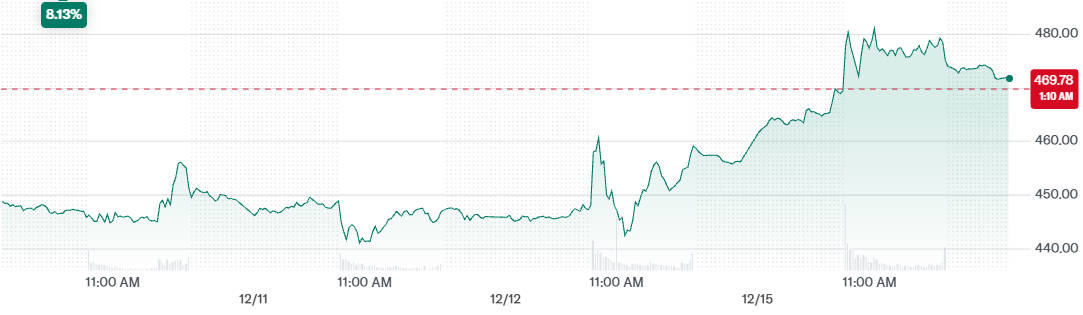

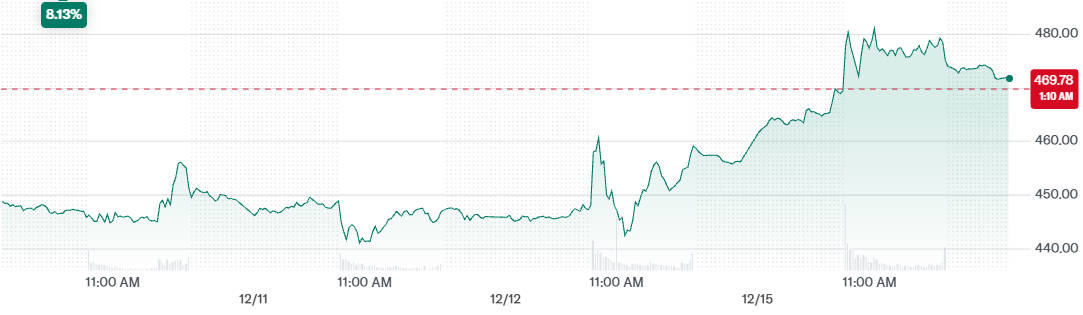

As of today, Tesla's stock price reached $475.31, reflecting an increase of $16.35(3.56%) in just one trading session. Currently, Tesla drops to $468.77 in after-hours trading.

The main catalyst for this price surge is Tesla's confirmation of testing robotaxis, autonomous vehicles that operate without a safety driver. This move has sparked enthusiasm in the market, propelling Tesla further ahead in the race for dominance in both electric vehicles (EV) and autonomous driving technologies.

The latest developments could significantly disrupt the transportation industry and provide Tesla with new, lucrative revenue streams.

Tesla Stock Price Performance Overview

1. Current Stock Performance

Tesla has been on an impressive run this year, with its stock continuing to gain momentum. As of today, Tesla’s stock is priced at $475.31, marking a $16.35 increase, or a 3.56% rise in one trading day. This follows several weeks of positive performance, driven by optimism surrounding Tesla's advancements in both electric vehicles and self-driving technology.

To provide a clearer picture, here's a detailed look at Tesla's stock performance over different time periods:

| Time Period |

Price Change |

Percentage Change |

| Last Week |

+$52.00 |

+5.8% |

| Last Month |

+$112.00 |

+15% |

| Last Year |

+$410.00 |

+50% |

| Today (Current) |

+$16.35 |

+3.56% |

Tesla's continued growth is evident not just in its EV sales, but also in its market leadership within the autonomous driving space, a factor that has greatly influenced the company's recent stock price surge.

2. Recent Price Surge

Today's price surge of 3.56% can be attributed directly to the announcement of Tesla's robotaxi testing. With this announcement, Tesla investors have reacted enthusiastically, pushing the stock to new highs. The increase in Tesla's market value reflects the optimism surrounding the potential of robotaxi services, which could become a significant source of revenue for the company.

