Cryptocurrency markets declined following the Federal Reserve's 25 basis point rate cut on Wednesday, October 29, with Bitcoin dropping 1.6% to $111,000 and Ethereum falling 2% to $3,900 despite monetary easing that typically supports risk assets.

The counterintuitive move stems from Fed Chair Jerome Powell's hawkish press conference comments suggesting December's rate cut remains uncertain, dampening expectations for continued monetary accommodation.

More significantly, crypto markets remain fragile following the catastrophic October 10-11 liquidation event that wiped out $19 billion in leveraged positions—the largest single-day crypto wipeout in history—triggered by President Trump's shock 100% tariff threat on Chinese imports.

The combination of October's unprecedented deleveraging, persistent hawkish Fed signals, and elevated risk aversion has left crypto markets disconnected from traditional risk-on correlations.

What Caused the $19 Billion Liquidation Event?

The weekend of October 10-11, 2025, marked the most devastating single-day liquidation event in cryptocurrency history, fundamentally resetting market structure and sentiment.

| Metric |

Impact |

Historical Context |

| Total liquidations |

$19 billion in 24 hours |

9x larger than February 2025 crash |

| Traders affected |

1.6 million |

Largest count on record |

| Bitcoin decline |

-18% ($126K → $104,782) |

Worst drop since May 2021 |

| Ethereum decline |

-20% (fell below $4,000) |

Steeper than Bitcoin selloff |

| Market cap destroyed |

$370 billion |

Comparable to Terra Luna collapse |

Trump's tariff shock triggers cascade:

The chaos began on October 10 following President Trump's unexpected announcement of 100% tariffs on Chinese imports "over and above" existing tariffs. Within the first hour, $7 billion in positions vanished as automated liquidations triggered cascading selloffs. [1]

Cryptocurrencies, which trade 24/7 unlike traditional markets, bore the brunt of immediate selling pressure. Bitcoin shed more than $200 million in market capitalisation within hours, whilst Ethereum experienced an even more drastic 14% downturn as traders fled risk assets.

How liquidations created a death spiral:

