The ICLN ETF, formally known as the iShares Global Clean Energy ETF, is an exchange traded fund that provides investors with exposure to global companies operating in the clean energy sector. The fund aims to replicate the performance of the S&P Global Clean Energy Transition Index, which consists of companies involved in producing energy from renewable sources such as solar and wind and related technologies. The ETF was launched on 24 June 2008.

Investors often choose the ICLN ETF to capture the growth potential of renewable energy markets and align their portfolios with environmental and sustainability objectives. The fund offers a diversified set of equities from multiple regions, allowing broad exposure to developments in the global energy transition.

Key Features of the ICLN ETF

Portfolio Summary and Structure

The ICLN ETF is structured as an equity fund that holds approximately 101 global clean energy stocks. The fund's primary focus is on renewable energy producers and related technologies that are instrumental in the transition away from fossil fuels.

Key Fund Facts (as of December 2025)

| Attribute |

Value |

| Total Net Assets |

Approximately $1.9 billion |

| Expense Ratio |

0.39 per cent net |

| Number of Holdings |

101 |

| Benchmark Index |

S&P Global Clean Energy Transition Index in USD |

| Exchange |

NASDAQ |

| Dividend Yield |

Around 1.5 per cent annually |

| Launch Date |

24 June 2008 |

These metrics provide a snapshot of the ETF's scale, cost and focus. The net expense ratio of 0.39 per cent is competitive within thematic equity ETFs.

Top Holdings and Sector Exposure of ICLN ETF

The ICLN ETF invests in a range of companies that help advance the global adoption of clean energy. Below is a selection of its largest current holdings:

| Company |

Approximate Weight (%) |

| First Solar Inc |

8.36 |

| SSE PLC |

6.35 |

| Iberdrola SA |

6.02 |

| Vestas Wind Systems |

5.42 |

| China Yangtze Power Ltd |

4.20 |

| NexTracker Inc Class A |

3.99 |

| EDP Energias de Portugal SA |

3.71 |

| Equatorial SA |

3.54 |

| Suzlon Energy Ltd |

3.26 |

| Enphase Energy Inc |

2.68 |

These companies span several sub-sectors within clean energy, including solar, wind and hydroelectric power, as well as component and system providers. This diversity helps mitigate company-specific risk while maintaining focused exposure to the renewable energy theme.

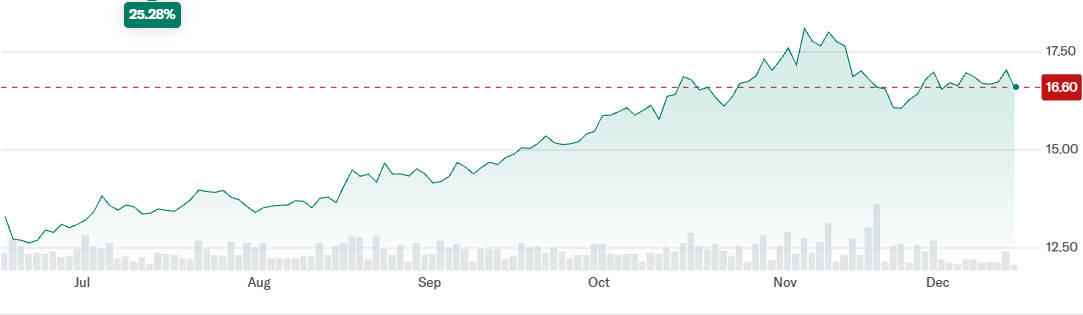

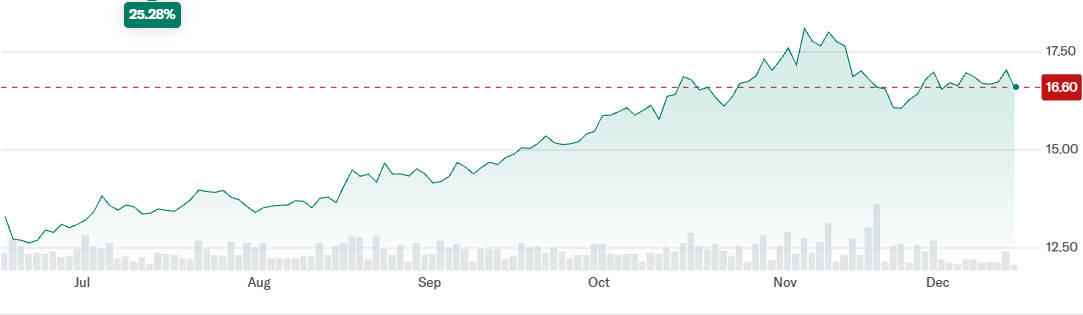

Performance Overview and Risk Characteristics

ICLN's performance reflects the dynamics of the renewable energy sector, which can diverge from broad market indices due to regulatory changes, technological progress and commodity price shifts.

