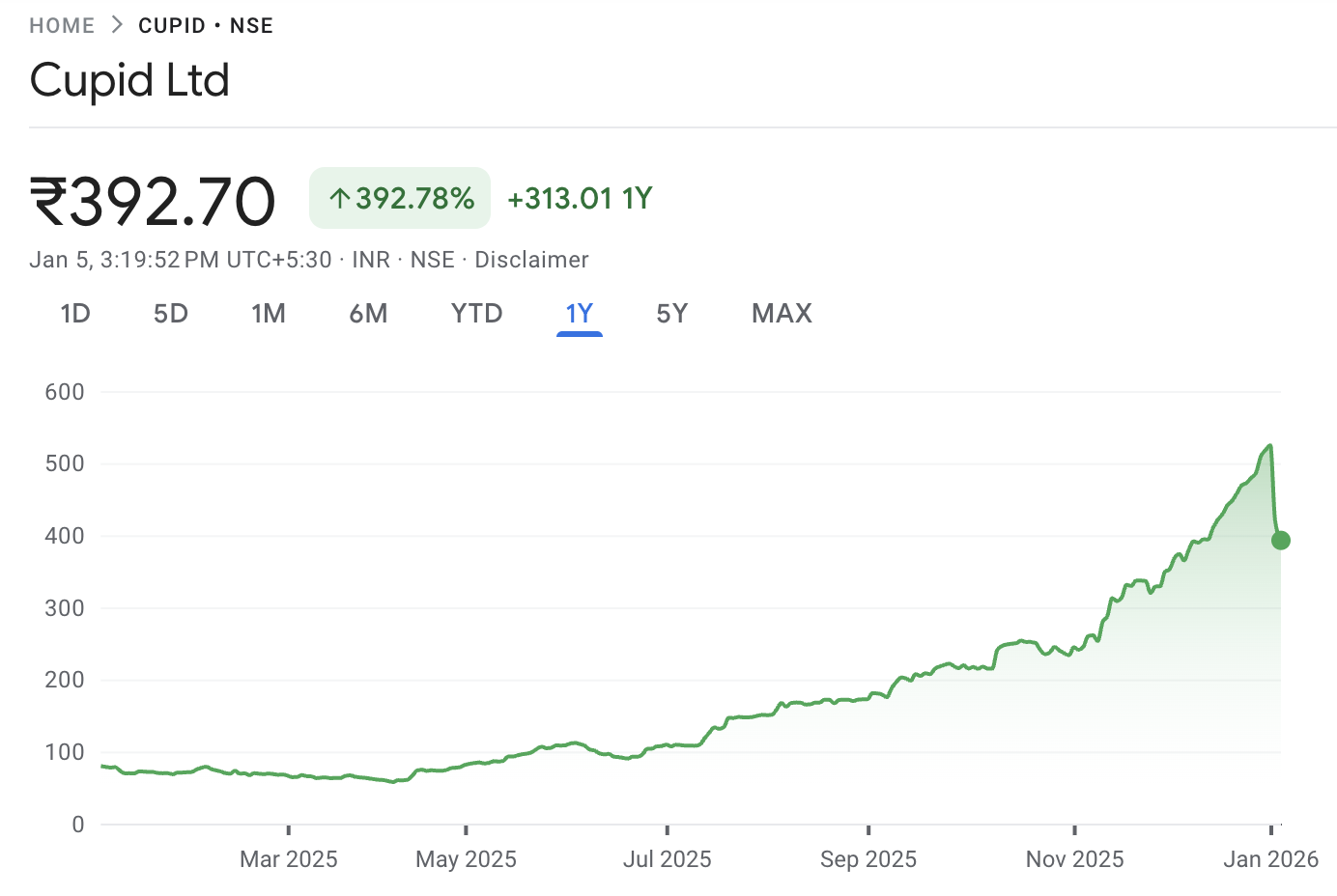

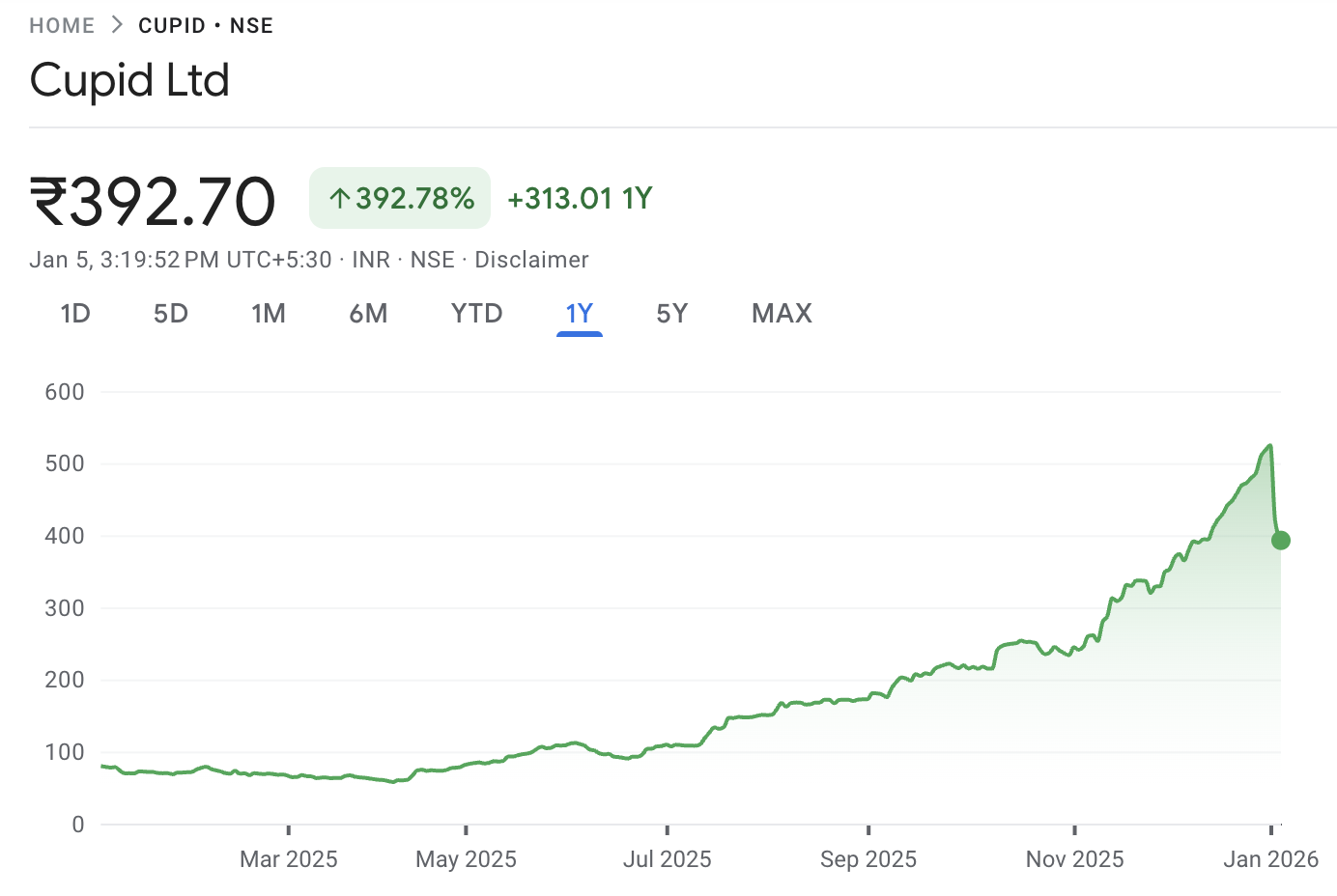

The Cupid share price has entered a sharp correction after a powerful rally that carried the stock to a 52-week high of ₹512 on December 30, 2025. The drawdown is not just a “bad day” move. It reflects a classic transition from momentum-driven pricing to a phase in which liquidity, risk controls, and expectations begin to dominate.

