Applied Materials (AMAT) Stock approaches 2026, characterized by both strong momentum and increased scrutiny. AMAT stock currently trades near $369, close to its 52-week high of approximately $376, following a robust 12-month performance that has elevated valuation multiples to the upper end of their historical range.

The investment question for 2026 is not whether semiconductors matter. It is whether Applied can keep converting AI-driven complexity into durable earnings growth while absorbing policy friction, especially in China, without losing margin structure or share in its most profitable process steps.

AMAT Stock Forecast Key Takeaways For 2026

The outlook for 2026 is fundamentally positive. AI infrastructure investment is accelerating demand for leading-edge foundry logic, HBM DRAM, and advanced packaging, all of which align with Applied Materials’ core product and service strengths.

Valuation has become the primary constraint. With AMAT trading at approximately 31 times forward earnings and nearly 38 times trailing earnings, future appreciation is likely to depend more on earnings performance than on further multiple expansion.

China represents a significant risk factor. Management has identified a material revenue headwind in 2026 arising from export regulations and licensing constraints. Even with underlying demand, shipment timing and tool eligibility remain critical considerations.

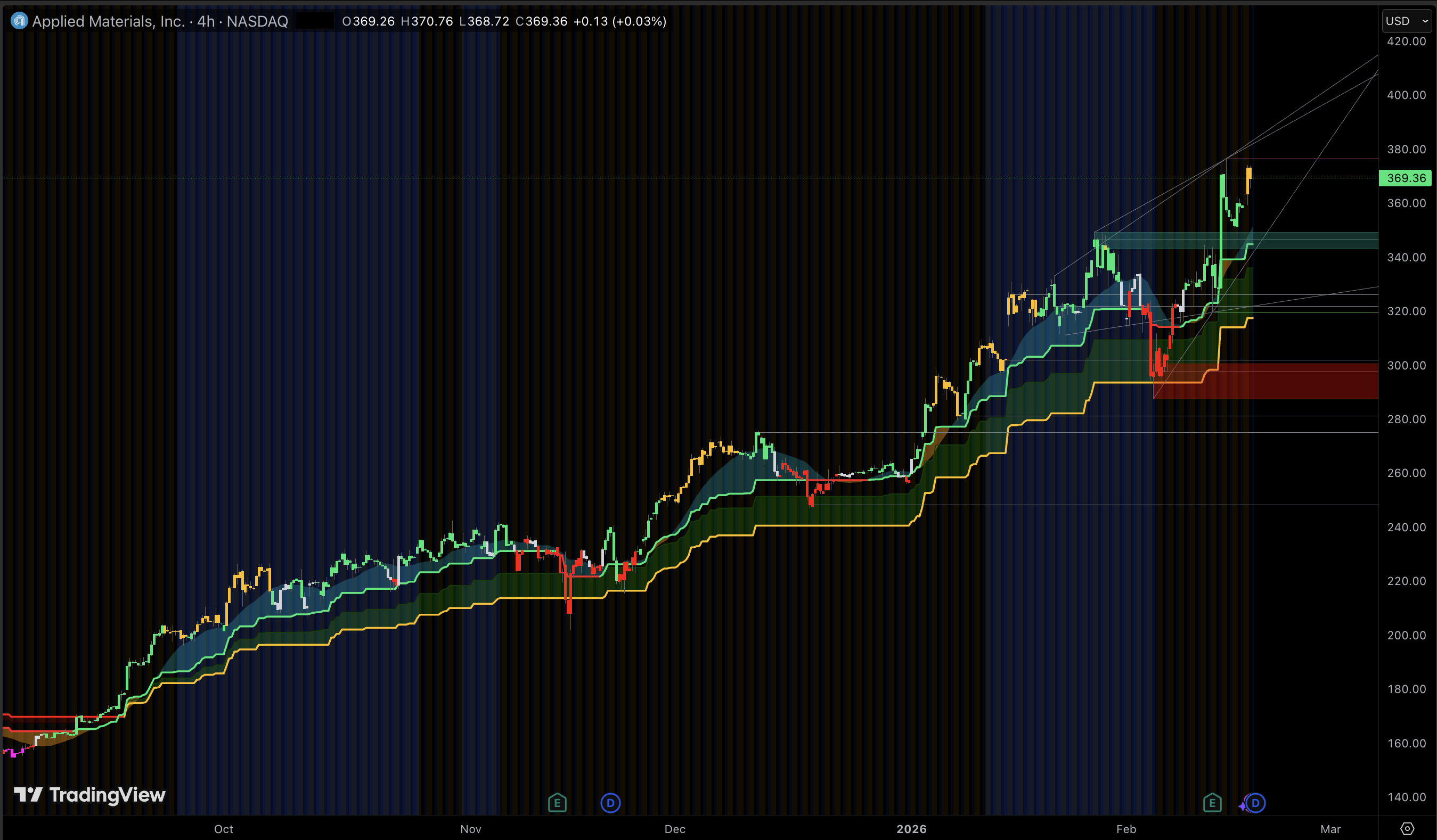

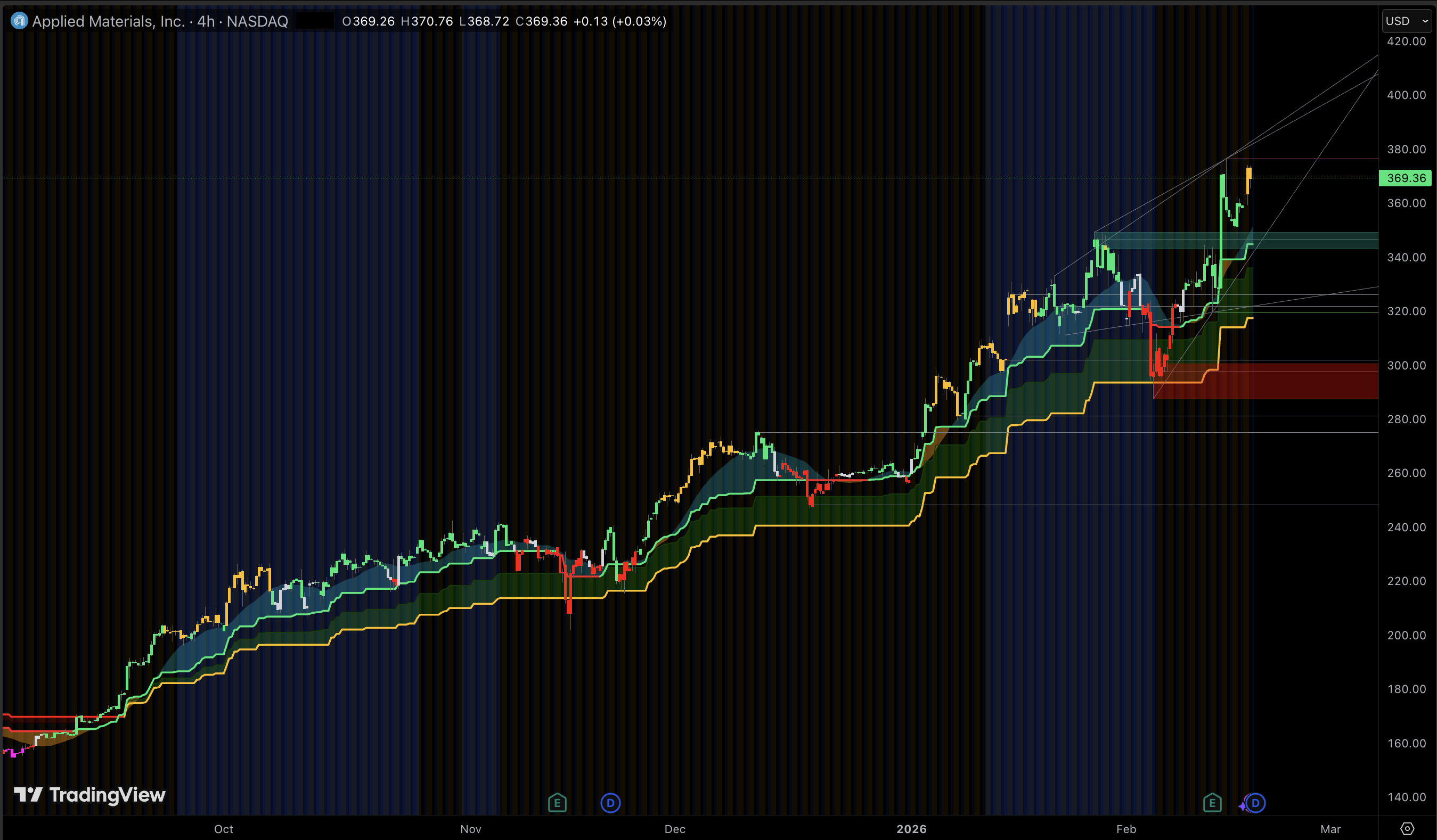

Technical indicators remain positive but suggest the stock is overextended. The price is significantly above both the 50-day and 200-day moving averages, and the relative strength index (RSI) is elevated. While this typically supports continued upward momentum, it also increases the risk of a price decline if earnings guidance falls short or adverse policy developments occur.

