Picture yourself driving a car at 200 km/h without brakes or a seatbelt. Exciting? Maybe. Safe? Absolutely not. Trading without risk management is the financial equivalent of that reckless drive. You might feel the rush when prices move in your favour, but a single sharp turn could leave your account shattered.

That's why risk management in trading is like your seatbelt; it won't prevent accidents, but it helps you survive and continue heading towards your financial objectives. As of 2025, with global markets moving faster than ever, mastering risk management isn't just a skill; it's your survival kit.

Our guide below will walk you through the foundations, tools, strategies, and real-world applications of risk management in trading, featuring straightforward examples which you can easily envision.

What Is Risk Management in Trading?

In trading, risk management involves recognising, assessing, and managing the possible losses that may arise from your investments.

It's not about avoiding risk, because trading without risk is impossible. Instead, it's about making sure:

You never risk more than you can handle.

One bad trade doesn't wipe out your account.

You give yourself the chance to stay in the market long enough to win.

Think of it like playing a long game of chess. You may lose pieces along the way, but the goal is to protect your king, your trading capital.

The Trading Psychology of Risk Management

Risk management is not just about numbers; it's also about controlling emotions.

Fear makes traders exit too early.

Greed makes traders take oversized positions.

Overconfidence leads to ignoring stops.

By setting predefined risk rules, you reduce emotional trading and ensure consistency.

Why Risk Management Matters More in 2025 and Beyond?

1. Volatility Is Rising

As of 2025, global markets are more connected than ever. A tweet, a central bank decision, or even a sudden conflict can move currencies, stocks, and crypto within minutes. Without a plan, volatility can wipe out beginners in seconds.

2. AI and Algorithmic Trading

Institutions now utilise AI-driven algorithms that move faster than humans. It means markets can swing rapidly, leaving manual traders vulnerable if they don't have protective stops and limits in place.

3. Crypto Integration

Bitcoin surged above $120,000 in 2025, making crypto too big to ignore. However, cryptocurrency experiences significant fluctuations, occasionally ranging from 10% to 20% within a single day. Risk management is no longer optional in this space.

4. Global Participation

With millions of new traders entering from emerging markets, competition is fiercer. To survive, you need rules, not just luck.

What Are the Key Principles of Risk Management?

1. Never Risk More Than You Can Afford to Lose

A golden rule: never put money into a trade that would hurt your lifestyle if lost. Successful traders risk only 1–2% of their account per trade.

2. Use Stop-Loss Orders

A stop-loss order automatically closes your trade when the price hits a certain level. It's your safety net, preventing small losses from becoming disasters.

3. Position Sizing

Position sizing refers to adjusting the quantity of shares, lots, or coins purchased based on your account balance and risk level.

For example, if you're willing to risk $200 on a trade and your stop is $20 away, you should only buy 10 units.

4. Diversification

Don't put all your eggs in one basket. Trade across different assets (stocks, forex, crypto, commodities) or industries to spread your risk.

