The post-earnings drop in SoFi stock appears to reflect a valuation adjustment rather than a fundamental issue. The company reported first-quarter revenue exceeding $1.0 billion, maintained GAAP profitability, and set 2026 targets indicating further earnings growth.

The real question for 2026 is not whether SoFi Stock can grow, but whether investors are being paid enough for the risks that come with a fast-scaling, credit-exposed fintech bank. At roughly $19.54 a share, the market is pricing in meaningful progress, but also leaving room for upside if management executes and rate and credit conditions stay constructive.

SoFi Stock Forecast: Key Takeaways For 2026

2026 Guidance Sets A Higher Floor For Earnings

Management targets adjusted net revenue of approximately $4.655 billion, adjusted EBITDA of $1.6 billion (34% margin), and adjusted EPS of $0.60 for 2026. This profile could support a valuation re-rating if the market views it as sustainable.

The “Dip” Was More About Expectations Than Results

SoFi reported Q4 2025 adjusted net revenue of $1.013 billion, adjusted EBITDA of $318 million, and GAAP net income of $174 million. Despite these results, the stock declined, reflecting a common pattern in which strong performance fails to meet heightened expectations.

Technicals Suggest Oversold Conditions, Not A Broken Trend

Momentum indicators have declined significantly. An RSI in the mid-30s and prices below long-term moving averages suggest a consolidation phase following strong gains, rather than a structural downtrend.

The 2026 Bull Case Requires Two Things: Deposit Scale And Fee Mix

To achieve a higher valuation, SoFi must secure lower-cost, stable funding and increase its share of recurring fee-based revenue. Q4 results demonstrated strong growth in fee-based income, and management is prioritizing this shift.

The Bear Case Is Still Credit And Capital

SoFi’s core lending operations are robust but carry consumer credit risk and capital requirements. Increased losses or additional capital raises could limit upside, even with revenue growth.

Why SoFi Stock Dropped: The Quarter That Triggered The Dip

SoFi’s Q4 2025 report was objectively strong:

Total net revenue: $1.025 billion (GAAP)

Adjusted net revenue: $1.013 billion

Adjusted EBITDA: $318 million, about a 31% margin

GAAP net income: $174 million;

EPS: $0.13

Members: 13.7 million (up 35% year over year)

Originations: $10.5 billion total, led by $7.5 billion in personal loans

Management positioned 2026 as a year for both growth and margin expansion, setting Q1 2026 targets of approximately $1.04 billion in adjusted net revenue and $0.12 in adjusted EPS.

SoFi Stock dropped because, after significant gains, markets often require stronger evidence of continued growth. Even strong results can prompt selling if investors anticipated greater upside or if the next catalyst appears distant. This pattern is common in fintech, where valuations can change rapidly.

The 2026 Fundamental Setup: Growth Is Real, The Mix Matters

SoFi’s 2026 guidance implies roughly 30% annual revenue growth and a move toward mid-30s EBITDA margins. That matters because valuation in 2026 will likely depend less on “members added” and more on whether SoFi is compounding earnings per share with operating leverage.

Three drivers deserve the most attention:

Lending: Scale With Discipline

Personal loans remain the engine. Q4 originations show the platform still has demand, and management highlighted stable credit performance, with charge-off commentary focused on seasoning rather than sudden deterioration.

In 2026, the market will focus on loss rates more than on volume. If unemployment rises or consumer stress broadens, high-yield personal loans will reprice the equity, even if SoFi continues to grow its membership.

Funding: Deposits Are A Strategic Weapon

SoFi’s banking charter gives it a structural edge over pure fintech lenders: deposits can be a cheaper, more stable funding source than warehouse facilities. Management has explicitly discussed the advantages of cost of funds and interest expense savings from shifting the funding mix.

Each sustained reduction in funding costs in 2026 will enhance margin stability.

Fee-Based Revenue: The Multiple Expander

Fee-based revenue reached a record in Q4 and is becoming increasingly important, as it reduces business cyclicality compared to a lending-only model.

