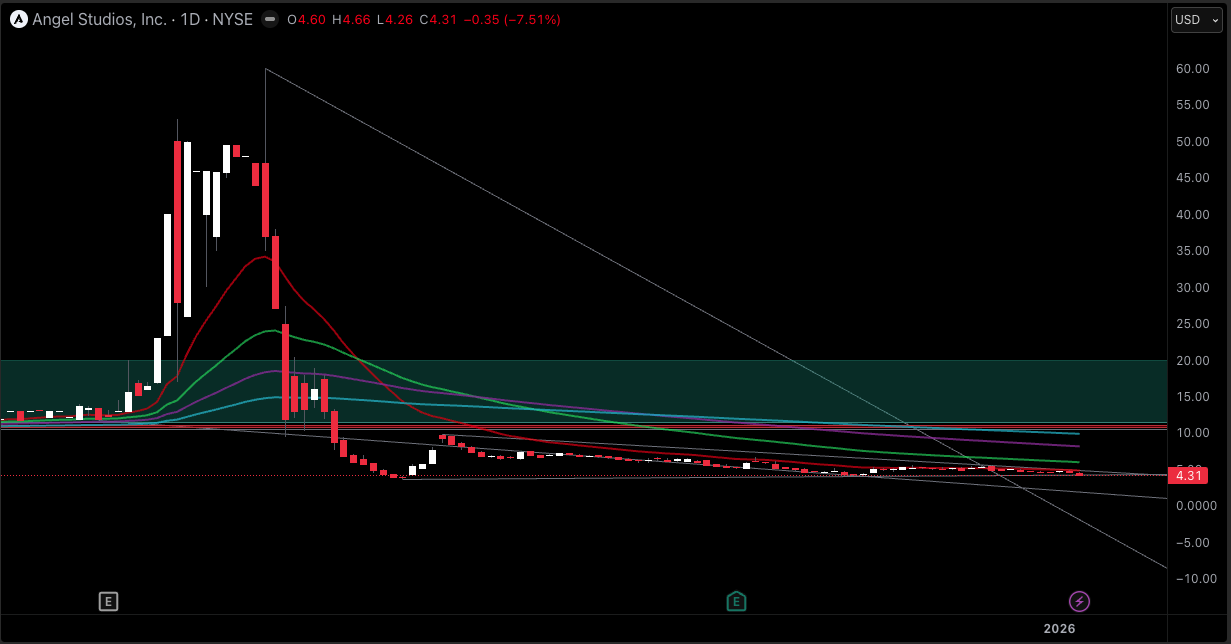

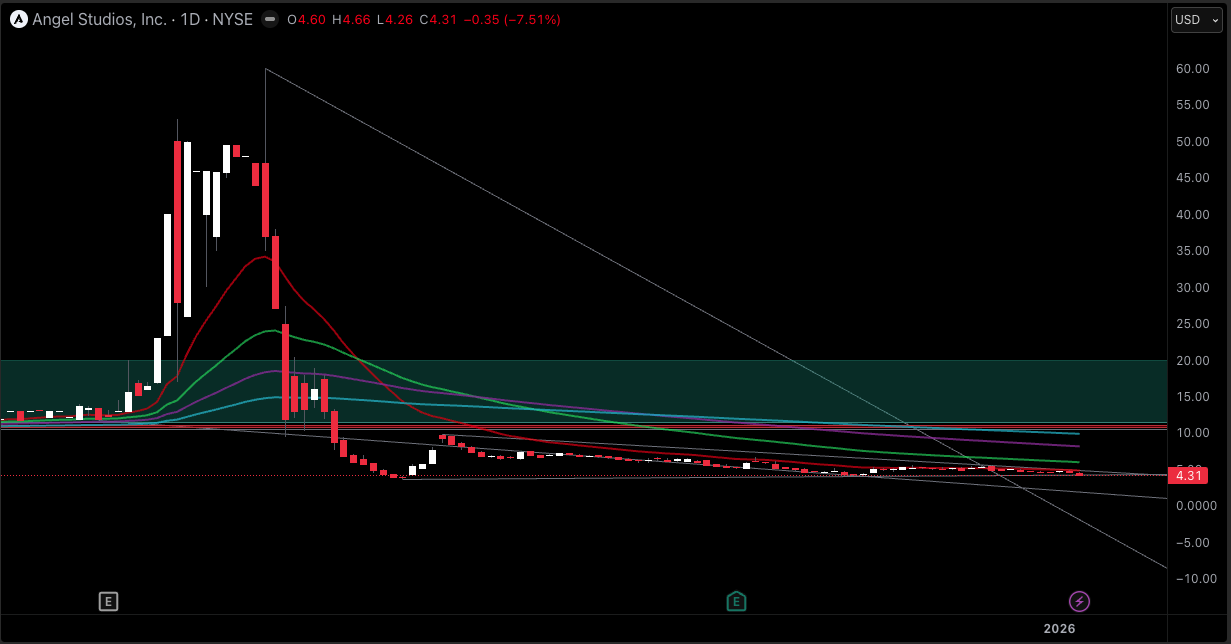

Angel Studios (ANGX) stock is experiencing a typical post-listing adjustment, as investors discount the share price to reflect expectations of a larger and more flexible future share supply.

This repricing is based on documented changes, not sentiment, and often occurs when secondary liquidity grows faster than buyer demand in newly public companies.

Two key disclosures are driving pressure on Angel Studios' stock. The company registered 10,042,523 shares for resale by existing holders, enabling potential sellers to sell without receiving proceeds from the company. Additionally, it established an at-the-market program of up to $150 million, allowing management to issue new shares and potentially dilute existing holders.

The Two Filings That Changed The Supply Outlook For ANGX Stock

ANGX stock price movements are clearer when considering the market as a clearing mechanism. As available shares increase, traders demand lower prices to balance supply and demand. The following two filings each affect supply differently.

ANGX stock price movements are clearer when considering the market as a clearing mechanism. As available shares increase, traders demand lower prices to balance supply and demand. The following two filings each affect supply differently.

Both factors can impact valuation before any shares are sold, as markets price in probabilities rather than waiting for confirmation.

Resale Registration: What 10,042,523 Shares Mean For Angel Studios stock

Angel Studios filed a prospectus that, from time to time, covers the offer and sale of up to 10,042,523 shares of common stock to securityholders. The company states it will not receive any proceeds from these resales.

This distinction matters, but the filing still affects the share price.