As of January 5, 2026 (intraday), market data shows Cupid trading around ₹372, down materially on the day. When a small and mid-cap stock shifts from steady buying to aggressive selling, the price can fall faster than fundamentals change, because the market’s microstructure changes first. Understanding that plumbing is essential to reading the next phase in Cupid’s stock story.

Why Is Cupid's Share Price Dropping

1) The correction is a reset after a steep 2025 rally

A stock that climbs quickly tends to attract short-horizon capital: traders using leverage, momentum systems, and fast rotation strategies. That money is powerful on the way up, but fragile on the way down. Once price action breaks, the unwind is rarely linear. Sellers do not arrive politely; they arrive together.

The datapoint that matters here is not only the latest price. It is the distance the stock travelled. Cupid moved from a 52-week low of ₹67.60 (January 18, 2025) to a 52-week high of ₹512 (December 30, 2025). Corrections after that kind of move are often violent even if the company remains fundamentally sound, because the market is repricing the risk premium, not merely the earnings.

2) Volatility controls can tighten liquidity and amplify downside

When exchanges apply surveillance and volatility measures, the goal is to reduce disorderly trading. The market impact, however, is predictable: liquidity thins, leverage is squeezed, and price discovery becomes jumpier.

Under the Long Term Additional Surveillance Measure framework, Stage I can include a 100% margin requirement and tighter price bands, among other actions. A 100% margin requirement is not a headline. It is a direct reduction in the system’s buying power. Traders who relied on margin must either add cash immediately or reduce positions. Many positions are reduced.

This matters to anyone tracking Cupid's share price today, because these controls do not merely slow speculation. They can mechanically create one-way markets for extended periods.

3) Price bands and “lower circuit” dynamics can trap both buyers and sellers

Many investors underestimate how price bands affect behavior. When a stock keeps hitting the lower band, buyers step back because they expect better prices. Sellers rush because they fear getting stuck. That imbalance can persist.

Exchanges also explain how price band flexing works in trend moves, but the core point is simple: in fast markets, the band becomes a gatekeeper for liquidity. That is why a falling Cupid Ltd share price can look “irrational” for a few sessions. It is often microstructure first, fundamentals second.

4) Expectations can outrun earnings, even when earnings are improving

To judge whether the fall is purely technical or partly fundamental, focus on operating reality versus the expectations embedded in the prior price.

For the quarter ended September 30, 2025, Cupid reported consolidated revenue from operations of ₹8,144.68 lakh (about ₹81.45 crore), up strongly from the comparable period a year earlier. For the six months ended September 30, 2025, revenue from operations was ₹14,425.17 lakh (about ₹144.25 crore).

Those numbers point to a business that is scaling. But a stock can still fall hard if the earlier valuation assumed even faster growth, higher margins, or a cleaner path to repeatability. The market does not punish only “bad companies.” It punishes mismatched expectations.

5) Business concentration shapes risk, and the market reprices that risk quickly

Cupid’s annual disclosures show the company’s turnover concentration. In FY 2024-25, female condoms contributed 63.71% of turnover, male condoms 14.67%, and IVD sales 6.76%, with fragrances and deodorants also contributing.

Concentration is not automatically negative, but it increases sensitivity to procurement cycles, tender dynamics, export timing, and regulatory or program-level demand swings. When a stock is priced for perfection, concentration becomes a valuation discount factor. In corrections, the market tends to widen that discount.

6) Balance sheet events can change sentiment, even when they are technically positive

Cupid disclosed that convertible warrants reached expiry on September 13, 2025, and were not exercised, and that a non-refundable upfront amount of ₹96.30 crore was retained, implying no equity dilution from that instrument.

This is fundamentally supportive for existing shareholders because dilution risk is reduced and cash is retained. Yet markets can still react in complex ways. If a speculative narrative had been built around future growth capital or a specific funding route, the disappearance of that route can force a narrative reset even if the balance sheet improves.

7) Promoter pledge overhang can distort trading, even when it improves

Pledge levels matter because pledged shares can serve as a forced-selling channel if collateral values decline. Cupid filed that pledged shareholding was reduced from 36.13% (as of September 30, 2025) to 20% (as of December 23, 2025).

