshot: growth, margins, cash, and capital returns

| Metric |

Latest datapoint |

Why it matters |

| Share price (recent) |

~$233.53 |

Sets the technical context and sentiment. |

| 52-week range |

$221.96 to $367.09 |

Shows CRM is trading closer to cycle lows than highs. |

| Q3 FY26 revenue |

$10.259B (+9% YoY) |

Confirms steady top-line growth despite a cautious IT backdrop. |

| Q3 FY26 cRPO |

$29.4B (+11% YoY) |

A forward demand signal, supports “pipeline stability” thesis. |

| FY26 revenue guidance |

$41.45B to $41.55B |

Guidance raise reduces “fundamental deterioration” risk. |

| FY26 non-GAAP op margin guide |

34.1% |

The business is structurally more profitable than in prior cycles. |

| Capital returned (Q3 FY26) |

$4.2B |

Buybacks and dividends support EPS, but do not fix sentiment alone. |

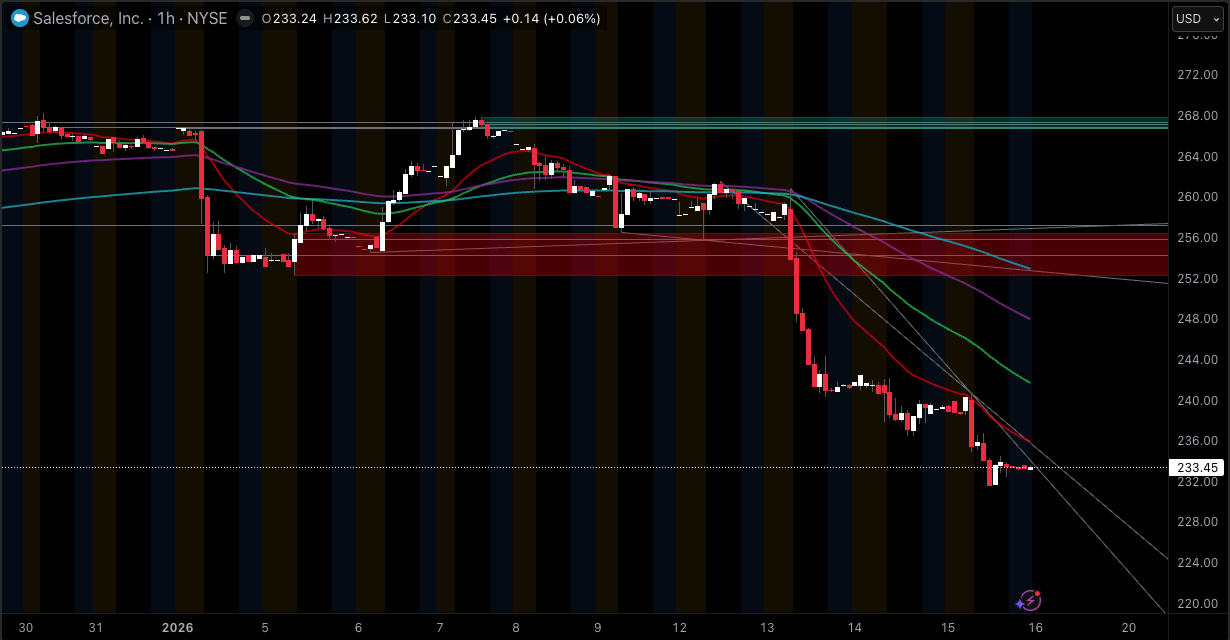

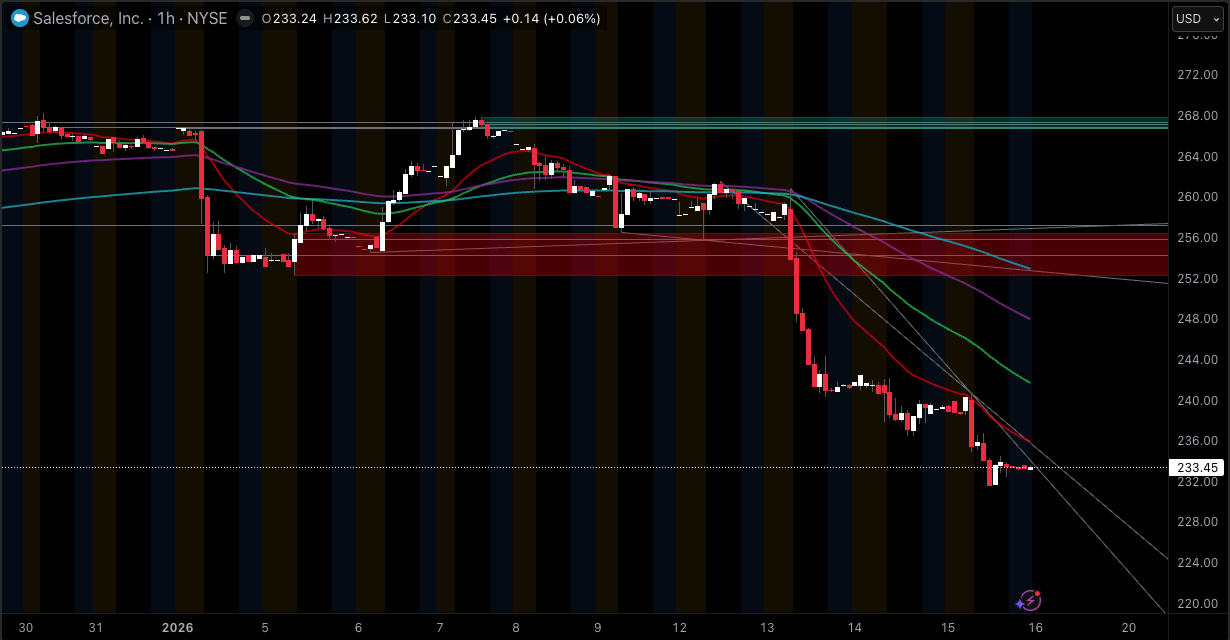

CRM Technical Analysis: Trend, Momentum, and Key levels

Trend: still bearish below the medium and long-term averages

Momentum: oversold readings suggest exhaustion, not reversal

RSI (14): ~26.7, a classic oversold zone that often precedes bounces.

Oversold signals across multiple indicators suggest selling pressure is extended, but oversold can persist in a downtrend.

Support and resistance: the market is defending a narrow shelf

Based on current pivot levels and recent lows:

Immediate support: $231 to $233, aligned with recent intraday lows and classic pivot supports.

Major support: ~$222, near the 52-week low $221.96. A decisive break below the $231 zone increases the probability of a liquidity test toward that level.

First resistance: $240 to $241, near the latest session high area.

Trend resistance zone: $252 to $259, where the 50-day and 200-day averages cluster. Reclaiming this zone on rising volume would be the first meaningful technical repair.

What Would Change The Chart?

A durable reversal usually needs two ingredients:

A higher low above $231 to $233, and

A breakout that reclaims at least the 50-day moving average, then holds it.

Until then, the technical posture remains “oversold within a broader downtrend.”

What To Watch Next: Catalysts That Can Reprice CRM Stock

AI monetization evidence: Not just deal count, but net expansion rates tied to AI workloads and measurable productivity outcomes. (Agentforce and Data 360 ARR is already nearing $1.4B, so the next question is pace and margin profile of incremental AI revenue.)

Integration execution: Any sign that Informatica strengthens Data 360 attach rates without diluting margins would reduce the “story risk” discount.

