NVIDIA’s (NVDA) year-to-date drawdown is best attributed to a repricing of discount rates and policy risk, rather than deteriorating fundamentals. The company’s valuation reflects expectations of sustained, robust AI-driven growth. When the market increases the probability of slower near-term AI capital expenditures, margin normalization during platform transitions, or ongoing geopolitically driven revenue limitations, the resulting decline in present value disproportionately affects mega-cap growth leaders, even if current-quarter revenue remains strong.

On February 5, 2026, NVDA Stock dropped to an intraday low of approximately $172, its lowest level of the year to date. This decline indicates a reassessment of the valuation investors assign to AI infrastructure cash flows, rather than a fundamental deterioration in those cash flows.

What Matters Most Right Now

1) The Market Is Repricing The “Length” Of The AI Cycle, Not The “Existence” Of The AI Cycle

NVIDIA’s reported demand picture remains strong, with fiscal Q3 2026 revenue of $57.0 billion and Data Center revenue of $51.2 billion. The company guided fiscal Q4 2026 revenue to $65.0 billion plus or minus 2%. Those are not recessionary numbers. They are “still accelerating” numbers. [1]

The decline in NVDA stock reflects market uncertainty about the duration and trajectory of AI growth. Key considerations include the pace at which AI training demand transitions to inference, the extent of hyperscaler spending optimization, and the degree to which additional compute capacity translates into incremental NVIDIA gross profit as systems, networking, and competitive supply expand.

Once a growth cycle becomes widely recognized, the market shifts focus from the existence of the cycle to changes in expectations. Even a minor downward adjustment to long-term growth assumptions can outweigh the impact of a strong quarterly performance.

2) Gross Margin, Optics, and Transition Risk Are Back In Focus

NVIDIA is in the midst of a high-velocity architecture transition. In its October 26, 2025, quarter filing, the company explicitly tied gross margin changes to a shift in business model toward Blackwell full-scale datacenter solutions from Hopper HGX systems. It also disclosed that gross margin for the first nine months of fiscal 2026 was impacted by a $4.5 billion charge associated with H20 excess inventory and purchase obligations. [2]

Investors can simultaneously believe “AI demand is real” and still mark down the stock if they think:

The mix is temporarily less favorable during ramps,

Supply chain and configuration complexity increase variability,

One-offs, such as inventory charges, hint at forecasting errors in constrained geographies.

Such factors commonly serve as catalysts for multiple compression in companies with elevated investor expectations.

3) China And Export Controls Remain A Structural Constraint, Not A Headline Risk

In the same 10-Q, NVIDIA stated it is effectively foreclosed from competing in China’s data center compute market under the current rules and geopolitical landscape, and that it is unable to create and deliver a competitive product for China’s data center market that receives approval from both governments. [2] Separately, the U.S. Commerce Department’s BIS has continued to tighten and update advanced computing semiconductor export controls and its related enforcement posture. [3]

China’s significance extends beyond its contribution to revenue. The country’s role influences several strategic dimensions, including:

Competitor ecosystem development,

Pricing power in adjacent regions,

The global diffusion of CUDA alternatives over time.

Even with rapid growth in other regions, the market is likely to apply a persistent policy-related discount when a major end-market remains structurally constrained.

4) Higher Policy Uncertainty Raises The Equity Risk Premium

The Federal Reserve held the target range for the federal funds rate at 3.50% to 3.75% at its January 28, 2026, meeting. [4] A “higher for longer” rate backdrop does not need to be extreme to pressure long-duration equities. What matters is the combination of:

A non-trivial discount rate,

High starting valuation,

Elevated policy and regulatory uncertainty around strategic technologies.

This combination of factors often prompts capital to move away from heavily owned growth stocks during periods of heightened risk aversion.