Tesla's Robotaxi Testing: A Game-Changer in Autonomous Driving

1. The Announcement

Tesla confirmed that it has begun testing robotaxis that operate without the need for a safety driver. This development is part of Tesla's ongoing work towards creating fully autonomous vehicles, a breakthrough that could reshape the way people think about transportation. The robotaxis will rely solely on AI for navigation, decision-making, and passenger transport, eliminating the need for human drivers altogether.

Tesla's AI system will continue to evolve with each trip, improving the safety and efficiency of the vehicles. This announcement positions Tesla at the forefront of the autonomous vehicle industry, and the potential benefits for the company are immense.

2. Implications for Tesla's Future

The testing of robotaxis without a safety driver is a major step in Tesla's broader vision of transforming transportation. This could be the foundation for a fleet of autonomous vehicles providing ride-hailing services, similar to Uber or Lyft, but with no drivers. By removing the cost of human drivers, Tesla could significantly reduce operational costs, leading to higher profit margins.

In the longer term, this move could lead to a fundamental shift in how people travel. As autonomous vehicles become more common, the demand for private car ownership could decline, especially in urban areas where robotaxis could become a popular alternative. This transition would not only position Tesla as a leader in EVs but also in the emerging autonomous transport market.

3. Industry Response

The industry has been quick to respond to Tesla's latest move. Companies like Waymo, owned by Alphabet, and General Motors' Cruise are also pursuing autonomous driving technologies. However, Tesla's ability to integrate its existing EV fleet with cutting-edge self-driving capabilities gives it a strong competitive advantage.

Analysts are optimistic about the potential impact of Tesla's robotaxi program. With Tesla already operating the largest fleet of electric vehicles in the world, the company's ability to scale autonomous vehicles is unmatched. The successful deployment of robotaxis could increase Tesla's revenue streams and solidify its position as a technology leader in the transportation industry.

The Role of Robotaxi in Tesla's Business Model

1. Revenue Streams from Autonomous Vehicles

Tesla's entry into the robotaxi market opens up new and potentially lucrative revenue streams. If Tesla's robotaxi fleet operates on a similar model to traditional ride-hailing services, the company could earn significant income from ridesharing. The cost-saving advantages of autonomous vehicles, particularly the elimination of driver wages, could make robotaxis a highly profitable venture for Tesla.

Using conservative estimates, if Tesla's robotaxi fleet conducts 500,000 rides per day at an average fare of $20 per ride, the potential daily revenue could reach $10 million. Over the course of a year, this could add up to $3.65 billion in revenue, contributing to Tesla’s overall financial growth.

2. Long-Term Impact on the EV Market

The success of Tesla's robotaxi service could have a profound impact on the EV market. As autonomous vehicles become more common, Tesla's role as an EV leader will only be further solidified. The company's ability to produce both the hardware (electric vehicles) and software (autonomous driving technology) gives it an edge over competitors in the race for dominance in autonomous transport.

Additionally, the growth of robotaxi services could make electric vehicles more accessible to the general public. Rather than owning a vehicle, consumers could rely on autonomous taxis for their daily transportation needs, further promoting the adoption of EVs.

Market Reactions and Investor Sentiment

1. Analysts' Insights on Tesla Stock

Following the announcement of robotaxi testing, several analysts have raised their price targets for Tesla's stock. Morgan Stanley, for example, upgraded Tesla's stock to 'Overweight' from 'Equal Weight' due to the potential for growth in the autonomous vehicle sector. Other analysts have noted that Tesla's position as a leader in both EV production and autonomous driving technology puts it in a prime position to dominate the market.

As Tesla's stock continues to rise, investor sentiment remains overwhelmingly positive. The company's ability to innovate and lead in multiple high-growth areas has bolstered confidence among investors, leading to increased institutional investment in Tesla.

2. Institutional Investment

Tesla's stock has attracted significant institutional investment in recent months, and today's surge has only strengthened that trend. Large hedge funds and mutual funds have been increasing their holdings in Tesla, reflecting growing confidence in the company's future. This institutional backing provides additional stability for Tesla's stock price and could drive further upward movement in the future.

