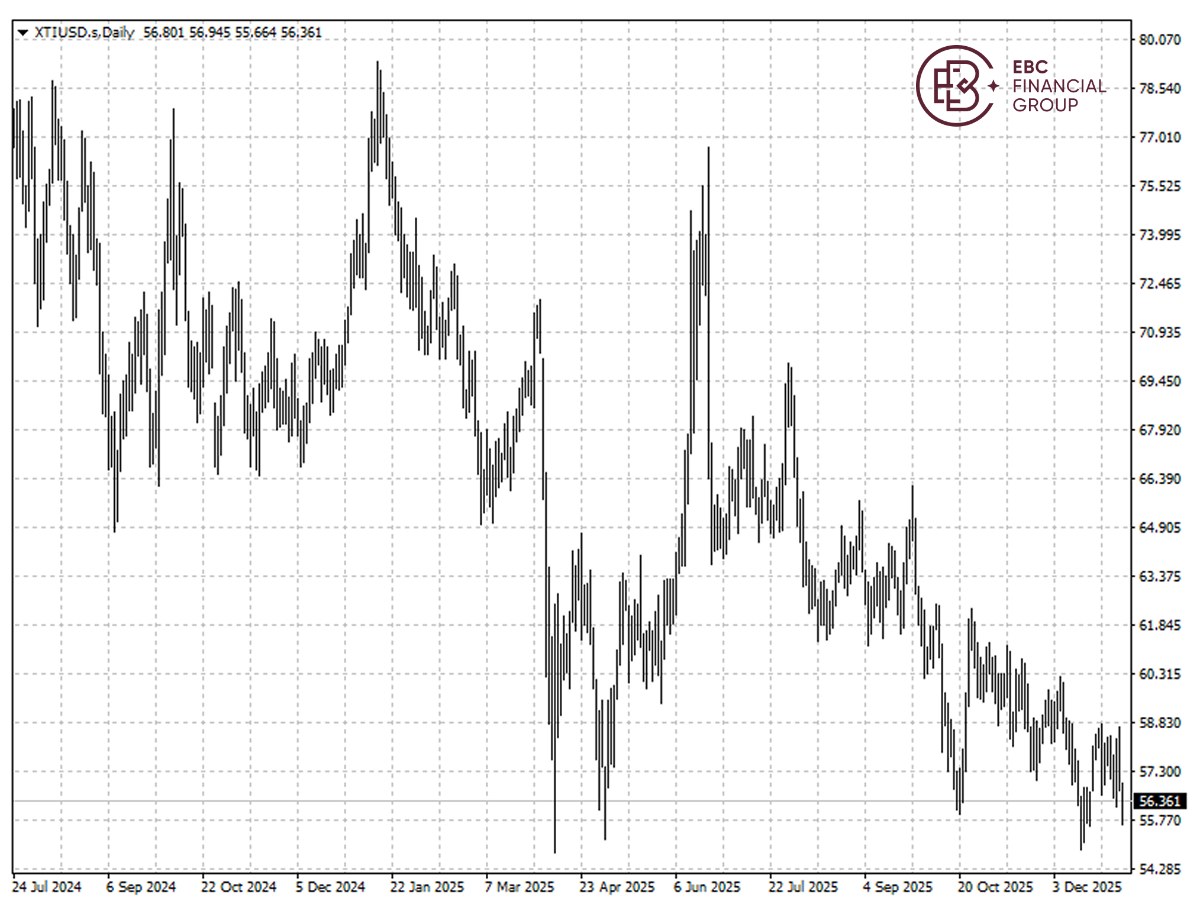

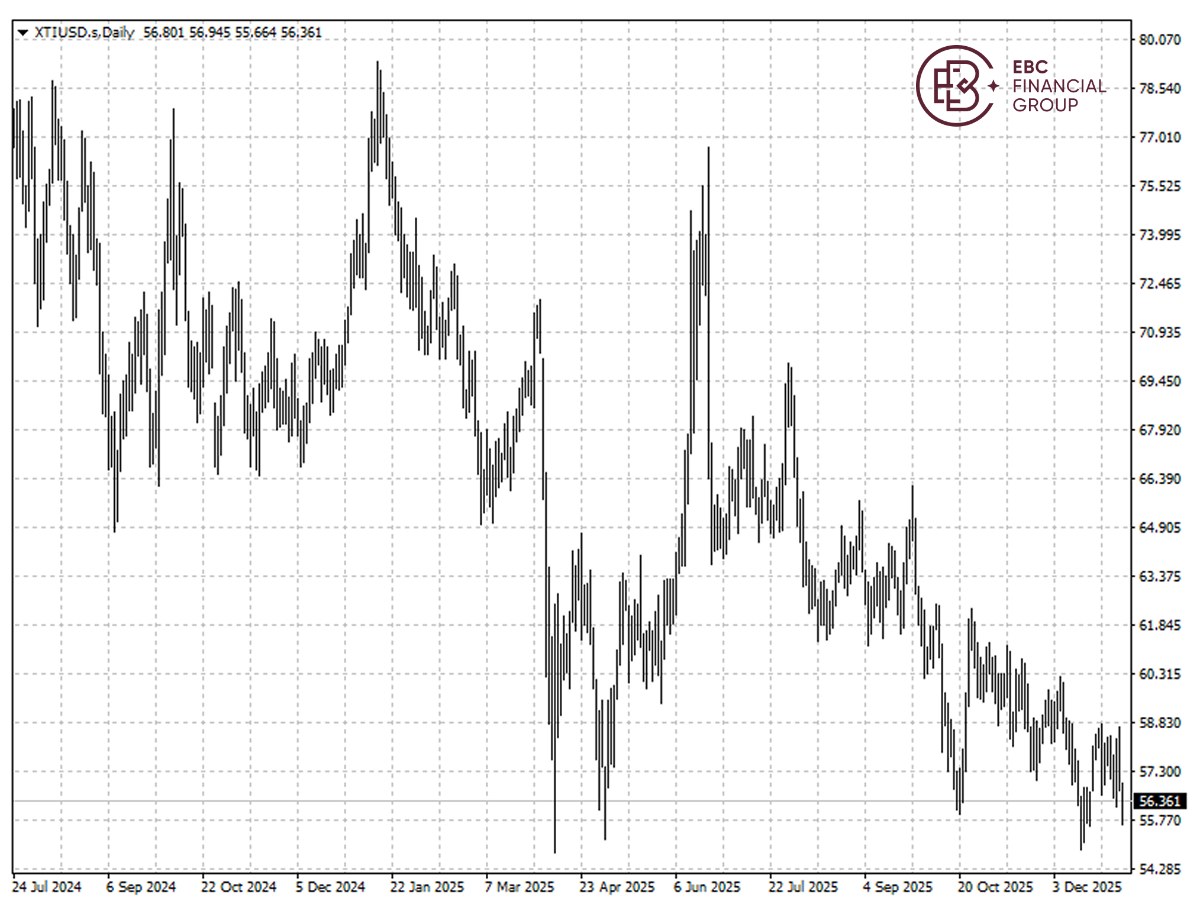

Trump's plan to revive the oil flow in Venezuela has posed a particular

challenge for Canada, which produces the same heavy and difficult-to-refine oil

– a mainstay of the country's export revenue.

Shares of Canada's oil producers generally fell on Monday. Historic arrest of

Maduro constitutes a longer-term structural risk for oil prices in general, and

Canada's WCS in particular, according to RBC Capital Markets.

After Venezuela's energy industry was hit by extensive sanctions, refineries

along the American Gulf Coast turned to Alberta's oil sands instead. Until 2024,

almost all of Canada's oil shipments headed to its neighbour.

OPEC+ kept oil output unchanged on Sunday after tensions mounted between

Saudi Arabia and the UAE flared last month over a decade-long conflict in Yemen.

That adds to downward pressures on oil prices.

US net crude oil imports are forecast to fall by 20% this year to 1.9 million

bpd, their lowest since 1971, the EIA said last month, pointing to higher

domestic production and lower refinery demand.

Dual headwinds – lower price and volume – could thus lie ahead for PM

Carney's economic agenda. GDP growth for 2025 is projected to be around 1.2% to

1.4%, reflecting a slowdown after a stronger 2024.

Tariffs weighed heavily on business investment in 2025, creating challenges

for investment and hiring decisions, a worrying sign of protracted lagging

productivity that has haunted Canada for a dozen years.

No viable endgame

While Venezuela has the world's largest proven crude oil reserves, the

country only produced about 900,000 bpd last year, sharply down from the 3.5

million bpd it was producing in 1999.

Industry sources said that American oil executives are wavering for multiple

reasons: The situation on the ground remains uncertain, Venezuela's oil industry

is in shambles and Caracas has a history of seizing US oil assets.

Chevron is best positioned to scale up production quickly. The Biden

administration issued a license in 2022 that allowed the firm's joint venture

with PDVSA to produce and export oil.