The base-case assessment is that Applied Materials remains attractive for long-term investors who can tolerate volatility. However, the current valuation no longer supports a passive investment approach, and a disciplined entry strategy is essential in 2026.

The Business Reality Behind The Tape

Applied Materials is more than a wafer fabrication equipment (WFE) company; it operates as a materials engineering platform that generates value across deposition, etch, patterning, metrology, inspection, and increasingly, packaging and services that enhance production ramp and yield. This distinction is important because 2026 demand is driven less by unit growth and more by performance requirements. AI chips increase power density, thermal constraints, and interconnect complexity, resulting in more process steps per wafer and greater tool intensity.

From a revenue composition standpoint, the company’s scale is concentrated in the areas where secular spending is strongest. Fiscal 2025 net revenue totaled $28.368 billion, led by Semiconductor Systems ($20.798 billion) and Applied Global Services ($6.385 billion). Segment operating margins remain structurally attractive, with Semiconductor Systems around the mid-30s percent range and AGS near the high-20s percent range in fiscal 2025.

This business mix has contributed to AMAT’s resilience during periods of uneven node transitions and memory cycles. Service revenue is linked to installed base utilization and operational efficiency, rather than solely to new fabrication facility construction. In an AI-driven capital expenditure environment, where customers prioritize speed-to-yield and cost per inference, the value of the installed base increases.

2026 Demand Drivers That Move AMAT’s Numbers

AI Compute Is Repricing Process Complexity

Investment in AI infrastructure is driving increased demand for enabling tools in leading-edge logic, DRAM, and advanced packaging. Applied Materials’ recent quarterly results demonstrate that this demand is tangible. In fiscal Q1 2026, the company reported $7.01 billion in revenue and $2.38 in non-GAAP earnings per share (EPS). For fiscal Q2 2026, guidance is approximately $7.65 billion in revenue and $2.64 EPS.

A key implication for the AMAT stock forecast is that 2026 performance is less reliant on a broad-based recovery in the consumer electronics sector. The primary growth drivers have shifted toward AI-driven foundry expansions, high-value memory (particularly HBM), and advanced packaging. These segments allow Applied Materials’ per-wafer content to increase even as overall end-market demand is volatile.

Memory Is Not A Typical Cycle In 2026

High Bandwidth Memory (HBM) is altering the dynamics of memory capital expenditures. While traditional DRAM cycles were influenced by commodity pricing and supply discipline, HBM demand is driven by computational requirements and packaging architectures. This shift can sustain equipment spending even if standard DRAM prices decline. Applied Materials’ involvement in DRAM and packaging-related process steps provides a structural advantage in this context.

Services And Installed Base Monetization

Applied Materials generated approximately $6.19 billion in free cash flow over the trailing twelve months, and its service-driven cash generation underpins ongoing shareholder returns. The installed base provides an additional source of revenue when growth in new systems moderates.

The Two Risks That Can Break The 2026 Bull Case

China Policy And Shipment Timing Risk

China is a meaningful end market for wafer fab equipment, but the issue in 2026 is not demand. It is eligibility, licensing, and timing. Export restrictions and compliance requirements have already been quantified as a 2026 revenue headwind in public disclosures and reporting around the rule changes.

The practical implication for investors is that AMAT may continue to perform well operationally, yet the stock could experience valuation declines if quarterly visibility is reduced by licensing delays. Such circumstances can result in volatility driven by news events, which technical indicators may not mitigate.

Multiple Compression Risk

With a valuation of approximately 38 times trailing earnings per share and 31 times forward earnings per share, AMAT is valued as a structural compounder. While this may be justified, it reduces the margin of safety for investors (StockAnalysis). If growth in 2026 is solid but not exceptional, the stock may decline due to multiple compression, even if earnings continue to increase.

AMAT Valuation And Capital Returns

Applied Materials’ capital return profile continues to provide support for the stock, although it does not fully offset valuation concerns at current levels.

Market Cap: about $293 billion

Free Cash Flow (TTM): about $6.19 billion

Dividend: $0.46 quarterly, or $1.84 annualized

Share Count Trend: shares down roughly 3.2% year over year

Applied distributed about $6.3 billion through dividends and repurchases in fiscal 2025, reinforcing that shareholder yield is a core part of the equity story.

Technical Analysis For AMAT Stock In 2026

In the near term, technical analysis indicates that AMAT is overextended but remains structurally sound. Momentum is positive, the trend is intact, and volatility is manageable relative to price. The primary tactical risk is not a trend reversal, but rather an overbought condition in which further gains are possible, yet new positions may underperform unless established after price corrections. Intraday indicators suggest a bullish environment with strong trend signals, although oscillators caution that pursuing momentum at current levels may be costly.