Next earnings window: The next report is widely expected around late February 2026, though published estimates vary by data provider.

Frequently Asked Questions (FAQ)

1. Why is Salesforce stock dropping right now?

The decline is largely driven by investor uncertainty around AI’s impact on enterprise software pricing. The market is waiting for clearer proof that AI agents will expand Salesforce’s revenue pool faster than automation compresses seat-based demand.

2. Is Salesforce’s business weakening, or is this mostly sentiment?

Recent operating data points to stability rather than deterioration. Q3 FY26 revenue grew 9% year over year, and cRPO rose 11%, suggesting contract demand remains intact even as investor risk appetite shifts.

3. What is Agentforce, and why does it matter for CRM stock?

Agentforce is Salesforce’s push into AI agents embedded in sales, service, and workflow execution. It matters because it can shift monetization toward higher-frequency usage and data-driven consumption. Agentforce and Data 360 ARR is nearing $1.4B.

4. What does the technical analysis say about CRM stock?

Momentum is heavily oversold, with RSI around 26.7, but the trend remains bearish because CRM is below its 50-day and 200-day moving averages. Oversold conditions can spark bounces, yet reversals typically need reclaiming key averages.

5. What price levels are most important to watch?

The near-term support zone sits around $231 to $233. A break raises downside risk toward the 52-week low near $222. On the upside, $240 is the first resistance, then the $252 to $259 area where major moving averages cluster.

Conclusion

Salesforce’s pullback is best understood as a valuation and narrative reset, not a sudden collapse in fundamentals. The company is still growing, expanding margins, generating strong cash flow, and building a data-and-agent platform that can be structurally advantaged in an AI-first enterprise.

For CRM stock to stop trading like “legacy software at risk,” the market needs repeatable evidence that AI is adding net-new spend rather than reallocating existing budgets. Until that proof shows up in sustained reacceleration and a repaired chart, the stock can remain volatile even while the business stays solid.

Sources:

https://s205.q4cdn.com/626266368/files/doc_financials/2026/q3/CRM-Q3-FY26-Quarterly-Investor-Deck.pdf

https://investor.salesforce.com/news/news-details/2025/Salesforce-Delivers-Record-Third-Quarter-Fiscal-2026-Results-Driven-by-Agentforce--Data-360/default.aspx