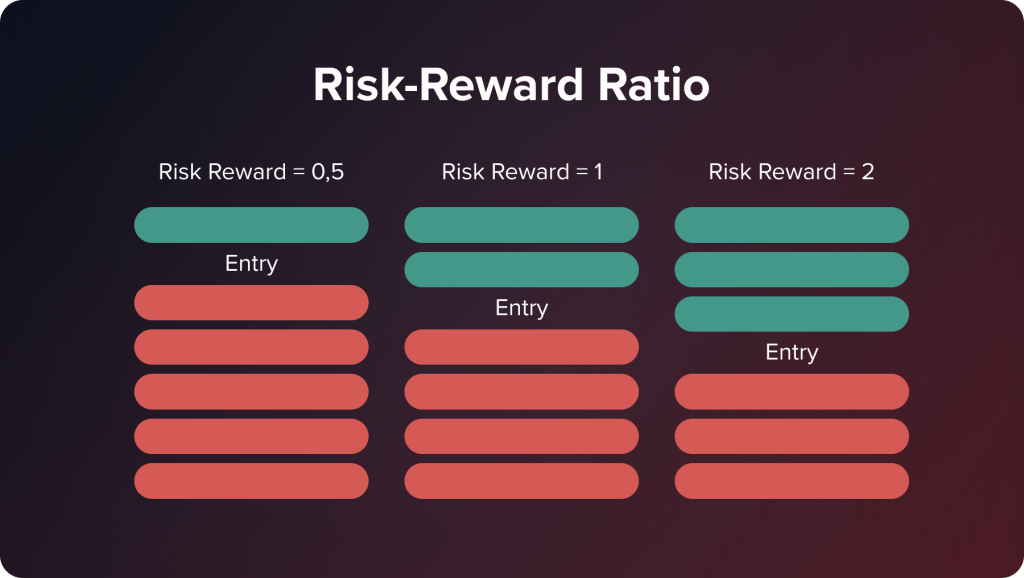

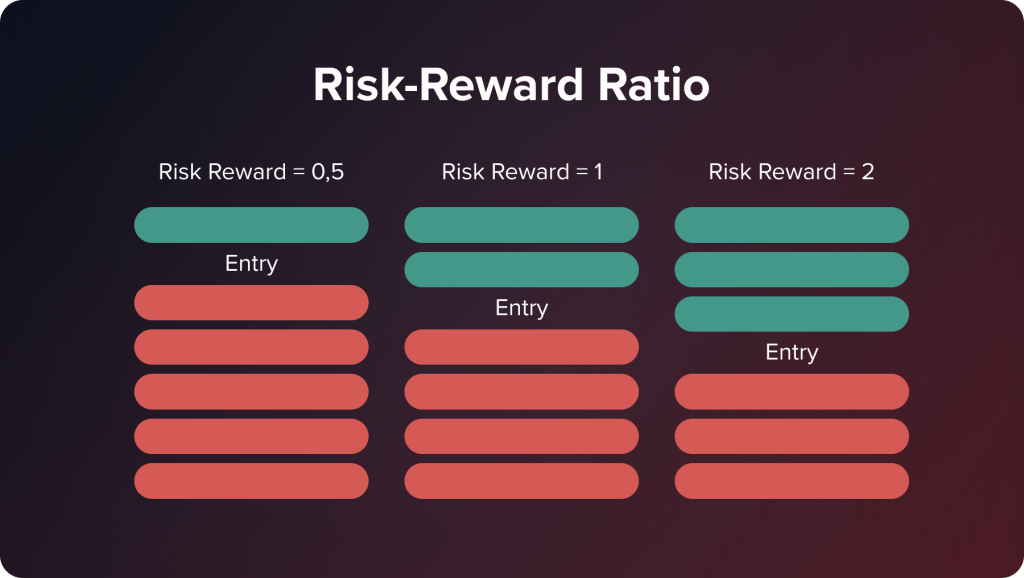

5. Risk-to-Reward Ratio

Always aim for a reward greater than your risk. A common rule is risking $1 to make $2 or more (1:2 ratio). That way, even if you lose half the time, you'll still be profitable.

Tools and Techniques Traders Apply for Risk Management

1. Stop Orders (Stop-Loss and Trailing Stops)

As we mentioned earlier, stop-loss protects you from excessive losses. A trailing stop moves up automatically when the market goes in your favour, locking in profits.

2. Leverage Control

Leverage can magnify both profits and losses. In forex and crypto, traders often misuse high leverage, such as 50x or 100x, which can wipe out accounts instantly.

Experts suggest keeping leverage low (under 10x) unless you're highly experienced.

3. Hedging

Hedging refers to mitigating risk by taking an opposite position in another market. For example, if you're long on oil, you might short airline stocks (which drop when oil rises).