If SoFi continues to expand its Financial Services and Technology Platform contributions while maintaining profitable lending, it will increasingly resemble a scalable digital bank with fintech infrastructure, rather than solely a lending platform.

Valuation Framework For A SoFi Stock Forecast In 2026

A 2026 forecast should begin with earnings potential and apply valuation multiples that reflect prevailing interest rates and credit conditions.

SoFi’s 2026 adjusted EPS target is about $0.60. If the market applies:

25x (skeptical multiple for consumer-credit exposure): implies roughly $15

35x (growth bank multiple if execution stays clean): implies roughly $21

45x (premium fintech bank multiple if fee mix and margins re-rate): implies roughly $27

That range is wide because SoFi occupies the intersection of banking, consumer credit, and fintech. The post-earnings dip matters because it can shift the entry price closer to the “reasonable multiple” zone if fundamentals are tracking.

Here is a simple scenario map for 2026:

2026 Scenario |

What Has To Go Right (Or Wrong) |

Plausible Price Behavior |

| Bear Case |

Credit losses rise, funding costs stay sticky, multiple compresses |

Revisits mid-teens |

| Base Case |

Guidance achieved, credit stable, valuation normalizes |

High-teens to mid-20s |

| Bull Case |

Fee growth accelerates, margins stick, market re-rates the model |

Upper-20s and above |

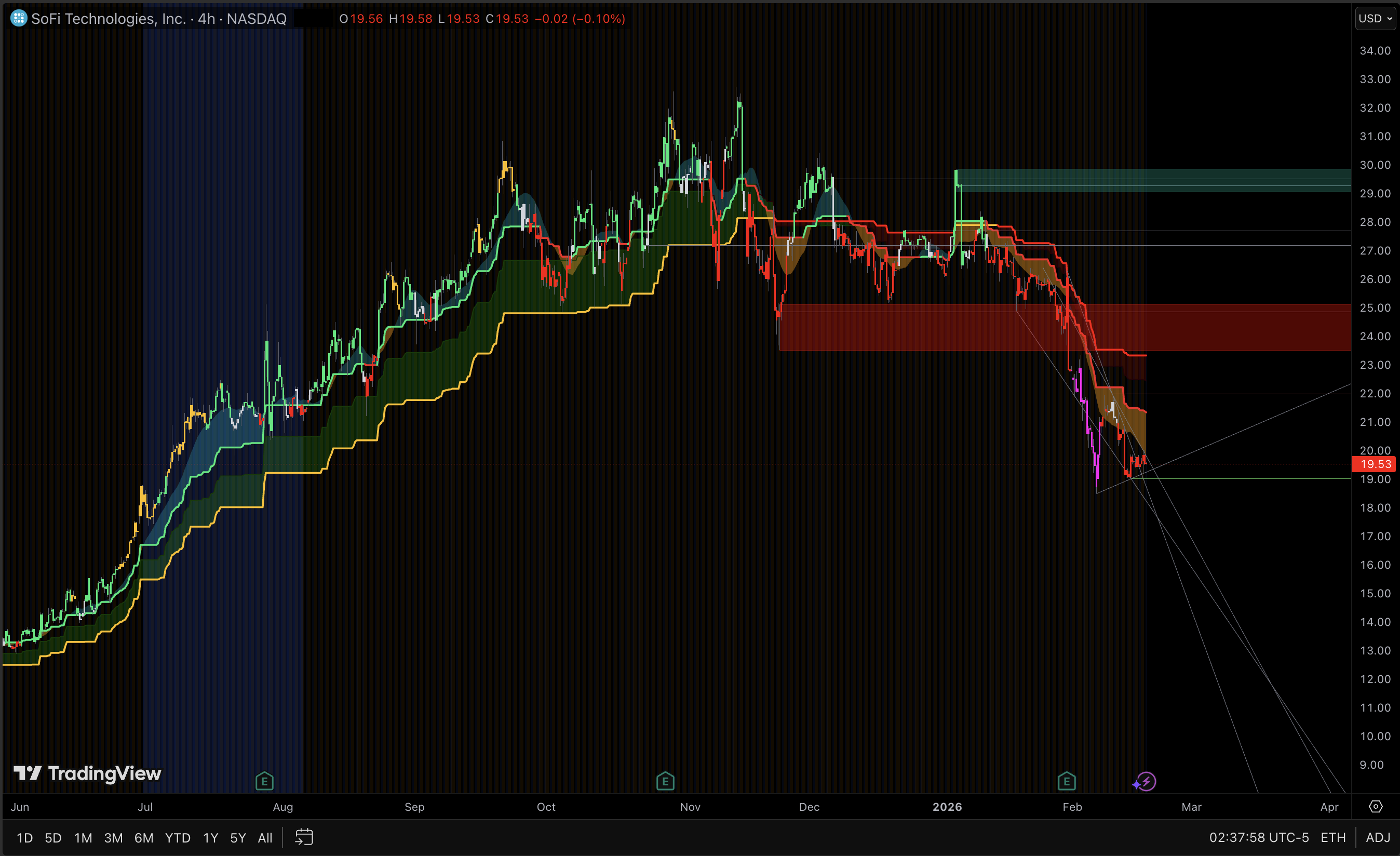

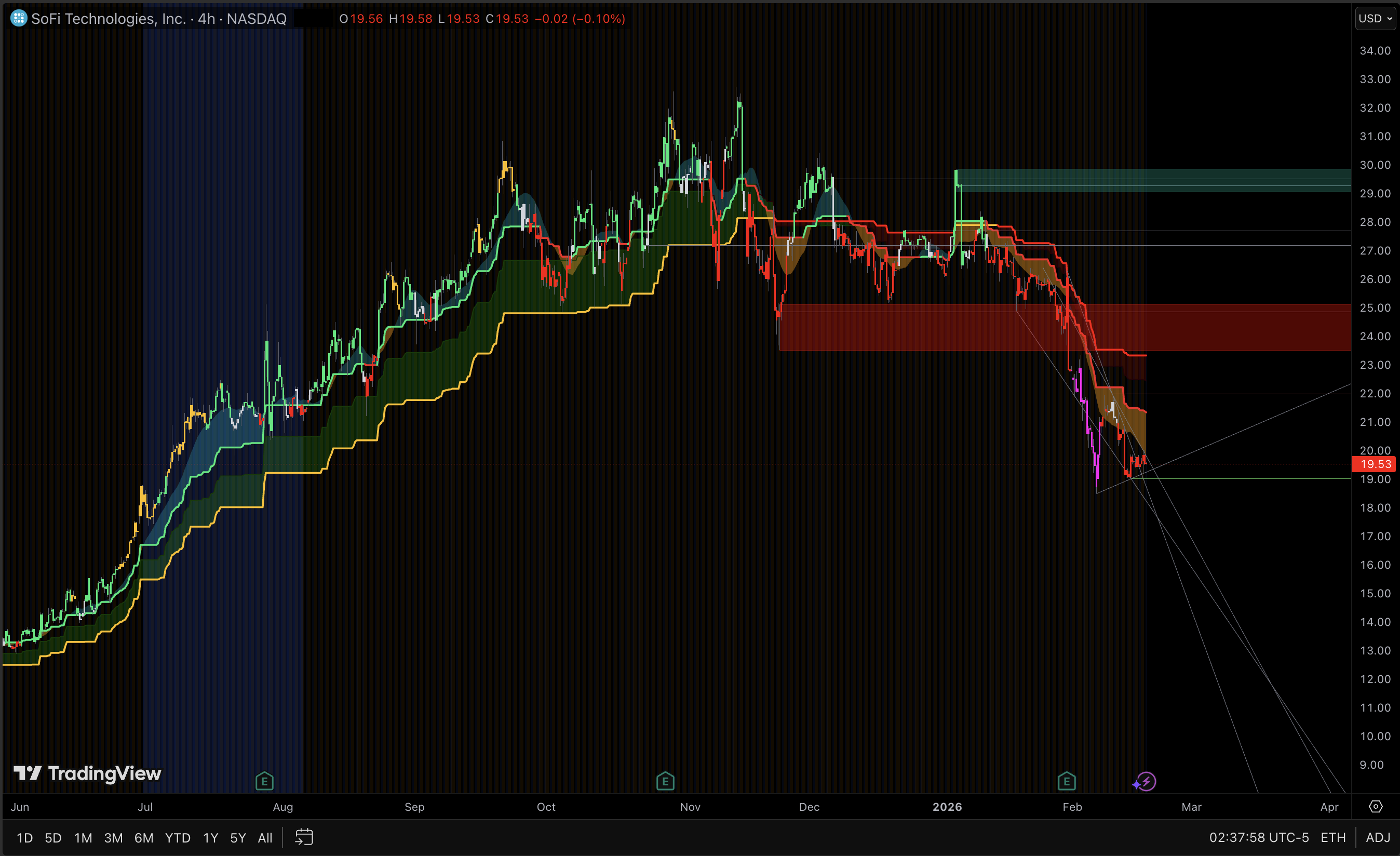

Key Levels For SoFi Stock This Week

Level |

Price |

Why It Matters [H4 Timeframe] |

| Resistance 2 |

$22.80 |

Post-earnings close area and prior supply |

| Resistance 1 |

$20.60 |

Breakdown point, reclaim line for momentum |

| Pivot Zone |

$20.00 |

Round-number retest zone, intraday magnet |

| Support 1 |

$19.20 |

Recent intraday low area, triggers risk-off |

| Support 2 |

$18.00 |

Psychological floor and high attention strike |

Technical Analysis: Key Levels To Watch After The Selloff

The post-earnings dip needs to be read through two lenses: fundamentals accelerated while price corrected. In Q4 2025, SoFi printed record net revenue of $1.025B (+40% YoY), record adjusted EBITDA of $318M (+60% YoY), and fee-based revenue of $443M (+53% YoY). Management guided 2026 to ~$4.655B adjusted net revenue, ~$1.6B adjusted EBITDA, and ~$0.60 adjusted EPS. That is not “hope,” it is explicit underwriting of scale and margin expansion.

Indicator note: The H4 signals below are estimated from recent intraday structure, as consistent broker-level H4 OHLC datasets are not always identical across feeds. The directional reads are the priority.

