Choosing a forex broker with low spread is one of the simplest yet most powerful decisions a trader can make. Tight spreads reduce trading costs, protect your profit margins, and allow high-precision entries during volatile market conditions.

For active traders, especially scalpers and intraday strategies. Low spreads are not just beneficial; they are essential.

This guide breaks down what makes the best low spread forex broker, how to compare spreads effectively, and why EBC stands out as a top recommendation for traders who demand transparency, stability, and competitive pricing.

What Defines a Great Forex Broker With Low Spread?

Not all brokers with "low spreads" are created equal. Many advertise attractive minimum spreads that rarely appear in real trading conditions. To identify a genuinely low spread forex broker, traders must look beyond the surface.

Here are the characteristics that truly matter:

1. Consistent Average Spreads Across All Sessions

A great low spread broker maintains stability during:

London open (high volatility)

New York overlap (fastest order flow)

Asian session (thin liquidity)

News events

Some brokers widen spreads dramatically during volatility, negating the benefit of advertised tight pricing. A reliable broker keeps spreads tight most of the day—not only during quiet periods.

2. Transparent Pricing Without Manipulation

Some brokers artificially widen the spread to compensate for zero-commission marketing. A trustworthy broker offers:

Raw spreads

Transparent commissions

No hidden markups

3. Deep Liquidity and High-Quality Order Routing

Spreads are a reflection of liquidity. Better liquidity = tighter pricing.

High-end brokers consolidate liquidity from:

The deeper the pool, the tighter the bid–ask range.

4. Regulated and Reliable Execution Environment

Low spreads mean little if the broker:

Requotes

Slips frequently

Delays execution

Strong regulatory oversight reduces this risk.

Why Low Spread Forex Brokers Give Traders a Competitive Edge

A low spread is not simply a "discount" but also a built-in advantage.

1. Lower Trading Costs and Better Net Returns

Spreads deduct from every trade, visible or not. A small numerical difference creates a large financial impact.

Cost Impact of Spread

| Daily Trades |

Spread (1.2 pips) |

Spread (0.2 pips) |

Cost Saved |

| 10 trades/day |

12 pips |

2 pips |

10 pips/day |

| Monthly (20 days) |

240 pips |

40 pips |

200 pips saved |

2. Scalpers and Day Traders Gain the Biggest Advantage

Traders using strategies that capitalize on small price movements, such as scalping, breakout entries, or reacting to economic news, benefit most from tight spreads. When every fraction of a pip counts, a lower spread can mean the difference between a winning and a losing trade. This is especially critical in fast-moving markets where timing and precision are essential.

3. Reduced Slippage and Better Fill Quality

Tighter spreads often indicate a broker with strong liquidity and efficient order execution. This means:

Balanced order flow that minimizes gaps between supply and demand

Faster execution, reducing the risk of slippage during volatile periods

Reliable fills even during high-speed trading or major market events

Reduced slippage ensures that trades are executed closer to the intended price, preserving both profit potential and risk control.

4. More Precise Entry and Exit Levels

Accurate entry and exit points are critical in forex trading. Lower spreads allow traders to:

Enter positions closer to their target price

Exit trades without losing extra pips to the spread

Apply tighter stop-loss or take-profit levels, improving risk-to-reward ratios

In short, trading with low-spread brokers enhances precision, profitability, and overall trading confidence.

Forex Spreads Comparison: How to Evaluate a Broker's Pricing

Choosing the right forex broker goes far beyond glancing at a number on their website. Traders must look at minimum spreads, average spreads, account types, and how spreads behave under market volatility to make informed decisions.

1. Understand Minimum vs. Average Spreads

Many brokers advertise extremely low minimum spreads, but these numbers are often misleading. Minimum spreads occur only under ideal market conditions and may not reflect the costs most traders actually face.

Average spreads, on the other hand, show what traders can realistically expect during normal market conditions and are far more important for evaluating a broker's pricing.