Why Resale Shares Can Still Pressure ANGX Stock

A resale registration is not the same as a capital raise. It is a liquidity event for holders. Once shares are registered, holders can generally sell without the friction that unregistered stock faces. The filing also makes clear that selling securityholders can sell publicly or through private transactions at market or negotiated prices, and that registration does not guarantee any sales will occur.

Markets typically treat a large registered resale block as an overhang for three reasons:

The timing is unpredictable. Holders decide when to sell. That uncertainty widens the risk premium.

Liquidity can be thin. In newer listings, incremental supply can dominate day-to-day order flow.

Rallies can be sold into. Any rebound can become an exit window for holders with a shorter time horizon than public investors.

How Large Is The Resale Block Relative To The Share Base?

The prospectus discloses that as of November 24, 2025, Angel Studios had 111,053,974 shares of Class A and 57,579,096 shares of Class B outstanding.

The resale figure of about 10.0 million shares is meaningful relative to the Class A base, particularly if the effective float is smaller than the outstanding number due to insider or strategic holdings.

A dual class structure adds a separate layer of market dynamics.

Angel Studios has a dual-class structure in which Class A shares carry one vote per share, and Class B shares carry ten votes per share. Class B is also convertible into Class A in specified circumstances, including voluntary conversion at the holder’s option and other conversion triggers described in the charter.

This is not automatically bearish, but it matters because future Class B conversion can increase Class A supply over time, and the market often discounts uncertainty around float expansion.