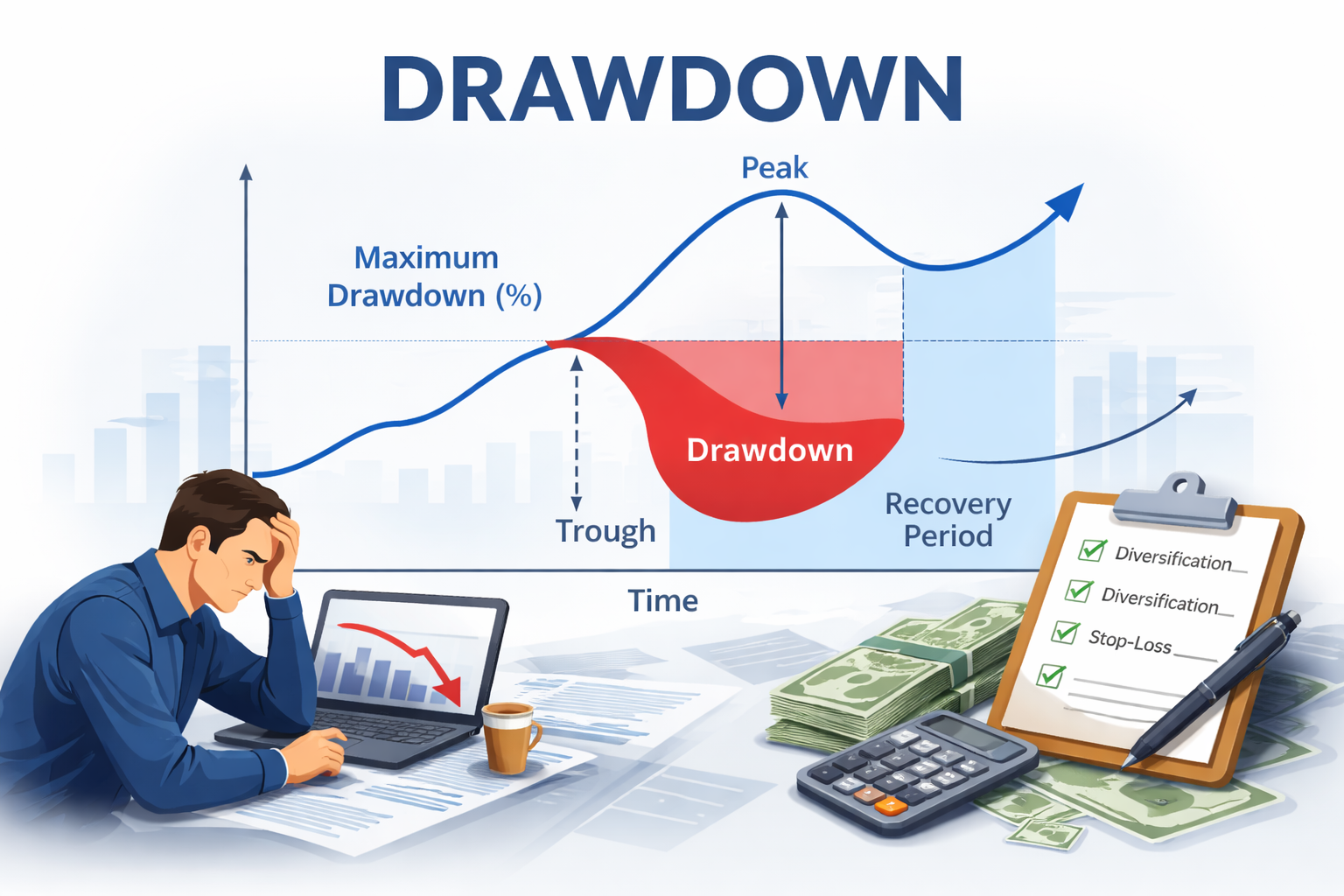

Cryptocurrency exchanges allow traders to borrow funds to amplify their positions using leverage or margin trading. A trader might deposit $10,000 but control a $100,000 position using 10x leverage, amplifying both gains and losses.

When prices move against a leveraged position beyond a certain threshold, exchanges automatically close the position to protect lenders from losses—this forced selling is called liquidation. As prices fell on October 10, the first wave of liquidations triggered additional selling pressure, pushing prices lower and triggering the next wave.

According to CoinGlass data, open interest—the total value of outstanding leveraged positions—collapsed from $65 billion to early-2025 levels, resetting the market's leverage profile. The 1.6 million traders affected represents an unprecedented scale of retail participation in overleveraged positions.

Trump subsequently backtracked on his aggressive rhetoric. "Don't worry about China, it will all be fine!" he posted on Truth Social days later. Thursday's overnight meeting between Trump and Chinese President Xi Jinping produced an agreement pausing plans to expand the blacklist of Chinese companies. However, markets had already suffered devastating losses by the time this positive news emerged.

Why Fed Rate Cuts Haven't Helped Crypto Markets

Historically, Federal Reserve rate cuts boost cryptocurrency prices by reducing the opportunity cost of holding non-yielding assets and increasing liquidity available for risk-taking. However, October 2025's rate cut delivered the opposite effect, with crypto declining whilst traditional risk assets rallied.

Powell's hawkish signals that spooked markets:

December cut now uncertain: Fed funds futures shifted to pricing just 71% probability of a December cut, down from 90% earlier on Wednesday

"Growing chorus to wait": Powell emphasised "there's a growing chorus now of feeling like maybe this is where we should at least wait a cycle"

FOMC divisions revealed: Powell noted "strongly differing views" among committee members about future cuts, revealing internal disagreement

Treasury yields jumped: The two-year note rose 9 basis points as traders reassessed the Fed's near-term trajectory

No rush to cut further: Powell stated the economy's resilience allows the Fed to move deliberately rather than aggressively

This uncertainty weighs particularly heavily on speculative assets like cryptocurrencies, which thrive on dovish monetary conditions and clear policy direction.

Carry trade dynamics compound pressure:

Lower US rates typically reduce the profitability of crypto carry trades—where investors borrow dollars at low rates to buy cryptocurrencies. However, if the Fed pauses at 3.75%-4.00%, borrowing costs remain elevated, suppressing leverage appetite. This explains crypto's muted response compared to past easing cycles when rates fell to near zero.