5) Crowding And Positioning Amplify Down Moves

Mega-cap AI companies frequently serve as primary vehicles for expressing shifts in AI-related risk sentiment. During periods of de-risking, investors tend to sell the most liquid holdings, regardless of underlying fundamentals. This dynamic can drive NVDA’s share price below levels justified by near-term earnings, even when the company’s fundamentals remain strong.

NVIDIA Fundamentals Versus NVIDIA Expectations

Fundamentals (What The Company Reported)

Fiscal Q3 2026 revenue: $57.0B, up 62% year over year. [1]

Fiscal Q3 2026 Data Center revenue: $51.2B, up 66% year over year. [1]

Fiscal Q4 2026 revenue outlook: $65.0B plus or minus 2%. [1]

Expectations (What The Stock Price Was Discounting)

The stock price had been discounting a relatively clean path of:

Sustained hyperscaler and enterprise AI capex,

Rapid product ramps without margin volatility,

Manageable geopolitics,

Limited competitive pricing pressure.

The recent drawdown indicates that investors are now assigning greater probability to a more volatile and uncertain growth trajectory, rather than a complete breakdown in prospects.

What’s Next: Three Scenarios For NVDA Stock

Scenario 1: Base Case, Consolidation Then Re-Acceleration

NVDA stabilizes as the market regains confidence in ramp execution and gross margin trajectory through the transition.

The stock is expected to trade within a volatile range until the next earnings report, as investors prioritize concrete evidence over speculative narratives.

What to watch: management commentary on supply, lead times, mix, and margin sensitivity to systems and networking attach.

Scenario 2: Bull Case, Demand Visibility Wins

Data center demand stays constrained by supply, not demand.

Investors refocus on earnings power, and the multiple rebuilds.

What to watch: sustained sequential Data Center growth, and language indicating improving cost structure as Blackwell's mix matures. [1], [2]

Scenario 3: Bear Case, Policy, and Capex Become A Two-Sided Headwind

Export controls remain tight, and additional uncertainty around diffusion-type licensing increases. [2], [3]

Hyperscalers moderate the pace of incremental spend after a front-loaded build cycle, shifting the market’s “terminal growth” assumption down.

What to watch: any widening of restrictions or enforcement actions that raise friction in shipping, servicing, or designing compliant products. [3]

