If you search for "currencies lower than India," you are usually asking a simple question: Which countries have currencies where one unit is worth less than one Indian rupee (₹1)?

That is a real and practical comparison, but it also has a catch. A "low" currency unit does not automatically mean a country is poor, broken, or in crisis. Often, this reflects how a currency is denominated, specifically, the number of units that constitute everyday prices, as well as its long-term inflation history and policy decisions.

To keep this grounded in facts, the table below uses mid-market exchange rates from XE's INR currency table, dated Feb 5, 2026. XE also notes that these are informational mid-market rates, not consumer rates.

What "Lower Than the Indian Rupee" Means

There are two simple ways to read an INR comparison:

Example: if ₹1 buys 185 IDR, then 1 IDR is worth about ₹0.0054. That makes the IDR unit "lower than INR."

Which Country Currency Is Lower Than India in 2026? Complete List

| Rank |

Code |

Currency |

Country/Region |

Units per ₹1 |

₹ per 1 unit |

| 1 |

IRR |

Iranian rial |

Iran |

13,066.1 |

0.0000765 |

| 2 |

LBP |

Lebanese pound |

Lebanon |

976.554 |

0.0010240 |

| 3 |

VND |

Vietnamese dong |

Vietnam |

287.32 |

0.0034803 |

| 4 |

LAK |

Lao kip |

Laos |

238.03 |

0.0042010 |

| 5 |

IDR |

Indonesian rupiah |

Indonesia |

186.22 |

0.0053698 |

| 6 |

UZS |

Uzbekistani som |

Uzbekistan |

135.74 |

0.0073607 |

| 7 |

GNF |

Guinean franc |

Guinea |

97.19 |

0.010288 |

| 8 |

PYG |

Paraguayan guarani |

Paraguay |

73.19 |

0.013661 |

| 9 |

SSP |

South Sudanese pound |

South Sudan |

54.42 |

0.02 |

| 10 |

MGA |

Malagasy ariary |

Madagascar |

49.09 |

0.020375 |

| 11 |

KHR |

Cambodian riel |

Cambodia |

44.64 |

0.022398 |

| 12 |

COP |

Colombian peso |

Colombia |

40.32 |

0.024801 |

| 13 |

MNT |

Mongolian tugrik |

Mongolia |

39.53 |

0.025295 |

| 14 |

UGX |

Ugandan shilling |

Uganda |

39.42 |

0.025362 |

| 15 |

BIF |

Burundian franc |

Burundi |

32.76 |

0.030519 |

| 16 |

TZS |

Tanzanian shilling |

Tanzania |

28.51 |

0.035069 |

| 17 |

CDF |

Congolese franc |

DR Congo |

25.25 |

0.039589 |

| 18 |

MMK |

Myanmar kyat |

Myanmar |

23.26 |

0.042985 |

| 19 |

MWK |

Malawian kwacha |

Malawi |

19.24 |

0.051970 |

| 20 |

KRW |

South Korean won |

South Korea |

16.21 |

0.061657 |

| 21 |

RWF |

Rwandan franc |

Rwanda |

16.16 |

0.061853 |

| 22 |

ARS |

Argentine peso |

Argentina |

16.04 |

0.062319 |

| 23 |

NGN |

Nigerian naira |

Nigeria |

15.20 |

0.065786 |

| 24 |

IQD |

Iraqi dinar |

Iraq |

14.52 |

0.068832 |

| 25 |

AOA |

Angolan kwanza |

Angola |

10.14 |

0.098525 |

| 26 |

KPW |

North Korean won |

North Korea |

9.982 |

0.100215 |

| 27 |

CLP |

Chilean peso |

Chile |

9.547 |

0.104719 |

| 28 |

SDG |

Sudanese pound |

Sudan |

6.658 |

0.150314 |

| 29 |

SOS |

Somali shilling |

Somalia |

6.308 |

0.158523 |

| 30 |

XOF/XAF |

CFA franc (West & Central Africa) |

Multi-country (14 nations) |

6.144 |

0.162219 |

Snapshot date: Feb 5, 2026

Source: XE, cleartax (SSP)

Note on CFA franc: XOF (West Africa) and XAF (Central Africa) are separate currency zones with the same exchange value in this snapshot, because both are linked to the euro under a fixed arrangement.

Who uses XOF and XAF?

XOF (UEMOA): Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo.

XAF (CEMAC): Cameroon, Central African Republic, Chad, Congo, Gabon, and Equatorial Guinea

Why are Some Currencies "Below ₹1"?

A very low unit value usually reflects one or more of these forces.

1) High Inflation Can Shrink a Currency's Unit Value

When prices rise quickly for years, people need more notes to buy everyday items. Over time, the currency's value can diminish compared to stable currencies, even if the economy continues functioning.

Inflation pressure is often linked to:

Large budget deficits that are hard to fund.

Weak confidence in long-term policy.

Shortages of foreign currency for imports.

Political instability or conflict that damages output.

2) Denomination Choices Can Make a Currency Look Cheap Without Being Weak

Some countries maintain their currency in smaller units for convenience, historical reasons, or tradition. This practice can persist for decades.