Conoco and Exxon pulled out after Chavez's nationalization. Perhaps the

biggest problem is that oil prices are too low today to justify spending the

gobs of money, with WTI crude trading below $60.

Oil executives operating in Venezuela say it will cost $10 billion annually

and a stable security environment is essential to grow production back to

historic levels, said RBC Capital Markets.

Acting president Delcy Rodríguez h said she had "invited the US government to

work together on an agenda of cooperation," dialling down the confrontational

tone she initially adopted.

Reuters reported Monday police were ordered to "immediately begin the

national search and capture of everyone involved in the promotion or support of

the armed attack by the US."

A buffer

The Canadian dollar weakened so far this week, after notching the second

worst performance among major currencies excluding the greenback in 2025,

despite stalled process on deflation.

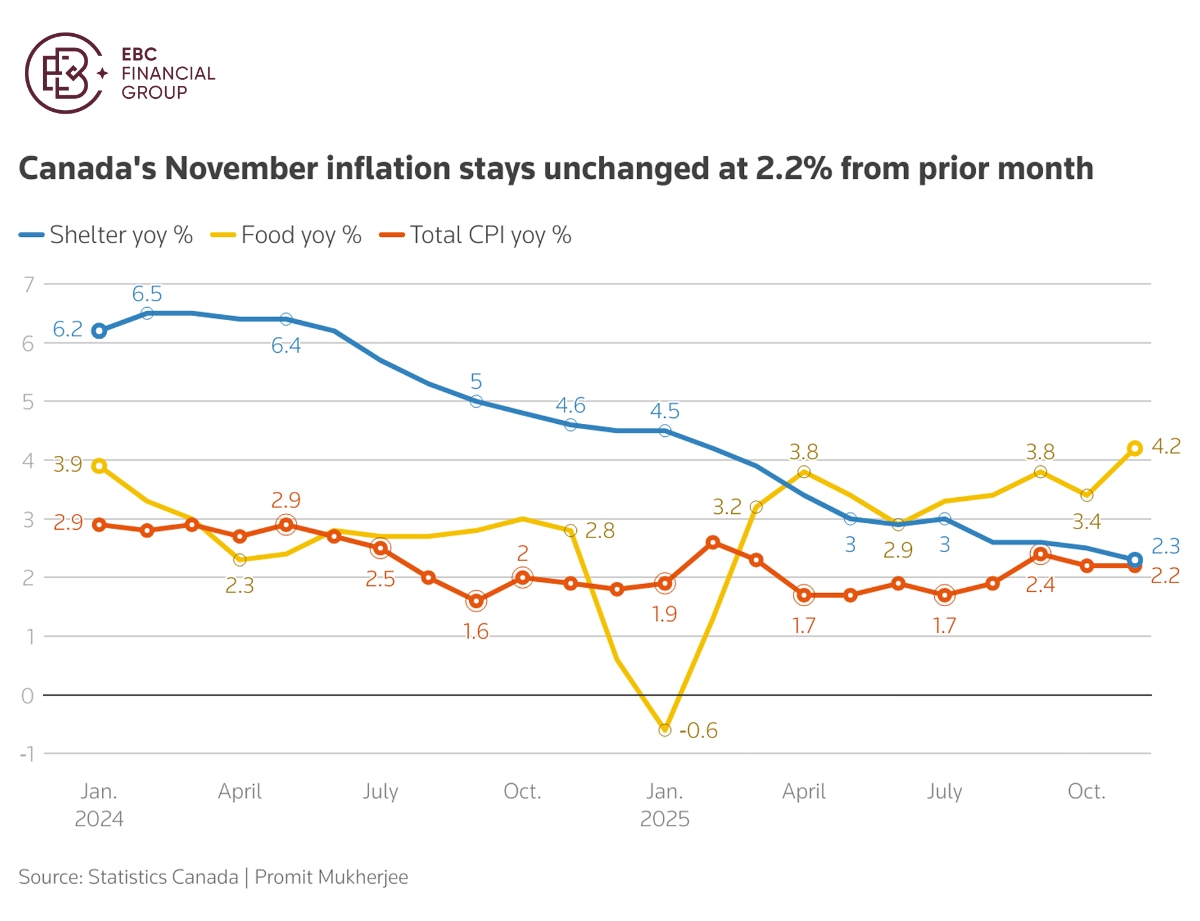

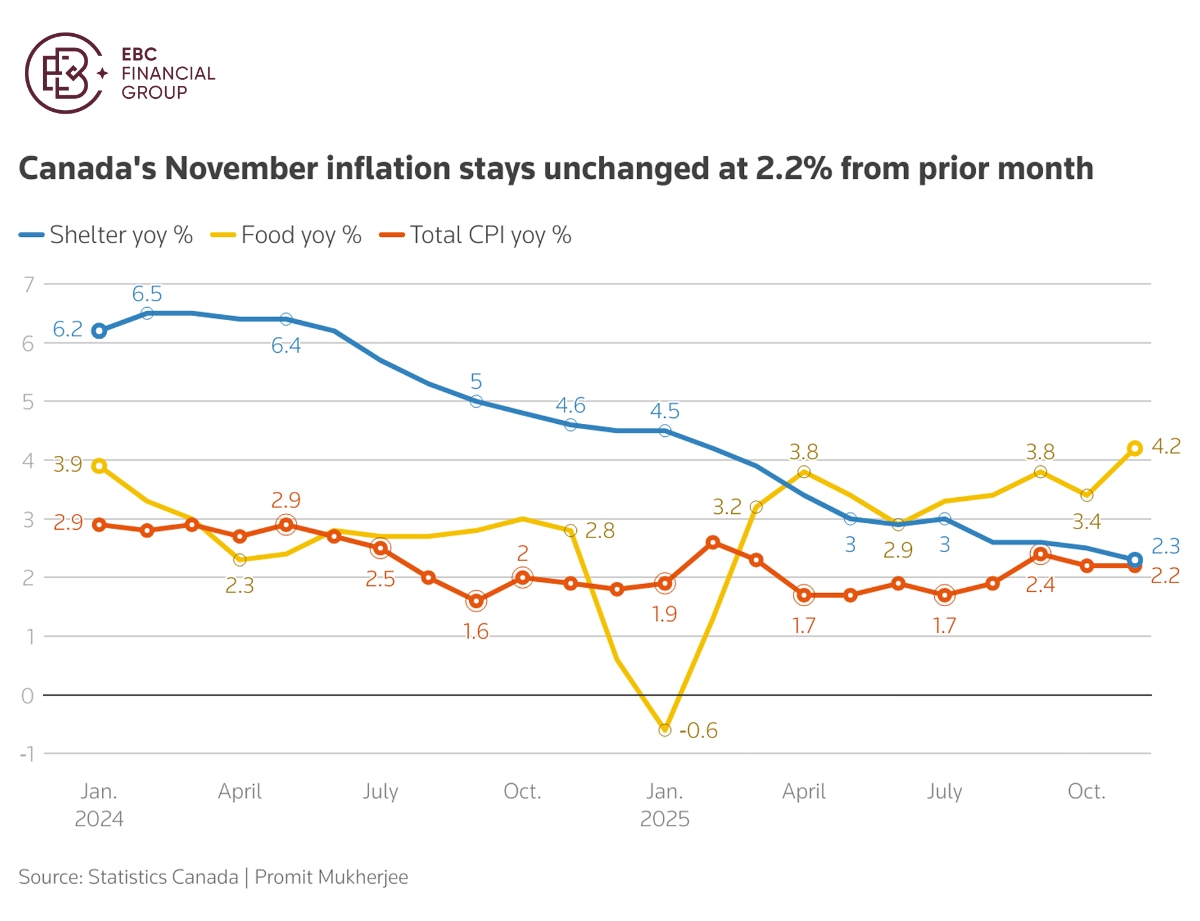

Consumer prices increased 2.2% in November, driven primarily by food prices

rising at their fastest pace in more than two years. It was the first month

since March that core measures of inflation came in below 3%.

The BOC has signalled a potential end to its interest rate cutting campaign

as Carney committed to invest billions of dollars on infrastructure as well as

measures to raise productivity and competitiveness.

The loonie will strengthen less than previously expected over 2026 if the

time it takes for Canada to reach a trade deal with the US raises prospects of

additional interest rate cuts, a December Reuters poll found.

The median forecast of analysts in the poll predicted the currency would

strengthen 0.3% to 1.39 per dollar in three months. In 12 months, they expected

it to rise further to 1.36 per dollar.

Notably a scramble to diversify exports beyond the US has been put on the

table against the backdrop of "America First." Political case for this strategy

is now strengthened amid changes in oil supply pattern.

Alberta announced last year plans to fund early work on proposal to enable

the export of bitumen from a strategic deep-water port to Asia, which could help

patch up losses in the loonie from the Trump Shock.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.