How 2025 differs from past Fed easing cycles:

| Factor |

March 2020 |

October 2025 |

Impact on Crypto |

| Rate level after cuts |

0–0.25% |

3.75–4.00% |

Still expensive to borrow for leverage |

| Inflation backdrop |

2.0% |

2.7% |

Limits how much Fed can cut |

| Equity market response |

Initial crash, then rally |

Hit record highs |

Stocks rallied, crypto didn't |

| Crypto correlation |

Strong with risk assets |

Broken |

Faces idiosyncratic headwinds |

| Subsequent BTC move |

-39% initially |

-7% and struggling |

Rate cuts don't guarantee rallies |

Whilst stock markets hit record highs following the Fed decision, with the S&P 500 above 6,900 and tech shares rallying, cryptocurrencies declined. This divergence reveals that crypto faces idiosyncratic headwinds beyond monetary policy—primarily the aftermath of October's deleveraging event.

The current environment differs from typical easing cycles, with inflation remaining elevated at 2.7% well above the Fed's 2% target, constraining how aggressively policymakers can cut without risking renewed price pressures.

Are Bitcoin Whales Buying or Selling Right Now?

On-chain metrics provide critical insight into holder behaviour and network health during periods of price stress, revealing what large holders and long-term investors are actually doing versus what price action suggests.

Key on-chain indicators:

| Metric |

Current Reading |

What It Means |

| Exchange flows |

Modest net outflows since Oct 20 |

Light accumulation returning after crash selling |

| Long-term holders |

75% supply unmoved 6+ months |

Strong hands not selling despite volatility |

| MVRV Z-Score |

3.0 |

Below cycle-top euphoria levels (6–7 range) |

| NVT Signal |

1.51 |

Healthy network utilisation relative to value |

| Active addresses |

~735,000 daily |

Robust user activity continuing |

| On-Balance Volume |

Lowest since April 2025 |

Weak spot buying demand persists |

| Stablecoin market cap |

Down 4% in October |

Capital leaving crypto ecosystem entirely |

What this tells traders:

Bitcoin exchange reserves increased during the October crash period, indicating holders moved coins from cold storage to exchanges in preparation for selling. This created substantial selling pressure as panic spread through retail markets.

However, the period following October 20 has seen modest net outflows, suggesting some accumulation is occurring, though at lower volumes than the panic selling witnessed during the crash. This mixed signal indicates neither strong bullish nor bearish conviction among holders.

Despite price volatility, analysis shows 75% of Bitcoin supply remained unmoved for 6+ months, demonstrating that whilst short-term traders panicked, experienced holders largely held their positions. The MVRV Z-Score currently sits at 3.0, indicating Bitcoin remains below historically overheated levels that typically mark cycle tops. Readings above 6-7 generally signal euphoric peaks, suggesting the current market has room for recovery despite recent weakness.

The NVT Signal stands at 1.51 with approximately 735,000 active addresses, confirming healthy network utilisation relative to current valuation levels. This suggests the blockchain continues processing meaningful economic activity despite price declines.

Stablecoin dynamics signal genuine capital flight:

Tether (USDT) maintained its $1 peg throughout the chaos, whilst USDC experienced substantial redemptions as institutional investors exited. Stablecoin market cap declined approximately 4%, reflecting capital leaving the crypto ecosystem entirely rather than rotating between assets.

This contrasts with typical corrections where stablecoin supply remains constant or increases as traders rotate from volatile assets into stablecoins whilst waiting for re-entry opportunities. The outright redemptions indicate genuine risk-off behaviour and reduced confidence in near-term crypto prospects.

Which Crypto Is Recovering Faster: Bitcoin or Ethereum?

Bitcoin and Ethereum have shown divergent recovery patterns following October's crash, revealing different investor risk appetites across crypto assets.

Head-to-head performance comparison:

| Metric |

Bitcoin (BTC) |

Ethereum (ETH) |

Advantage |

| Current price |

$111,000 |

$3,900–$4,000 |

– |

| Recovery from Oct 10 low |

+6% from $104,782 |

+2–3% from lows |

BTC ✓ |

| October monthly return |

-7% |

-10% |

BTC ✓ |

| Crash decline magnitude |

-18% |

-20% |

BTC ✓ |

| Market dominance trend |

Rising to ~62% |

Declining |

BTC ✓ |

| On-chain activity |

Stable fundamentals |

Layer-2 growth strong |

Mixed |

| Recovery momentum |

Moderate bounce |

Weaker bounce |

BTC ✓ |

Why Bitcoin shows relative strength:

Bitcoin maintains a modest 6% bounce from the $104,782 crash low, demonstrating some institutional support remains intact. However, the flagship cryptocurrency remains on track for its worst October return in more than a decade, shattering the "Uptober" pattern of autumn rallies that typically delivers strong gains.