Catalyst / indicator |

Why it matters for NVDA stock |

What would be constructive |

Feb 25 earnings and FY2026 results |

Resets guidance, confirms demand and supply assumptions |

Clear revenue trajectory and confident Q1 outlook |

China licensing clarity |

Tightens the distribution of outcomes |

Fewer conditional statements, more measurable expectations |

Data center revenue growth rate |

The market’s core KPI |

Growth that stays strong without margin erosion |

Gross margin path |

Signals pricing power and mix |

Mid-70% narrative remains intact |

Semiconductor risk sentiment (SOX) |

NVDA trades with the complex during stress |

SOX stabilization reduces forced selling pressure |

Rates and term premium |

Drives multiple compression/expansion |

Lower yield volatility and easing financial conditions |

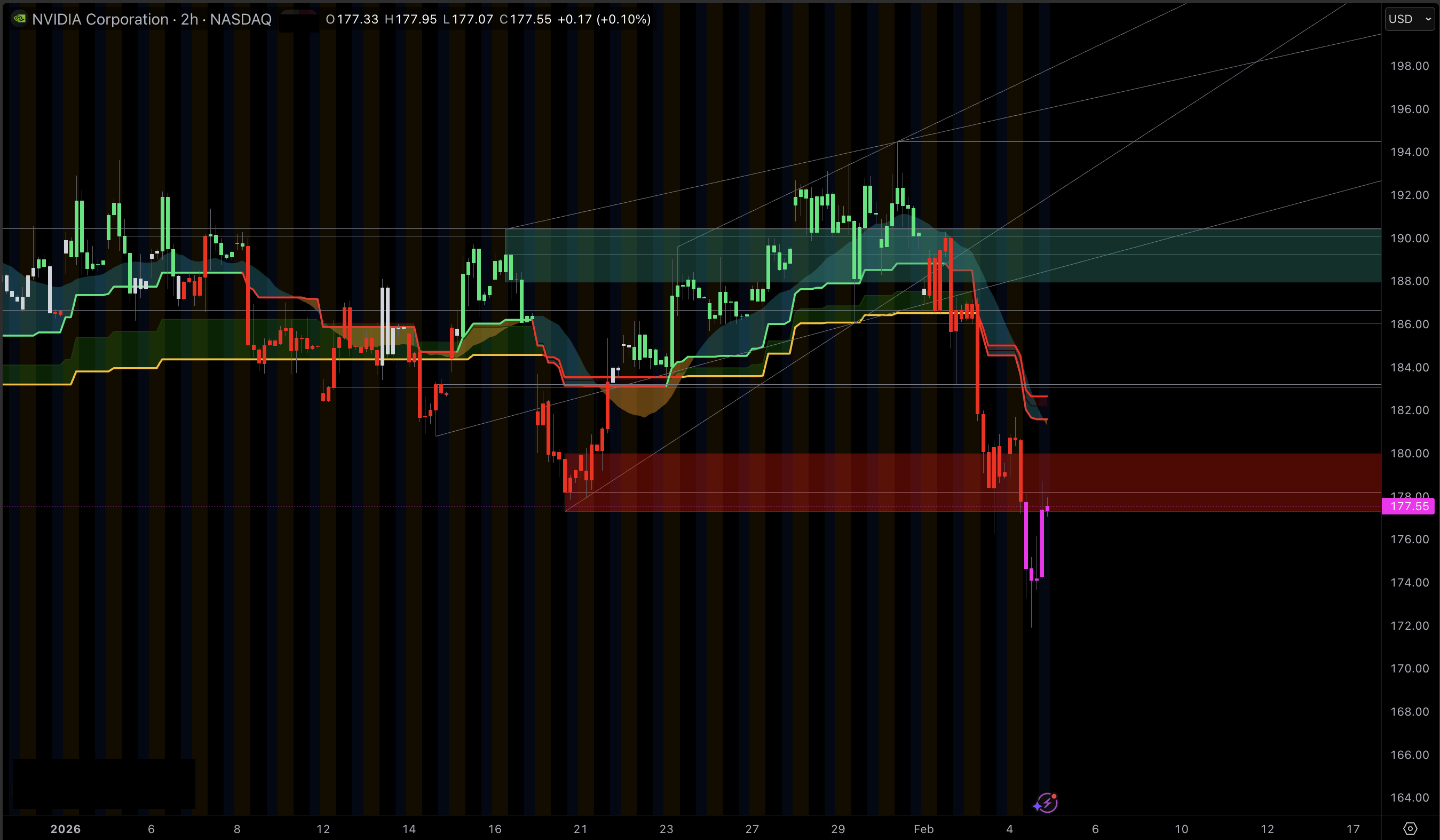

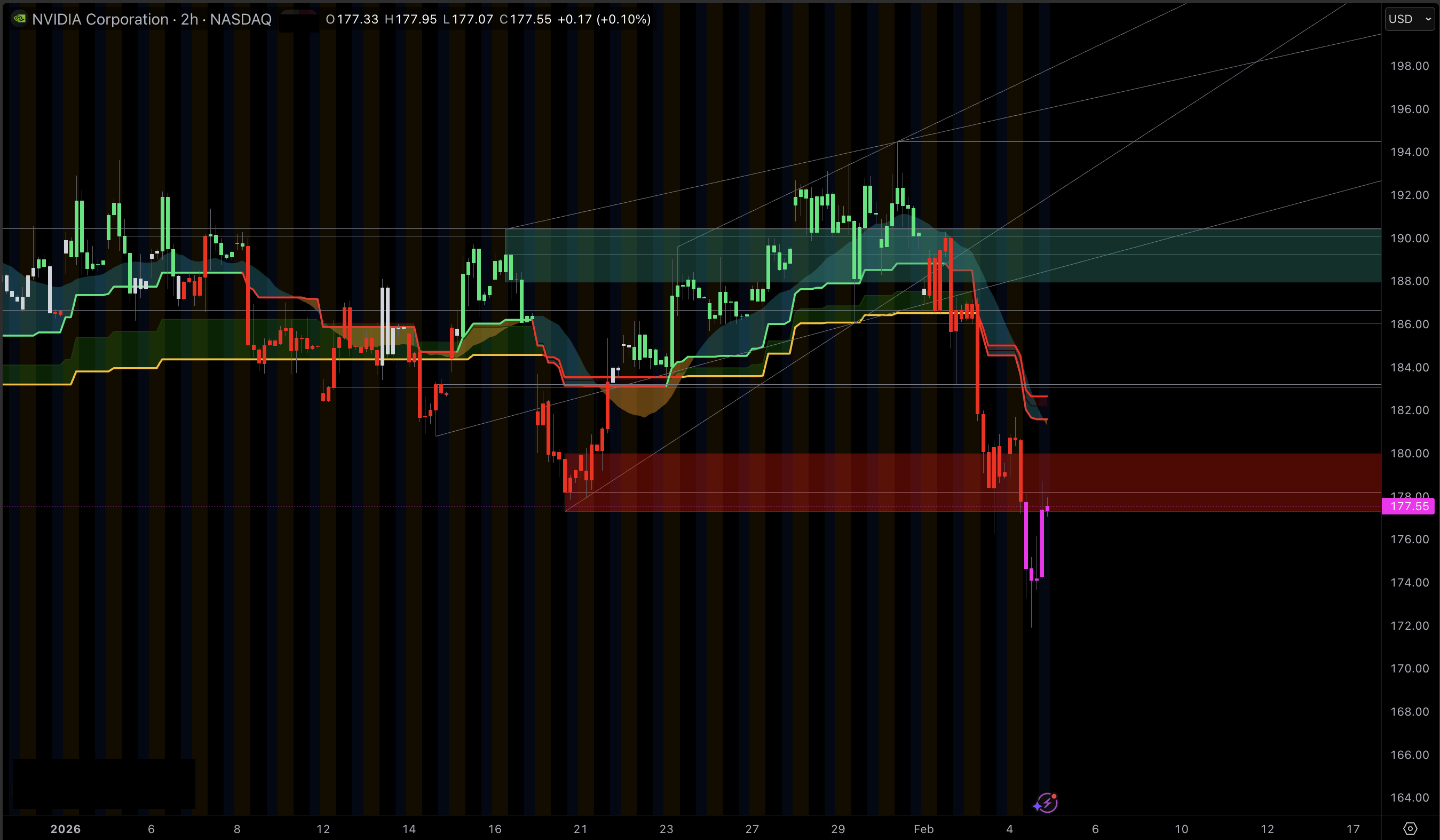

Technical Levels Investors Are Actually Trading

Without overfitting to any single indicator, NVDA’s tape is currently reacting to simple, visible levels:

$170 area: psychological and recent low-region support.

$180 area: first overhead supply zone after the breakdown.

$200 area: a round-number magnet that often marks sentiment shifts in mega-cap momentum names.

NVDA Stock Technical Analysis: What The Signals Suggest

Indicator |

Latest reading |

What it implies |

RSI (14) |

31.19 |

Selling pressure is stretched, raising the odds of a bounce or base-building if fundamentals hold. |

MACD (12,26) |

-3.63 |

Momentum remains negative, so rebounds can fail until MACD stabilizes and turns upward. |

EMA 20 |

179.75 |

Near-term trend is down; reclaiming this level is an early stabilization signal. |

EMA 50 |

183.74 |

Medium-term trend has weakened; rallies may meet supply below the mid-180s. |

EMA 200 |

185.35 |

Long-term trend line is being challenged; sustained trading below it often invites systematic selling. |

