The January Barometer has returned to importance as 2026 begins under unusually tight financial conditions. Investors are closely watching early price movements for signals on direction, liquidity, and confidence, recognizing that January often carries greater informational value when the margin for error is limited.

With interest-rate expectations unsettled, geopolitical risks unresolved, and market leadership increasingly concentrated, January’s performance is no longer being dismissed as a seasonal pattern.

Instead, it is being treated as a real-time gauge of market sentiment, one that could influence asset allocation and risk positioning well beyond the first quarter.

January Barometer: What the Market Is Signaling Right Now

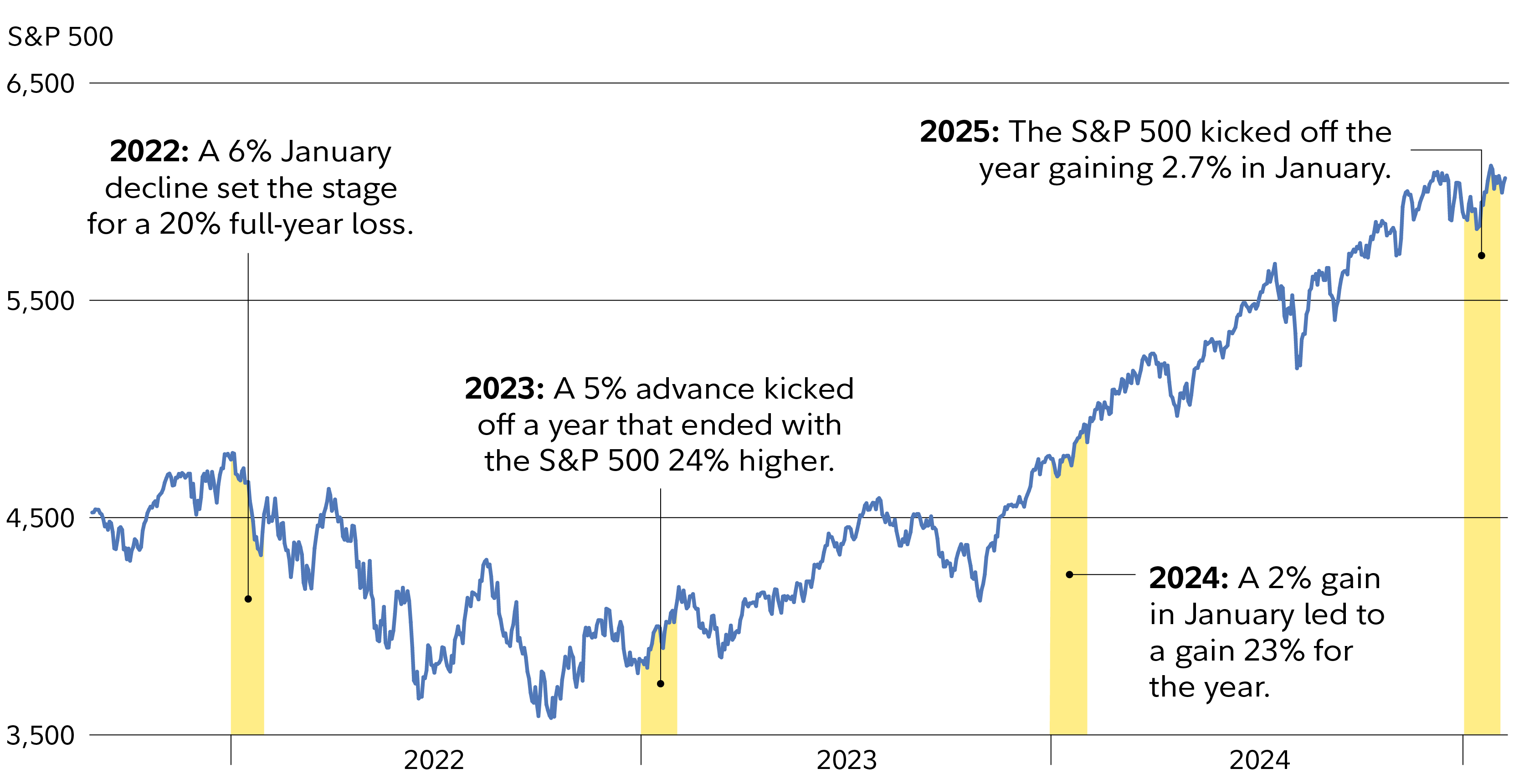

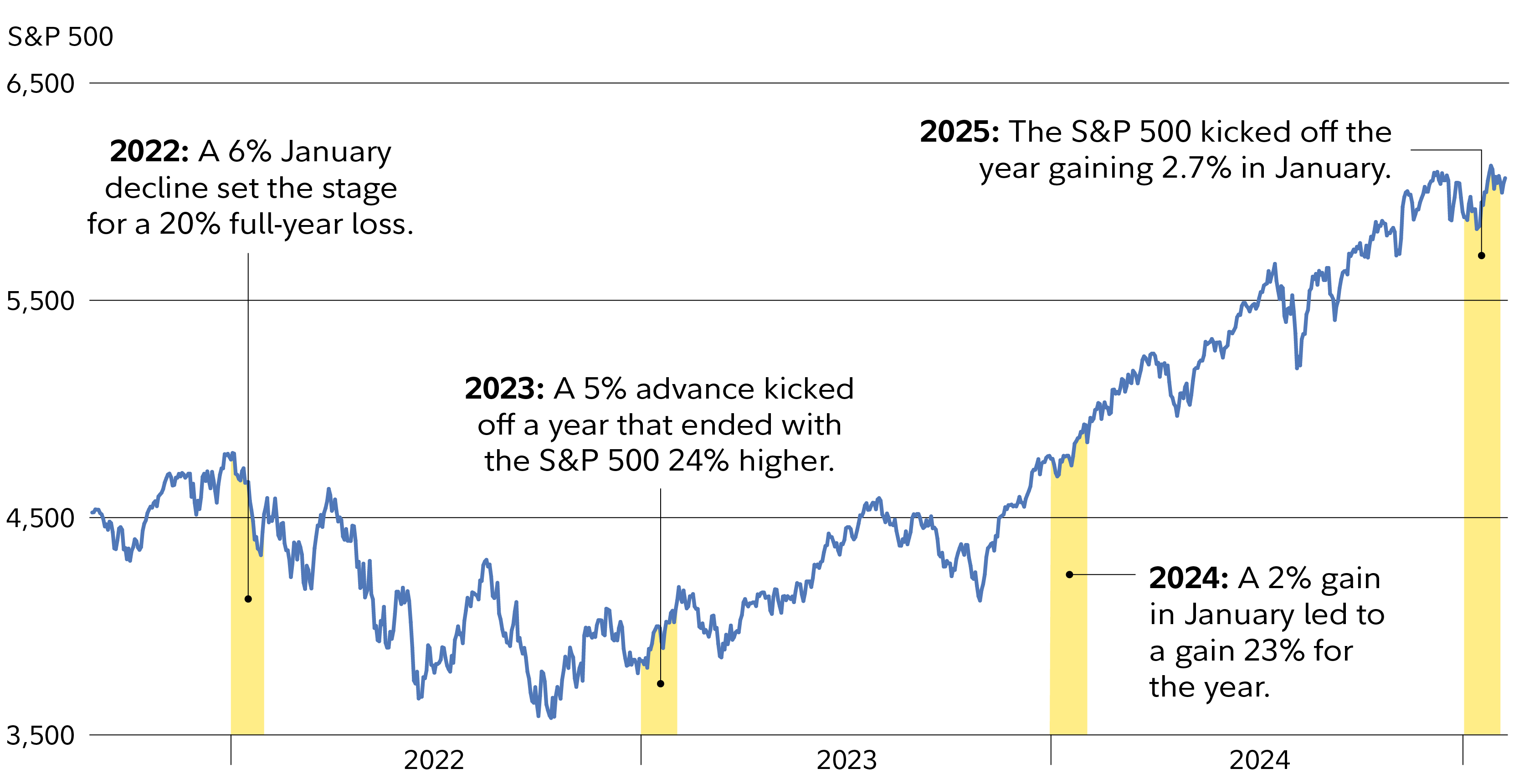

The January Barometer links January’s market direction to the broader year. Historically, positive Januaries have aligned with stronger full-year outcomes, while negative Januaries have often coincided with weaker performance.

Although not foolproof, the pattern has proven most relevant during periods of macro transition, such as the one markets are navigating now.