ATM Offering: How A $150 Million Program Affects Valuation And Trading

An at-the-market program shifts the market’s forward supply curve by giving the company a mechanism to issue shares continuously, in small increments, at prevailing prices.

Angel Studios entered an equity distribution agreement dated December 5, 2025, that allows it to offer and sell, from time to time, shares of Class A common stock with an aggregate offering price of up to $150,000,000.

The prospectus supplement explains that sales, if any, may be executed as transactions deemed to be at the market offerings under Rule 415, including ordinary broker transactions, block trades, or negotiated transactions.

The prospectus supplement explains that sales, if any, may be executed as transactions deemed to be at the market offerings under Rule 415, including ordinary broker transactions, block trades, or negotiated transactions.

The Features That Make An ATM A Persistent Overhang

The core mechanics are straightforward, and investors price them immediately:

No minimum issuance requirement: there is no minimum amount that must be sold. The company can sell none, some, or all of the program amount.

Company-controlled pacing: the company can determine the size, timing, daily limits, and minimum price thresholds in placement notices.

Sales agent incentives: the agreement provides for commissions of up to 3.0% of the gross sales price for shares sold through the agents.

Disclosure cadence: The company states it will report at least quarterly for any quarter in which ATM sales occur, including shares sold, net proceeds, and agent compensation.

For ANGX Stock, the practical effect is that any rebound can be treated as a potential financing window. That expectation can cap rallies and deepen downtrends.

How Many Shares Could Be Issued Under The ATM?

It depends on the price at which shares are sold. The prospectus supplement provides an illustrative example using a last reported sale price of $4.48 per share (as of December 3, 2025) and shows that selling about 33,482,142 shares at that price would reach $150 million of gross proceeds. That example is illustrative, but it indicates scale.

Dilution Is Not Just About Share Count; It Is A Cost-Of-Capital Signal

Investors focus on dilution because new shares reduce ownership percentage unless earnings power increases proportionally. But the more subtle issue is the signal: an ATM suggests management values financing flexibility and may anticipate needing additional capital. In early public life, that inference can weigh on multiples because the market prefers self-funded growth.

Why Supply Matters More In A Newly Public SPAC Listing

Angel Studios became public through a business combination and began trading on the NYSE under the ticker ANGX on September 11, 2025.

In the first year after a listing like this, price discovery is heavily influenced by mechanics:

The shareholder base includes holders with different liquidity needs and cost bases.

Registration rights often result in resale registrations that expand tradable supply.

New issuance tools, like ATMs, create uncertainty about future dilution.

This is why ANGX Stock can fall even as operating metrics improve. Public markets discount the security, not just the business.

Funding Signals Behind Dilution Expectations For Angel Studios Stock

To assess whether the market is rationally pricing the ATM as a likely source of funds, the most relevant question is whether the company’s current cash generation and financing profile can fund operations without equity issuance.

The company’s quarterly report for the period ended September 30, 2025, shows rapid revenue growth but continued losses:

Total revenue: $211,624,538 for the nine months ended September 30, 2025 (versus $65,485,798 in the prior year period shown in the same table).

Net loss: $91,874,332 for the nine months ended September 30, 2025.

Angel Guild scale: growth to approximately 1.6 million paying members as of September 30, 2025, generating about $170.6 million in cash from paid memberships during the nine months ended September 30, 2025.

Capital raised: The filing states that the company generated approximately $102.8 million of cash during the nine months ended September 30, 2025, from the sale of common stock.

Explicit financing posture: management states it believes the company can fund operating capital shortfalls through November 2026 by issuing debt and common stock.

That last statement is the bridge between fundamentals and the share price. When management names common stock issuance as a funding option, the market assigns a higher probability of dilution. An ATM then becomes a practical implementation tool rather than a theoretical option.

Separately, the company announced a $100 million credit facility with Trinity Capital in connection with the business combination, which helps explain why management might want a mix of debt and equity capacity rather than relying on a single channel.