Minimum Spread vs Average Spread

| Metric |

Minimum Spread |

Average Spread |

| What it is |

Lowest possible spread under perfect conditions |

Typical real-world spread experienced by traders |

| When it occurs |

During extremely calm, low-volume periods |

Across all trading sessions and market conditions |

| Reliability |

Low |

High |

| Important for traders? |

Not very |

Extremely |

A reputable low-spread broker will publish its average spreads transparently, giving traders a realistic view of trading costs instead of only marketing the best-case scenario.

2. ECN vs Standard Accounts

Account type significantly affects spreads, commissions, and trading style suitability.

ECN / Raw Spread Accounts:

Spread: 0.0–0.2 pips

Commission: Yes, per lot

Best for: Scalpers, high-frequency traders, and those trading high volumes

Why: The raw, direct access to liquidity ensures the tightest spreads, allowing precise entries and exits.

Standard Accounts:

Spread: Marked-up by the broker

Commission: Usually zero

Best for: Beginners or casual traders

Why: The cost is built into the spread rather than as a separate commission, making it simpler but less optimal for frequent trading.

Traders seeking minimal costs almost always prefer ECN or raw spread accounts because even small savings per trade compound into substantial monthly benefits.

3. Spread Behaviour During Volatility

Spreads are not static—they widen and narrow depending on market conditions. A trustworthy broker maintains tight, stable spreads even during periods of high volatility, such as:

Non-Farm Payroll (NFP) releases

Consumer Price Index (CPI) announcements

Central bank policy statements or speeches

Many brokers exploit these events by widening spreads excessively, increasing trading costs and creating execution uncertainty. The best brokers, however, implement efficient liquidity routing and risk management systems to keep spreads as narrow as possible, ensuring traders can execute strategies reliably even in fast-moving markets.

Key Features to Look for in a Forex Broker With Low Spread

When selecting a broker, evaluate more than just the spread figure.

1. Execution Quality

Execution speed determines how close you get to your expected entry price.