Performance varies across different time horizons. It should be noted that past performance is not a guarantee of future results, and investors should consider multiple metrics over meaningful time periods.

Key risk and return characteristics include:

Standard Deviation: Around 24.16 per cent over three years, indicating comparatively higher volatility relative to broader equity indices.

Beta: Approximately 1.06, suggesting that the ETF's price tends to move slightly more than the market on average.

This ETF can be expected to show significant price fluctuations in response to sector-specific news and broader market movements.

Benefits of Investing in the ICLN ETF

Investors may find several distinct advantages in holding the ICLN ETF:

Global Diversification

The ETF holds companies from multiple geographic regions, spreading risk across various markets and regulatory environments.

Thematic Exposure to Clean Energy

The fund provides targeted exposure to companies positioned to benefit from the long-term shift towards renewable energy and decarbonisation strategies.

Competitive Cost Structure

With a net expense ratio of 0.39 per cent, the fund balances the need for thematic focus with relatively low costs compared with similar specialty ETFs.

Dividend Income

The fund distributes dividends semiannually, with an annualised yield near 1.5 per cent.

Risks and Considerations for Investors Investing in ICLN ETF

As with any investment, the ICLN ETF carries inherent risks:

Sector Specific Volatility

Clean energy stocks can be subject to rapid shifts in investor sentiment, largely driven by policy changes, subsidies and global energy demand. This can lead to elevated price volatility.

Regulatory Risk

Government policies and environmental regulations can materially influence the performance of companies in the fund. Changes in support for renewable energy could impact returns.

Currency Risk

Given the global nature of the holdings, fluctuations in currency exchange rates may affect the fund’s net asset value and returns.

How to Invest in the ICLN ETF

Investors can purchase shares of the ICLN ETF through most brokerage accounts that offer access to the NASDAQ exchange. The process typically involves:

Opening a brokerage or investment account with a licensed provider.

Searching for the ticker symbol ICLN.

Placing a buy order at market or a specified limit price.

Monitoring your investment according to your portfolio objectives.

It is advisable to consult a financial professional to ensure that the ETF aligns with your risk tolerance and long term investment strategy.

ICLN ETF Compared with Other Clean Energy ETFs

When compared to similar renewable energy funds, the ICLN ETF offers:

Broad exposure across sub-sectors within clean energy.

A moderate expense ratio relative to other thematic ETFs.

A sizable asset base that supports liquidity and trading efficiency.

Alternative ETFs might focus on narrower themes such as solar energy alone or incorporate different weighting methodologies. Investors should compare objectives, costs and holdings before choosing a fund.

Frequently Asked Questions

1. What is the expense ratio of the ICLN ETF?

The net expense ratio for ICLN is approximately 0.39 per cent, which reflects the annual cost of managing the fund relative to its assets.

2. How often does the ICLN ETF pay dividends?

The ICLN ETF pays dividends twice per year, typically on a semiannual basis, with a modest yield reflecting its equity holdings.

3. Can I hold ICLN ETF in a retirement account?

Yes, ICLN ETF is eligible for holding in tax advantaged accounts such as IRAs and pensions, subject to your brokerage platform's policies.

4. Is ICLN suitable for long term investing?

ICLN may suit long term investors who seek exposure to renewable energy, but it still carries sector specific risks and market volatility.

5.Does the ICLN ETF track a specific index?

Yes, the fund aims to replicate the performance of the S&P Global Clean Energy Transition Index, which comprises clean energy companies worldwide.

Conclusion

The ICLN ETF offers a powerful opportunity for investors to align their portfolios with the rapidly growing clean energy sector. With its diversified holdings in leading renewable energy companies, low expense ratio, and potential for long-term growth, ICLN is a compelling choice for those seeking both financial returns and a sustainable investment strategy. As global demand for clean energy continues to rise, ICLN ETF stands positioned to capture the momentum of this transformative industry.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.