Secondary Share Supply Investors Should Not Ignore

Even if the resale registration and ATM are the primary drivers of near-term supply perception, investors typically layer in additional potential share creation that can influence expected float.

Class B conversion into Class A

Class B shares are convertible into Class A, including voluntary conversion at the holder’s option. Any material conversion increases Class A supply and can affect trading dynamics, even if it does not change enterprise value on paper.

Equity plan and equity-linked instruments referenced in the ATM filing

The ATM prospectus supplement lists several categories of shares reserved for issuance as of September 30, 2025, including shares reserved under an incentive plan and shares reserved for issuance related to former options, conversion features on debt, and warrants. These categories matter because they represent structural, not discretionary, pathways for share count to rise over time.

These are not necessarily immediate sellers, but they form part of the market’s medium-term share supply model.

What To Monitor Next For ANGX Stock

A high-quality read of ANGX Stock requires separating what is permitted from what is happening. The following indicators have the strongest signal value.

1) Evidence of actual ATM usage

The ATM provides capacity, not certainty. What matters is whether the company begins selling shares and at what pace. The company states it will report at least quarterly in any quarter in which ATM sales occur, including shares sold and net proceeds. That disclosure is the confirmation point for dilution.

2) Persistent distribution patterns tied to registered resales

A resale registration enables selling. The market reads sustained high volume during declines and repeated failures to hold rebounds as potential distribution. The filing itself makes clear that holders control timing and method.

3) Liquidity commentary and reliance on equity financing

Management’s statement about funding through debt and common stock is explicit. Any update that reduces reliance on common stock issuance tends to relieve dilution pressure, while any tightening of liquidity tends to increase the perceived likelihood of ATM usage.

4) Membership economics and operating leverage

Angel Studios stock ultimately needs operating leverage to reduce dependence on financing. The company discloses membership growth and a trailing twelve-month average revenue per member figure in its quarterly report. Investors will focus on whether revenue growth translates into improving margins and narrowing losses.

Frequently Asked Questions (FAQ)

1. Why is ANGX Stock dropping?

ANGX Stock is under pressure primarily because investors are repricing the stock for a higher expected share supply. Angel Studios registered 10,042,523 shares for resale by existing holders and established an at-the-market program that can issue up to $150 million in new shares.

2. Does the resale registration dilute shareholders?

Not directly. In a resale registration, existing holders sell their shares, and the company receives no proceeds. The price impact comes from potential selling pressure, not from new share issuance.

3. Does the ATM offering dilute shareholders?

It can. An ATM involves issuing new shares when the company sells into the market. The program size is up to $150 million, and the company has discretion over whether to sell shares at all.

4. How many shares could be sold through the ATM?

It depends on the sale price. The prospectus supplement includes an illustrative assumption of about 33,482,142 shares at $4.48 per share to reach $150 million of gross proceeds, but actual sales would occur over time at varying prices.

5. When did Angel Studios stock begin trading as ANGX?

The company’s common stock began trading on the NYSE under the symbol ANGX on September 11, 2025.

Conclusion

ANGX Stock has been weak because the market is pricing in a larger, less predictable supply of shares. The resale registration makes up to 10,042,523 shares available for sale by existing holders, and the ATM gives the company the capacity to issue up to $150 million of new equity over time. Together, those mechanisms increase the probability of near-term selling pressure and medium-term dilution, which typically compresses valuation until the market can see how much supply is actually coming.

For Angel Studios stock, the next decisive information is operational and mechanical: whether the ATM is used, whether resale selling becomes persistent, and whether the business narrows losses enough to reduce reliance on common stock issuance.

The filings already define the tools. The stock will be driven by how aggressively those tools are used and whether underlying cash generation can eventually make them unnecessary.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

The prospectus supplement explains that sales, if any, may be executed as transactions deemed to be at the market offerings under Rule 415, including ordinary broker transactions, block trades, or negotiated transactions.

The prospectus supplement explains that sales, if any, may be executed as transactions deemed to be at the market offerings under Rule 415, including ordinary broker transactions, block trades, or negotiated transactions.