Bollinger Bands help traders instantly visualize volatility by showing whether price is running hot, cooling down, or preparing for a breakout.

As one of the most widely used technical indicators in modern trading, Bollinger Bands offer a simple yet powerful framework for understanding market movement.

By combining a moving average with volatility-based upper and lower bands, the indicator helps traders interpret price extremes, trend strength, and potential turning points across forex, stocks, indices, commodities, and cryptocurrencies.

Definition

Bollinger Band is a volatility-based indicator that plots an average price with upper and lower bands to show how high or low price moves relative to recent market activity.

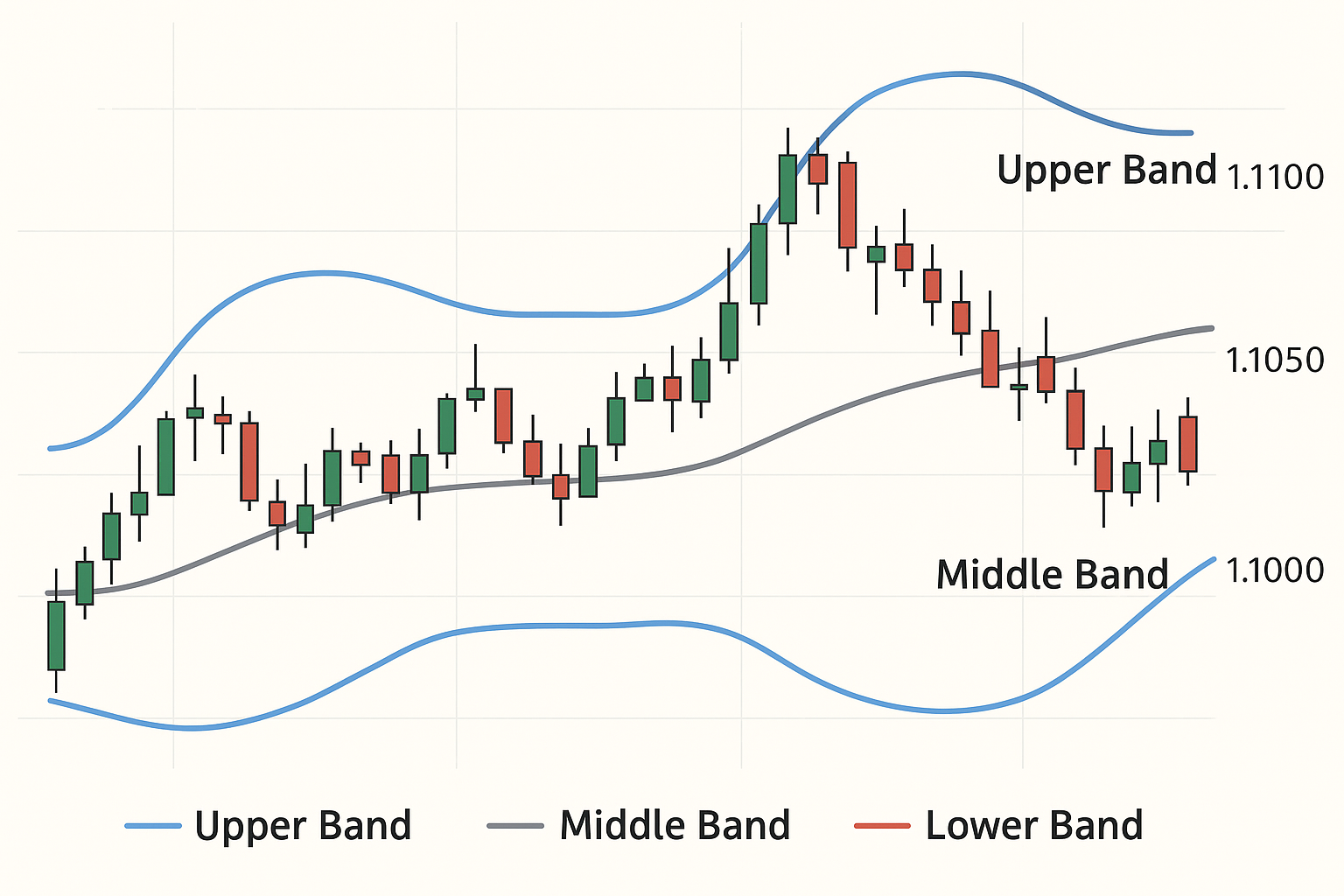

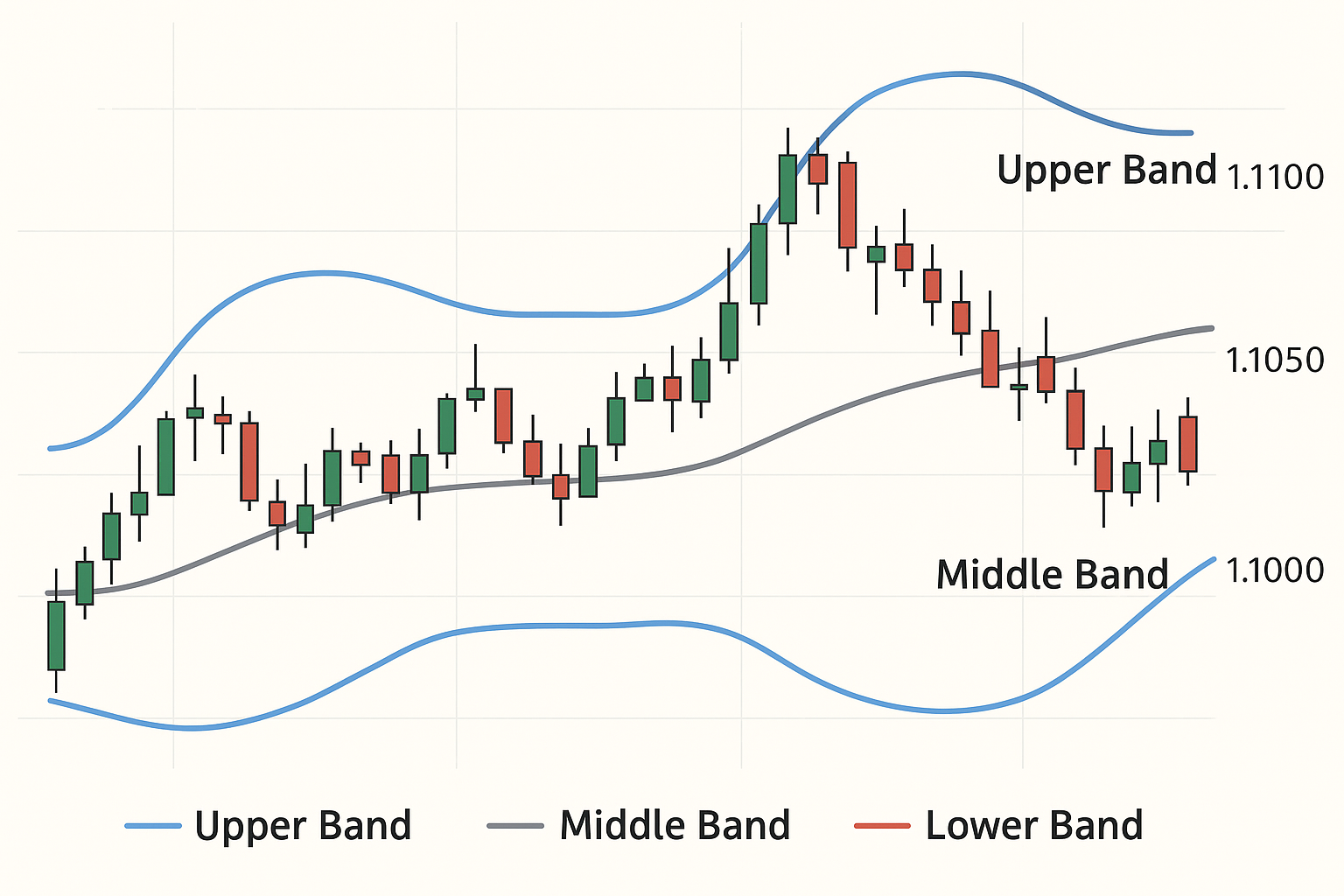

It consists of three lines plotted around price: a middle moving average, an upper band, and a lower band.

These bands expand when volatility increases and contract when volatility decreases, helping traders understand market conditions and identify potential price extremes.

Key Elements of Bollinger Bands

This table gives traders a visual representation of price relative to recent volatility.

| Element |

Description |

| Middle Band |

A Simple Moving Average (SMA), commonly set to 20 periods. |

| Upper Band |

The SMA plus a selected standard deviation multiplier. |

| Lower Band |

The SMA minus a selected standard deviation multiplier. |

| Volatility-Based Movement |

Bands expand during high volatility and contract during low volatility. |

Common Uses

Identifying overbought and oversold environments

Detecting volatility spikes or volatility squeezes

Supporting trend-following strategies

Anticipating breakouts after consolidation

Confirming entries with other indicators like RSI or MACD

Formula Of Bollinger Bands

The formula for Bollinger Bands involves three lines: the middle band is a simple moving average (SMA), and the upper and lower bands are calculated by adding and subtracting a multiple of the standard deviation from the middle band.

The standard formula uses a 20-period SMA and a 2 standard deviation multiplier.

Upper Band = 20-day SMA + (20-day standard deviation of price x 2)

Middle Band = 20-day simple moving average (SMA)

Lower Band = 20-day SMA - (20-day standard deviation of price x 2)

How To Interpret Bollinger Bands

1. Price Near the Upper Band

When price approaches or touches the upper band, it means the market is trading near the high end of its recent range.

