A "year-end rally" is not a myth, but it is also not a promise. It is a short window when liquidity thins, positioning becomes decisive, and investor behaviour turns more seasonal than usual.

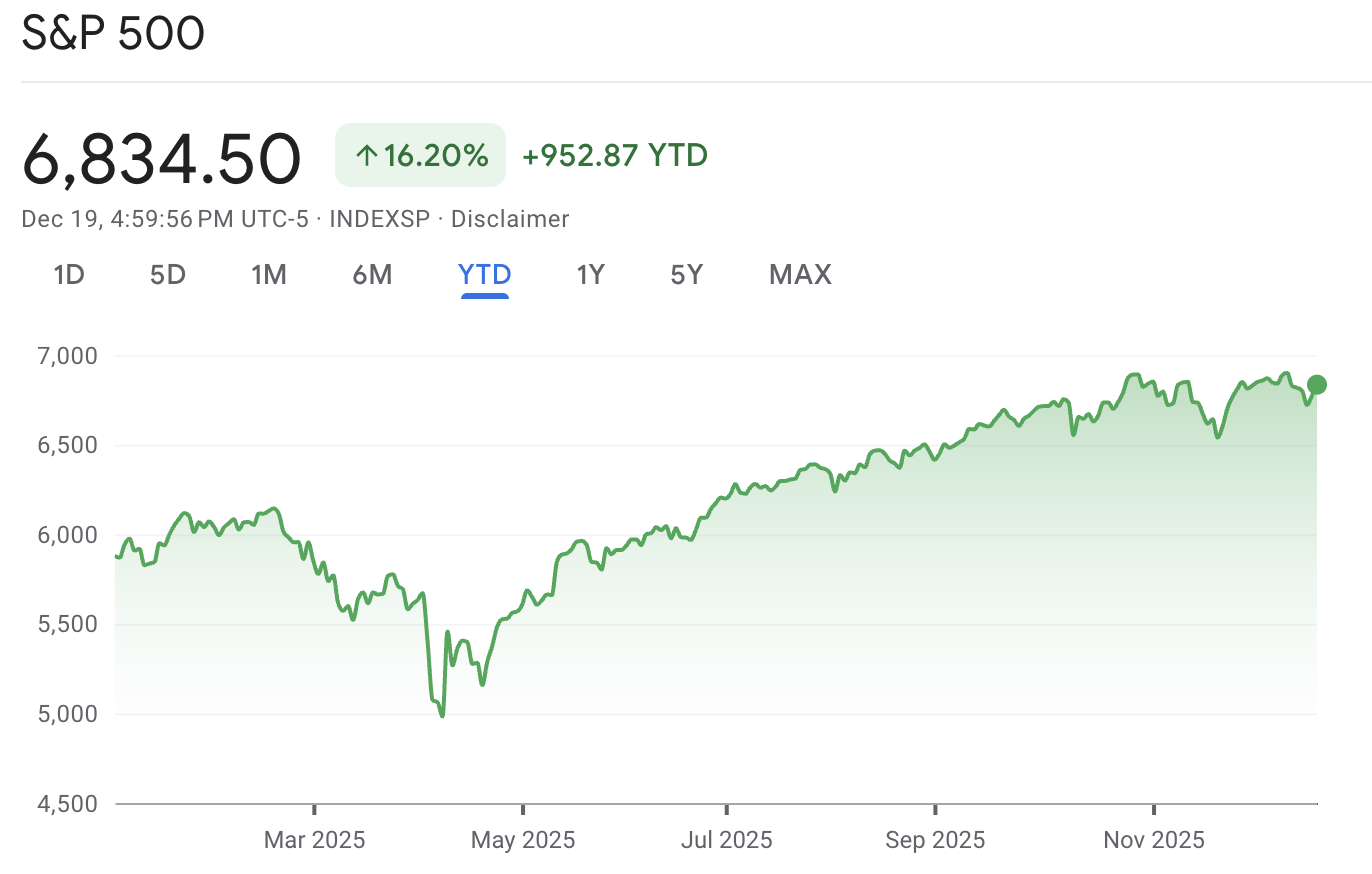

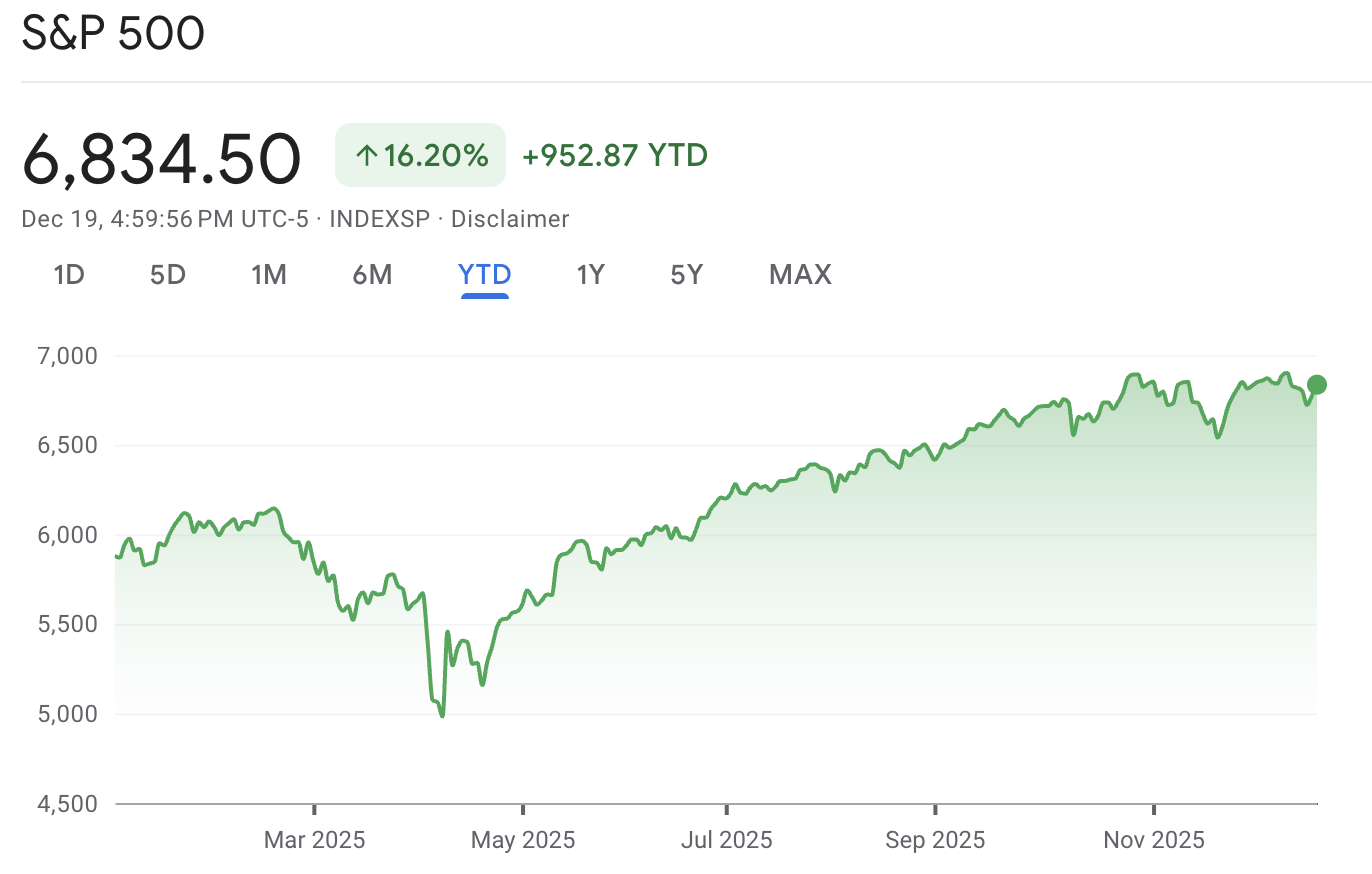

The timing matters because US equities have already had a strong year, with the S&P 500 up more than 15% in 2025 and are on track for a third straight year with gains of at least 10%. That kind of run can support a final push higher, but it can also leave the market sensitive to any sudden disappointment.

Seasonality remains supportive on paper, as December has historically been one of the better months for US equities; however, recent decades have shown more mixed outcomes than the long-run average.

Thus, the question is not whether a year-end rally is "supposed" to happen. The real question is whether the usual ingredients are lining up, or whether December turns into a risk-off month where traders sell rallies and protect gains into January. Recent reporting indicates that markets are still awaiting a Santa Claus-style rally, but confidence is not universal.

What People Mean by a "Year-End Rally"?

Most traders are actually talking about the Santa Claus rally period, which is commonly defined as the last five trading days of December and the first two trading days of January.

Over a long history, that window has often been positive, with reference datasets showing the S&P 500 has gained about 1.3% on average and has been positive close to 80% of the time since 1950.

Why Year-End Rallies Can Happen When Nothing "Big" Is Happening

A year-end rally tends to be driven by market mechanics that are simple but powerful:

Many investors conduct tax-related selling earlier in December, which reduces supply late in the month.

Some fund managers purchase recent outperformers to enhance the appearance of their year-end portfolios, a tactic commonly referred to as window dressing.

Trading volume often drops around holidays, and thinner liquidity can amplify price swings in either direction.

Options flows can push markets around because dealers hedge differently as time to expiry shrinks.

None of these forces creates value on its own, but they can help prices drift higher when the macro backdrop is not actively hostile.

What Would Make a Year-End Rally Fail?

A year-end rally usually fails for one of two reasons.

The broader narrative becomes more challenging, prompting investors to shift towards defence.

A crowded positioning theme breaks, and forced selling starts.

In late 2025, the most obvious "crowded themes" revolve around mega-cap tech leadership and the broader AI trade, both of which are key drivers of equities this year.

Is A Year-End Rally Likely This Year?

