The decline in AMD stock reflects the market’s reassessment of the near-term outlook for AI accelerator revenue and margins. The fourth quarter results were positively impacted by two non-recurring items: the release of approximately $360 million in previously reserved Instinct MI308 inventory and related charges, and roughly $390 million in MI308 revenue from China.

AMD indicated that MI308 revenue from China is expected to decrease to approximately $100 million in the first quarter. For a stock priced for rapid AI-driven growth, concerns about the sustainability of reported results and sensitivity to policy-driven revenue fluctuations have prompted significant profit-taking. [1]

While AMD reported strong fourth-quarter results, with $10.27 billion in revenue and $1.53 in non-GAAP EPS, the market focused on the sustainability of these figures. AMD disclosed that, excluding the reserve reversal and MI308 China sales, the non-GAAP gross margin for the quarter would have been approximately 55%, compared to the reported 57%. This distinction signaled to investors that the expansion in AI-driven operating leverage might not be as consistent as previously anticipated, leading to a swift reassessment when first-quarter projections appeared less robust. [1]

What Drove The AMD Stock Selloff

Forward Visibility Reset In Data Center AI: Q1 guidance implies a step-down in China MI308 revenue and a sequential revenue decline, which matters more than a backwards-looking beat. [1]

Margin Optics Normalized: A portion of Q4 gross margin strength was non-recurring, and Q1 non-GAAP gross margin is guided at about 55%, consistent with AMD’s own “adjusted” Q4 margin. [1]

Operating Leverage Concerns: Non-GAAP operating expenses rose materially year over year, which raises the hurdle for sustained EPS upside if GPU ramps are lumpy. [1]

Valuation And Positioning: High-multiple, AI-exposed semis tend to gap lower when the growth path looks “stair-step” instead of “smooth,” especially after a run-up.

Q4 Earnings Were Strong, But Not Pure

AMD reported Q4 2025 revenue of $10.27 billion, GAAP gross margin of 54%, non-GAAP gross margin of 57%, GAAP EPS of $0.92, and non-GAAP EPS of $1.53. Full-year 2025 revenue was $34.64 billion. [1]

The critical nuance is AMD’s own disclosure on what boosted Q4:

Approximate $360 million release of previously reserved MI308 inventory and related charges

Approximate $390 million of Instinct MI308 revenue to China

Non-GAAP gross margin would have been about 55% without those two items [1]

This context alters investor interpretation of the quarter. Rather than perceiving margins as structurally expanding, the market views them as relatively stable, with the quarter’s results benefiting from one-time accounting adjustments and geographic revenue mix.

Segment Mix Matters More Than The Headline Beat

Q4 revenue by segment shows why the market is hyper-focused on the quality of data center growth:

Data Center: $5.38 billion in Q4, up year over year; full-year $16.64 billion [1]

Client: $3.10 billion in Q4 [1]

Gaming: $0.84 billion in Q4 [1]

Embedded: $0.95 billion in Q4 [1]

The Data Center segment now constitutes more than half of AMD’s quarterly revenue, resulting in the stock being increasingly evaluated as an AI infrastructure company. This shift heightens market sensitivity to uncertainties regarding accelerator deployment timing, export exposure, and margin trends.

Guidance, Not The Quarter, Set The Price

AMD guided Q1 2026 revenue to about $9.8 billion plus or minus $300 million, including about $100 million of MI308 sales to China, with non-GAAP gross margin around 55%. AMD explicitly characterized the midpoint as about 32% year-over-year growth and about a 5% sequential decline. [1]

Three takeaways matter for the stock:

1) Sequential Decline Is The Opposite Of “AI Ramp Narrative”

Despite potential seasonality, companies positioned as AI leaders are typically valued for consistent sequential growth. A sequential decline prompts investors to question whether demand is inconsistent, supply is constrained, or policy restrictions are limiting shipments.

2) China MI308 Goes From A Q4 Boost To A Q1 Headwind

If Q4 included about $390 million to China and Q1 is about $100 million, investors infer that part of Q4’s AI GPU revenue was “pulled forward” or timing-driven. AMD also ties the dynamics to export restriction impacts, which increases the risk premium the market assigns to that revenue stream. [1]

3) Gross Margin Guide Confirms Normalization

Q1 non-GAAP gross margin guidance of about 55% lines up with AMD’s own “clean” Q4 margin estimate, which discourages the market from extrapolating Q4’s 57% non-GAAP gross margin. [1]

AI Revenue Is Not One Product, Or One Risk

A common investor shortcut is to treat “AI revenue” as one homogeneous growth engine. In reality, AMD’s data center AI exposure spans multiple product types and demand profiles (server CPUs, GPUs, DPUs, NICs, and more), sold through hyperscalers, OEMs, and ODM supply chains. [2]

The market’s response suggests a differentiation between two categories of AI-related revenue:

Recurring, less policy-sensitive growth: server CPU adoption tends to be steadier, tied to platform refresh cycles and total cost of ownership.

