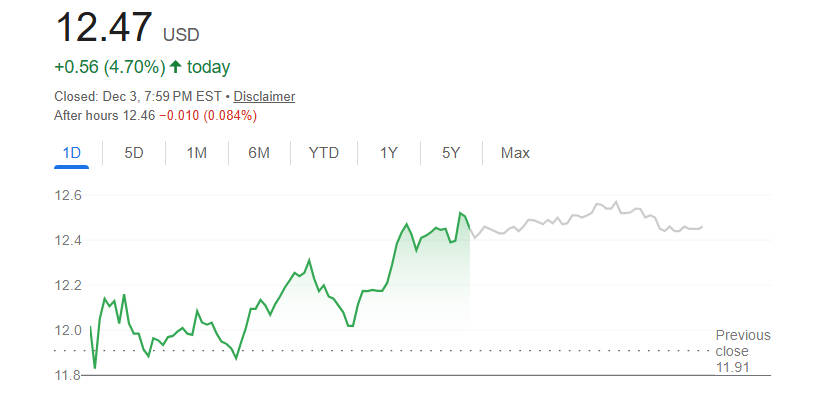

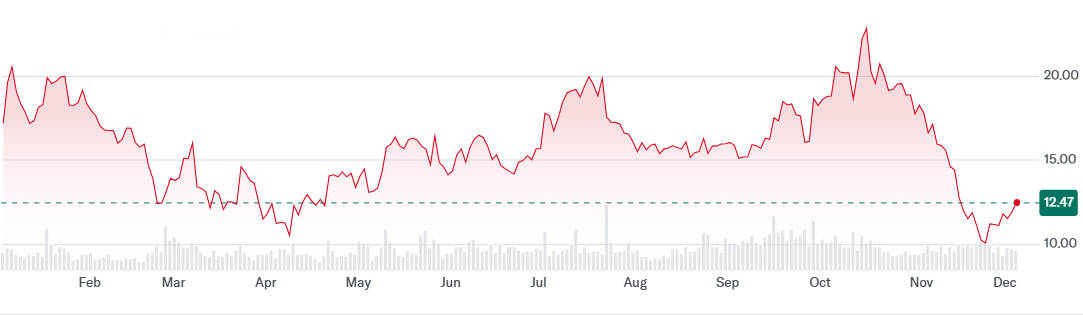

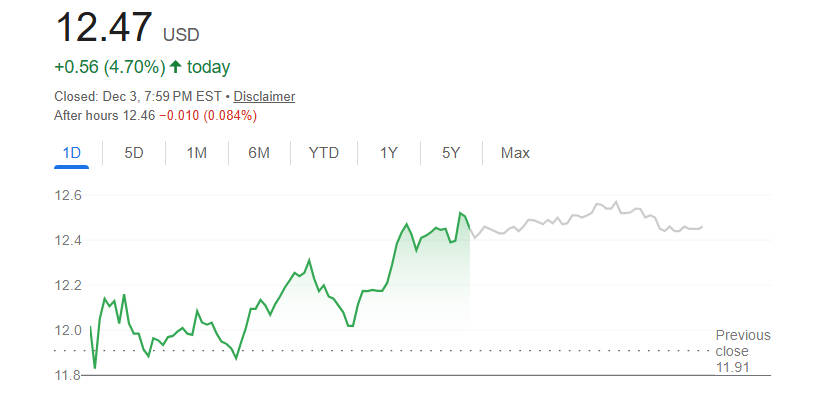

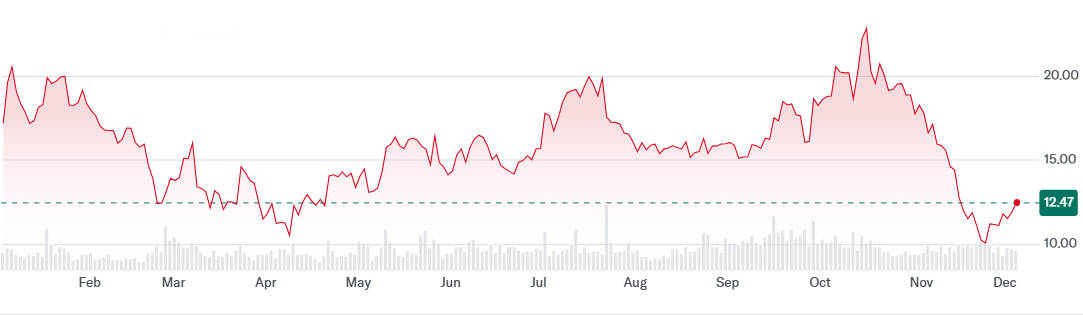

The recent trading pattern of Marathon Digital Holdings ($MARA) stock is a perfect microcosm of its high-volatility nature. The stock is currently priced at $12.47. having surged +1.18 (+10.45%) over the past five days alone, an immediate sign that investor interest is reigniting.

