Shein’s IPO is widely expected to debut on the Hong Kong Stock Exchange, positioning Shein stock as one of the most closely watched consumer equities globally.

Shein stock has returned to the center of market attention as renewed Shein IPO speculation builds, following earlier attempts to list in the U.S. and London that stalled due to regulatory hurdles.

For investors evaluating Shein stock, the key question is no longer simply when the Shein IPO will occur, but at what valuation Shein stock may enter public markets, under what regulatory conditions, and whether Shein stock can deliver sustainable long-term returns rather than short-lived IPO-driven momentum.

Shein’s IPO Journey: From Ambition To Recalibration

Shein’s path to a public listing has been anything but linear. Early discussions around a U.S. listing faded quickly due to geopolitical sensitivity and regulatory complexity.

London then emerged as a potential venue, but concerns related to supply chain transparency, governance standards, and political optics slowed progress.

By 2025, momentum shifted decisively toward Hong Kong. The company reportedly filed confidentially, signaling a pragmatic pivot toward a market more familiar with China-linked business structures and cross-border e-commerce models.

This move should not be read as a retreat, but rather as a recalibration. Hong Kong offers deeper regional investor understanding and a regulatory framework that may be more workable for Shein’s operational reality.

Timing remains fluid. While preparatory steps are advanced, the actual listing window will depend on market conditions, regulatory feedback, and the company’s willingness to accept a valuation that reflects public-market risk tolerance rather than private-market optimism.

Executive Snapshot: What To Know Right Now

Shein has been actively pursuing a public listing and reportedly filed confidentially for a Hong Kong IPO.

Earlier plans to list in London stalled amid regulatory concerns; the company pivoted toward Hong Kong as the primary venue.

Market estimates and press reports show a wide range of valuations (from pressured $30B targets to far higher early-2020s private rounds), and management has flagged much stronger profit expectations.

Regulatory and geopolitical headwinds, including tighter EU scrutiny of low-value imports, are an active risk for valuation and timing.

Why Shein’s IPO Matters

Shein transformed fast fashion by tightly integrating design, ultra-fast supply chains, and a data-driven product cadence. A public listing would:

Provide liquidity to early investors and employees.

Offer a market valuation benchmark that could influence valuations across e-commerce and consumer retail.

Expose the company to ongoing regulatory, sustainability and trade scrutiny that private markets could more easily manage.

Because Shein has shifted domicile/operational filings (Singapore, Hong Kong discussions), regulatory approvals and cross-border considerations will shape both the venue and timing.