Bitcoin dominance—the percentage of total crypto market capitalisation held by Bitcoin—has risen since the crash, typically signalling a flight to quality within crypto as investors prefer Bitcoin's relative stability over higher-risk altcoins. This rising dominance indicates risk-off behaviour persisting within the crypto ecosystem, with capital flowing from smaller projects toward the most established asset. [2]

Ethereum's mixed signals:

Ethereum shows weaker recovery momentum, trading around $3,900-$4,000 with a smaller bounce from crash lows than Bitcoin achieved. The second-largest cryptocurrency by market capitalisation experienced a steeper initial decline during the October 10 crash, falling 20% compared to Bitcoin's 18% drop.

Ethereum's underperformance reflects its higher sensitivity to risk sentiment and leverage activity. The platform hosts most decentralised finance protocols where leveraged trading occurs, making ETH prices more vulnerable when deleveraging events strike.

However, on-chain activity on Ethereum shows resilience that contradicts price weakness. Layer-2 scaling solutions like Arbitrum and Optimism continue processing substantial transaction volumes despite price declines. DeFi protocols maintain meaningful total value locked, suggesting protocol usage remains more robust than price action indicates.

What the divergence means:

The Bitcoin-Ethereum performance gap reveals that within the crypto ecosystem, investors are rotating toward perceived safety rather than abandoning digital assets entirely. Rising Bitcoin dominance combined with Ethereum's strong fundamentals despite price weakness suggests the market is distinguishing between price volatility and underlying utility—a potentially healthy sign for long-term market maturation.

How Institutions Are Positioned for Crypto's Next Move

Bitcoin spot exchange-traded funds and corporate treasury holdings provide critical insight into institutional sentiment and capital flows.

Institutional positioning snapshot (October 2025):

| Player |

Position |

Recent Action |

Signal |

| Bitcoin ETFs |

Net outflows |

$719.5M single-day outflow on Oct 29 |

Bearish ❌ |

| Ethereum ETFs |

Net outflows |

$428.52M record single-day outflow on Oct 13 |

Very bearish ❌ |

| Early October inflows |

Strong demand |

$5.95B in early October before crash |

Was bullish → reversed |

| MicroStrategy |

Holds ~252K BTC |

Stock down 7.6% to $254.57 |

Neutral ➡️ |

| Bitcoin miners |

Operating |

Hash rate 1.03 ZH/s near all-time highs |

Bullish ✓ |

Bitcoin ETF flows turn decisively negative:

Bitcoin spot ETFs in the United States experienced net outflows during October, marking the first sustained redemption period since the products launched in January 2025. According to Farside Investors data, October 29 alone recorded $719.5 million in net redemptions, representing one of the largest single-day outflows since launch.

These institutional outflows contrast sharply with the first three quarters of 2025, when Bitcoin ETFs recorded record inflows exceeding $5.95 billion in early October alone before the crash. The reversal suggests institutional investors reduced crypto exposure following October's turmoil, viewing current market conditions as unfavourable for risk-taking.

However, outflow volumes appear to be moderating in recent sessions, with some days showing modest inflows of several hundred million dollars. This deceleration suggests selling pressure may be stabilising, though sustained renewed inflows haven't yet materialised to confirm a trend reversal.

Ethereum ETF adoption remains tepid:

Ethereum spot ETFs continue struggling to gain traction, with October showing substantial outflows including a single-day record of $428.52 million on October 13. The products have failed to replicate Bitcoin ETF success since their July launch, indicating institutional appetite for ETH exposure remains weak compared to BTC.

The persistent Ethereum ETF outflows suggest institutions view ETH as a higher-risk proposition than Bitcoin, particularly during periods of market stress. This institutional reluctance compounds Ethereum's price weakness relative to Bitcoin.

MicroStrategy maintains accumulation strategy:

Corporate Bitcoin treasury company MicroStrategy (MSTR) continues holding substantial Bitcoin positions despite market volatility. However, the company's stock price declined 7.6% to $254.57, trading at a significant discount to its Bitcoin holdings' net asset value. This discount reflects investor concerns about the company's leveraged exposure to Bitcoin price volatility and its ability to service debt if crypto remains weak for extended periods.