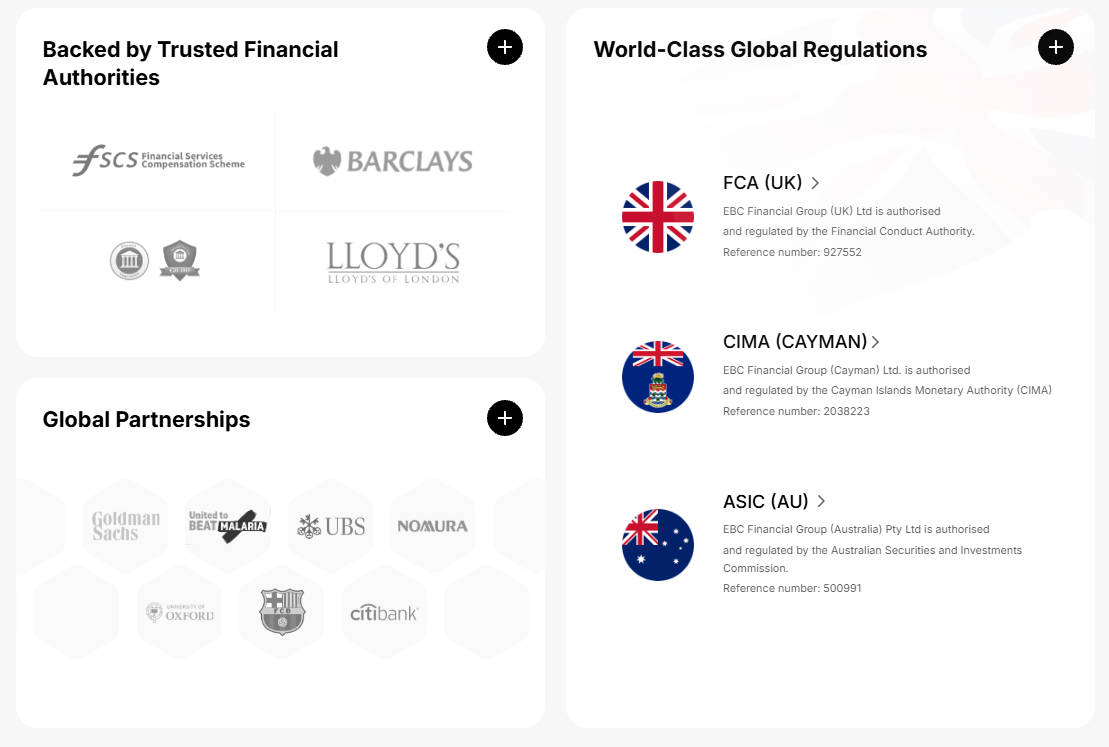

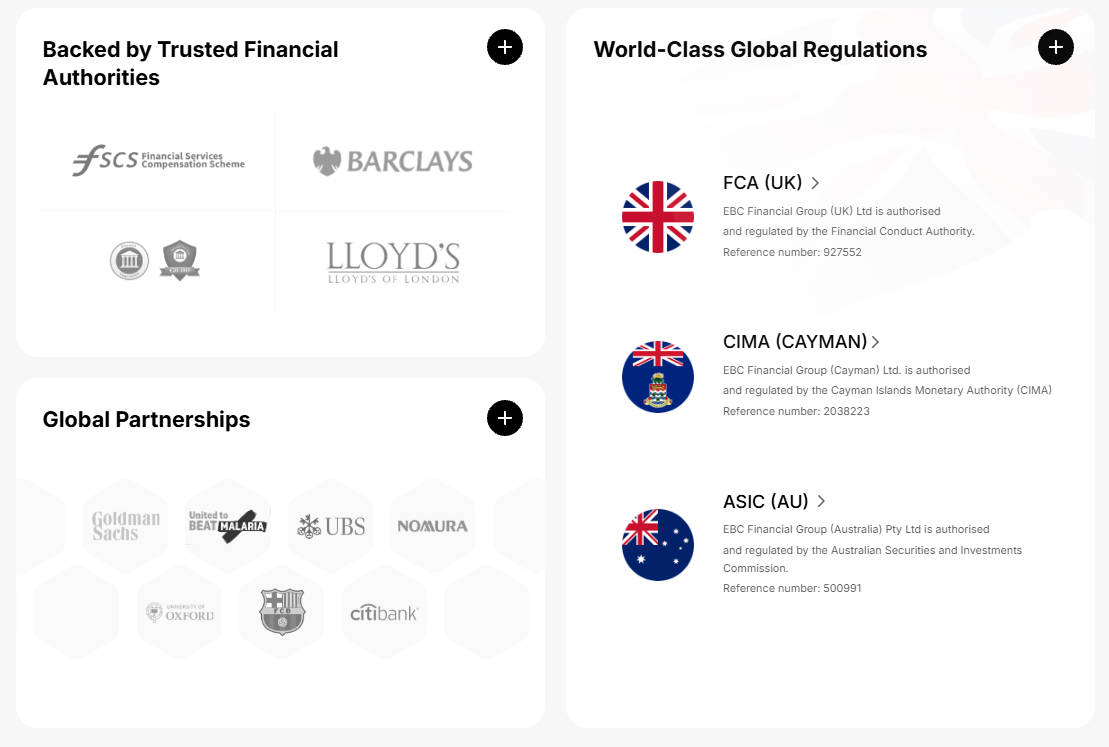

2. Regulation and Safety

Choose brokers regulated by reputable authorities. A safe broker = no price manipulation or spread games.

3. Account Types That Fit Your Strategy

4. Depth of Liquidity

More liquidity means fewer requotes and lower spreads.

