Energy stocks are entering 2026 in a structurally different position from past low oil price cycles. The global crude market remains well supplied, pricing power is limited, and volatility has compressed into narrower ranges. Yet beneath subdued benchmarks, balance sheets across the energy sector are stronger, capital discipline is tighter, and cash generation is increasingly decoupled from headline oil prices.

This shift is redefining how investors should approach energy stocks in a low-price environment. The opportunity set is no longer about directional oil exposure. It is about ownership of companies that can compound value through efficiency, downstream integration, disciplined capital returns, and structural cost advantages even when crude struggles to break higher.

2026 Key Investment Takeaways

Energy stocks that outperform in a low oil price regime share three defining traits.

First, they operate at the lower end of the global cost curve, allowing for free cash flow generation even if oil prices remain capped below long-term averages.

Second, they prioritize shareholder returns through dividend payments and buybacks rather than production growth. Third, they benefit from diversification across refining, chemicals, natural gas, or infrastructure, reducing reliance on upstream margins.

For 2026, the most attractive energy stocks are not speculative producers. They are integrated majors, disciplined shale operators, resilient midstream firms, and selectively positioned energy infrastructure names. These companies are structurally built to monetize stability rather than volatility, making them well-suited for an extended period of low oil prices.

Why Low Oil Prices Do Not Mean Weak Energy Stocks

Low oil prices historically crushed margins across the energy sector. That relationship has weakened materially. Break-even costs across US shale basins have fallen sharply, refinery margins remain supported by structural undercapacity, and capital spending discipline has reduced the boom-bust cycle that once defined the industry.

More importantly, energy companies are no longer chasing volume growth. Production flatlines paired with aggressive capital returns have turned energy stocks into yield-driven assets. In a market where real yields remain elevated and equity valuations are stretched, this cash flow profile carries growing strategic value.

Top 10 Energy Stocks to Buy in 2026 When Oil Prices Stay Low

| Company |

Price Range |

Dividend Yield |

Forward Dividend Yield |

5-Year Growth Profile |

| Exxon Mobil |

$125–$130 |

~3.5% |

~3.5%–4% |

Strong triple-digit total return driven by buybacks and downstream strength |

| Chevron |

$160–$165 |

~4% |

~4%–4.5% |

Solid double-to-triple-digit return with low volatility |

| Shell |

$70–$75 |

~4% |

~4%–4.5% |

Roughly doubled over five years on LNG and refining margins |

| TotalEnergies |

€60–€65 |

~4.5% |

~4.5%–5% |

Steady double-digit annualised returns with diversified earnings |

| ConocoPhillips |

$115–$125 |

~3% |

~3%–3.5% |

Strong total returns driven by capital discipline |

| EOG Resources |

$105–$110 |

~2.5%–3% |

~3% |

Triple-digit gains from cost leadership and FCF returns |

| Devon Energy |

$45–$50 |

~4%–6% (variable) |

~4%–5% (base + variable) |

Returns driven primarily by dividends rather than price |

| Diamondback Energy |

$150–$160 |

~3% |

~3%–3.5% |

Strong multi-year gains from operational efficiency |

| Enterprise Products Partners |

$32–$33 |

~7% |

~7%–7.5% |

Stable income-driven returns with limited price growth |

| Kinder Morgan |

$17–$19 |

~6% |

~6% |

Moderate returns led by dividends and gas demand growth |

1. Exxon Mobil

Exxon Mobil remains one of the most resilient energy stocks in a low oil price environment. Its scale across upstream, refining, chemicals, and LNG creates margin stability when crude prices soften, while low global breakeven levels support consistent free cash flow generation.

Exxon Mobil currently trades around $125–$130, offers a dividend yield of around 3.5%, and over the past five years has delivered well over 200% total return, driven by disciplined capital allocation, downstream strength, and aggressive buybacks, with steady compounding expected into 2026.

2. Chevron

Chevron combines upstream discipline with one of the strongest balance sheets in the energy sector. Capital spending remains conservative, while shareholder returns are prioritised through dividends and buybacks, limiting downside risk in a flat oil price environment.

Chevron shares trade near $160–$165, carry a dividend yield of roughly 4%, and over the last five years have generated approximately 100%–120% total return, positioning the stock for stable, low-volatility performance through 2026.

3. Shell

Shell is structurally well-positioned for low oil prices due to its dominant LNG trading business, refining exposure, and chemicals operations, allowing it to monetise volatility rather than rely on crude price appreciation.

Shell trades close to $70–$75, offers a dividend yield of around 4%, and over the past five years, its share price has roughly doubled, with returns driven primarily by downstream and LNG strength.

4. TotalEnergies

TotalEnergies benefits from a diversified earnings base spanning LNG, power generation, and upstream operations, reducing dependence on oil prices while maintaining strong cash generation.