Mining economics show confidence:

Hash rate resilience: Bitcoin hash rate reached record highs above 1.25 zettahashes per second before pulling back modestly in early October to approximately 1.03 ZH/s.

US miner dominance: US-listed miners now account for approximately 38% of global hash rate, with combined market cap reaching $79 billion.

Profitability intact: Daily block rewards per exahash rose 6% to $52,500 in the first half of October, suggesting mining remains economically viable.

No capitulation: Unlike previous bear markets where hash rate declined 20-40%, current levels near all-time highs indicate miners aren't shutting down operations.

The mining sector's resilience indicates improved profitability structures and confidence in long-term price appreciation despite near-term volatility. When miners continue operating despite price weakness, it typically signals they expect eventual recovery rather than prolonged bear market conditions.

What Comes Next

Cryptocurrency markets face several critical catalysts in coming weeks that will determine whether current weakness persists or recovery accelerates.

| Scenario |

Probability |

BTC Price Target |

Key Drivers |

| Fed cuts + trade deal |

35% |

$120,000+ |

Risk-on returns, renewed institutional flows |

| Fed cuts + trade tensions persist |

30% |

$108,000–$115,000 |

Range-bound consolidation, mixed signals |

| Fed pauses + trade deal |

25% |

$110,000–$118,000 |

Higher rates offset by reduced tariff fears |

| Fed pauses + trade war escalates |

10% |

$95,000–$105,000 |

Retest October lows, risk-off intensifies |

December FOMC meeting crucial:

December's Federal Open Market Committee meeting on December 17-18 represents the next major monetary policy decision. If the Fed delivers another 25 basis point cut despite Powell's cautious rhetoric, crypto markets would likely rally on renewed dovish expectations.

However, if the Fed pauses as Powell hinted, cryptocurrencies could retest October lows as higher-for-longer rate expectations reduce speculative appetite. Current futures market pricing shows just 71% probability of a December cut, down from 90% before Powell's hawkish press conference.

Trump-Xi trade relationship:

Thursday's meeting between President Trump and Chinese President Xi produced preliminary progress, with agreements on soybean purchases and pausing company blacklist expansions. However, the 100% tariff threat hasn't been formally withdrawn.

A comprehensive trade deal would remove a major overhang on risk assets, potentially allowing crypto to recover toward pre-crash levels around $120,000. Conversely, renewed trade tensions could trigger another liquidation event if leverage rebuilds in the market, particularly given that some traders have already begun re-establishing positions after October's purge.

Regulatory wildcards under Trump administration:

President-elect Trump campaigned on pro-crypto promises, including establishing a strategic Bitcoin reserve and appointing crypto-friendly regulators. If implemented, these policies could provide tailwinds for 2026. However, the incoming administration's actual regulatory approach remains uncertain, with appointments to key positions like SEC Chair still pending.

Global regulatory developments also matter. The European Union's Markets in Crypto-Assets (MiCA) framework takes full effect in December 2025, potentially affecting international crypto flows and exchange operations. Regulatory clarity typically reduces uncertainty and supports prices, though implementation challenges could create near-term volatility.

Technical recovery requirements:

Bitcoin needs to reclaim $116,000 to negate October's damage and establish a foundation for new all-time highs. Ethereum must break decisively above $4,200 to confirm its recovery.

Failure to hold support at $108,000 for Bitcoin would raise concerns about retesting the $104,782 crash low. Ethereum support sits at $3,800, with breaks below potentially triggering renewed selling toward $3,500. [3]

The October 10 liquidation event fundamentally reset crypto's market structure by purging excessive leverage. Whilst painful, this deleveraging may ultimately prove healthy by reducing the market's fragility and creating a more sustainable foundation for future gains. However, the combination of uncertain Fed policy, unresolved trade tensions, and cautious institutional positioning suggests volatility will persist through year-end.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://edition.cnn.com/2025/10/13/business/crypto-bitcoin-price-drop-trump-tariffs

[2] https://finance.yahoo.com/news/why-october-2025-down-most-150216105.html

[3] https://www.coindesk.com/markets/2025/10/31/asia-morning-briefing-bitcoin-trades-at-usd109k-as-u-s-etf-demand-fades-and-powell-s-hawkish-tone-hits-risk-assets