This short-term uptrend, however, follows a severe correction, with the price still down -4.15 (-24.97%) over the past month and -3.20 (-20.42%) over the last six months.

This dramatic contrast frames the central investment query: Is MARA Stock a Buy Now? Will I ts Growth Continue?

The ability of Marathon to transform its recent micro-rally into a sustained next 6 months forecast depends entirely on whether its strategic pivot to AI infrastructure, combined with rising Bitcoin efficiency, can finally overcome the volatility that has weighed on its long-term chart.

Analyzing MARA's Strength and Operational Efficiency

A thorough examination of Marathon Digital's recent financial performance is essential to understand the foundation of its potential MARA Growth Continuation.

| Metric |

Value |

Interpretation for Growth |

| Quarterly Revenue |

$252.41 Million |

Missed analyst expectations slightly but still represents a massive year-over-year increase, driven by higher Bitcoin production and price. |

| Q3 EPS |

-0.32 |

Missed analyst consensus of $-\$0.26$, indicating high operational costs and dilution are still concerns despite revenue growth. |

| Bitcoin Treasury |

Over 52,850 BTC |

A massive, valuable asset that ties the stock price directly to Bitcoin. The treasury acts as a significant store of value for MARA Stock. |

| Institutional Ownership |

$\approx 44.53\%$ |

High institutional ownership signals strong market trust in the company's long-term strategy, despite recent insider selling. |

The narrative of MARA's growth continue is supported by a nearly doubling of revenue year-over-year. However, the EPS miss highlights the continuous challenge of controlling costs and minimizing share dilution, which are critical for the stock to sustain its uptrend.

The Primary Price Drivers of MARA Stock Forecast

The MARA Stock Forecast is governed by a dynamic interplay of three core drivers. Understanding these factors is essential for determining if MARA Stock is a Buy Now and evaluating if MARA's Growth will Continue.

1. The Bitcoin Nexus (High Correlation)

Driver:

The price of Bitcoin ($BTC) and its related market sentiment.

Impact:

MARA holds over 52.850 BTC in its treasury and generates revenue solely through Bitcoin Mining. Its price often exhibits a high beta (around 6.4), meaning it is significantly more volatile than the general market, amplifying both gains and losses. A major Bitcoin rally is the strongest immediate catalyst.

2. Operational Efficiency & Scaling (Fundamental Growth)

Driver:

Growth in energized hash rate and reduction in the cost per Bitcoin mined.

Impact:

Marathon has maintained its status as one of the largest public miners by energized hash rate. The success of its cost-reduction efforts—particularly ahead of the Bitcoin Halving—is essential to protect the margin and prove that its growth will continue through market cycles.

3. The AI Infrastructure Pivot (Future Valuation)

Driver:

Successful diversification into high-performance computing (HPC) and AI-optimized data centers, utilizing their massive energy footprint.

Impact:

This pivot, which includes the strategic investment in Exaion and the partnership with MPLX, is key to introducing high-margin, recurring revenue streams to counterbalance the cyclical mining business. Success here could decouple MARA's valuation from Bitcoin and justify the premium analyst price targets.

Technical Analysis: Is MARA Stock a Buy Now

A professional technical analysis shows the stock is at a critical inflection point, currently attempting to reverse a multi-month correction of around 20%.

| Indicator |

Current Signal |

Interpretation |

| Recent Price Action (Past 5 Days) |

+10.45% Uptrend |

Confirms strong short-term buying pressure, indicating a move away from oversold conditions following the recent decline. |

| Major Resistance Level |

$15.20 (Minor) / 50-Day MA at $16.67 (Major) |

The 50-Day Moving Average at $16.67 is the next major technical hurdle. Breaking this resistance is necessary to confirm that MARA's growth will continue in a sustained fashion. |

| Moving Averages (50-Day vs. 200-Day) |

Bearish Crossover |

The recent short-term average crossing below the long-term average is a cautionary short-term signal, but this can precede a dramatic rally if Bitcoin momentum sustains. |

| MACD (Momentum) |

Turning Positive |

The MACD line is signaling a potential positive crossover. This momentum shift strongly supports the thesis that the current uptrend may be the start of a sustained rally toward the analyst targets. |

Is MARA Stock a Buy Now technically? The stock exhibits compelling short-term momentum, but a true reversal is only confirmed by breaching major resistance.

Technical traders should consider the range between $15.20 and the $16.67 (50-Day MA) as the "buy zone" for an aggressive play on MARA's growth continuation.