January 2026 is unfolding under unusually tight conditions. Equity valuations remain high, monetary policy is restrictive by historical standards, and growth expectations are fragile rather than buoyant.

Against that backdrop, January’s early moves are being treated less as noise and more as information. Traders are not fading the signal. They are leaning into it.

What stands out is not just direction, but participation. Market breadth, sector rotation, and factor exposure are all responding to January’s tone. When the Barometer “works,” it tends to do so because January captures the market’s first honest consensus of the year, before narratives harden and before liquidity thins.

Why January Matters More Than Other Months

January carries more weight than most months because it reflects conscious decisions rather than leftover activity from the prior year. Large investors reset portfolios, new money is put to work, and risk limits are reviewed, meaning market moves are driven by fresh views instead of temporary distortions.

This reset gives January unusual clarity. Year-end effects such as tax-driven selling and cosmetic portfolio adjustments fade, allowing prices to better reflect expectations for the year ahead.

As a result, January often helps set the tone for risk appetite, leadership, and market direction that can influence behavior well beyond the first quarter.

What the January Barometer Actually Measures

| What It Measures |

What It Does Not Measure |

| Market conviction |

Exact annual return |

| Risk appetite |

Economic growth rate |

| Liquidity tone |

Inflation data |

| Sentiment alignment |

Timing of corrections |

| Directional bias |

Policy decisions |

1. Directional Market Conviction

The January Barometer measures whether broad equity markets finish January higher or lower. That simple outcome reflects whether investors collectively believe growth, earnings, and policy conditions are supportive enough to justify risk exposure.

A positive January signals confidence. A negative January signals restraint.

2. Capital Deployment Willingness

January is when new allocations are made. The Barometer measures whether fresh capital is being deployed aggressively or defensively. Strong January performance implies that institutions are comfortable putting money to work early rather than waiting on the sidelines.

3. Risk Appetite vs. Risk Aversion

The indicator captures the balance between optimism and caution. Rising markets in January indicate a willingness to absorb uncertainty. Falling markets indicate that investors prefer protection over participation.

This is why the Barometer tends to matter more in uncertain macro environments than in stable expansions.

4. Liquidity Confirmation

The January Barometer measures whether liquidity conditions are supportive. Sustained buying in January suggests that financial conditions allow risk assets to rise without stress. Weak Januarys often coincide with tighter liquidity or reduced market depth.

5. Psychological Anchoring

January performance often becomes an emotional reference point for the rest of the year. Gains reinforce confidence; losses increase doubt. The Barometer measures this anchoring effect as it forms in real time.

Pros And Cons Of January Barometer

| Pros |

Cons |

| Reflects real capital flows as portfolios and benchmarks reset |

Does not indicate the size or speed of market moves |

| Provides an early read on market conviction and risk appetite |

Can be distorted by short-term volatility or thin liquidity |

| Most useful during macro transitions and regime shifts |

Less reliable when market leadership is narrow |

| Simple to observe and easy to monitor in real time |

Vulnerable to early-year geopolitical or policy shocks |

| Helps frame positioning and follow-through rather than timing |

Should not be used as a standalone signal |

Other January Indicators Investors Watch Closely

The First Five Days Indicator

First Five Days focuses on market performance during the first week of January.

Positive first five days suggest early conviction.

Negative first five days signal caution.

When the first five days align with the full month of January, the signal strengthens.

2. The Santa Claus Rally

The Santa Claus Rally measures performance during the final five trading days of December and the first two of January.

A strong rally reflects optimism and liquidity support.

A failed rally often precedes volatility or broader risk aversion.

When the Santa Claus Rally fails and January weakens, markets historically become more fragile.

3. The January Effect (Small-Cap Focus)

The January Effect refers to the tendency for small-cap stocks to outperform early in the year.

When small caps lead:

Confidence in domestic growth rises.

Investors move down the quality curve.

When small caps lag, defensiveness dominates.

4. Market Breadth in January

Professionals also monitor January’s market breadth closely:

Strong Januarys with broad participation tend to be more durable. Narrow rallies are less reliable.

Is The January Barometer Real

The January Barometer is real in that January’s market direction has historically aligned with the full year’s direction more often than chance. That relationship is observable in long-term data. However, it is not a law, not predictive of returns, and not reliable in every environment.

What makes it real is behavior, not causality. January reflects fresh positioning, new capital deployment, and reset risk budgets. When those flows are decisive, they often set a tone that persists. When they are not, the signal fades quickly.