Metric |

Current Value |

Signal |

Practical Read |

| RSI (14) |

~42 |

Bearish |

Below 45 typically means sellers still control bounces |

| MACD (12,26,9) |

Negative |

Bearish |

Momentum under signal line, rallies fade sooner |

| ADX (14) |

~21 |

Weak |

Trend strength is soft, prone to chop around $20 |

| ATR (14) |

~$0.75 |

Normal |

Typical H4 swing size, stops need room |

| Williams %R (14) |

~-78 |

Neutral |

Near oversold, but not a buy signal alone |

| CCI (14) |

~-90 |

Neutral |

Weak momentum, needs a catalyst for follow-through |

| MA20 |

Below |

Below |

Fast trend down, bounce attempts face supply |

| MA50 |

Below |

Below |

Swing filter bearish, dips can keep dipping |

| MA100 |

Near |

Below |

Mid-term reference, reclaim improves risk/reward |

| MA200 |

Below |

Below |

Long trend line overhead, reclaim is a bigger regime shift |

| Volume vs 20D Avg |

Normal |

Normal |

Active tape, not capitulation |

| Earnings Window |

Not Near |

Not Near |

Next catalyst is macro and rate sensitivity |

| Gap Risk |

Medium |

Medium |

Prior earnings reaction raises gap probability on headlines |

Momentum And Structure

RSI and MACD are aligned bearish, which usually means bounces are tradable but less reliable, and upside follow-through needs a clear reclaim level to flip the tape.