Project-based, policy-sensitive growth: accelerator deployments can be bursty, subject to customer qualification timelines, cluster build-outs, and export licensing or restrictions.

AMD’s disclosures about MI308 reserve releases, China shipments, and a sharp Q1 reduction in China revenue effectively reinforced that the accelerator ramp will likely be stair-step rather than linear. [1]

Cost Structure And Working Capital Added Friction

Two balance-sheet and expense signals likely contributed to the market’s caution.

Operating Expense Trajectory

Non-GAAP operating expenses in the fourth quarter totaled $3.001 billion, representing a significant year-over-year increase. [1] While higher operating expenses can be justified during periods of aggressive market expansion, they reduce investor tolerance for revenue fluctuations. If GPU sales growth slows temporarily, while operating expenses remain elevated, the risk to profitability increases.

Inventory Build And Cash Conversion

At year-end, AMD reported inventories of $7.92 billion, an increase from $5.73 billion in the previous year, according to the 10-K inventory table. [2] Although inventory growth can result from product transitions, supply assurance, or ramp preparation, markets often view inventory increases sceptically when near-term guidance suggests a potential revenue decline.

Despite these factors, AMD generated robust cash flow, including $5.52 billion in free cash flow for full-year 2025 and a 16% free cash flow margin, as defined by the company (operating cash flow minus capital expenditures). [1] The primary concern is not liquidity risk, but rather the efficiency with which revenue growth translates into incremental free cash flow amid volatility in the AI business mix.

Valuation And Profit-Taking Did The Rest

When the market shifts its perspective from anticipating consistent AI-driven growth to recognizing policy- and timing-dependent fluctuations, valuation multiples tend to contract rapidly.

Using AMD’s full-year 2025 EPS disclosures:

At approximately $200 per share, AMD trades at a high earnings multiple, even on a non-GAAP basis (approximately in the high-40s), and significantly higher on GAAP earnings. High-duration equities, which are valued for long-term growth, are particularly sensitive to changes in perceived growth trajectories.

When uncertainty increases, investors require a higher discount rate, resulting in rapid price adjustments. This effect is often intensified by profit-taking following strong performance leading up to earnings, especially in sectors with significant AI exposure.