A country can also change denominations through redenomination, which removes zeros from banknotes to simplify pricing.

This changes the label on money more than the underlying economics, unless it comes with stronger policy reform.

3) Exchange Controls Can Distort Published Rates

A few currencies operate under controls, have limited convertibility, or operate in segmented markets. In these situations, different exchange rates can exist for various purposes, such as trade settlement, travel, or official accounting.

That is one reason why you should treat any "lowest currency list" as informational, not as a direct guide to what cash you will receive at a counter.

Does a "Low Currency" Mean the Economy Is Weak?

A low face value does not automatically mean a country is poor or failing.

Japan's yen and Korea's won are clear examples of "low unit value" currencies that belong to advanced, high-export economies. Their unit sizes are historical and practical, not a simple badge of weakness.

A better way to judge strength is to look at:

Inflation stability.

Interest-rate credibility and central bank independence.

External balance (exports, imports, and foreign reserves).

Political and institutional stability.

Whether businesses and households trust the currency as a store of value.

What Does This List Mean for FX Traders in 2026?

If you trade FX or CFDs, a "low unit" currency should prompt practical questions, not assumptions.

Focus On These Four Checks

Liquidity: Is the pair widely traded, or is pricing thin and jumpy?

Policy risk: Are there any controls, sudden rule changes, or managed currency pegs in place?

Inflation trend: Is inflation easing, stable, or re-accelerating?

External balance: Is the country short of foreign currency because imports and debt payments are heavy?

Frequently Asked Questions

1. Is the Indian Rupee One of the Lowest Currencies in the World?

The rupee sits in the middle by global standards. Many currencies have units worth far less than ₹1, while many others have units worth far more than ₹1. The unit size does not equal purchasing power.

2. Is a Currency Below ₹1 Always a Sign of a Failing Economy?

No. A low unit value can reflect currency denomination and history. Broader measures, such as the NEER and the REER, are often more informative for assessing currency strength.

