Exxon Mobil, Chevron, Shell, BP and ConocoPhillips stand out as the best oil stocks of 2025. supported by solid balance sheets and steady cash flow.

As the year closes, the energy sector shows resilience despite softer prices and uneven global demand. The leading oil companies continue to deliver dependable dividends and disciplined capital returns, keeping them attractive to long-term investors.

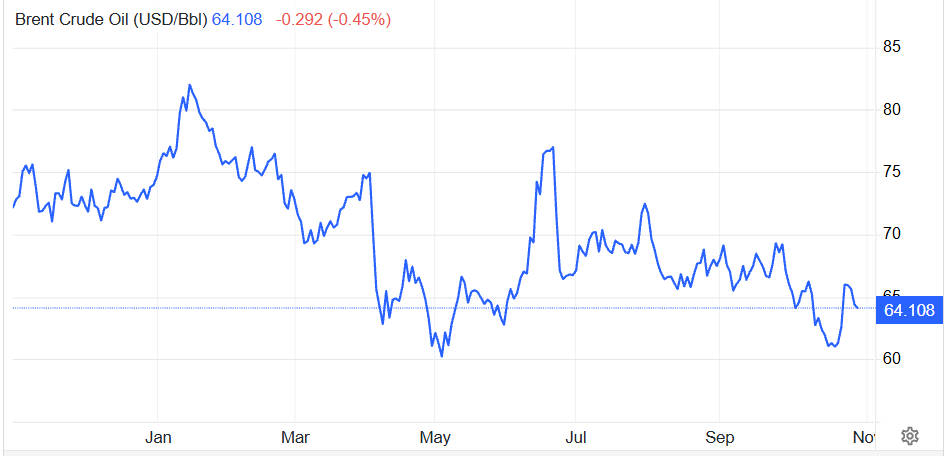

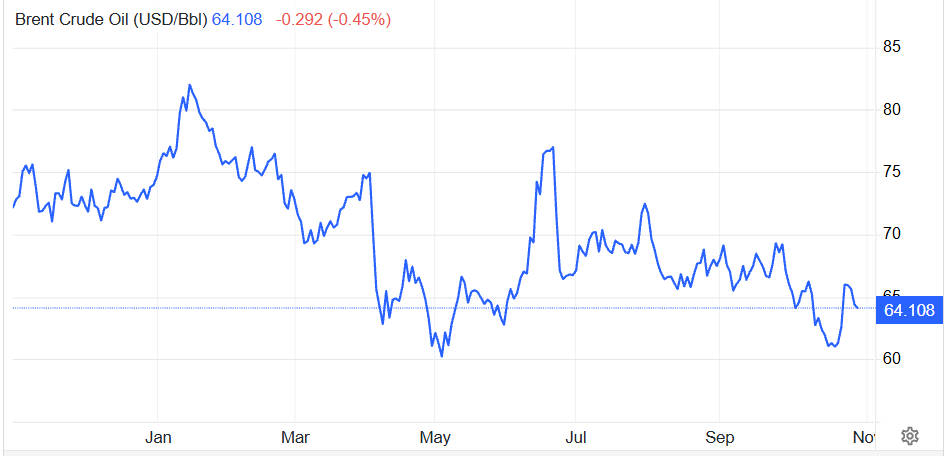

With oil prices hovering near US $64 per barrel and global supply rising faster than demand, investors now face a more selective landscape where scale, cost discipline and capital efficiency define success.

This article reviews 2025's top performers, examines the forces shaping the oil market, highlights key selection metrics, and provides a practical guide to positioning for 2026.

Best Oil Stocks to Buy Now: 2025 Performance Leaders

Below is a ranking of the top five oil stocks based on market cap, dividend yield, and recent performance as of 29 October 2025.

| Company |

Ticker |

Market Cap (USD bn) |

Dividend Yield (Forward %) |

Key Strengths |

| Exxon Mobil |

XOM |

490 |

3.4 |

Integrated operations, strong free cash flow, consistent buybacks |

| Chevron |

CVX |

310 |

4.4 |

Disciplined capital allocation, high dividend yield |

| Shell plc |

SHEL |

217 |

3.9 |

Diversified refining and trading operations, energy transition projects |

| BP plc |

BP |

80 |

4.5 |

Attractive yield, strategic repositioning under activist guidance |

| ConocoPhillips |

COP |

140 |

3.6 |

Low-cost upstream production, high leverage to oil price upside |

Key observations

Large integrated producers dominate the top positions due to diversified cash flow and reliable shareholder returns.

Dividend yield remains a differentiating factor for retail investors seeking income.

Upstream specialists like ConocoPhillips benefit from breakeven cost advantages during price volatility.

Market Backdrop: Energy Sector Dynamics in 2025

Understanding oil stock performance requires a review of macro and micro factors influencing the sector:

Oil Prices:

Brent crude has traded near US$64 per barrel in late October 2025, down from earlier peaks, reflecting slower demand growth and inventory accumulation.