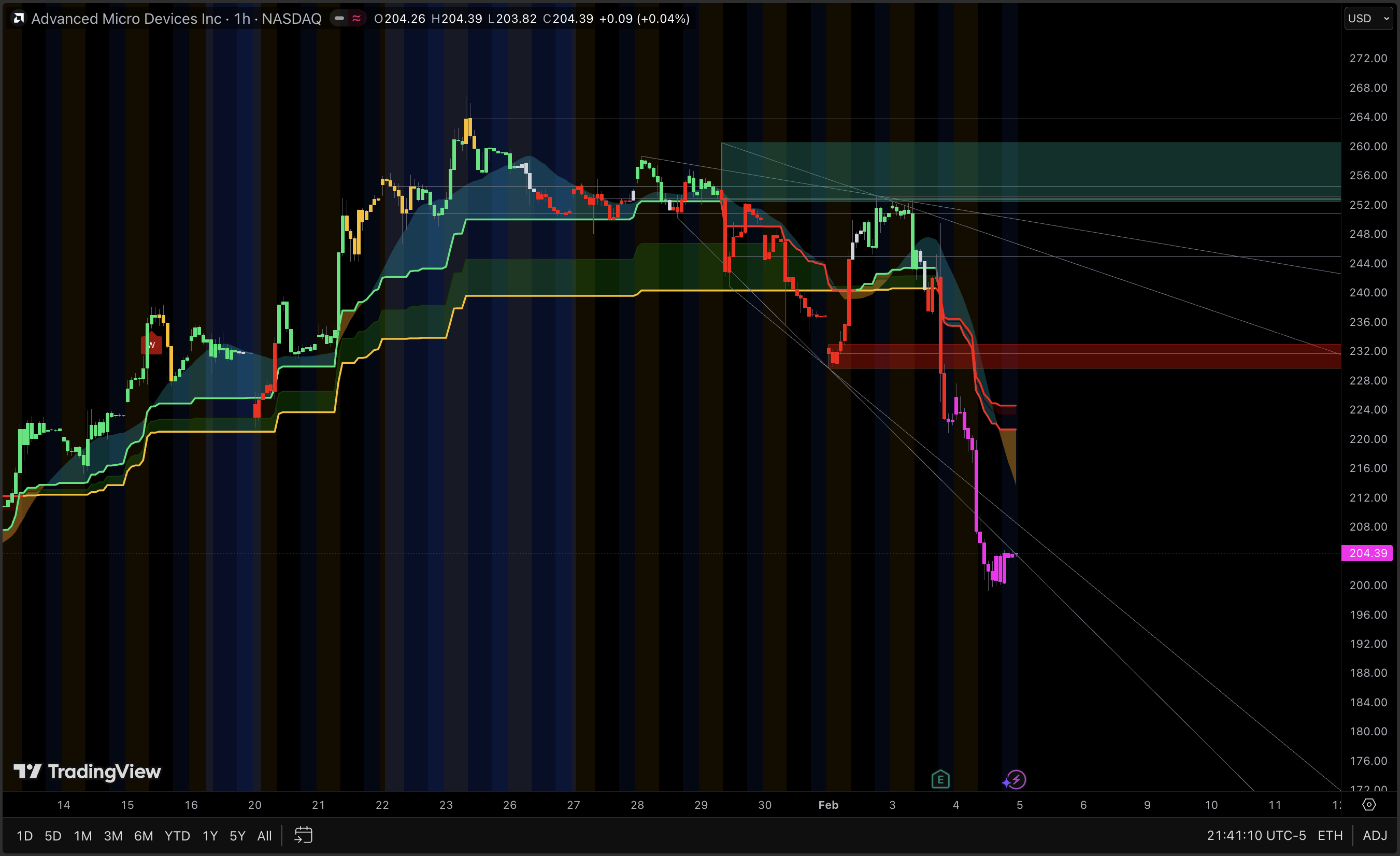

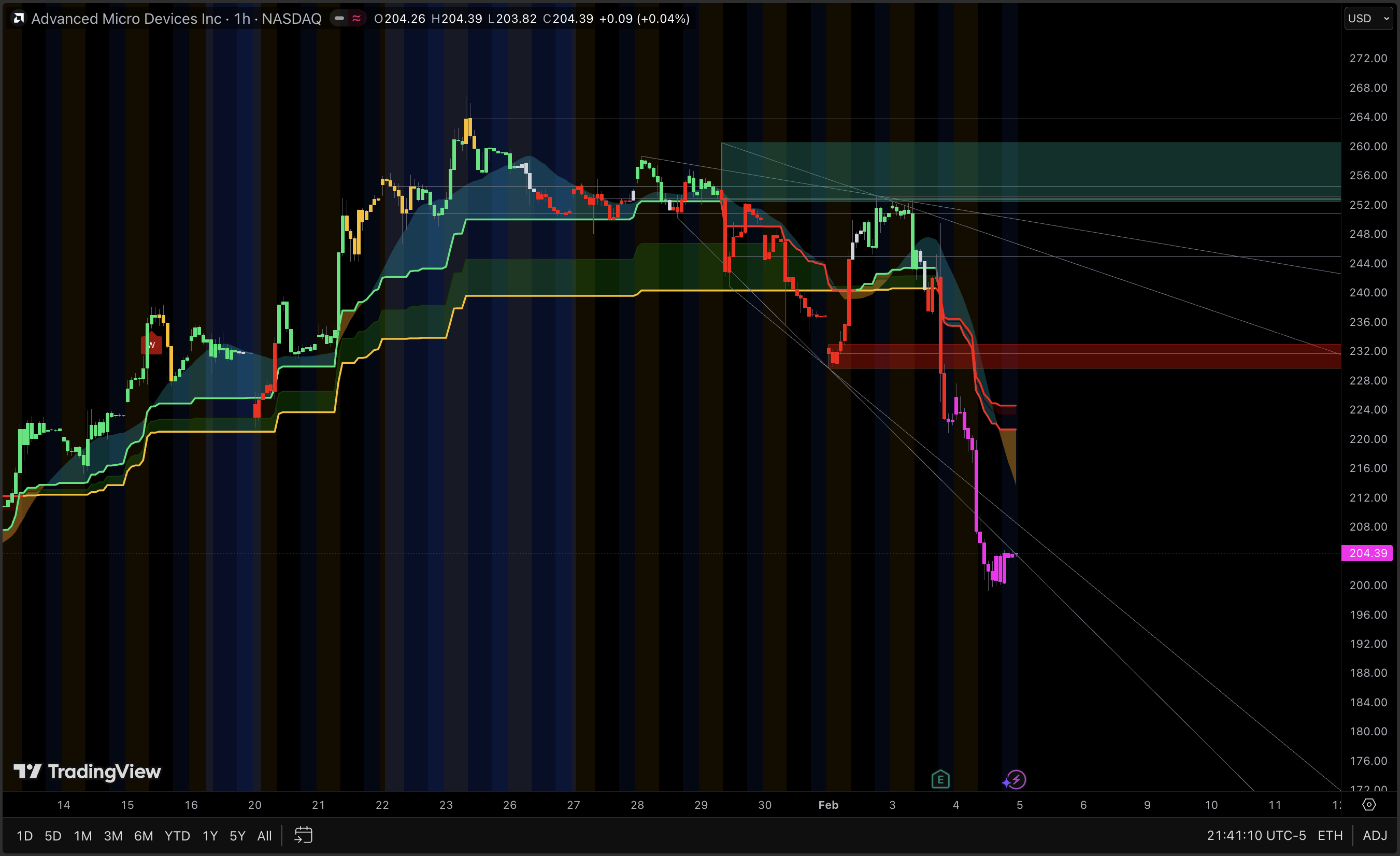

Technical And Positioning Effects Amplified The Drop

Significant post-earnings price declines are seldom attributable solely to fundamentals. When a widely held growth stock opens substantially below key technical levels, systematic selling strategies such as momentum trading, volatility targeting, and delta hedging may be triggered. In these scenarios, fundamental factors initiate the decline, while market positioning and trading microstructure accelerate the movement.

What To Watch Next For A Real Recovery

For AMD stock to stabilize and rebuild, the market will likely need evidence on three fronts:

Non-China Data Center AI GPU Momentum

Investors will look for acceleration that is not dependent on a single geography, timing event, or reserve release.

Margin Durability Through The Accelerator Ramp

The market wants proof that gross margin can hold or expand as AI GPU volume increases, without relying on one-offs. AMD’s own “clean” margin math makes this a measurable checkpoint. [1]

Operating Leverage Versus Opex Growth

AMD can spend aggressively and still win, but the incremental revenue needs to outpace incremental expenses over multiple quarters, not just in a single print.

Frequently Asked Questions (FAQ)

1) Why did AMD stock fall even after beating earnings?

Because the stock traded on forward expectations, not the reported quarter. Q4 results included one-time items that lifted profitability, while Q1 guidance implied a sequential revenue decline and a sharp reduction in China MI308 revenue, which reduced near-term visibility. [1]

2) What was the one-time boost in AMD’s Q4 results?

AMD disclosed an approximate $360 million release of previously reserved Instinct MI308 inventory and related charges, plus about $390 million of MI308 revenue to China. Excluding those items, AMD indicated Q4 non-GAAP gross margin would have been about 55%. [1]