Current Value of Shein: What It’s Worth Now

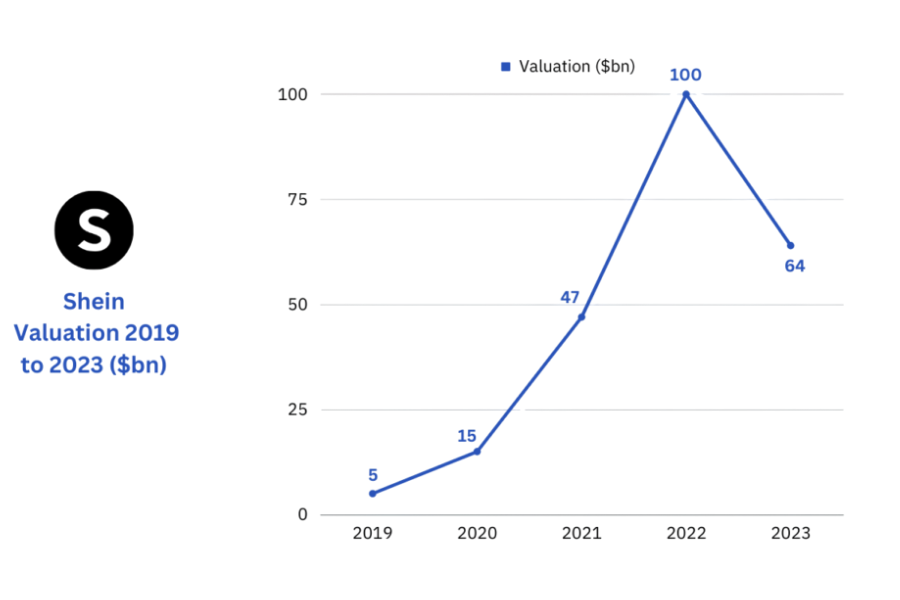

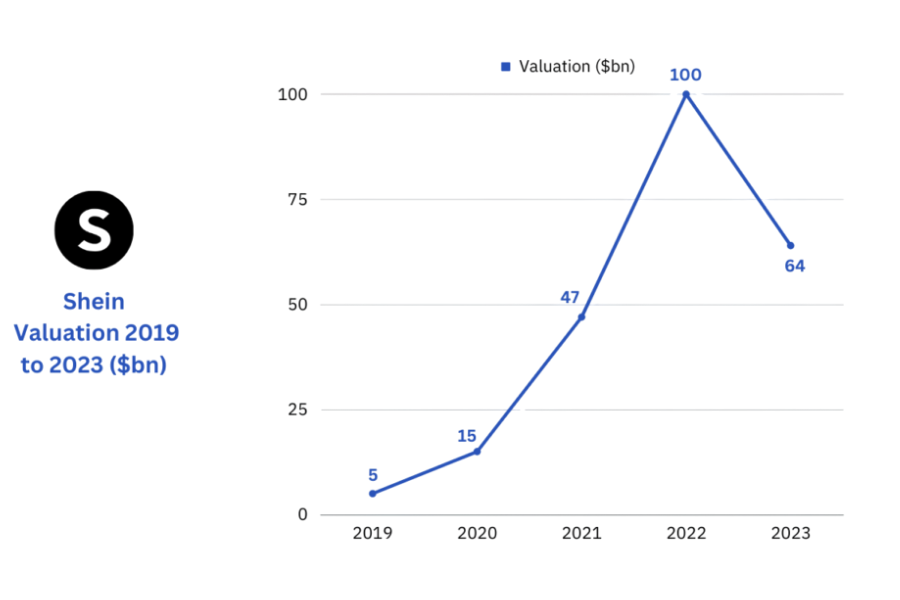

Shein’s valuation has shifted significantly from its peak private-market estimates. After being valued as high as around $100 billion following a 2022 funding round, the company’s expected IPO valuation has been under pressure from investors and market conditions, with reports suggesting it may be priced closer to approximately $30 billion ahead of its public offering.

This downward adjustment reflects a combination of regulatory scrutiny, slowing profit growth in certain markets, tariff impacts, and caution from institutional investors seeking a more realistic entry point into public markets.

Despite these headwinds, Shein’s strong 2025 profit outlook , including expectations of nearly $2 billion in net income, provides a foundation for a meaningful valuation range once official IPO pricing is announced.

Valuation Analysis: Expectations Versus Reality

Valuation is where sentiment and discipline collide. During the peak of private-market exuberance in 2021 and 2022, Shein was rumored to command valuations approaching $100 billion.

Those figures reflected abundant liquidity, limited public comparables, and optimism about endless consumer demand.

Public markets operate under different rules. Recent discussions suggest that potential IPO valuations may cluster far lower, with ranges often cited between $25 billion and $40 billion depending on profitability, regulatory clarity, and market tone.

To frame expectations realistically, consider three valuation narratives:

| Scenario |

Rationale |

Implied IPO Valuation Range |

| Bull |

Strong 2025 profits, convincing governance, robust U.S. and EU revenue recovery |

$50B–$70B |

| Base |

Solid 2025 profitability guidance, softer traffic, modest regulatory frictions |

$25B–$40B |

| Bear |

Regulatory constraints, tariff shocks, weak growth, investor risk discount |

$10B–$25B |

In a bull scenario, Shein demonstrates strong audited earnings, stabilizes regulatory relationships, and lists into a favorable consumer market. Valuation could approach the upper end of recent expectations.

In a base scenario, growth remains solid but compliance costs and geopolitical discounting persist, resulting in a mid-range valuation aligned with global apparel peers adjusted for growth.

In a bear scenario, regulatory friction intensifies or consumer demand softens, forcing a defensive IPO pricing to ensure deal completion.

The key insight for investors is that valuation compression is not necessarily a failure. A lower, more credible IPO price can improve long-term returns by reducing downside risk and allowing upside to be earned rather than assumed.