Support |

172.15 to 174.43 |

This zone represents immediate downside reference points where forced selling may exhaust. |

Resistance |

176.71 to 178.99 |

A recovery must clear this band to reduce the risk of another leg lower. |

Trend |

Bearish short term |

The tape favors caution until the stock reclaims key moving averages. |

Momentum |

Oversold but negative |

Oversold does not mean reversal, but it does mean downside marginal returns can diminish. |

In summary, NVDA’s near-term performance will be influenced as much by investor risk appetite and market positioning as by incremental changes in fundamentals, unless significant developments in earnings or policy occur.

Frequently Asked Questions (FAQ)

1) Why Did NVIDIA Stock Hit A Year-To-Date Low In 2026?

The NVDA stock’s repricing reflects sensitivity to discount rates, uncertainty regarding margin stability during platform transitions, and ongoing structural policy constraints, particularly related to China. Robust reported revenue can coincide with a declining share price when the market reduces long-term growth expectations or increases the required risk premium.

2) Is NVIDIA’s AI Business Slowing?

NVIDIA’s reported results still show rapid growth, including $57.0B quarterly revenue and $51.2B Data Center revenue in fiscal Q3 2026. [1] The debate is about sustainability and slope, not whether AI demand exists.

3) How Do Export Controls Impact NVIDIA’s Valuation?

They limit the addressable market, increase product-design friction, and can accelerate competitor ecosystem formation in restricted regions. NVIDIA has described itself as effectively foreclosed from China’s data center compute market under current rules. [2]

4) What Was The H20 Inventory Charge And Why Does It Matter?

NVIDIA disclosed a $4.5B charge tied to H20 excess inventory and purchase obligations in the first nine months of fiscal 2026. [2] Beyond the dollar amount, it heightens investors' sensitivity to forecasting errors and policy-driven product constraints.

5) How does China affect NVIDIA’s outlook?

China affects NVIDIA primarily through licensing and timing. If customers cannot forecast delivery conditions, orders can be paused even when end demand exists. NVIDIA has already shown it can exclude certain shipments from China from its guidance when visibility is limited.

6) What Should Investors Watch In The Next Earnings Cycle?

Watch the Q4 revenue trajectory versus the $65.0B outlook, gross margin progression through the transition, and any update on regulatory scope and licensing uncertainty. [1], [2]

7) Does The Fed Matter For NVDA Stock?

Yes. Higher policy rates raise the discount rate applied to long-duration cash flows from growth. The Fed held the federal funds target range at 3.50% to 3.75% on January 28, 2026. [4]

8) When is NVIDIA’s next earnings report, and why does it matter?

NVIDIA is scheduled to report Q4 and full fiscal year 2026 results on February 25. This is the next major catalyst because it resets guidance, clarifies product cadence, and provides updated margin and revenue assumptions.

Conclusion

NVDA’s Stock decline to a year-to-date low is primarily due to valuation and risk premium adjustments amid platform transition challenges and ongoing geopolitical tensions. While the company continues to report exceptional growth, future stock performance will depend on renewed investor confidence in margin stability, execution of product ramps, and the resilience of the global AI capital expenditure cycle under export-control limitations. Elevated volatility is likely to persist until forthcoming fundamental data provide greater clarity.

Sources

[1] https://investor.nvidia.com/news/press-release-details/2025/NVIDIA-Announces-Financial-Results-for-Third-Quarter-Fiscal-2026/default.aspx

[2] https://www.sec.gov/Archives/edgar/data/1045810/000104581025000230/nvda-20251026.htm

[3] https://www.bis.gov/press-release/commerce-strengthens-restrictions-advanced-computing-semiconductors-enhance-foundry-due-diligence-prevent-diversion-prc

[4] https://www.federalreserve.gov/newsevents/pressreleases/monetary20260128a.htm