In practice:

The January Barometer works best during macro transitions, when conviction is being rebuilt or withdrawn.

It is weaker in range-bound markets, policy-dominated regimes, or years driven by external shocks.

It signals regime and follow-through, not magnitude or timing.

So the right way to think about it is this:

The January Barometer does not predict the year; it reveals how committed investors are at the start of it. When that commitment is clear and broadly supported, markets tend to respect it. When it isn’t, January loses its edge.

In short: real as a signal, unreliable as a rule, and useful only with confirmation.

The Barometer does not speak to magnitude. It reflects whether money is being put to work or held back. Strong Januarys tend to see sustained participation and follow-through, while weak Januarys often coincide with defensive positioning and fragile rallies.

This year, elevated volatility and narrow leadership make early flow signals more visible, not less. January is not a forecast, but when flows confirm direction, the market rarely ignores it.

Factors That Affect the January Barometer

The January Barometer is not a fixed rule; its usefulness depends on several underlying conditions that can strengthen or weaken the signal.

1. Flow Reset Intensity

January signals are stronger when portfolio rebalancing, benchmark resets, and fresh inflows are meaningful. When allocations change materially, price action carries more information.

2. Market Liquidity

High liquidity allows January moves to reflect real conviction. Thin or uneven liquidity can exaggerate moves and distort the signal.

3. Breadth and Participation

Broad-based buying or selling reinforces the Barometer. Narrow leadership weakens it, especially if driven by a small group of large-cap names.

4. Macro Uncertainty Level

The Barometer tends to matter more during transition periods, policy shifts, late-cycle conditions, or post-tightening phases than during stable expansions.

5. Volatility Regime

Moderate volatility sharpens January signals. Extremely high volatility can overwhelm flows and reduce interpretability.

6. External Shocks

Unexpected geopolitical or policy events early in the year can override positioning-driven signals and limit the Barometer’s usefulness.

How Investors Are Using the January Barometer Now

Professional investors are not trading January in isolation. They are using it as confirmation. A strong January reinforces risk-on positioning, favors cyclical exposure, and supports multiple expansion. A weak January justifies defensiveness, balance-sheet quality, and cash discipline.

What matters most is confirmation across indicators. January strength, paired with improving breadth, carries far more weight than a narrow rally. January weakness paired with rising credit stress is more ominous than a mild pullback.

Right now, the market is treating January as a referendum on whether optimism can survive reality. That alone explains why every session feels consequential.

Frequently Asked Questions (FAQ)

1. What is the January Barometer in practical terms?

The January Barometer is a directional signal that compares January’s market performance with the rest of the year. A strong January often coincides with sustained risk appetite, while a weak January tends to reflect caution that can persist.

2. How reliable is the January Barometer?

It is not a forecasting tool, but it has shown consistent directional relevance over time, particularly in years marked by policy shifts, valuation pressure, or changing liquidity conditions.

3. Does the January Barometer work in bear markets?

It tends to be most useful during transition phases rather than entrenched bear markets. Its value lies in identifying whether selling pressure is exhausting or becoming more deeply embedded.

4. Is January’s direction more important than its magnitude?

Yes. The Barometer focuses on tone and follow-through rather than point gains or losses. Participation and consistency matter more than headline returns.

5. What indicators should confirm the January Barometer?

Market breadth, volume, credit spreads, volatility trends, and sector leadership all help determine whether January’s signal is being reinforced or contradicted.

6. Can the January Barometer fail?

Yes. Large external shocks, extreme volatility, or sudden policy changes can override early-year positioning and reduce its effectiveness.

7. Should investors trade based on the January Barometer alone?

No. It is best used as a contextual filter alongside fundamentals, valuations, earnings trends, and macro conditions, rather than as a standalone strategy.

Summary

The January Barometer endures because it captures something timeless: how investors feel when the year truly begins. This January is not being ignored or dismissed; it is being watched, tested, and respected. The market is acting as though the signal matters, and history suggests that when participants behave that way, January often earns its reputation.

Whether this year ultimately confirms the January Barometer will only become clear over time. What is already evident, however, is that January’s price action is influencing expectations around risk appetite, positioning, and follow-through. The market is signaling that early conviction matters, and participants are adjusting exposure accordingly rather than waiting for later confirmation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.