Metric |

Current Value |

Signal |

Practical Read |

| RSI (14) |

63.64 |

Bullish |

Above 55, momentum supports dips over rips |

| MACD (12,26,9) |

7.71 |

Bullish |

MACD line above signal, trend still pushing |

| ADX (14) |

30.82 |

Trending |

Trend strength is present, follow-through odds improve |

| ATR (14) |

5.68 |

Normal |

About 1.5% of price, stops need room but not extreme |

| Williams %R (14) |

-17.71 |

Overbought |

Strength is real, but pullbacks become more likely |

| CCI (14) |

67.13 |

Neutral |

Not a +100 surge, upside can pause without breaking |

| MA20 |

361.84 |

Above |

Fast trend up, pullbacks into MA20 often bought |

| MA50 |

344.40 |

Above |

Swing trend firmly up, dip-buying bias intact |

| MA100 |

332.07 |

Above |

Mid-term structure supports higher lows |

| MA200 |

323.09 |

Above |

Long trend is up, trend followers stay engaged |

| Volume vs 20D Avg |

8.78M vs 8.63M |

Normal |

Activity is healthy, not a blow-off spike |

| Earnings Window |

Feb 12, 2026 |

Not Near |

Catalyst just passed, next reset is later in the cycle |

| Gap Risk |

Elevated |

Medium |

Post-earnings repricing raises air-pocket risk on bad news |

Level |

Price |

Why It Matters [H4 Timeframe] |

| Resistance 2 |

$373.98 |

Session swing high, immediate supply trigger |

| Resistance 1 |

$370.41 |

Upper pivot band, breakout continuation line |

| Pivot Zone |

$367.13 |

Midpoint retest zone, trend control level |

| Support 1 |

$365.10 |

First demand shelf, failed-break protection |

| Support 2 |

$361.80 |

Structural floor, trend invalidation reference |

AMAT Stock Forecast 2026 Scenarios

The right way to frame 2026 is scenario-based, because the key variable is not demand. It is the balance between leading-edge strength and policy friction, and the extent to which margin is retained as customers push for cost reductions.

2026 Scenario |

What Has To Happen |

Plausible Market Reaction |

| Bull Case |

AI capex stays hot, HBM ramps accelerate, China headwinds are manageable through licenses and mix shift |

Breakout above prior highs, valuation holds |

| Base Case |

Growth continues but normalizes, services stay solid, policy friction creates quarterly noise |

Range-bound with upside bias, pullbacks become entry points |

| Bear Case |

Export limits bite harder than expected, multiple compresses as growth decelerates |

Sharp rerating despite still-healthy fundamentals |

The base-case assessment is that Applied Materials remains a high-quality compounder; however, returns in 2026 are likely to be driven by earnings growth and disciplined entry points rather than by further multiple expansion.

Frequently Asked Questions About AMAT Stock

Is Applied Materials A Buy In 2026?

Applied Materials may remain a viable investment in 2026; however, position sizing and entry timing are increasingly important. Elevated valuation levels make the stock more sensitive to changes in guidance and policy developments, even if the underlying business remains robust.

What Will Drive AMAT Stock The Most In 2026?

Spending on leading-edge logic, investment in HBM DRAM, and increased intensity of advanced packaging are the primary growth drivers. These areas increase tool intensity and benefit vendors that can enhance yield and throughput.

How Big Is The China Risk For AMAT?

China-related risk is significant because it influences both the timing and eligibility of shipments, not merely demand. Revenue headwinds in 2026, driven by export regulations and licensing constraints, may increase quarter-to-quarter volatility.

Does AMAT Pay A Dividend?

Yes. Applied pays a quarterly dividend of $0.46 per share, or $1.84 annually, and has continued to increase the payout over time alongside share repurchases.

What Technical Levels Matter Most For AMAT In 2026?

The $375 to $380 range represents near-term resistance. During pullbacks, the low-to-mid $330s has served as initial support following earnings-related volatility. The 50-day moving average provides trend support, although it is currently well below the prevailing price.

Conclusion

In summary, the AMAT stock forecast for 2026 indicates that the company is well-positioned to benefit from favorable semiconductor demand trends, a fact reflected in its current valuation. Applied Materials’ exposure to AI-driven logic, HBM, and advanced packaging provides a strong fundamental outlook, further supported by its services and cash return profile.

However, success in 2026 will likely depend on precise investment strategies. Given elevated valuation multiples and significant policy risks, optimal outcomes are more likely when purchases are made during periods of temporary weakness rather than when pursuing momentum at resistance levels. For investors seeking sustained exposure to the most valuable segments of the semiconductor equipment cycle, Applied Materials remains a viable candidate, though a more disciplined approach is warranted compared to previous years.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.