TotalEnergies trades around €60–€65, provides a dividend yield of approximately 4.5%, and over the past five years has delivered solid double-digit annualised returns, supported by capital discipline and shareholder-focused strategy.

5. ConocoPhillips

ConocoPhillips stands out among independent producers due to its globally diversified assets and low reinvestment intensity, offering more earnings stability than shale-heavy peers.

ConocoPhillips trades near $115–$125, carries a dividend yield of around 3%, and over the last five years has produced strong total returns, driven primarily by buybacks and disciplined capital returns rather than oil price leverage.

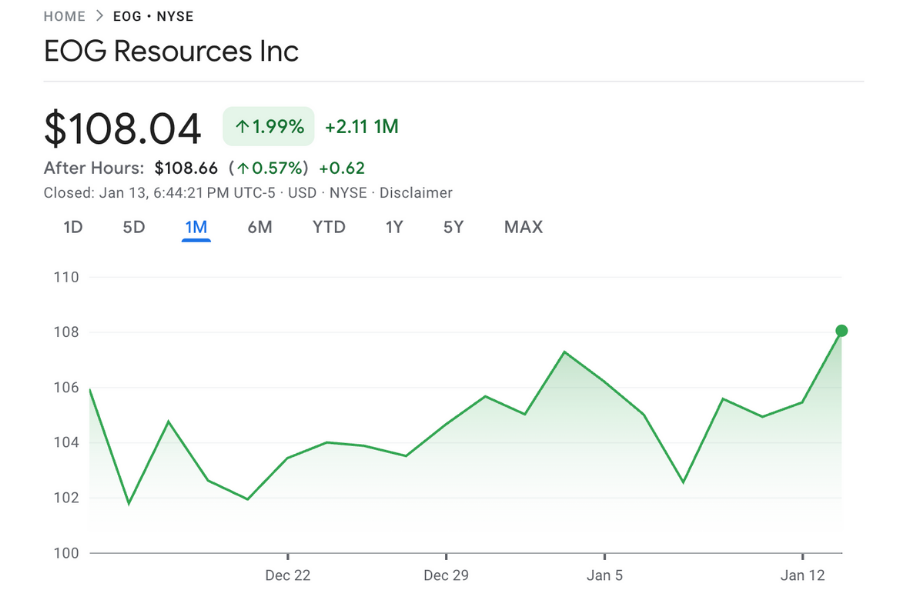

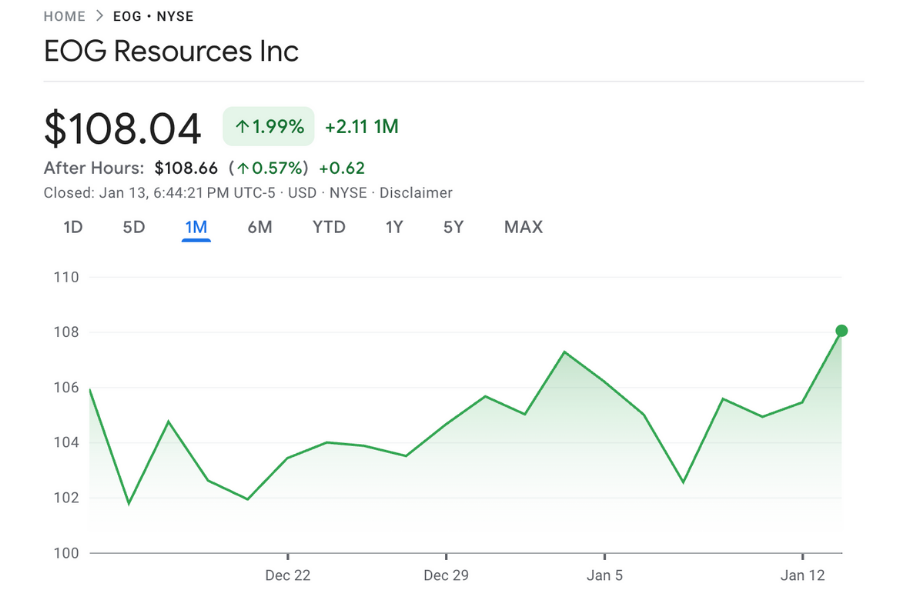

6. EOG Resources

EOG Resources continues to differentiate itself through industry-leading well economics and premium drilling inventory, allowing profitability at oil prices that would pressure most shale competitors.

EOG Resources trades around $105–$110, offers a dividend yield of approximately 2.5%–3%, and over the past five years has delivered strong triple-digit gains, with future returns increasingly driven by shareholder distributions.

7. Devon Energy

Devon Energy operates as a cash-return-focused shale producer, using a variable dividend model that adjusts payouts based on free cash flow and commodity pricing.

Devon trades near $45–$50, with a dividend yield that typically ranges between 4% and 6% depending on oil prices, and over the past five years has generated returns largely driven by income rather than sustained share price appreciation.