5. Trading Platforms Offering Accurate Market Pricing

A strong platform should include:

Real-time depth

One-click trading

Stable chart performance

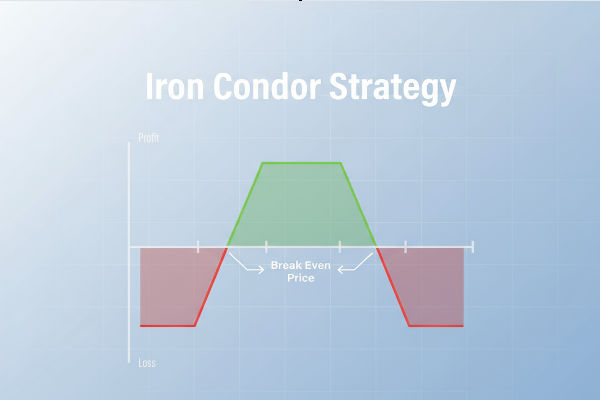

6. Spread-Based Trading Strategies for Low Spread Forex Brokers

Low spread brokers open the door to more advanced strategies.

1) Scalping the Major Pairs

Tight spreads let scalpers extract small but consistent gains.

2) News Trading With Lower Cost Pressure

Low spreads help reduce the cost impact of fast entries and exits.

3) Asian-Session Range Trading

With quieter movement, low spreads allow tighter stops and cleaner structures.

4) Short-Term Algorithmic Strategies

Algos thrive on stable spreads and predictable environment.

Best Low Spread Forex Broker: Why EBC Stands Out

Among global brokers, EBC.com has established a reputation for transparent pricing and institutional-grade execution.

1. Consistently Tight Spreads

EBC offers some of the lowest spreads on major pairs, backed by deep liquidity routing.

EBC Typical Spreads vs Market Average

| Forex Pair |

EBC.com Typical Spread |

Market Average |

Advantage |

| EUR/USD |

0.0–0.2 pips |

0.8–1.2 |

Significantly tighter |

| GBP/USD |

0.1–0.3 pips |

1.0–1.6 |

Strong advantage |

| USD/JPY |

0.0–0.2 pips |

0.7–1.1 |

Major cost savings |

| XAU/USD |

5–12 cents |

18–30 cents |

Lower cost volatility |

2. Institutional-Grade Liquidity

EBC aggregates liquidity from banks, non-bank LPs, and global venues, ensuring stable spreads even during fast markets.

3. Fast, Precise Order Execution

Execution speeds are optimised for:

News trading

Scalping

Algo execution

High-volume flow

4. Trusted and Secure Trading Environment

EBC operates under strict regulatory oversight with transparent operational standards. If you are comparing brokers and want a best low spread forex broker, EBC ranks as a strong recommendation.

Frequently Asked Questions

1. What is a forex broker with low spread?

A forex broker with low spread offers a tight difference between bid and ask prices, lowering trading costs. This benefits traders by preserving profit margins, especially for scalpers and high-frequency strategies that depend on efficient entries and exits.

2. Why are low spreads important for traders?

Low spreads directly reduce transaction costs, allowing traders to keep more of their profits. For active or intraday traders, even small differences in spread can significantly influence long-term results and strategy performance.

3. How do I compare low spread forex brokers?

Look at average spreads, execution speed, regulation level, liquidity depth, and pricing transparency. Avoid relying solely on minimum spreads, and always examine real-market conditions to identify which broker offers consistent low-cost trading.

4. Is EBC.com a good low spread forex broker?

EBC.com offers consistently tight spreads, deep liquidity, fast execution, and robust regulation. Traders seeking transparency and cost efficiency often find EBC's trading environment ideal for both scalping strategies and long-term active trading.

Conclusion: Choose the Right Forex Broker With Low Spread

Selecting a forex broker with low spread is one of the highest-impact decisions a trader can make. Lower costs improve your long-term profitability, while tight pricing and stable execution allow for more reliable strategies.

If you're looking for a broker that delivers consistent low spreads, strong regulation, and institutional-level execution, EBC remains one of the most dependable and transparent choices available.

A disciplined trading plan plus a high-quality low spread broker is a powerful combination that helps traders maximise every opportunity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.