Yes, a modest year-end rally is still more likely than not in 2025, but we would expect it to be uneven and headline-sensitive, not a smooth "straight up" move.

The cleanest way to judge a year-end rally is to monitor whether "risk-on" remains consistent across equities, credit, bonds, the dollar, and volatility.

| Market slice |

Practical proxy |

Latest read (recent close) |

What it usually signals into year-end |

| Large-cap US equities |

SPY |

$680.59 |

Strength supports a rally narrative. |

| US tech leadership |

QQQ |

$617.05 |

Leadership confirms risk appetite. |

| Small-cap participation |

IWM |

$250.79 |

Breadth improves when small caps join in. |

| Broad participation |

RSP |

$192.88 |

Equal-weight strength suggests a healthier rally. |

| US dollar conditions |

UUP |

$28.07 |

A sharply stronger dollar can tighten conditions. |

| Credit risk appetite |

HYG |

$80.36 |

Weak credit can warn that "risk-on" is fragile. |

| Long-duration rates |

TLT |

$87.55 |

Falling long yields can help valuations, but context matters. |

| Volatility pressure |

VIXY |

$27.05 |

Rising volatility often kills a seasonal rally. |

The main story inside this table is not a single number. The main story is whether the pieces move together, because real rallies tend to be broad and calm.

4 Signals That Would Confirm a Year-End Rally

1) Volatility Stays Pinned

If volatility continues to decline, pullbacks are usually purchased rapidly as hedging needs diminish and systematic investments remain favourable.

Bullish sign: VIX-style proxies trend down while equities hold gains.

Bearish sign: Volatility spikes on up days, which often signals distribution.

2) Breadth Does Not Collapse

A year-end rally is more robust when it involves more than just mega-cap tech driving it.

Bullish sign: Equal-weight (RSP) keeps up with SPY.

Bearish sign: SPY rises, but RSP lags hard, which implies narrow leadership and fragile support.

3) Credit Does Not Start With a "Warning" First

Credit is often the first place stress shows up.

Bullish sign: High yield is steady, and spreads do not widen.

Bearish sign: High yield slips for several sessions while equities pretend nothing is wrong.

4) The US Dollar Does Not Surge on Risk-off

A sudden spike in the dollar at the end of December frequently accompanies de-risking, stricter financial conditions, or a challenging positioning squeeze.

The Main Risk: Thin Liquidity Can Exaggerate Moves

Late-December trading can be thin, making both rallies and sell-offs appear larger than they really are.

Additionally, US markets will have a formal early closure on December 24, which can amplify price "air pockets" if an unforeseen news story emerges.

The Most Realistic Outcomes for Year-End 2025

A sensible way to think about year-end is to separate price action into three broad paths.

| Path into year-end |

What you would likely see |

What it would mean for traders |

| A steady grind higher |

Broad participation, calm volatility, and credit stability. |

A typical seasonal rally, with less need to chase moves. |

| A choppy, narrow lift |

Index holds up, but breadth stays weak and leadership is concentrated. |

The rally is tradable but more fragile, especially into January. |

| A failed rally |

Volatility rises, credit weakens, and dollar strength adds pressure. |

De-risking dominates, and "seasonality" stops being a support. |

How to Position Without Chasing

If You Are a Short-Term Trader

Focus on levels and reaction, not predictions.

Do not chase gap-ups in thin sessions.

Focus on breadth and leadership, as they indicate whether the rally is genuine.

If You Are a Longer-Term Investor

Avoid letting a seven-day seasonal window dictate your risk budget.

Use weakness to rebalance into quality, not to swing at high-beta names after a strong run.

Remember that seasonal strength is a tendency, not an entitlement.

Frequently Asked Questions

1. What Is the Santa Claus Rally Window?

The last five trading days of December and the first two trading days of January.

2. Does a Strong Year Make a Year-End Rally More Likely?

A strong year can help because investors feel confident and risk budgets are larger. A strong year can also be damaging because valuations are higher and profit-taking becomes more tempting, especially when liquidity is thin.

3. Why Do Stocks Often Rise at Year's End?

Lighter selling after tax-loss harvesting, institutional window-dressing, reinvestment flows, and improved sentiment.

4. What Is the Biggest Threat to a Year-End Rally in 2025?

The greatest danger is another valuation adjustment in large-cap tech, fueled by worries about AI capital expenditures and worsened by rising yields.

5. Does a Year-End Rally Guarantee a Strong January?

No. Seasonality is a short-term pattern. The first quarter is often driven by earnings guidance, rates, and positioning resets, which can overwhelm December patterns.

Conclusion

In conclusion, a year-end rally in 2025 remains plausible, but it is not a free pass. Seasonality is supportive, and the Santa window has a strong historical batting average. Yet, this market has a clear vulnerability: when AI confidence wobbles and yields rise, tech-led indices can drop quickly.

The most useful mindset is to treat the final sessions as a confirmation phase. If breadth improves and volatility stays contained, seasonal momentum can carry into early January. If credit weakens and volatility rises, the "rally narrative" can fail quickly in thin holiday trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.