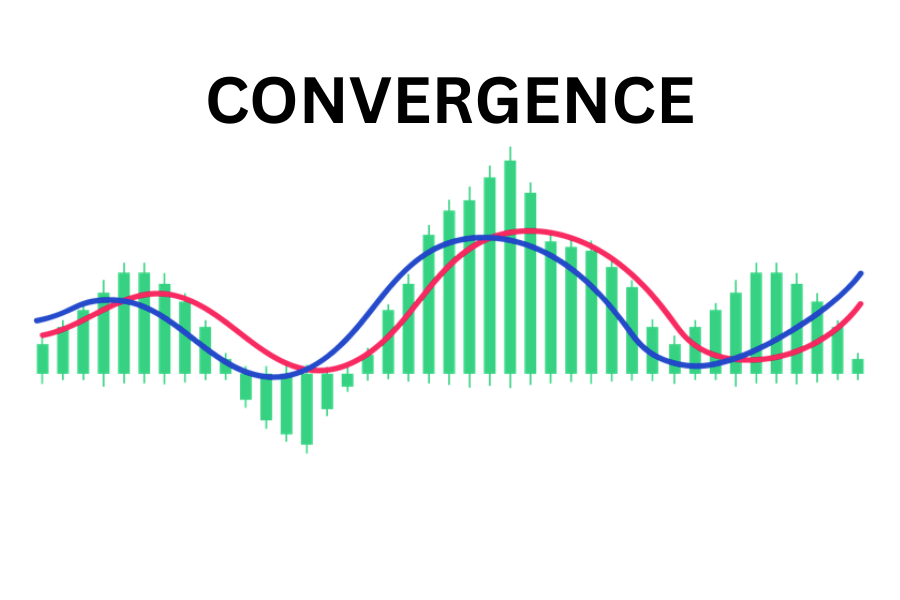

4. Volatility Indicators

Tools like Average True Range (ATR) or Bollinger Bands help you set stop levels based on actual market volatility, not just random numbers.

5. Risk Management Software and AI Tools

As of 2025, platforms like EBC Financial Group offer built-in risk calculators, automated stop placement, and AI suggestions for managing trades.

Applying Risk Management Across Different Markets

1. Stocks

Investors utilise diversification, stop-losses, and position sizing to avoid massive drawdowns. Long-term investors also hedge with options.

2. Forex

Due to leverage, forex requires tight stop-losses and strict position sizing. Risking even 2% per trade is considered aggressive here.

3. Crypto

Volatility demands wider stops and smaller position sizes. Many crypto traders maintain assets in stablecoins to mitigate risk.

4. Commodities

Commodities like oil and gold react to global news. Traders use futures contracts and options to hedge risk.

Simple Examples of Applying Risk Management in Trading

1) Forex Trading

A trader has $10,000 in his account. He risks only 1% ($100) per trade. On EUR/USD, he sets his stop-loss 50 pips away. With each pip worth $10, he buys only 0.2 lots. Even if he loses, his account remains safe.

2) Stock Trading

A trader buys Tesla at $250. She sets a stop-loss at $230 (a $20 risk). She buys only 5 shares, meaning her maximum risk is $100. If Tesla jumps to $300, her trailing stop follows upward, locking in profits.

3) Crypto Trading

A crypto trader buys Bitcoin at $120,000. Instead of betting his entire savings, he allocates just 10% of his portfolio. He sets a stop-loss at $100,000, limiting his risk to a manageable level.

What Are the Common Mistakes Beginners Make in Risk Management?

Using too much leverage and blowing up accounts.

Ignoring stop-loss orders, hoping trades will recover.

Overtrading with too many positions at once.

Revenge trading by doubling down after a loss without a plan.

Risking more than 5–10% on a single trade, leaving no room for error.

Famous Traders and Their Risk Management Lessons

1) Warren Buffett:

Known for saying, "Rule No.1: Never lose money. Rule No.2: Never forget rule No.1." While Buffett invests long-term, his principle is about protecting capital first.

2) Paul Tudor Jones:

One of the best hedge fund managers, he attributes his success not to predicting markets but to strict risk controls.

3) George Soros:

His famous quote, "It's not whether you're right or wrong, but how much you make when you're right and how much you lose when you're wrong," reflects pure risk management.

Frequently Asked Questions

1. What Does Risk Management Mean in Trading?

Risk management in trading is the practice of protecting your capital by controlling the losses on each trade.

2. How Much of My Account Should I Risk per Trade?

Most experts recommend risking only 1–2% of your account per trade.

3. Can Risk Management Guarantee Profits?

No. Risk management doesn't guarantee profits; it ensures survival.

4. What's the Difference Between Money Management and Risk Management?

5. Is Risk Management the Same Across Stocks, Forex, and Crypto?

The principles are the same: never risking too much, using stops, and sizing positions correctly.

Conclusion

Trading is often portrayed as a game of predicting prices. In reality, the winners are those who manage risk better than the rest. As of 2025, with markets moving at lightning speed and new traders entering daily, risk management isn't just a strategy; it's your shield, compass, and safety net.

Think of it like sailing. You can't control the wind (the market), but you can adjust your sails (your risk) to survive storms and keep moving forward.

Thus, as you step into trading, remember this: capital protection comes first, profits come second.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.