Supply:

OPEC+ and non-OPEC producers increased output in 2025. with global supply projected to rise further in 2026.

Demand:

Global oil demand is growing modestly at around 0.7 million barrels per day, driven mainly by emerging economies.

Volatility Factors:

Geopolitical tensions, regulatory shifts, and inflationary pressures continue to affect pricing and operational decisions.

Implications for investors

Upstream exposure is more volatile and requires attention to breakeven costs.

Integrated and midstream companies offer smoother cash flows and lower cyclicality.

Dividend reliability and capital discipline are critical for retail investors during uncertain cycles.

Key Metrics for Selecting the Best Oil Stocks

Successful stock selection relies on objective, data-driven criteria:

Cash Flow: Positive and consistent free cash flow after capital expenditure

Balance Sheet Strength: Low net debt to EBITDA ratio or clear deleveraging plans

Breakeven Costs: Producers with breakeven costs below mid-cycle oil prices are resilient

Capital Allocation: Evidence of disciplined buybacks and conservative capex

Business Mix: Integration or midstream exposure reduces cyclicality

Dividend Sustainability: Stable payout ratios and growth history

Transition Strategy: Investment in low-carbon projects and ESG compliance

Selection Criteria Table

| Category |

What to Monitor |

| Cash Generation |

Free cash flow per share and operating cash flow |

| Balance Sheet |

Net debt to EBITDA < 1.5x or trending down |

| Cost Competitiveness |

Upstream breakeven < US$45 per barrel |

| Shareholder Returns |

Sustainable dividends, buybacks, and payout ratios |

| Business Diversity |

Upstream, midstream, and downstream integration |

| ESG Readiness |

Publicly stated low-carbon or transition initiatives |

Category Breakdown: Investment Approaches in Oil Stocks

1. Integrated Supermajors

Examples: Exxon, Chevron, Shell, BP

Diversified revenue streams across exploration, refining and trading

Provides stable cash flow and reliable dividends

Lower earnings volatility relative to upstream-only producers

2. Low-Cost Upstream Producers

Examples: ConocoPhillips, EOG Resources

High earnings leverage to oil price increases

Attractive breakeven costs provide resilience during price drops

Greater volatility than integrated majors

3. Refining and Midstream Companies

Examples: Phillips 66. Kinder Morgan

Stable cash flow from processing fees and transport contracts

Less sensitive to crude price swings

Earnings dependent on refining margins and regulatory conditions

4. Oilfield Services and Equipment

Examples: Schlumberger, Halliburton

5. Risk Factors and Mitigation Strategies

Retail investors should consider explicit risks:

Price Risk: Oil price declines can sharply reduce earnings

Regulatory Risk: Stricter carbon regulations may affect profitability

Operational Risk: Cost inflation or production disruptions

Geopolitical Risk: Conflicts or sanctions affecting key regions

Valuation Risk: Overpaying for expected growth

Mitigation Tactics

Diversify across integrated, upstream, and midstream stocks

Limit position sizes based on risk tolerance

Consider ETFs for broad exposure with lower volatility

Monitor breakeven costs, dividends, and macroeconomic indicators regularly

Portfolio Allocation Guidance for Retail Investors

1.Conservative Income-Focused Portfolio

60% Integrated majors

30% Midstream/refining

10% Low-cost upstream producers

2. Balanced Growth and Income Portfolio

40% Integrated majors

30% Low-cost upstream producers

20% Midstream/refining

10% Oilfield services or selected growth names

3. Practical Monitoring Tips

Track quarterly free cash flow and dividend announcements

Review breakeven cost updates from company presentations

Follow IEA and EIA reports for supply and demand insights

Frequently Asked Questions

Q1: What are the best oil stocks to buy now?

A: Exxon, Chevron, Shell, BP and ConocoPhillips combine cash flow, dividends and resilience in 2025.

Q2: Are oil stocks still a good long-term investment?

A: Yes. Oil remains critical for transportation and petrochemicals, and companies with strong balance sheets and transition strategies remain attractive.

Q3: Which metrics should investors prioritise?

A: Free cash flow, net debt to EBITDA, breakeven costs, dividend coverage and capital allocation discipline.

Q4: How much of a portfolio should be in oil stocks?

A: Retail investors typically hold a modest 5–15% allocation. ETFs can provide core exposure, while individual stocks can be used for higher conviction positions.

Q5: What is the outlook for oil prices?

A: Brent is averaging around US$64 per barrel in late 2025. with forecasts for slight softening in 2026 depending on supply, demand and geopolitical developments.

Conclusion

Investors should begin with top-performing integrated majors for a stable core, add measured exposure to low-cost upstream producers for cyclical upside, and consider midstream/refining names for income and cash-flow stability. Discipline, monitoring key metrics, and understanding macro trends are essential for navigating the transition from 2025 into 2026 successfully.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.