8. Diamondback Energy

Diamondback Energy remains one of the most efficient operators in the Permian Basin, combining low costs with disciplined reinvestment and balance sheet improvement.

Diamondback trades around $150–$160, offers a dividend yield of around 3%, and over the past five years has delivered strong triple-digit returns, supported by operational efficiency rather than aggressive growth.

9. Enterprise Products Partners

Enterprise Products Partners operates fee-based pipelines, storage, and export infrastructure with cash flows that are largely insulated from oil price movements.

Enterprise Products Partners operates fee-based pipelines, storage, and export infrastructure with cash flows that are largely insulated from oil price movements.

Enterprise Products Partners trades near $32–$33, provides a high distribution yield of around 7%, and over the past five years has delivered stable total returns driven primarily by income rather than price appreciation.

10. Kinder Morgan

Kinder Morgan benefits from long-term growth in natural gas demand linked to LNG exports and power generation, making it relatively insensitive to oil prices.

Kinder Morgan trades around $17–$19, offers a dividend yield of approximately 6%, and over the past five years has delivered moderate total returns largely driven by dividends, reinforcing its role as an income-focused energy stock for 2026.

Risk Factors to Monitor in 2026

Even resilient energy stocks face structural risks. Regulatory pressure, unexpected demand slowdowns, and geopolitical supply shifts can compress margins. However, the companies highlighted above are positioned to absorb these risks through scale, diversification, and financial strength.

Investors should also monitor refining spreads, LNG contract pricing, and capital allocation trends, as these will increasingly drive performance when oil prices remain range-bound.

Oil Prices and Energy Sector 2026 Outlook

Oil prices in 2026 are expected to remain range-bound and structurally pressured, as global supply growth continues to outpace demand.

Current projections suggest:

Forecasts project Brent crude averaging about $55 per barrel in 2026 and WTI around $51 per barrel, underpinned by continued inventory accumulation and supply growth that outpaces consumption. [1]

Some analyst ranges and bank forecasts also place Brent prices mostly within $50–$60 per barrel for the year, with some models suggesting downside risk toward $50 by mid-2026 if the supply glut deepens or demand remains soft. [2]

Polls of economists and analysts find similar expectations, with Brent and U.S. crude average forecasts clustering around low-to-mid $50s, reflecting ongoing market surplus concerns.

For energy equities, this outlook reinforces a key shift. Returns in 2026 are unlikely to be driven by rising oil prices. Instead, performance will depend on free cash flow resilience, dividend sustainability, and disciplined capital allocation. Companies with low breakeven costs, diversified operations, and fee-based or downstream income streams are best positioned to perform in a prolonged low-price environment.

Frequently Asked Questions (FAQ)

1. Are energy stocks still attractive if oil prices stay low in 2026?

Yes. Energy stocks with structurally low breakeven costs, diversified earnings streams, and strict capital return frameworks can sustain positive free cash flow even in flat pricing regimes. In this environment, equity performance is driven less by oil price beta and more by balance sheet efficiency, payout sustainability, and per-share cash flow accretion.

2. Which energy stocks perform best during low oil price cycles?

Integrated majors and midstream operators tend to outperform during prolonged low price periods. Refining, chemicals, LNG, and fee-based infrastructure revenues offset upstream margin compression, allowing these businesses to stabilize earnings while maintaining shareholder distributions when pure-play producers face earnings volatility.

3. Are dividends from energy stocks safe when oil prices are low?

For high-quality energy companies, base dividends are typically underpinned by conservative payout ratios and stress-tested cash flow assumptions. While variable dividends and buybacks may flex with commodity pricing, core dividends at disciplined operators are generally protected by strong balance sheets and reduced reinvestment intensity.

4. Should investors avoid shale producers when oil prices are weak?

Shale exposure should be selective rather than avoided outright. Operators with premium acreage, low decline rates, and drilling inventories capable of generating returns at conservative oil prices can remain free-cash-flow positive. High-cost producers with leverage-dependent growth models face structural underperformance in low-price environments.

5. Do low oil prices reduce long-term upside for energy stocks?

Not necessarily. Lower prices often reinforce capital discipline, limit value-destructive growth, and accelerate share repurchases. Over time, restrained supply growth and declining reinvestment requirements can support per-share earnings expansion even without a sustained recovery in oil prices.

Conclusion

Energy stocks in 2026 are no longer a blunt instrument tied solely to oil price direction. The sector has matured into a cash flow-driven asset class where efficiency, discipline, and diversification define success. In a prolonged low oil price environment, the winners will be companies that treat stability as a feature rather than a constraint.

Investors who focus on structurally resilient energy stocks, rather than speculative upside, can still extract durable value from the sector. The opportunity lies not in predicting oil prices, but in owning businesses engineered to thrive without them.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.eia.gov/outlooks/steo/

[2] https://publications.opec.org/momr