Technical Analysis Preparation

Because Shein is still private, technical analysis must be approached indirectly. Traders sre advised to focus on sector proxies such as global apparel and e-commerce stocks to assess risk appetite and momentum within the broader fast-fashion universe.

Once listed, early price action will likely follow a familiar IPO pattern. Initial volatility, driven by retail enthusiasm and limited float, may push momentum indicators such as RSI into overbought territory quickly.

MACD crossovers and volume spikes during the first several weeks will offer clues about institutional accumulation versus short-term speculation.

Moving averages, particularly the 50-day and 200-day, will become meaningful only after sufficient trading history develops. Until then, technical signals should be used defensively, emphasizing risk management rather than aggressive trend chasing.

Retail Versus Institutional Demand: Who Will Own Shein Stock?

Shein’s strong global brand recognition and social-media reach are likely to attract significant retail investor interest during the early stages of the IPO.

Heavy retail participation can drive short-term price momentum but may also increase volatility if sentiment shifts quickly.

Institutional investors will focus more closely on governance standards, earnings visibility, regulatory exposure, and free-float structure before committing capital.

Any perception of elevated compliance or geopolitical risk could limit early institutional allocation, affecting price stability.

Over time, increasing institutional ownership would signal confidence in Shein’s long-term business sustainability and valuation discipline.

Monitoring post-IPO ownership disclosures can help investors assess whether Shein is transitioning from a speculative trade to a long-term investment candidate.

Risks and Catalysts

Risks

Heightened regulatory scrutiny in Europe and the U.S. around product safety, tariffs, and data controls

Potential geopolitical and onshore regulatory approval delays affecting listing timing or venue

Reputational and sustainability concerns that could pressure consumer demand and investor sentiment

Catalysts

Publication of the IPO prospectus and audited financial statements

Confirmation of Beijing and Hong Kong regulatory approvals and a successful investor roadshow

Strong demand for recent consumer and e-commerce IPOs in the region, supporting positive market sentiment

Frequently Asked Questions (FAQ)

1. What kind of company is Shein from an investment perspective?

From an investment standpoint, Shein stock represents exposure to a hybrid business operating at the intersection of fast fashion, global e-commerce, and data-driven supply chain technology. Rather than a traditional apparel retailer, Shein stock is better viewed as a consumer platform with technology-enabled scale, which enhances growth potential but also increases operational and regulatory complexity.

2. Why does Shein’s valuation generate so much debate?

The valuation of Shein stock is widely debated due to the company’s rapid historical growth, large private-market funding rounds, and a lack of direct public comparables. At the same time, regulatory scrutiny, sustainability concerns, and geopolitical risks introduce uncertainty that public investors often price more conservatively when assessing Shein stock.

3. How important is regulatory approval to Shein’s IPO success?

Regulatory approval is critical to the success of Shein stock at IPO because it directly influences listing timing, disclosure standards, and investor confidence. Any delays, additional compliance requirements, or jurisdictional limitations could materially affect demand for Shein stock and result in valuation adjustments.

4. Should long-term investors focus more on timing or fundamentals with Shein?

While IPO timing may impact short-term price action in Shein stock, long-term performance is far more dependent on fundamentals such as profitability, governance quality, and competitive positioning. Investors who prioritize these core drivers may be better positioned to navigate post-IPO volatility in Shein stock.

Final Thoughts

Shein’s IPO is likely to be a defining event for global consumer markets, not because of speculation, but because it will test how public investors ultimately value Shein stock at the intersection of scale, speed, and controversy within a single balance sheet.

The long-term performance of Shein stock will depend less on IPO marketing narratives and more on the company’s ability to convert operational dominance into transparent, repeatable earnings that public markets can consistently price.

For traders, Shein stock may present opportunity through post-IPO volatility and momentum as price discovery unfolds. For long-term investors, the real advantage with Shein stock may come from restraint, valuation discipline, and patience, allowing the market to establish fair value rather than reacting to early enthusiasm.

In the end, the listing of Shein stock is less about fashion trends and more about market maturity. Investors who approach Shein stock with analytical rigor rather than excitement are most likely to benefit once the opening bell finally rings.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.