This does not automatically mean “sell”; instead, it suggests:

Price is strong relative to recent movement

The market may be trending upward

The move could continue if momentum remains

Reversal signals must be confirmed with other tools

2. Price Near the Lower Band

When price moves toward or touches the lower band, the market is trading near the low end of its recent range. This suggests:

Weakness or downward pressure

A possible continuation of the downtrend

A potential bounce only if confirmed by other indicators

3. Price at the Middle Band (SMA 20)

The middle band acts like a short-term value area or balance point.

When price moves above the middle band:

When price moves below the middle band:

4. Bands Widening (Volatility Expanding)

When the upper and lower bands move farther apart, the market is becoming more volatile.

This can indicate:

Widening bands often appear during sudden news or strong trend legs.

5. Bands Tightening (The Bollinger Squeeze)

A “squeeze” happens when the bands move closer together. This signals:

The squeeze is one of the most important Bollinger Band signals.

6. Price “Walking the Band”

In strong trends, price may “walk” along the upper or lower band.

This is a confirmation of trend continuation rather than a reversal signal.

7. False Signals and Confirmation

Bollinger Bands should not be used alone to enter trades, because band touches can happen repeatedly in strong trends, traders use confirmations such as:

RSI (to check momentum or divergence)

Volume (to confirm breakouts)

Candlestick patterns (for signals of rejection or continuation)

Support and resistance levels

Quick Example

Imagine a currency pair trading around 1.1000 for the past several days.

Imagine a currency pair trading around 1.1000 for the past several days.

Your chart calculates the average of the last 20 candles, and the 20-day SMA comes out to 1.1050.

This value becomes your Middle Band.

The market has been moving up and down moderately, and the platform measures this fluctuation as a standard deviation of 0.0025. Since Bollinger Bands use 2 standard deviations, the platform multiplies this value by 2 to create the “volatility cushion”.

1. Upper Band Calculation

SMA + (σ × 2)

= 1.1050 + (0.0025 × 2)

= 1.1050 + 0.0050

= 1.1100

2. Lower Band Calculation

SMA − (σ × 2)

= 1.1050 − (0.0025 × 2)

= 1.1050 − 0.0050

= 1.1000

3. Final Result

Middle Band: 1.1050

Upper Band: 1.1100

Lower Band: 1.1000

How a trader would read this:

If price reaches near 1.1100, it’s on the high side compared to recent movement.

If price dips near 1.1000, it’s on the low side compared to recent movement.

If the bands are far apart, the market is very active.

If the bands are tight, the market is calm and could be getting ready for a big move.

What is the “volatility cushion”?

It is simply a way to measure how much price has been jumping around recently.

Quick Tip:

Suppose price touches the upper band twice while the bands widen. A beginner might assume this means “sell”, but Bollinger Bands do not signal exact entries. Instead, the touch indicates that price has moved to a relative high compared to recent volatility.

To confirm a trade decision, the trader might combine it with RSI divergence, candlestick patterns, or trendline support.

This example shows traders that Bollinger Bands are best used in context, not alone.

Difference From Similar Indicators

| Indicator |

Focus |

How It Differs |

| Bollinger Bands |

Volatility and price extremes |

Uses moving average and standard deviation |

| Keltner Channels |

Price channels |

Based on ATR instead of standard deviation |

| Moving Averages |

Trend direction |

No volatility component |

Related Terms

Moving Average: A calculated average of past prices used to smooth market noise and reveal trend direction.

Standard Deviation: A statistical measure showing how much price moves away from its average, commonly used to gauge volatility.

Volatility: The speed and magnitude of price changes within a market over a given period.

RSI (Relative Strength Index): A momentum indicator that measures the strength of recent price moves to identify overbought or oversold conditions.

Breakout: A price movement that pushes above resistance or below support, often signaling the start of a new trend.

Frequently Asked Questions (FAQ)

1. What settings of Bollinger Bands should beginners use?

Most traders start with 20 periods and 2 standard deviations.

2. Do Bollinger Bands work on all timeframes?

Yes. They are popular on 1-hour, 4-hour, and daily charts but can be used on any timeframe.

3. Can Bollinger Bands predict reversals?

Bollinger Bands cannot predict reversals alone. A band touch shows price extremes but does not guarantee reversal.

Summary

Bollinger Bands give traders a clear visual guide to market volatility by plotting an average price line with dynamic upper and lower boundaries.

These boundaries adjust automatically based on how actively price has been moving, helping traders identify overbought and oversold zones, spot volatility squeezes, and evaluate trend strength.

While Bollinger Bands are versatile and beginner-friendly, they work best when combined with additional tools such as RSI or support and resistance analysis.

By understanding how the bands expand, contract, and interact with price, traders can make more informed decisions and better navigate changing market conditions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Imagine a currency pair trading around 1.1000 for the past several days.

Imagine a currency pair trading around 1.1000 for the past several days.