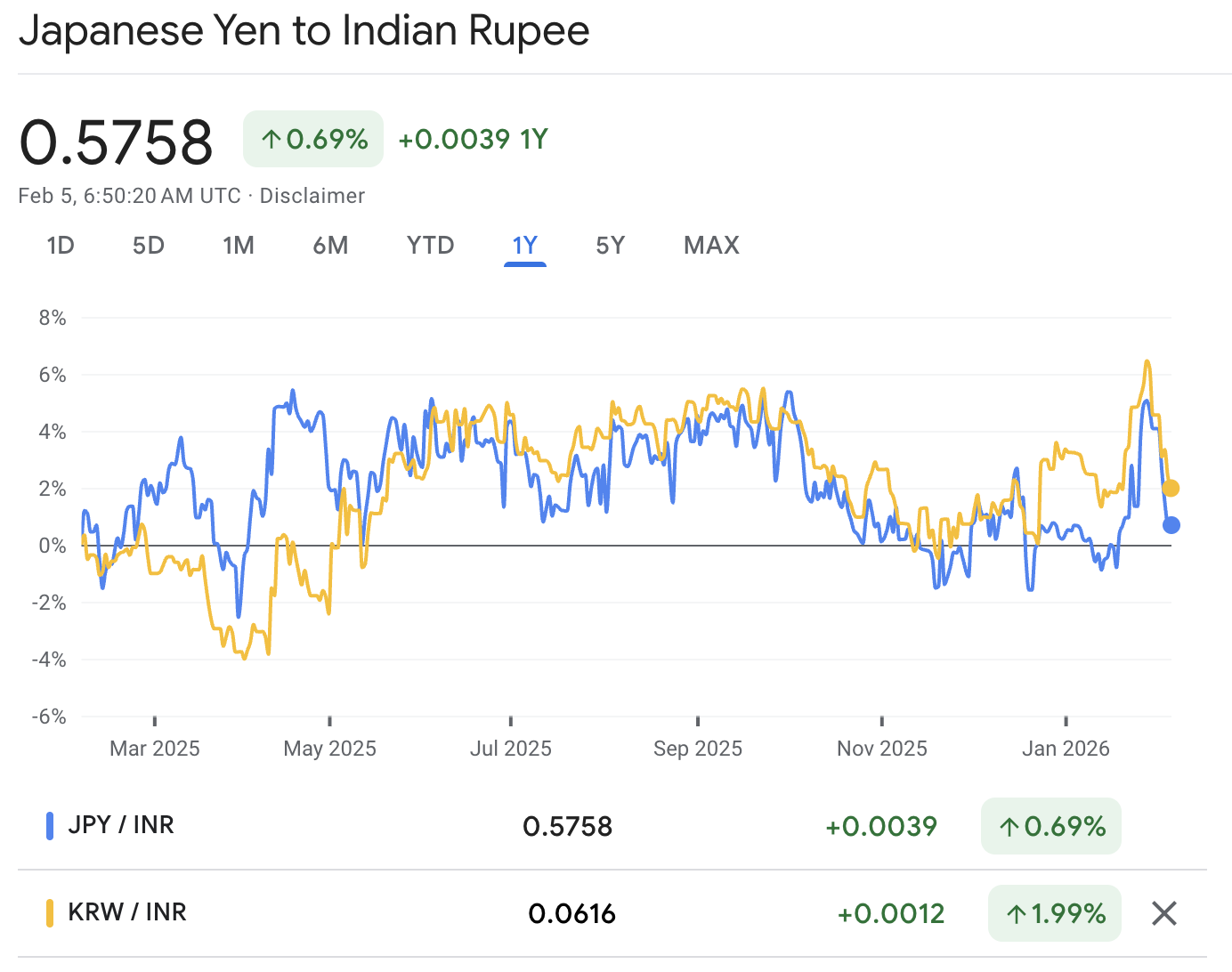

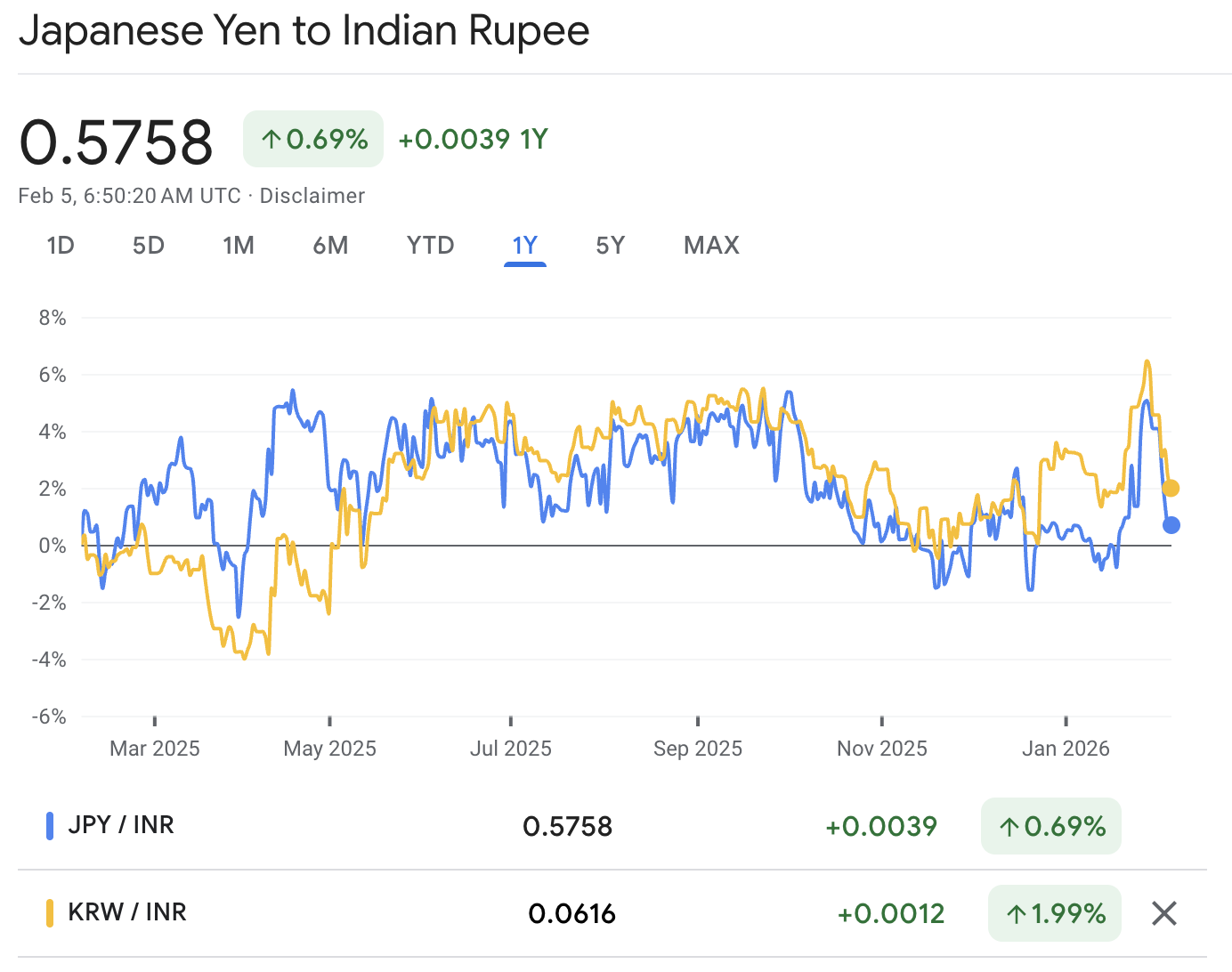

3. Why Is the Japanese Yen Worth Less Than ₹1?

The yen is a low-unit-value currency because Japan uses low-denomination bills. It does not automatically signal a weak economy, because Japan's income levels and industrial strength are high.

Conclusion

In conclusion, a "currency lower than India" usually means one unit is worth less than ₹1, not that the country is automatically weaker than India.

The top of the list is dominated by currencies that have experienced prolonged inflationary shocks, tight controls, or confidence issues. At the same time, some advanced economies also sit on the list because their unit sizes are smaller.

The Key Takeaway: Unit value is a label, while stability is the real story.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.