3) What did AMD guide for Q1 2026?

AMD guided Q1 2026 revenue at about $9.8 billion plus or minus $300 million, including about $100 million of MI308 sales to China, and non-GAAP gross margin at about 55%. The midpoint implies about 32% year-over-year growth and about a 5% sequential decline. [1]

4) Is the drop about weak demand for EPYC or Ryzen?

Not necessarily. Q4 segment data showed strong overall growth, with data center revenue at $5.38 billion in Q4 and $16.64 billion for the year. The stock move looks more tied to accelerator visibility, margin normalization, and valuation sensitivity than to an abrupt collapse in CPU demand. [1]

5) Does higher inventory mean AMD has a demand problem?

Not automatically. Inventory can be built ahead of product ramps or supply-chain planning. Still, markets tend to discount inventory growth when near-term guidance implies a sequential revenue decline, because the risk of mix shifts or slower turns increases. AMD reported year-end 2025 inventories of $7.92 billion. [2]

Conclusion

The post-earnings decline in AMD’s stock is most accurately characterized as a reset in market expectations rather than a deterioration in underlying fundamentals. The quarter benefited from a significant China accelerator shipment and a reserve reversal, but forward guidance indicated that these factors would diminish in the first quarter as margins normalize near 55%.

For a stock valued on the basis of accelerating, high-confidence AI growth, this combination has led to valuation compression and profit-taking. Future performance will depend on demonstrating that data center AI growth is broad-based, sustainable, and contributes positively to margins.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://ir.amd.com/news-events/press-releases/detail/1276/amd-reports-fourth-quarter-and-full-year-2025-financial-results

[2] https://ir.amd.com/financial-information/sec-filings/content/0000002488-26-000018/amd-20251227.htm