A reduction is positive. But during a sharp price fall, the market often stays sensitive to anything pledge-related because it is assessing tail risk, not only the base case. This is one reason the cupid shareholding pattern and pledge disclosures often coincide with higher stock price volatility, even when the direction of change is favorable.

What Matters Next For Cupid Stock Analysis

Watch 1: Liquidity signals, not only fundamentals.

For the near term, the most important drivers are market mechanics:

Whether the stock stops repeatedly touching the lower band

Whether volumes normalize without sharp price gaps

Whether the bid-ask spread tightens again

Whether the stock trades two-sided rather than one-sided

If these improve, the price can stabilize even before the next earnings release.

Watch 2: Operating consistency across quarters

For long-term investors looking beyond Cupid's share price chart volatility, the key test is repeatability:

Revenue growth that does not depend on one-off timing

Stable gross margin behavior through cycles

Working capital discipline, especially receivables and inventory

Export mix stability and customer concentration risk

The market tends to forgive a single soft quarter if the long-run trajectory is credible. It does not forgive repeated unpredictability when the valuation was previously premium.

Watch 3: Capital allocation and capacity decisions

Any capex decision, new facility, or manufacturing expansion can be value-creating, but it can also change the risk profile. Investors should track whether growth is being pursued with controlled capital intensity and whether returns on incremental capital remain attractive.

Watch 4: Valuation compression versus business deterioration

A brutal truth of small-cap corrections is that price can fall sharply without the business deteriorating. That is valuation compression. The distinction matters because the recovery path differs:

If it is mostly valuation compression, stabilization can occur once forced selling ends and risk appetite returns.

If it is business deterioration, recovery typically requires either earnings re-acceleration or a long period of re-rating.

The recent revenue trajectory supports the view that the business has been expanding, but the stock can still correct deeply if the prior price assumed too much, too quickly.

A Practical Framework For Investors Tracking Cupid's Share Price On The NSE And BSE

Separate price action from business reality. A 10% to 20% move can be a microstructure. A multi-month downtrend needs a fundamental check.

Treat leverage-driven rallies as fragile. The faster the rise, the more violent the unwind tends to be.

Monitor surveillance and risk controls. These can change demand overnight through margin requirements and trading conditions.

Anchor to operating data. Revenue scale, margins, and cash conversion are the long-run gravity.

Track pledge and promoter signals. Improvements reduce tail risk, but markets react to the level during drawdowns.

Frequently Asked Questions (FAQ)

1. What is the main reason Cupid's share price is falling?

The decline is best explained as a post-rally reset where liquidity conditions and volatility controls matter as much as fundamentals. After a move from under ₹100 to above ₹500 within the same 52-week window, corrections tend to be sharp as leveraged and momentum positions unwind.

2. Does this fall mean Cupid’s business is weak?

Not necessarily. Recent filings show revenue scaling in FY25 and through the first half of FY26 (up to September 30, 2025). A falling stock price can reflect valuation normalization and market mechanics even when operations are improving.

3. How do surveillance measures affect Cupid's stock price?

Under long-term surveillance frameworks, Stage I can include a 100% margin and tighter price bands. These reduce leverage and shrink marginal demand, which can amplify downside in the short run.

4. Is the promoter pledge still a risk?

Pledged shareholding was disclosed as reduced to 20% as of December 23, 2025, from 36.13% as of September 30, 2025. The direction is constructive, but the market can still price pledge-related tail risk during sharp drawdowns.

5. What should investors watch before assuming a bottom in Cupid's share price today?

Look for two-sided trading, fewer lower-band touches, normalized spreads, and stable volumes. Then cross-check with the next set of financial results and working capital behavior.

Conclusion

The Cupid share price is dropping because the stock has shifted from a momentum regime to a risk-control regime. After a dramatic 2025 rise, the market is now repricing the stock through the lens of liquidity, leverage, and expectations. Surveillance conditions and price band mechanics can intensify the move, temporarily disconnecting price from operating progress.

For investors, the right approach is disciplined and data-led: treat short-term price action as a signal about positioning and liquidity, while using quarterly performance, cash conversion, product concentration, and pledge trends to judge the long-term business trajectory.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.