3. Risk Factors and Potential Challenges

While the future looks bright for Tesla, there are risks associated with the robotaxi programme. Regulatory approval is one of the most significant hurdles Tesla must overcome.

The rollout of autonomous vehicles will require navigating a complex landscape of safety regulations and insurance protocols. Additionally, there are concerns about the technology's reliability and safety, as well as potential resistance from consumers or local governments.

Tesla's Competitive Landscape

Competing with Other Autonomous Vehicle Developers

Tesla is not alone in the race to develop autonomous vehicles. Companies like Waymo, Cruise, and Aurora are also advancing their self-driving technologies. However, Tesla's existing fleet of electric vehicles and its ability to combine AI with EV production gives it a competitive edge. Unlike some competitors, Tesla already has the infrastructure to scale its autonomous vehicle project quickly.

Tesla's robotaxi service could become a major disruptor in the transportation industry, offering a more cost-effective and efficient alternative to traditional taxis. The company's vertically integrated approach allows it to innovate at a faster pace, giving it a significant advantage over rivals.

Regulatory and Legal Considerations

1. Regulatory Challenges for Autonomous Vehicles

The widespread adoption of robotaxis will require approval from regulatory bodies in various markets. Countries around the world have yet to establish comprehensive guidelines for autonomous vehicles, and Tesla will need to navigate these complexities before it can fully deploy robotaxi services. Governments will need to address safety standards, insurance issues, and traffic regulations to accommodate fully driverless vehicles.

2. Safety and Liability Concerns

Tesla will also need to manage the legal and safety concerns surrounding autonomous vehicles. In the event of an accident involving a robotaxi, questions of liability will arise. Who is responsible if a fully autonomous vehicle causes damage or injury? Tesla will need to work with regulators to ensure that clear liability structures are in place.

Long-Term Impact on Tesla's Market Position

1. Impact on Tesla's Stock Valuation

The successful deployment of robotaxis could significantly impact Tesla’s stock valuation. With a scalable autonomous vehicle service, Tesla could increase its revenue by billions of dollars annually. This additional revenue stream, coupled with the growing demand for electric vehicles, could see Tesla's stock price continue to rise in the coming years.

2. Elon Musk's Vision for Tesla's Future

Elon Musk has consistently emphasised that Tesla is not just an electric car manufacturer but a technology company poised to revolutionise the transportation industry. The robotaxi project is a key element of this vision, and if successful, it could reshape the way people think about mobility, making Tesla an even more integral part of the global economy.

Frequently Asked Questions

1. What is Tesla's robotaxi project?

Tesla's robotaxi project involves autonomous vehicles operating without a safety driver. The vehicles use AI to navigate, with plans to offer a new, cost-effective transportation service that eliminates the need for human drivers in ride-hailing.

2. How does Tesla plan to make money from robotaxis?

Tesla will generate revenue from robotaxi services by charging passengers for rides. With no drivers, the cost of operations will be significantly lower, allowing Tesla to profit from a scalable, efficient transportation model in urban areas.

3. What are the benefits of robotaxi technology?

Robotaxis offer reduced transportation costs by eliminating human drivers, improving safety through AI-driven decision-making, and providing an efficient alternative to traditional ride-hailing services, potentially disrupting the automotive and transportation industries.

4. What are the risks associated with Tesla's robotaxi programme?

Tesla faces regulatory challenges, safety concerns, and potential public resistance to fully autonomous vehicles. Legal issues, such as liability in the event of accidents, and technological reliability also present significant hurdles for the successful rollout of robotaxis.

5. How will robotaxis affect Tesla's stock price?

The announcement of robotaxi testing has driven Tesla's stock price up by 3.56% today, reflecting strong investor confidence. If successful, the robotaxi service could generate substantial revenue, further boosting Tesla's stock valuation over the long term.

Conclusion

Tesla's robotaxi project marks a pivotal moment in the company's journey, with the potential to revolutionise transportation and significantly boost its revenue streams. While challenges remain, the company's innovative edge and strong market position suggest that its stock will continue to benefit from these advancements in autonomous driving technology. As Tesla accelerates towards full robotaxi deployment, it could further solidify its role as a leader in both the EV and autonomous vehicle sectors.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.