The Next 6 Months MARA Stock Forecast

Combining the analyst consensus with the identified price drivers, the forecast for MARA stock suggests significant potential, but caution is warranted.

Analyst ratings remain bullish, suggesting strong conviction in the company's future direction, particularly its diversification efforts.

Analyst Consensus and Price Targets

| Price Target Metric |

Value (USD) |

Implied Upside from Recent Price ($12.47) |

| Average Price Target |

23.5 |

around 88.4 |

| Highest Price Target |

30 |

around 140.6 |

| Lowest Price Target |

13 |

around 4.2 |

Forecast Drivers & Scenarios for MARA Stock

| Scenario |

Bitcoin Price Action |

AI/Operational Execution |

MARA Stock Forecast |

Conclusion |

| Bullish Case |

Sustained uptrend (e.g., reaching new highs). |

Successful partnership deployments (e.g., MPLX) announced. |

$25.00 - $30.00 |

MARA Growth Continue Confirmed. |

| Base Case |

Price consolidates or modest growth. |

Continued operational efficiency; positive early AI news. |

$18.00 - $23.50 |

Is MARA Stock a Buy Now? Yes, moderate risk. |

| Bearish Case |

Sharp market downturn or prolonged crypto winter. |

Delays or poor performance in AI initiatives. |

$9.50 - $12.00 |

Caution advised due to macro risk. |

Expanding the Strategic Pivot: MARA's AI Growth Continue Plan

The long-term success of MARA's growth continuation is heavily reliant on its strategic shift into the AI infrastructure space, a factor driving analyst price targets above $25.00.

Marathon is transitioning from being a purely transactional Bitcoin Mining company to an integrated digital infrastructure provider. This involves:

Energy Advantage:

Utilizing its massive energy footprint and power purchase agreements to host high-performance computing (HPC) and AI data centers—a highly profitable, stable service market.

Strategic Acquisitions:

The investment in the French firm Exaion grants Marathon access to expertise in secure cloud and AI inference infrastructure, bypassing the need to build the expertise from scratch.

Revenue Diversification:

Success in AI means introducing a more stable, recurring revenue stream, which ultimately reduces MARA's dependence on the volatile price of Bitcoin, making the stock more palatable to institutional investors.

Frequently Asked Questions

Q1: Is MARA Stock a Buy Now considering its volatility?

MARA Stock is a high-beta investment, down over 20% in the past six months, but up over 10% recently. Analysts issue a "Moderate Buy" consensus, suggesting the high potential reward justifies the elevated risk for investors with strong conviction.

Q2: What is the average MARA Price Target for the next 6 months?

The average 12-month MARA Price Target is approximately $23.50. indicating nearly 90% potential upside from the current $12.47 price. This aggressive target depends heavily on the successful expansion into new revenue streams.

Q3: How does the AI infrastructure pivot affect MARA's growth continuation?

The AI pivot is crucial for MARA's growth continuation because it aims to reduce its reliance on volatile Bitcoin prices. By converting its energy capacity into high-margin, recurring revenue from high-performance computing (HPC) for AI, it creates a more stable growth profile.

Q4: What does the Technical Analysis say about the stock's uptrend?

The technical analysis confirms a strong +10.45% uptrend in the short term, but the key technical hurdle is the 50-Day Moving Average at around $16.67. Breaking this level is necessary to confirm a sustained rally.

Q5: What is the biggest risk to the MARA Stock Forecast?

The most significant risk to the MARA Stock Forecast remains the price of Bitcoin. Despite diversification, the stock's performance is still highly correlated with the volatile crypto market, which affects both revenue and the value of its large treasury holdings.

Conclusion: Is Mara Stock Worth Buying Now?

So, is Mara stock worth buying now? The answer depends on your investment goals and risk tolerance. Over the next six months, the company's growth will be influenced by its ability to adapt to market changes, continue expanding operations, and mitigate external risks.

If you're a long-term investor with a moderate-to-high risk appetite, Mara could offer strong returns. However, for short-term investors, the stock may experience volatility, and careful consideration is necessary.

Is MARA Stock a Buy Now? For investors with a high-risk tolerance who recognize the powerful synergy between its Bitcoin Mining energy platform and the burgeoning AI infrastructure market, the answer is a qualified Yes, it's a Moderate Buy.

The recent +10.45% uptrend is an encouraging sign of investor confidence returning after the Q3 earnings miss and price correction. With analyst targets averaging $23.50. the potential reward for MARA's growth continuation is significant.

However, the investment is a high-beta bet on the successful execution of the AI pivot and favorable Bitcoin price action. Investors should monitor the stock's ability to clear the crucial $16.67 (50-Day MA) technical ceiling in the next 6 months to validate the aggressive analyst forecast.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.