Structurally, the H4 market has been printing lower highs and lower lows since the earnings reaction, but it is doing so in an orderly way rather than in a liquidation. That matters because orderly pullbacks often resolve into a base if a clean higher low forms near a major round number.

ATR suggests moves have enough width to punish tight risk, especially around $20. Triggers that tend to work best here are either (1) a break above resistance followed by a retest that holds, or (2) a rejection candle at support with immediate reclaim of the pivot zone.

Technical Scenarios For SoFi Stock In 2026

Scenario |

Trigger |

Invalidation |

Target 1 |

Target 2 |

| Base Case |

H4 close above $20.60, then retest holds |

$19.20 |

$22.80 |

$26.10 |

| Bull Case |

Break above $22.80 with strong close |

$20.60 |

$26.10 |

$32.70 |

| Bear Case |

H4 close below $19.20, failed reclaim |

$20.00 |

$18.00 |

$16.60 |

How those levels connect to 2026: management’s 2026 adjusted EPS guidance of ~$0.60 implies that at $19.54, the stock trades at approximately 32.6x that target. That multiple can work if growth stays near the guided trajectory, but it also explains why the tape can punish any “expectation gap,” even on headline beats.

So, Is The Post-Earnings Dip A Buy?

For long-term investors, the dip is selectively buyable, but only under a clear thesis:

Buyable if the goal is to own a scaling digital bank with expanding margins and a credible 2026 earnings guide, and if the position size respects the reality of consumer credit cyclicality.

Not buyable if the expectation is a straight-line rebound. SoFi can be volatile even when fundamentals are strong, especially when broader rate narratives and fintech multiples swing.

The 2026 setup is a phased entry: accumulation on weakness, adding only if execution shows up in quarterly prints and the chart stops making lower highs.

Frequently Asked Questions About SoFi Stock

What Is The SoFi Stock Forecast For 2026?

SoFi’s 2026 targetsprojecty adjusted net revenue ofapproximatelyt $4.655 billion and adjusted EPS of $0.60. Valuation will depend on credit and interest rate conditions, making a wide price range reasonable even if guidance is achieved.

Why Did SoFi Stock Drop After Strong Earnings?

A stock can fall after a beat when expectations were already high, positioning was crowded, or investors want clearer upside beyond guidance. That dynamic is common after big rallies, especially in fintech, where multiples move quickly.

Is SoFi Stock Profitable Now?

Yes. SoFi reported GAAP net income of $174 million in Q4 2025 and stated it has delivered multiple consecutive quarters of GAAP profitability.

What Are The Biggest Risks For SoFi Stock In 2026?

Key risks include deterioration in consumer credit, rising funding costs, and capital actions that dilute shareholders' equity. Since lending drives earnings, macroeconomic changes can impact valuation even if member growth continues.

What Technical Levels Matter Most For SOFI Stock?

The 52-week low near $8.60 marks long-term support, while the mid-$20s are significant as they align with long-term moving averages. An RSI in the mid-30s suggests selling may be nearing completion.

Is SoFi More Like A Bank Or A Fintech Stock?

SoFi trades as a fintech when growth is prioritized and as a bank when credit and interest rates are the main focus. Increased fee-based and platform revenue enhances resilience across market cycles.

Conclusion

The most reliable SoFi stock forecast for 2026 is based on the company’s projections: approximately $4.655 billion in adjusted net revenue, $1.6 billion in adjusted EBITDA, and $0.60 in adjusted EPS. If SoFi achieves these targets with stable credit quality, the recent decline may represent an opportunity driven by expectations rather than fundamentals.

Still, 2026 is not a year to buy blindly. SoFi remains a high-beta equity tied to consumer credit and market multiples. The dip is a buy only when paired with discipline: staged entries, a clear risk framework, and a willingness to track quarterly execution with the same intensity as the market will.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.